AIG

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The deal follows a minority investment from the insurer in the summer.

-

Clifford’s appointment follows Everest’s $2bn renewal rights sale to AIG.

-

This publication revealed earlier Everest could sell its LatAm and Canadian units.

-

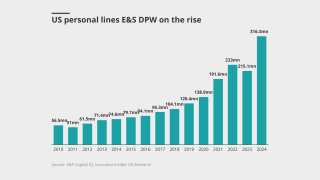

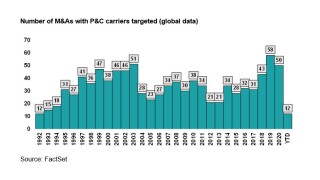

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Whether Clement's promotion was influenced by an inappropriate relationship is in scope.

-

The timing is unhelpful as the global insurer tries to get on the front foot with M&A.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

Underwriting income for North America quadrupled to $384mn, and the segment recorded a CoR of 82.6%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The company will implement a new leadership structure after his departure.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The Delaware high court’s reasoning could find application in other cases.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

The former executive passed away following a 40-year career in insurance.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

Submissions flow at E&S arm Lexington increased 28% year-over-year in Q2.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The former Everest executive has more than 30 years of A&H experience.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

He has pleaded not guilty to the criminal charges, which carry potential life sentences.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

He will lead AIG’s business across Latin America and the Caribbean.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The California wildfires in January accounted for $460mn of Q1 cat activity.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

A US buy would have to be easily integrated, the CEO stated.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

AIG veteran Kevin Bidney will focus on North American marine.

-

The executive said AIG’s E&S arm can grow 20% a year and generate $4bn of new business.

-

The judge noted similarities in Dellwood’s business plan and AIG’s.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.

-

Alexandra Furth has more than 20 years of claims and legal leadership experience.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier reshaped its portfolio in 2024, cutting costs and investing in Gen AI and LLM technology, CEO Peter Zaffino told staff.

-

The AIG subsidiary says it has no obligation to “defend or indemnify” McKinsey.

-

The carrier is restructuring the business into three segments.

-

The exec previously spent over 12 years at Aon, recently as chief innovation officer, commercial risk NA.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

Christopher Flatt succeeds Christopher Schaper, who was appointed CRO of AIG in November.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

Sonville’s hire was reported by Insurance Insider US last week.

-

Sources said the executive will join AJ Gallagher in a regional leadership position.

-

The carrier has used Lloyd’s London Bridge 2 structure for the launch.

-

AIG launched an IPO of Corebridge Financial in September 2022.

-

The sale of the business was confirmed in June.

-

The AIG and Stone Point-owned MGU will also look to move up-market, increase its weighting to E&S and add third-party paper.

-

Mr Cooper Group said it was the target of a 2023 hacking attack.

-

The firm had owned 3.45 million shares in Q2, then valued at over $256mn.

-

This publication revealed that Chris Schaper would move into the role on an interim basis in July.

-

Casualty submissions rose over 70% while property increased over 20% YoY in Q3.

-

The carrier reported a “large closeout transaction” that benefited the CoR but created a 0.7-point headwind for the loss ratio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer will move its Atlanta-area assets to a new "innovation hub".

-

Based in New York, he joins the firm after seven years as Marsh CFO.

-

The executive has resigned from AIG to fill the vacant CEO role at the large corporate unit of the German carrier.

-

The insurer said Dellwood’s "spin" isn’t enough to dismiss the litigation.

-

Last week, the insurer placed ~450 staff at risk of redundancy in its international business.

-

Zaffino said the divested crop and travel businesses needed scale to be more profitable.

-

The move is the latest phase of the operational transformation program, AIG Next.

-

The PVT market has seen a recent spike in staff movements, as new capacity enters the space.

-

Dellwood claims allegations in AIG’s latest filing are still barred by res judicata.

-

The impact on AIG’s top line will be around $750mn of net written premium within NA personal lines.

-

AIG recorded favorable excess casualty reserve development for AY prior to 2016 of $33mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Q2 cat losses of $325mn included $156mn in NA mainly from US SCS and $169mn overseas.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The arrangement enables PCS to expedite growth.

-

The executive has had a 40-year career at AIG, Berkshire Hathaway and Lloyd’s.

-

-

AIG says new details support case that former execs launched Dellwood using confidential business information.

-

Former Chesterfield managing director James Stevenson moves to exec chair.

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

This publication reported yesterday that the two carriers were nearing a deal.

-

The disposal is the latest milestone in AIG’s work to reposition itself as a commercial lines insurer.

-

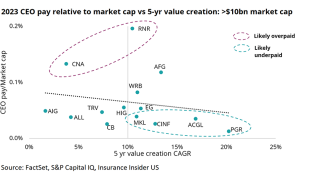

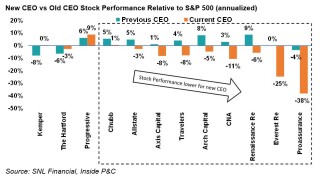

Analysis shows several CEOs with pay diverging from the trendline.

-

The company now owns around 48.35% of Corebridge Financial’s stock.

