AIG

-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Whether Clement's promotion was influenced by an inappropriate relationship is in scope.

-

The timing is unhelpful as the global insurer tries to get on the front foot with M&A.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

Underwriting income for North America quadrupled to $384mn, and the segment recorded a CoR of 82.6%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The company will implement a new leadership structure after his departure.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The Delaware high court’s reasoning could find application in other cases.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

The former executive passed away following a 40-year career in insurance.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

Submissions flow at E&S arm Lexington increased 28% year-over-year in Q2.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The former Everest executive has more than 30 years of A&H experience.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

He has pleaded not guilty to the criminal charges, which carry potential life sentences.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

He will lead AIG’s business across Latin America and the Caribbean.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The California wildfires in January accounted for $460mn of Q1 cat activity.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

A US buy would have to be easily integrated, the CEO stated.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

AIG veteran Kevin Bidney will focus on North American marine.

-

The executive said AIG’s E&S arm can grow 20% a year and generate $4bn of new business.

-

The judge noted similarities in Dellwood’s business plan and AIG’s.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.

-

Alexandra Furth has more than 20 years of claims and legal leadership experience.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier reshaped its portfolio in 2024, cutting costs and investing in Gen AI and LLM technology, CEO Peter Zaffino told staff.

-

The AIG subsidiary says it has no obligation to “defend or indemnify” McKinsey.

-

The carrier is restructuring the business into three segments.

-

The exec previously spent over 12 years at Aon, recently as chief innovation officer, commercial risk NA.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

Christopher Flatt succeeds Christopher Schaper, who was appointed CRO of AIG in November.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

Sonville’s hire was reported by Insurance Insider US last week.

-

Sources said the executive will join AJ Gallagher in a regional leadership position.

-

The carrier has used Lloyd’s London Bridge 2 structure for the launch.

-

AIG launched an IPO of Corebridge Financial in September 2022.

-

The sale of the business was confirmed in June.

-

The AIG and Stone Point-owned MGU will also look to move up-market, increase its weighting to E&S and add third-party paper.

-

Mr Cooper Group said it was the target of a 2023 hacking attack.

-

The firm had owned 3.45 million shares in Q2, then valued at over $256mn.

-

This publication revealed that Chris Schaper would move into the role on an interim basis in July.

-

Casualty submissions rose over 70% while property increased over 20% YoY in Q3.

-

The carrier reported a “large closeout transaction” that benefited the CoR but created a 0.7-point headwind for the loss ratio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer will move its Atlanta-area assets to a new "innovation hub".

-

Based in New York, he joins the firm after seven years as Marsh CFO.

-

The executive has resigned from AIG to fill the vacant CEO role at the large corporate unit of the German carrier.

-

The insurer said Dellwood’s "spin" isn’t enough to dismiss the litigation.

-

Last week, the insurer placed ~450 staff at risk of redundancy in its international business.

-

Zaffino said the divested crop and travel businesses needed scale to be more profitable.

-

The move is the latest phase of the operational transformation program, AIG Next.

-

The PVT market has seen a recent spike in staff movements, as new capacity enters the space.

-

Dellwood claims allegations in AIG’s latest filing are still barred by res judicata.

-

The impact on AIG’s top line will be around $750mn of net written premium within NA personal lines.

-

AIG recorded favorable excess casualty reserve development for AY prior to 2016 of $33mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Q2 cat losses of $325mn included $156mn in NA mainly from US SCS and $169mn overseas.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The arrangement enables PCS to expedite growth.

-

The executive has had a 40-year career at AIG, Berkshire Hathaway and Lloyd’s.

-

-

AIG says new details support case that former execs launched Dellwood using confidential business information.

-

Former Chesterfield managing director James Stevenson moves to exec chair.

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

This publication reported yesterday that the two carriers were nearing a deal.

-

The disposal is the latest milestone in AIG’s work to reposition itself as a commercial lines insurer.

-

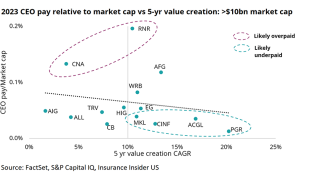

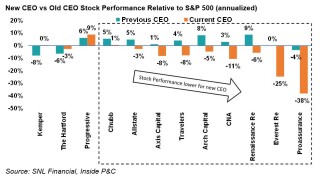

Analysis shows several CEOs with pay diverging from the trendline.

-

The company now owns around 48.35% of Corebridge Financial’s stock.

-

AIG is maintaining its initial 'unlawful misappropriation' suit against Dellwood.

-

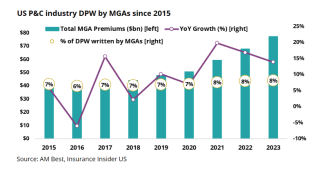

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The executive’s experience centers on program design for complex risk.

-

Browne joins from Allianz Global Corporate & Specialty, where he was head of specialty.

-

The executive announced last month that he was leaving Parsyl, where he had worked since 2021.

-

The deal represents a major milestone in AIG’s repositioning as a pure-play P&C insurer.

-

The executive is to pursue “a different entrepreneurial path”, according to an internal memo.

-

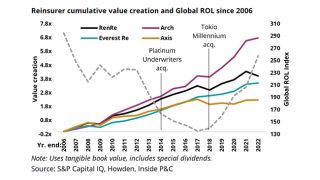

AIG sees improvement from tightened underwriting, though value creation has yet to catch up.

-

In certain classes like energy or cat, AIG switched “a bit” to XoL from quota share.

-

The carrier reported an E&S property slowdown but “massive” submission activity in casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

North America commercial lines' adjusted NWP grew 4% YoY on higher rates and new business.

-

The executive is to step back for personal reasons.

-

The group is looking to realize $500mn of run-rate savings through AIG Next.

-

The global insurer also alleges breach of contract and fiduciary duty in the federal suit.

-

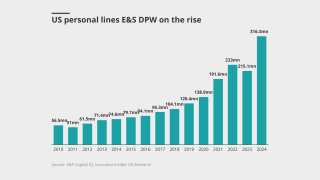

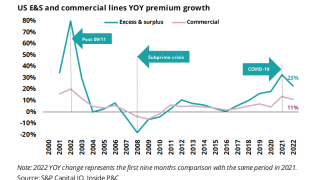

As admitted carriers pull out of riskier plays, E&S continues to expand and thrive.

-

Glatfelter CEO Chris Flatt will become interim chief executive.

-

A review of commercial lines loss picks for AIG vs the industry

-

Ross Bowie joins the MGA after serving as CUO at Orchid Insurance for two years.

-

For 2016 and 2017, in particular, the loss picks were raised to 91% and 96%, respectively.

-

Its property cat aggregate cover renewed with improved coverage.

-

Insurance Insider US runs you through the earnings results for the day.

-

NA commercial lines Q4 CoR increased 0.7 points to 85.1%.

-

Chris Inglis served as the first US Senate-confirmed national cyber director.

-

Between 2009 and 2012, Therese Vaughan served as CEO at NAIC.

-

The upgrade recognizes improving operating performance.

-

His last day will be December 2023, according to an internal memo seen by this publication.

-

Sources said the executive will join Mitsui Sumitomo in a leadership position based in Brazil.

-

James Dunne is vice chairman and senior managing principal of investment bank Piper Sandler.

-

AIG offered 35 million existing shares of Corebridge common stock priced at $20.50 per share Friday, out of 630 million total shares outstanding.

-

The executive will oversee AIG’s global technology and cybersecurity strategy and lead the insurer’s cloud strategy, along with other modernization technologies.