-

AIG is maintaining its initial 'unlawful misappropriation' suit against Dellwood.

-

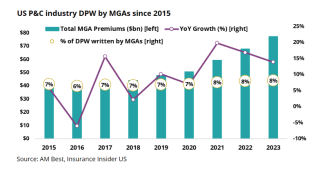

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The executive’s experience centers on program design for complex risk.

-

Browne joins from Allianz Global Corporate & Specialty, where he was head of specialty.

-

The executive announced last month that he was leaving Parsyl, where he had worked since 2021.

-

The deal represents a major milestone in AIG’s repositioning as a pure-play P&C insurer.

-

The executive is to pursue “a different entrepreneurial path”, according to an internal memo.

-

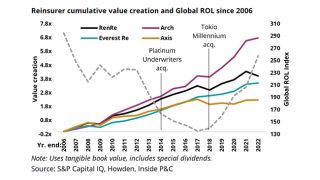

AIG sees improvement from tightened underwriting, though value creation has yet to catch up.

-

In certain classes like energy or cat, AIG switched “a bit” to XoL from quota share.

-

The carrier reported an E&S property slowdown but “massive” submission activity in casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

North America commercial lines' adjusted NWP grew 4% YoY on higher rates and new business.

-

The executive is to step back for personal reasons.

-

The group is looking to realize $500mn of run-rate savings through AIG Next.

-

The global insurer also alleges breach of contract and fiduciary duty in the federal suit.

-

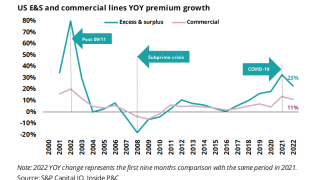

As admitted carriers pull out of riskier plays, E&S continues to expand and thrive.

-

Glatfelter CEO Chris Flatt will become interim chief executive.

-

A review of commercial lines loss picks for AIG vs the industry

-

Ross Bowie joins the MGA after serving as CUO at Orchid Insurance for two years.

-

For 2016 and 2017, in particular, the loss picks were raised to 91% and 96%, respectively.

-

Its property cat aggregate cover renewed with improved coverage.

-

Insurance Insider US runs you through the earnings results for the day.

-

NA commercial lines Q4 CoR increased 0.7 points to 85.1%.

-

Chris Inglis served as the first US Senate-confirmed national cyber director.

-

Between 2009 and 2012, Therese Vaughan served as CEO at NAIC.

-

The upgrade recognizes improving operating performance.

-

His last day will be December 2023, according to an internal memo seen by this publication.

-

Sources said the executive will join Mitsui Sumitomo in a leadership position based in Brazil.

-

James Dunne is vice chairman and senior managing principal of investment bank Piper Sandler.

-

AIG offered 35 million existing shares of Corebridge common stock priced at $20.50 per share Friday, out of 630 million total shares outstanding.

-

The executive will oversee AIG’s global technology and cybersecurity strategy and lead the insurer’s cloud strategy, along with other modernization technologies.

-

The low multiple shapes the decision set of the management team, negatively impacts staff, and creates potential opportunities for rivals.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

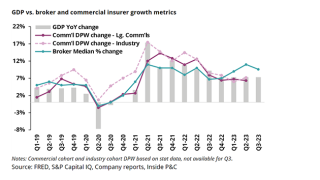

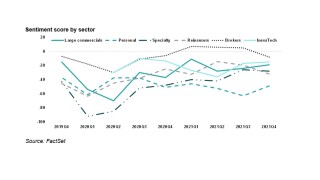

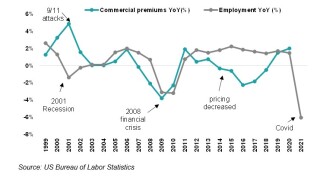

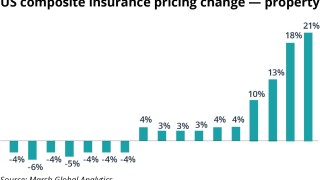

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

The carrier is offering 50 million existing shares of common stock and granted a 30-day option for underwriters to purchase up to an additional 7.5 million shares.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Excluding programs, the E&S insurer grew around 25% in the quarter, led by 33% growth in wholesale casualty.

-

-

The Inside P&C news team runs you through the earnings results for the day.

-

The firm booked catastrophe losses of $462mn — largely from Lahaina Wildfire and Hurricane Idalia — down from $655mn in Q3 last year, which was affected by Hurricane Ian.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

The executive left the company in June following a period of medical leave.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The departure of the president of North America retail was disclosed in an internal company memo.

-

AIG’s combined ratio improved to 92.6% in 2022 from an average of 106% between 2018 and 2020.

-

The move follows another incredibly soft year for the all-risk market as aviation war continues to harden.

-

Jon Hancock has also been named as international insurance CEO.

-

Having joined AIG in 2000, Poux was one of the Private Client Group’s founding members.

-

-

The former general counsel and communications chief will move to the role on 1 October.