-

The low multiple shapes the decision set of the management team, negatively impacts staff, and creates potential opportunities for rivals.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

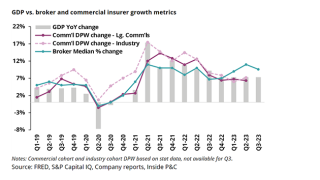

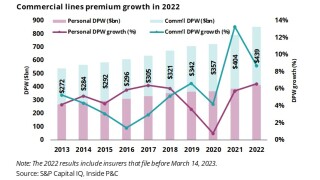

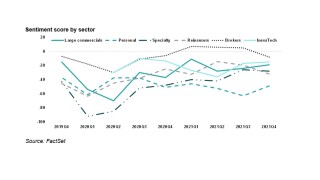

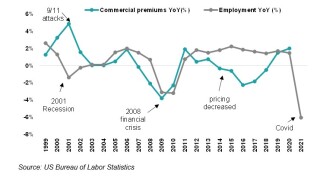

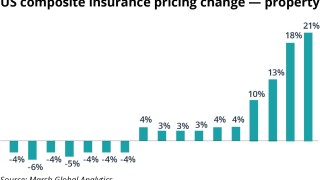

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

The carrier is offering 50 million existing shares of common stock and granted a 30-day option for underwriters to purchase up to an additional 7.5 million shares.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Excluding programs, the E&S insurer grew around 25% in the quarter, led by 33% growth in wholesale casualty.

-

-

The Inside P&C news team runs you through the earnings results for the day.

-

The firm booked catastrophe losses of $462mn — largely from Lahaina Wildfire and Hurricane Idalia — down from $655mn in Q3 last year, which was affected by Hurricane Ian.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

The executive left the company in June following a period of medical leave.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The departure of the president of North America retail was disclosed in an internal company memo.

-

AIG’s combined ratio improved to 92.6% in 2022 from an average of 106% between 2018 and 2020.

-

The move follows another incredibly soft year for the all-risk market as aviation war continues to harden.

-

Jon Hancock has also been named as international insurance CEO.

-

Having joined AIG in 2000, Poux was one of the Private Client Group’s founding members.

-

-

The former general counsel and communications chief will move to the role on 1 October.

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

AIG has been course-correcting since 2008, but recent efforts including AIG 200 seem to have finally set it in the right direction.

-

AIG expects to add new capital providers to its recently launched HNW MGA “in the coming quarters”.

-

AIG decided to buy additional retrocessional protection for Validus Re and a low XoL reinsurance placement for its Private Client Group ahead of the wind season.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

AIG grew GI NWP in NA by 17% to nearly $4bn as both commercial lines and personal lines NWP rose 17% to over $3.4bn and $563mn, respectively.

-

-

Mark Sperring’s promotion comes just a few months after AIG’s former head of global aerospace, Steve Eccles, left the carrier.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The first signs of limit expansion, growing appetite in the admitted market, and retail brokers' impatience with wholesalers are all evident.

-

In addition, the insurer completed the $240mn sale of its agribusiness unit Crop Risk Services to American Financial Group (AFG).

-

Before joining AIG, the executive had served as chief underwriting officer of marine at The Hartford.

-

Formerly head of AIG’s separation management unit, Tarpey joined Corebridge last August.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the company decided to outsource its claims function to Sedgwick, a third-party administrator in which Stone Point Capital is a minority investor.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Purtill became interim CFO in January after AIG terminated Mark Lyons, saying the executive violated his confidentiality/non-disclosure obligations to the firm.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG offered 65 million existing shares of common stock, or about 10% of approximately 648 million total shares outstanding.

-

The carrier is offering 65 million shares of common stock, out of approximately 648 million total shares outstanding.

-

Marcial will take over the position left vacant after the departure of Juan Costa, who moved to Berkshire Hathaway as casualty VP in Atlanta.

-

The recent deal is accretive at 18% and will allow RenRe to take further advantage of the hard market.

-

The group exited an off-strategy business at an attractive valuation – now it must give a clearer indication of where it is going.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

Proxy advisers had called for shareholders to reject the pay deals, which feature a $50mn pay award for CEO Peter Zaffino.

-

The Dan Loeb-controlled investment firm reduced its position in AIG to 2.95 million shares, or ~0.4%, in Q1, from or 5.1 million shares, or around 0.7%, at the end of Q4.

-

Speaking about the recently spun-out HNW MGA, Zaffino said AIG expects to bring on additional capital providers to the subsidiary through H2 2023.

-

Beginning in Q3, AIG will act as a fronting partner for AFG during a transitional period of the transaction.

-

The firm’s North America operations recorded $116mn of cat losses in Q1 while the international division reported $148mn losses.

-

Following the deal, around 450 CRS employees will move to AFG’s Great American Insurance group.

-

Senior departures, the Corebridge stock price and the arrival of Dan Loeb all throw up additional obstacles.

-

The new independent program manager will serve HNW and ultra-HNW markets and is expected to begin producing business in Q3 2023.

-

He replaces Steven Barnett, who is leaving to pursue opportunities outside the company.

-

The syndicate also reported net unrealised investment losses of $20.9mn, up from $5.7mn in 2021, amid mark-to-market losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The group CUO role is being eliminated with the function pushed back into the regions and specialties.

-

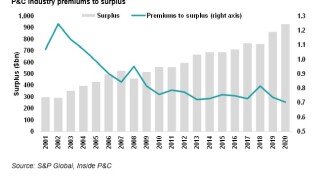

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The announcement follows the appointment of Diana Murphy and Vanessa Wittman as independent directors, which will be effective on March 16.

-

Diana Murphy has been managing director at Rocksolid for 15 years, while Vanessa Wittman was most recently CFO of Glossier.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The AIG 200 project has officially ended, with the goals met ahead of schedule and under-budget, but there is still work to do to close the gap with competitors.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

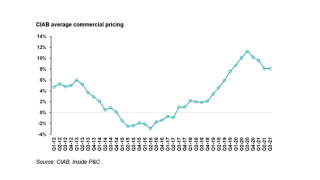

Pricing, which includes rate plus exposure, was up 6% for both North America and international.

-

The move fits the broader strategy around dampening volatility, but sourcing capacity in the US domestic market will be tough.

-

-

North America commercial lines CoR for the quarter improved 10.4 points to 84.4%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG has entered into a binding memorandum of understanding with Stone Point Capital to form an independent MGA to serve high-net-worth (HNW) markets, as it takes a dramatic step to address the volatility this business has brought.

-

Steve Eccles joined AIG in April 2020 from Argo, where he was active underwriter of Syndicate 1200.

-

It is understood that Lyons has been set to retire from the company in the summer of 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

To replace Lyons, AIG appointed Sabra Purtill as interim CFO and Turab Hussain as interim chief actuary.

-

Motamed has been a member of the carrier’s board since January 2019.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Former CFO Mark Lyons will step in as interim CFO, in addition to his current role as EVP, global chief actuary and head of portfolio management.

-

The ratings agency reaffirmed AIG and its P&C subsidiaries’ FSR rating of A and ICR of a.

-

Alvarez & Marsal North America and Latham & Watkins are advisers to the financial products unit in the bankruptcy process.

-

Inside P&C Research examines E&S sector growth over the past year and revisits historic trends.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Consistent underwriting performance, the completion of the exit from life, acquisitions, organic growth and succession planning will all be focuses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The two insurers are believed to provide in excess of 20% of the cat MGA’s capacity.

-

The CEO’s annual salary and short- and long-term incentive targets have increased.

-

Since joining the company in 2017, the executive has helped to spearhead a turnaround in performance for the carrier.

-

Bergamaschi joins the insurer’s board as Douglas Steenland will not stand for reelection in the next annual meeting of shareholders.

-

The likely windows for a secondary offering of Corebridge's common stock will be mid- to late March as well as mid-May to late June.

-

The executive said AIG expected growth opportunities ahead, including in the property cat market.

-

-

The firm’s North America CoR deteriorated 8.3 points to 114%, but the international division’s CoR improved 13.3 points to 81.4%.

-

The Massachusetts Bay Transportation Authority claims the firms failed to act over the bankruptcy of LMH-Lane Cabot Yard Joint Venture.

-

Universal P&C, the FHCF, Axis, Berkshire and Nephila are among the firms that will be in focus as the loss develops.