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

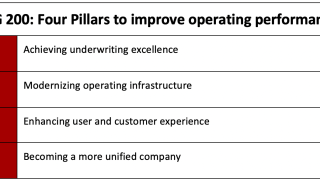

AIG has been course-correcting since 2008, but recent efforts including AIG 200 seem to have finally set it in the right direction.

-

AIG expects to add new capital providers to its recently launched HNW MGA “in the coming quarters”.

-

AIG decided to buy additional retrocessional protection for Validus Re and a low XoL reinsurance placement for its Private Client Group ahead of the wind season.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

AIG grew GI NWP in NA by 17% to nearly $4bn as both commercial lines and personal lines NWP rose 17% to over $3.4bn and $563mn, respectively.

-

-

Mark Sperring’s promotion comes just a few months after AIG’s former head of global aerospace, Steve Eccles, left the carrier.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The first signs of limit expansion, growing appetite in the admitted market, and retail brokers' impatience with wholesalers are all evident.

-

In addition, the insurer completed the $240mn sale of its agribusiness unit Crop Risk Services to American Financial Group (AFG).

-

Before joining AIG, the executive had served as chief underwriting officer of marine at The Hartford.

-

Formerly head of AIG’s separation management unit, Tarpey joined Corebridge last August.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the company decided to outsource its claims function to Sedgwick, a third-party administrator in which Stone Point Capital is a minority investor.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Purtill became interim CFO in January after AIG terminated Mark Lyons, saying the executive violated his confidentiality/non-disclosure obligations to the firm.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG offered 65 million existing shares of common stock, or about 10% of approximately 648 million total shares outstanding.

-

The carrier is offering 65 million shares of common stock, out of approximately 648 million total shares outstanding.

-

Marcial will take over the position left vacant after the departure of Juan Costa, who moved to Berkshire Hathaway as casualty VP in Atlanta.

-

The recent deal is accretive at 18% and will allow RenRe to take further advantage of the hard market.

-

The group exited an off-strategy business at an attractive valuation – now it must give a clearer indication of where it is going.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

Proxy advisers had called for shareholders to reject the pay deals, which feature a $50mn pay award for CEO Peter Zaffino.

-

The Dan Loeb-controlled investment firm reduced its position in AIG to 2.95 million shares, or ~0.4%, in Q1, from or 5.1 million shares, or around 0.7%, at the end of Q4.

-

Speaking about the recently spun-out HNW MGA, Zaffino said AIG expects to bring on additional capital providers to the subsidiary through H2 2023.

-

Beginning in Q3, AIG will act as a fronting partner for AFG during a transitional period of the transaction.

-

The firm’s North America operations recorded $116mn of cat losses in Q1 while the international division reported $148mn losses.

-

Following the deal, around 450 CRS employees will move to AFG’s Great American Insurance group.

-

Senior departures, the Corebridge stock price and the arrival of Dan Loeb all throw up additional obstacles.

-

The new independent program manager will serve HNW and ultra-HNW markets and is expected to begin producing business in Q3 2023.

-

He replaces Steven Barnett, who is leaving to pursue opportunities outside the company.

-

The syndicate also reported net unrealised investment losses of $20.9mn, up from $5.7mn in 2021, amid mark-to-market losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The group CUO role is being eliminated with the function pushed back into the regions and specialties.

-

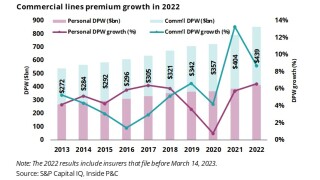

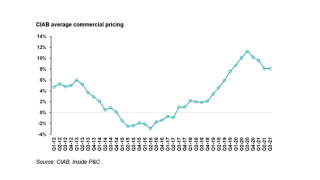

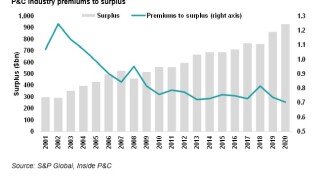

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The announcement follows the appointment of Diana Murphy and Vanessa Wittman as independent directors, which will be effective on March 16.

-

Diana Murphy has been managing director at Rocksolid for 15 years, while Vanessa Wittman was most recently CFO of Glossier.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The AIG 200 project has officially ended, with the goals met ahead of schedule and under-budget, but there is still work to do to close the gap with competitors.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Pricing, which includes rate plus exposure, was up 6% for both North America and international.

-

The move fits the broader strategy around dampening volatility, but sourcing capacity in the US domestic market will be tough.

-

-

North America commercial lines CoR for the quarter improved 10.4 points to 84.4%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG has entered into a binding memorandum of understanding with Stone Point Capital to form an independent MGA to serve high-net-worth (HNW) markets, as it takes a dramatic step to address the volatility this business has brought.

-

Steve Eccles joined AIG in April 2020 from Argo, where he was active underwriter of Syndicate 1200.

-

It is understood that Lyons has been set to retire from the company in the summer of 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

To replace Lyons, AIG appointed Sabra Purtill as interim CFO and Turab Hussain as interim chief actuary.

-

Motamed has been a member of the carrier’s board since January 2019.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Former CFO Mark Lyons will step in as interim CFO, in addition to his current role as EVP, global chief actuary and head of portfolio management.