-

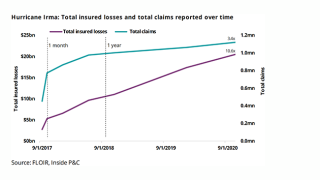

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

Josh Brekenfeld succeeds Patrick Mahon, who has been appointed head of group business for global accident and health.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG is offering 80 million existing shares of common stock, or 12.4%, out of 645 million total common shares of Corebridge.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive has over two decades of experience in the property underwriting sector, having worked for various carriers, including PartnerRe and RSA.

-

Paul McLaughlin, senior underwriting manager for Lexington, will head up the new team.

-

The executive pointed at cyber and excess and surplus carrier Lexington as businesses that AIG was seeing rapid growth.

-

The company is offering 80 million Corebridge shares, or 12.4% of the subsidiary’s 645 million total common shares.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

The appointment follows a delay of plans to take the life and health unit public.

-

Odyssey Group’s cyber chief Robert O’Connell is looking to raise up to $1bn of capital for a monoline cyber reinsurer.

-

The firm needs to get a grip in HNW, dial up commercial lines growth, cut through the Corebridge knot and then an acquisition will be next.

-

The company reached the fourth consecutive year achieving rate above loss-cost trends.

-

The chief executive said AIG’s next window of opportunity to strike Corebride’s IPO will be in September.

-

The carrier postponed the IPO of its life and health unit Corebridge due to stock market volatility.

-

Sources said Obregon will retire at year end after over 26 years working for Chubb Colombia.

-

The executive will rejoin as EVP, reinsurance purchasing and risk capital optimization.

-

Beazley and Chubb are working on different approaches as the market tries to get its arms around the aggregation risk.

-

Metromile’s Preston and Lemonade co-CEOs Wininger and Schreiber all joined industry stalwarts in this year’s top 10.

-

Adriana Cisneros was AIG’s LatAm property product leader for more than three years in south Florida.

-

Based in Bermuda, Jesse DeCouto will report directly to Validus Re CEO Chris Schaper.

-

The carrier has also disclosed carbon emission breakdowns across its underwriting portfolios, as well as D&I figures for its workforce, in an ESG report.

-

The executive will take up the role of global head of marine at AIG.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

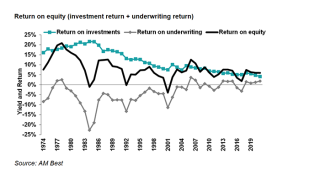

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

The appeals court for the eighth circuit overturned a prior ruling by a district court which had dismissed the broker’s claims that dated back to 2017.

-

The carrier, which has been a leader in the war liability market, has re-evaluated its appetite as a result of the Ukraine conflict.

-

Other defendants in the complaint include Endurance, Great American Insurance, Ironshore, Ace American Insurance and TIG Insurance.

-

Rate rises in the commercial lines market have decelerated in most insurance markets, but executives expect increases to remain above loss costs for some time.

-

Inside P&C’s news team runs you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

These results will strengthen convictions on the turnaround, but questions remain around how it will fare in a market where all insurers are looking to grow.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Aircraft location and condition is driving uncertainty around Russia aviation losses, CEO Peter Zaffino said.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

NA CoR declined 17.6 points to 90.8% as the region’s long-troubled commercial lines book swung to profits with an 88.8% CR, down 17.9 points from Q1 2021.

-

The executive joined AIG in early 2010 and has held myriad positions since then, including financial lines assistant underwriter and cyber specialist.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.

-

Bolt replaces Sabra Purtill, who was recently named EVP and CIO for AIG’s life and retirement business.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said they expect other major commercial insurers to follow suit, with territorial exclusions potentially broadening to Belarus.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The move will leave nearly 8,000 affluent customers without coverage and unable to turn to state-backed insurer Citizens Property Insurance.

-

The division reported in a regulatory filing total 2021 premiums of $5.6bn and $3bn in policy fees.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Board members include the former CEO of Assurant and the chief legal officer of Stripe.

-

BlackRock will manage up to $60bn of the global AIG investment portfolio and up to $90bn of the life and retirement investment portfolio.

-

Before retiring from GE in 2018, Rice served as president and CEO of the GE Global Growth for seven years.