-

The ratings agency reaffirmed AIG and its P&C subsidiaries’ FSR rating of A and ICR of a.

-

Alvarez & Marsal North America and Latham & Watkins are advisers to the financial products unit in the bankruptcy process.

-

Inside P&C Research examines E&S sector growth over the past year and revisits historic trends.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Consistent underwriting performance, the completion of the exit from life, acquisitions, organic growth and succession planning will all be focuses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The two insurers are believed to provide in excess of 20% of the cat MGA’s capacity.

-

The CEO’s annual salary and short- and long-term incentive targets have increased.

-

Since joining the company in 2017, the executive has helped to spearhead a turnaround in performance for the carrier.

-

Bergamaschi joins the insurer’s board as Douglas Steenland will not stand for reelection in the next annual meeting of shareholders.

-

The likely windows for a secondary offering of Corebridge's common stock will be mid- to late March as well as mid-May to late June.

-

The executive said AIG expected growth opportunities ahead, including in the property cat market.

-

-

The firm’s North America CoR deteriorated 8.3 points to 114%, but the international division’s CoR improved 13.3 points to 81.4%.

-

The Massachusetts Bay Transportation Authority claims the firms failed to act over the bankruptcy of LMH-Lane Cabot Yard Joint Venture.

-

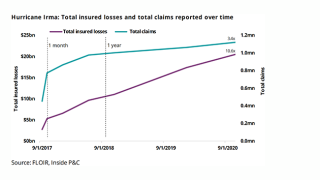

Universal P&C, the FHCF, Axis, Berkshire and Nephila are among the firms that will be in focus as the loss develops.

-

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

Josh Brekenfeld succeeds Patrick Mahon, who has been appointed head of group business for global accident and health.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG is offering 80 million existing shares of common stock, or 12.4%, out of 645 million total common shares of Corebridge.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive has over two decades of experience in the property underwriting sector, having worked for various carriers, including PartnerRe and RSA.

-

Paul McLaughlin, senior underwriting manager for Lexington, will head up the new team.

-

The executive pointed at cyber and excess and surplus carrier Lexington as businesses that AIG was seeing rapid growth.

-

The company is offering 80 million Corebridge shares, or 12.4% of the subsidiary’s 645 million total common shares.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

The appointment follows a delay of plans to take the life and health unit public.

-

Odyssey Group’s cyber chief Robert O’Connell is looking to raise up to $1bn of capital for a monoline cyber reinsurer.

-

The firm needs to get a grip in HNW, dial up commercial lines growth, cut through the Corebridge knot and then an acquisition will be next.

-

The company reached the fourth consecutive year achieving rate above loss-cost trends.

-

The chief executive said AIG’s next window of opportunity to strike Corebride’s IPO will be in September.

-

The carrier postponed the IPO of its life and health unit Corebridge due to stock market volatility.

-

Sources said Obregon will retire at year end after over 26 years working for Chubb Colombia.

-

The executive will rejoin as EVP, reinsurance purchasing and risk capital optimization.

-

Beazley and Chubb are working on different approaches as the market tries to get its arms around the aggregation risk.

-

Metromile’s Preston and Lemonade co-CEOs Wininger and Schreiber all joined industry stalwarts in this year’s top 10.

-

Adriana Cisneros was AIG’s LatAm property product leader for more than three years in south Florida.

-

Based in Bermuda, Jesse DeCouto will report directly to Validus Re CEO Chris Schaper.

-

The carrier has also disclosed carbon emission breakdowns across its underwriting portfolios, as well as D&I figures for its workforce, in an ESG report.

-

The executive will take up the role of global head of marine at AIG.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

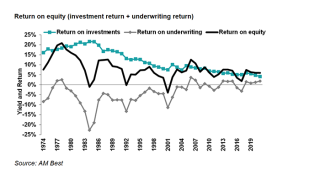

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

The appeals court for the eighth circuit overturned a prior ruling by a district court which had dismissed the broker’s claims that dated back to 2017.

-

The carrier, which has been a leader in the war liability market, has re-evaluated its appetite as a result of the Ukraine conflict.

-

Other defendants in the complaint include Endurance, Great American Insurance, Ironshore, Ace American Insurance and TIG Insurance.

-

Rate rises in the commercial lines market have decelerated in most insurance markets, but executives expect increases to remain above loss costs for some time.

-

Inside P&C’s news team runs you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

These results will strengthen convictions on the turnaround, but questions remain around how it will fare in a market where all insurers are looking to grow.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Aircraft location and condition is driving uncertainty around Russia aviation losses, CEO Peter Zaffino said.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

NA CoR declined 17.6 points to 90.8% as the region’s long-troubled commercial lines book swung to profits with an 88.8% CR, down 17.9 points from Q1 2021.

-

The executive joined AIG in early 2010 and has held myriad positions since then, including financial lines assistant underwriter and cyber specialist.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.

-

Bolt replaces Sabra Purtill, who was recently named EVP and CIO for AIG’s life and retirement business.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said they expect other major commercial insurers to follow suit, with territorial exclusions potentially broadening to Belarus.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The move will leave nearly 8,000 affluent customers without coverage and unable to turn to state-backed insurer Citizens Property Insurance.

-

The division reported in a regulatory filing total 2021 premiums of $5.6bn and $3bn in policy fees.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Board members include the former CEO of Assurant and the chief legal officer of Stripe.

-

BlackRock will manage up to $60bn of the global AIG investment portfolio and up to $90bn of the life and retirement investment portfolio.

-

Before retiring from GE in 2018, Rice served as president and CEO of the GE Global Growth for seven years.

-

The commercial lines turnaround is a remarkable achievement, but to succeed in the next phase it must pivot from its command-and-control culture.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Edwards had extensive experience in procurement and global sourcing roles before joining AIG in December.

-

Insurance carriers tailor their comments to leave investors walking away with an optimistic view.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The global insurer has added a "net-zero emissions" goal of 2050 for investments and underwriting.

-

The firm posted positive quarterly earnings – is this the beginning of a trend?

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG has kept the Q2 2022 target to land the life and retirement unit IPO, and still expects to retain more than a 50% stake after the event.

-

The executive said the business model in the high-net-worth space “simply needs to change” as loss costs have risen, fueled by increased frequency and severity.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Excluding the effects of cats and reserve developments, AIG’s core loss ratio also improved, decreasing to 59.2% from 60.3%.

-

Insurance stocks mixed following swath of earnings results; Aon gains nearly 7% in Friday trading.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The executive will have responsibility for global treasury activity, including financing plans and banking.

-

The Mayfield Consumer Products candle factory is one of the two most high profile large individual risk losses from the quad state tornado to date.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

Constance Hunter previously served as KPMG’s chief economist and has nearly three decades of experience in the financial sector.

-

Casualty rate hikes moderate, though areas like wildfire liability remain difficult amid an ever-more litigious environment.

-

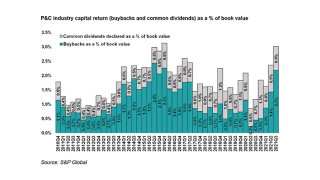

The higher level of repurchases seen in Q3 will likely last longer than expected.

-

Are this quarter’s positive results a sign of change for the company or a temporary blip?

-

Rates in the P&C market continued to rise in the third quarter, with outsized increases for cyber insurance driving up the average change, according to data revealed in company third-quarter conference calls.

-

AIG’s CEO Peter Zaffino said Friday the insurer’s life & retirement IPO plans are progressing, but may be pushed back to 2Q 2022.

-

The carrier has $175mn remaining in its aggregate retention and is expecting limited catastrophe losses during Q4 given their treaty cover.

-

The insurer grew GI net premiums by 11%, led by 17% growth in its commercial business.

-

-

The role changes will take effect on January 1, with both men continuing to report to group CEO Peter Zaffino.

-

The executive was serving as northeast zone manager for commercial D&O, private and non-profit management liability since last May.

-

In a virtual fireside chat with Aon CEO Greg Case, AIG’s CEO spoke candidly about the work the carrier’s management team had to put in to fix its underwriting results.

-

AM Best estimates that the loss of the life and retirement segment’s profitability will be offset by an increase in available capital and liquidity.

-

By moving a business from AIG's ecosystem into Coalition's, the perception of its value is transformed.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.

-

Hurricanes, floods and wildfires are pushing up Q3 catastrophe losses, AIG's finance chief says.

-

Dyer will work as head of logistics, while Adams will support Greek clients with insurance and risk management.

-

The insurer’s CEO and president Peter Zaffino will take on the extra remit when executive chairman Brian Duperreault switches to a non-exec role at the end of the year.

-

Goldberg will report to Susan Chmieleski, Lexington head of professional lines.

-

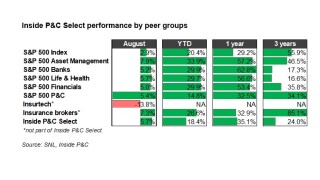

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

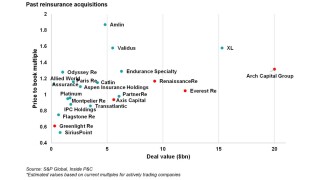

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

The newcomers are finding it more difficult to disrupt the sector than they had expected.

-

Employment data indicates that easy growth and margin expansion may slow soon.

-

The ransomware surge is likely to lead to changes in the product, a shake-up in market share and challenges for MGAs.

-

With the call taken on the break-up and radical re-underwriting over, the firm may become Just Another P&C Insurance Company.

-

The company expects inflation rate will rise 4%-5% in the medium term.

-

CEO Peter Zaffino said on Friday that AIG expects to be able to list more of the L&R unit than the 19.9% originally planned, and would fully use its remaining tax credits in 2022.

-

The GI segment combined ratio hit 92.5% off strong underlying margin expansion and a steep decline in catastrophes, as net written premiums climbed by 24%.

-

Purtill has served as chief risk officer on an interim basis since February.

-

Further resignations were expected after vesting of compensation incentives, following a number of departures from the firm in the past year.

-

The above-book valuation placed on the business will be a helpful anchor point for an IPO later in the year.