-

The commercial lines turnaround is a remarkable achievement, but to succeed in the next phase it must pivot from its command-and-control culture.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Edwards had extensive experience in procurement and global sourcing roles before joining AIG in December.

-

Insurance carriers tailor their comments to leave investors walking away with an optimistic view.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The global insurer has added a "net-zero emissions" goal of 2050 for investments and underwriting.

-

The firm posted positive quarterly earnings – is this the beginning of a trend?

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG has kept the Q2 2022 target to land the life and retirement unit IPO, and still expects to retain more than a 50% stake after the event.

-

The executive said the business model in the high-net-worth space “simply needs to change” as loss costs have risen, fueled by increased frequency and severity.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Excluding the effects of cats and reserve developments, AIG’s core loss ratio also improved, decreasing to 59.2% from 60.3%.

-

Insurance stocks mixed following swath of earnings results; Aon gains nearly 7% in Friday trading.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The executive will have responsibility for global treasury activity, including financing plans and banking.

-

The Mayfield Consumer Products candle factory is one of the two most high profile large individual risk losses from the quad state tornado to date.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

Constance Hunter previously served as KPMG’s chief economist and has nearly three decades of experience in the financial sector.

-

Casualty rate hikes moderate, though areas like wildfire liability remain difficult amid an ever-more litigious environment.

-

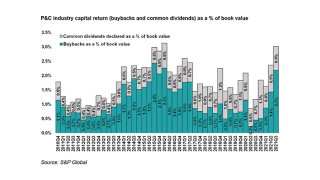

The higher level of repurchases seen in Q3 will likely last longer than expected.

-

Are this quarter’s positive results a sign of change for the company or a temporary blip?

-

Rates in the P&C market continued to rise in the third quarter, with outsized increases for cyber insurance driving up the average change, according to data revealed in company third-quarter conference calls.

-

AIG’s CEO Peter Zaffino said Friday the insurer’s life & retirement IPO plans are progressing, but may be pushed back to 2Q 2022.

-

The carrier has $175mn remaining in its aggregate retention and is expecting limited catastrophe losses during Q4 given their treaty cover.

-

The insurer grew GI net premiums by 11%, led by 17% growth in its commercial business.

-

-

The role changes will take effect on January 1, with both men continuing to report to group CEO Peter Zaffino.

-

The executive was serving as northeast zone manager for commercial D&O, private and non-profit management liability since last May.

-

In a virtual fireside chat with Aon CEO Greg Case, AIG’s CEO spoke candidly about the work the carrier’s management team had to put in to fix its underwriting results.

-

AM Best estimates that the loss of the life and retirement segment’s profitability will be offset by an increase in available capital and liquidity.

-

By moving a business from AIG's ecosystem into Coalition's, the perception of its value is transformed.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.

-

Hurricanes, floods and wildfires are pushing up Q3 catastrophe losses, AIG's finance chief says.

-

Dyer will work as head of logistics, while Adams will support Greek clients with insurance and risk management.

-

The insurer’s CEO and president Peter Zaffino will take on the extra remit when executive chairman Brian Duperreault switches to a non-exec role at the end of the year.

-

Goldberg will report to Susan Chmieleski, Lexington head of professional lines.

-

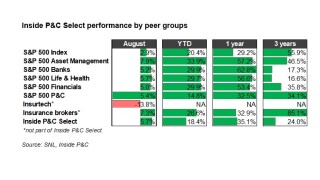

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

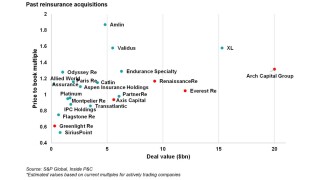

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

The newcomers are finding it more difficult to disrupt the sector than they had expected.

-

Employment data indicates that easy growth and margin expansion may slow soon.

-

The ransomware surge is likely to lead to changes in the product, a shake-up in market share and challenges for MGAs.

-

With the call taken on the break-up and radical re-underwriting over, the firm may become Just Another P&C Insurance Company.

-

The company expects inflation rate will rise 4%-5% in the medium term.