-

The carrier has agreed to sell a 9.9% stake in its life and retirement business to Blackstone for $2.2bn, in a deal that also involves a $5.1bn sale of property assets.

-

Owning a cat reinsurer is off-strategy for a firm trying to curb volatility, but a sale would be hard to execute.

-

Bergman will be reporting directly to Western World’s head Tim Whisler.

-

The read-across from the extreme weather to losses is not simple and insurers may do better than would be assumed.

-

Maritzen was previously head of risk management, property, at AIG, having joined the insurance giant in 2019 from Sompo International.

-

Jessie Ruppe joins from Arch to oversee casualty ceded reinsurance, while two internal promotions will be responsible for financial lines and property cessions.

-

The insurer has published its first-ever ESG report, detailing diversity and equality initiatives, along with pledges to cut carbon emissions.

-

Every market is going to have to decide where they stand on the issue of SPACs, said AIG’s head of North America financial lines.

-

Gilmore takes over for David Lynders, who is moving to a senior ceded reinsurance position after three years leading the financial institutions business.

-

AIG is among four companies dropped from the asset manager’s investment portfolio.

-

The executive joined AIG in 2018 and previously served as the president for Allied World’s US healthcare practice.

-

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

The 11-year Aon veteran most recently served as strategy director and client leader at Aon InPoint.

-

The executive previously served as an equity analyst at KBW and Morgan Stanley.

-

Sven Wehmeyer, who will remain as CEO of Validus’s Zurich-domiciled reinsurance arm, replaced Steve Bardill as head of international on 1 June.

-

Zaffino had said he wanted the deal done by year-end but conceded that the timetable might slip into 2022 depending on regulatory factors and market conditions.

-

The diversification benefits and complementary capabilities Validus affords AIG, along with the parent’s move to split its life and P&C operations, factored into the upgrade.

-

Dachille has long led AIG’s investment function, having first joined the company in 2015.

-

The Insure Our Future network is due to hold “physical and digital actions” in Japan, South Korea, the UK and the US.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

Competition is intensifying, with increased London market appetite one of the drivers.

-

Activist investors are successfully learning how to navigate a regulated industry.

-

At the carrier’s AGM, more than a quarter of votes were cast against a non-binding resolution to approve compensation arrangements.

-

AIG-owned surplus lines insurer Lexington is bringing to market a combined professional and general liability policy offering "dual tower aggregate limits" aimed at healthcare facilities in the small to medium-sized enterprise (SME) segment.

-

The pivot to profitable growth will be a topic to watch as investors patiently wait for this execution to deliver real margin improvement.

-

The CEO of general insurance says AIG achieved average rate increases of 41% for cyber business at Q1.

-

The carrier’s North American commercial lines unit grew net written premiums by 29% to $2.7bn.

-

Binding insurers include Chubb and AIG, with reinsurance from Munich Re.

-

She has held several casualty underwriting leadership positions at the company, where she has worked since 2009.

-

The underwriting executive has worked at the carrier since 2006.

-

The next few years could prove to be more active in consolidation than normal for underwriters.

-

The remarks come in the context of a dispute over ballot access in Georgia, as corporations speak out.

-

Claude Wade spent six years at Marsh in various COO roles, at a time when Zaffino was CEO.

-

The Lloyd’s broker plans to establish additional regional offices.

-

Appointment comes as the insurance industry is adapting to the Biden White House.

-

Regional per occurrence deals were also down compared to last year, but Validus lifted its retro cover by $75mn.

-

On its fourth quarter call, AIG management shared it received “quality” interest from parties willing to acquire a minority interest in its life and retirement business.

-

Athene CEO Jim Belardi says it has expressed interest in purchasing the minority stake.

-

An IPO remains on the table, alongside the option of a minority stake sale.

-

The company also lowered the attachment points on its per-occurrence and aggregate property catastrophe treaties after shrinking its portfolio.

-

The GI commercial unit boosted net premiums by 8.5% in the quarter, led by a 21% rise in property business.

-

AIG’s shareholders are getting a raw deal, with an outcome on compensation that does not look like value for money.

-

The new CUO previously led the New York zone for AIG’s financial lines book.

-

Some sub-classes of the cyber market such as industrial manufacturing and retail wholesalers are seeing rate hikes of as much as 40%.

-

Pure pricing data suggested the D&O market kept taking rate-on-rate in Q4, while the policy restructuring and retention data showed early signs of peaking.

-

Twelve funds, which together manage around $7.5bn in assets, will be moved into Touchstone Investments.

-

Finance minister Nirmala Sitharaman said the government will lift the foreign direct ownership cap from 49% to 74%.

-

Run-off business from the carrier’s general insurance and Fortitude Re units will now sit within its other operations segment.

-

The new unit focuses on SME clients with under $150mn in revenue.

-

Corine Troncy joins from Coface, where she was most recently a senior advisor to the French carrier’s executive committee.

-

Bill Fahey is the latest senior D&O underwriter to switch roles as the management liability market continues to harden.

-

The company expects reinsurance to provide 78% of its $2.5bn gross written premium target.

-

Inside P&C places the key news from the past week under the microscope.

-

The insurer highlights the discrepancy between how the Trump rally and BLM protests were treated.

-

It follows earlier efforts by excess cyber insurers to introduce sub-limits during Q4.

-

Validus executive Cossu and nine of her team move to Hudson.

-

Hawkins was head of retail distribution at AIG, having joined the insurance giant in 2019, where he was a managing director.

-

The insurer is also said to have scaled back its cession percentage to between 25%-30%, with final signings still being determined.

-

The CEO called reinsurance an incumbents’ market, despite the influx of new capital.

-

Senior management liability underwriters Brady Head and Shelley Norman have left for Berkshire Hathaway.

-

Allison Barrett has taken over the underwriter’s responsibilities at the carrier.

-

The carrier has placed its book of primary business into run-off but will continue to write space reinsurance.

-

Lucy Fato gains an expanded role, as Emily Garbaccio is promoted.

-

Insurance stocks hurtled upwards on a Biden victory and bullish vaccine news.

-

Thoughts from our research team on new disclosures on the firm’s proposed break up.

-

Hotspots include property insurance and excess casualty, where rate increases of over 30% were obtained.

-

AIG executives revealed that proceeds from the sale would be used to reduce the carrier’s debt leverage.

-

On Thursday, the carrier reported consolidated operating income of $918mn, higher than last year’s $718mn total and well ahead of the $0.54 a share that analysts predicted.

-

Inside P&C looks ahead to the insurer’s results/call, with both comp and capital under scrutiny.

-

Sources said AIG is offering some staff guaranteed bonuses and stay packages.

-

Banking sources are divided on whether AIG is likely to be able to find a buyer for its life arm.

-

AM Best said it will continue to monitor the carrier as it spins off its life and retirement operations.

-

The ratings agency says it will conduct a review of AIG’s group credit profile without the life and retirement business.

-

The carrier aims to create a separate company from its life and retirement business.

-

The jump follows news of a life and retirement spin out and the departure of Brian Duperreault as CEO.

-

Duperreault will take the post of executive chairman, and Steenland will become lead independent director.

-

The dispute was over contentious 1990s tax structures.

-

The money will be split between 4,400 people, including survivors and the families of those who lost their lives.

-

-

The executive previously spent 22 years at AIG before moving to XL Catlin in 2013.

-

The case for an AIG break-up is clear, but the market remains skeptical. We outline the primary pushback and arguments against it.

-

The reinsurance broker’s international chief leaves after 35 years.

-

The newly created role will focus on broker relationships in the E&S markets.

-

The GI CUO was at the heart of a remediation drive at AIG that involved major cuts to limits and a de-risking of the portfolio.

-

Driscoll was a founding employee of Validus in 2005 and became CEO of its reinsurance division in 2012.

-

The executive, a key lieutenant of group COO Peter Zaffino, is the first of the Duperreault-era management team to leave.

-

The Inside P&C research team takes a deep dive into AIG's current crisis and the case for a break-up.

-

The digital MGA uses machine learning to augment the underwriting of small business cover.

-

Chris Schaper is to step in as CEO of the unit, as Jeff Clements and Chris Silvester depart.

-

In the first of a two-part series on a year of transition at AIG, we argue the board deserves more scrutiny for its role in tolerating persistent underperformance.

-

The plaintiffs have challenged Lexington’s requirement for proof of physical loss.

-

The agency downgrades credit outlook for life and retirement segment from a+ to a.

-

The appointment follows McElroy’s elevation to global CEO of general insurance at the carrier.

-

The reshuffle at AIG is a new step towards the group president and COO succeeding Duperreault as CEO.

-

The airline has said that it does not expect a total loss to the $200mn policy with the aircraft repairable.

-

Insurance CEOs say a narrative of economic disruption helped to achieve double-digit rate rises in lines such as commercial property and D&O.

-

The carrier’s share price had declined to $29.71 as of 13:56 in New York.

-

The company confirmed it had bought $500mn of additional catastrophe aggregate.

-

Zaffino said also that AIG remains on track to achieve run rate savings of $300mn for 2020.

-

AIG reported Q2 operating EPS of $0.66 versus $0.50 consensus and $1.43 YoY. Operating results were driven by an improving underlying general insurance result, offset by Covid losses, and lower net investment income.

-

Covid losses contributed eight points to the combined ratio of 106%.

-

Houston-based Valic Financial Advisors was earlier charged with failing to disclose key information to investment clients.

-

COO and general insurance chief Zaffino says the relocated HQ and consolidated sites incorporate remote working lessons.

-

He will assume management of AIG’s life and retirement, IT and enterprise risk functions alongside his existing roles.

-

Underwriters in the cyber insurance market are anticipating a major payout following a ransomware attack on US technology and consulting company Cognizant.

-

The renewal rights agreement for the upper middle market personal lines segment reflects AIG’s focus on the high-net-worth policyholders.

-

The insurers say they are not liable for Hertz’s defense costs from a 2014 regulatory probe.

-

Chubb and CNA fell by 7 percent, while AIG closed the day down 10 percent.

-

Yesterday Blackboard declared victory in its mission to disrupt insurance, and in a final glorious triumph announced it would be closing permanently.