-

CEO Peter Zaffino said on Friday that AIG expects to be able to list more of the L&R unit than the 19.9% originally planned, and would fully use its remaining tax credits in 2022.

-

The GI segment combined ratio hit 92.5% off strong underlying margin expansion and a steep decline in catastrophes, as net written premiums climbed by 24%.

-

Purtill has served as chief risk officer on an interim basis since February.

-

Further resignations were expected after vesting of compensation incentives, following a number of departures from the firm in the past year.

-

The above-book valuation placed on the business will be a helpful anchor point for an IPO later in the year.

-

The carrier has agreed to sell a 9.9% stake in its life and retirement business to Blackstone for $2.2bn, in a deal that also involves a $5.1bn sale of property assets.

-

Owning a cat reinsurer is off-strategy for a firm trying to curb volatility, but a sale would be hard to execute.

-

Bergman will be reporting directly to Western World’s head Tim Whisler.

-

The read-across from the extreme weather to losses is not simple and insurers may do better than would be assumed.

-

Maritzen was previously head of risk management, property, at AIG, having joined the insurance giant in 2019 from Sompo International.

-

Jessie Ruppe joins from Arch to oversee casualty ceded reinsurance, while two internal promotions will be responsible for financial lines and property cessions.

-

The insurer has published its first-ever ESG report, detailing diversity and equality initiatives, along with pledges to cut carbon emissions.

-

Every market is going to have to decide where they stand on the issue of SPACs, said AIG’s head of North America financial lines.

-

Gilmore takes over for David Lynders, who is moving to a senior ceded reinsurance position after three years leading the financial institutions business.

-

AIG is among four companies dropped from the asset manager’s investment portfolio.

-

The executive joined AIG in 2018 and previously served as the president for Allied World’s US healthcare practice.

-

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

The 11-year Aon veteran most recently served as strategy director and client leader at Aon InPoint.

-

The executive previously served as an equity analyst at KBW and Morgan Stanley.

-

Sven Wehmeyer, who will remain as CEO of Validus’s Zurich-domiciled reinsurance arm, replaced Steve Bardill as head of international on 1 June.

-

Zaffino had said he wanted the deal done by year-end but conceded that the timetable might slip into 2022 depending on regulatory factors and market conditions.

-

The diversification benefits and complementary capabilities Validus affords AIG, along with the parent’s move to split its life and P&C operations, factored into the upgrade.

-

Dachille has long led AIG’s investment function, having first joined the company in 2015.

-

The Insure Our Future network is due to hold “physical and digital actions” in Japan, South Korea, the UK and the US.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

Competition is intensifying, with increased London market appetite one of the drivers.

-

Activist investors are successfully learning how to navigate a regulated industry.

-

At the carrier’s AGM, more than a quarter of votes were cast against a non-binding resolution to approve compensation arrangements.

-

AIG-owned surplus lines insurer Lexington is bringing to market a combined professional and general liability policy offering "dual tower aggregate limits" aimed at healthcare facilities in the small to medium-sized enterprise (SME) segment.

-

The pivot to profitable growth will be a topic to watch as investors patiently wait for this execution to deliver real margin improvement.

-

The CEO of general insurance says AIG achieved average rate increases of 41% for cyber business at Q1.

-

The carrier’s North American commercial lines unit grew net written premiums by 29% to $2.7bn.

-

Binding insurers include Chubb and AIG, with reinsurance from Munich Re.

-

She has held several casualty underwriting leadership positions at the company, where she has worked since 2009.

-

The underwriting executive has worked at the carrier since 2006.

-

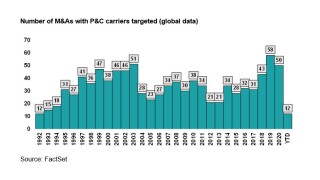

The next few years could prove to be more active in consolidation than normal for underwriters.

-

The remarks come in the context of a dispute over ballot access in Georgia, as corporations speak out.

-

Claude Wade spent six years at Marsh in various COO roles, at a time when Zaffino was CEO.

-

The Lloyd’s broker plans to establish additional regional offices.