-

CEO Macia said the closure was "not a criticism of our technology, team or mission".

-

The deal was announced in November last year, setting Fortitude Re on the path to independence.

-

CFO Mark Lyons spoke at an investor conference last week, pointing out potential offsets to Covid-19 losses due to lower frequency emerging.

-

About 44 percent of votes cast supported a move to increase investor power to demand special meetings.

-

Glass Lewis and ISS had previously opposed Brian Duperreault’s compensation package.

-

Shares in the insurers rose higher than the broader market as states move toward cautiously reopening their economies.

-

Tuesday’s call included an interesting shift in tone from AIG CEO Brian Duperreault, who suggested the company would “continue to look at” the possibility of a break-up of P&C and life.

-

The InsurTech, which AIG opted to put into run-off, had projected premium income of $50mn in 2020.

-

AIG “remains in a strong financial position” despite the pandemic, the executive said.

-

Last night featured the most significant “jailbreak” to date, with AIG taking the opportunity to drop its long-term ROE goal.

-

AIG will recognise an impairment charge of $210mn in connection with shutting down the InsurTech.

-

AIG will report earnings tonight and face investors tomorrow, and we see big strategic questions hanging over it on (a) AIG 200, (b) its capital allocation strategy and (c) its market sensitivity.

-

City comptroller Scott Stringer said AIG, BHSI and Liberty Mutual should stop underwriting and investing in coal.

-

Among the biggest gainers was Fairfax Financial, which jumped by nearly 10 percent.

-

Insurance stocks outperformed as Federal Reserve agreed to take further action and lawmakers mulled a pandemic backstop.

-

(Re)insurance shares in Europe also outperform market indices after a strong day for US brokers yesterday.

-

The mid-market commercial insurer also gains authorisation in Washington State.

-

The S&P 500 insurance industry index rose by 2.8 percent as lawmakers neared a vote on a coronavirus economic relief package.

-

George Williams joins the reinsurance broker as global head of client support services.

-

AIG gains 19 percent, outstripping a 12 percent increase on the S&P 500 insurance industry index.

-

Shareholder William Steiner is calling for AIG to lower the threshold of equity shareholders need to call a special general meeting.

-

AIG marked a third straight day of stock price losses, ending at $18.78 per share.

-

The S&P 500 insurance industry index rose by 8.2 percent by the close of markets Friday.

-

The broader S&P 500 insurance index ended the day down 11.3%.

-

The executive, who is also chief accounting officer, will leave at the end of the month.

-

London will set global strategy and serve as the core specialty hub.

-

The carrier’s stock price jumped to over $35 per share by the close of markets.

-

Insurers slump further than benchmark equity indices on fears for their investment portfolios.

-

The appointment positions the outgoing Lloyd's executive as a likely successor to Zaffino as GI head.

-

AIG announced a surprise $500mn accelerated share repurchase plan, having previously told investors not to expect capital return until likely H2.

-

The carrier takes its first bite of a $2bn repurchase authorisation after a steep drop in its share price.

-

AIG followed an encouraging Q4 print with 2020 guidance that disappointed investors, appearing to push out its expected earnings recovery further into 2021.

-

Pre-adverse development cover, the carrier saw impact from directors’ and officers’ and mergers and acquisitions-related business.

-

The insurer said it had shaved about 7 percent off overall reinsurance costs.

-

The carrier cut gross limits for the class of business by $40bn during the quarter.

-

We revisit key issues at stake at a crucial point of AIG's operating turnaround.

-

According to sources, AIG underwriters globally have been told not to write new construction risks in Latin America.

-

AIG's head of global specialty business Peter Bilsby has left his post and will be replaced on an interim basis by global head of energy and construction Gordon Browne.

-

AIG’s decision to exit the surety market illustrates that the re-underwriting wheels continue to turn at the carrier as it looks to dampen underwriting volatility and move away from its previous “large-limits strategy”.

-

Sources said Island Express Helicopters holds a $50mn hull and liability insurance policy.

-

The AIG executive urged carriers to be "part of the solution" and help customers transition to cleaner energy.

-

The Asia Pacific CEO’s departure from the general insurance division follows the exit of Chris Townsend earlier this month.

-

Speculation linking AIG with a bid for Voya highlights the competing operating and capital allocation challenges facing company in 2020.

-

The US insurer was one of several firms believed to have courted the retirement plan provider last year.

-

The equity research group says international P&C losses look likely to exceed earlier expectations.

-

Hilary Brown most recently served as head of casualty, international for AIG.

-

Move will be seen as a confirmation that the former MMC exec will ultimately succeed Duperreault.

-

Speaking during a conference in New York, the executive said said P&C pricing into 2020 would remain “disciplined".

-

Jason Rollins, Nadir Durrani, Neeraj Jeswani and Jessica Whiton have joined the carrier.

-

The ratings agency said the transaction reduced the carrier’s exposure to higher risk legacy products.

-

Carlyle and its investors will own 71.5 percent of the entity, which acquires life and property and casualty assets in run off.

-

An unsuccessful appeal against the claim by 23 former UK executives could encourage similar actions by ex-employees in the US.