AJ Gallagher

-

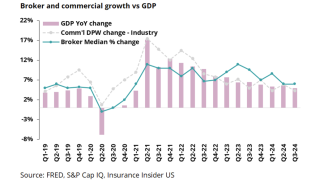

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

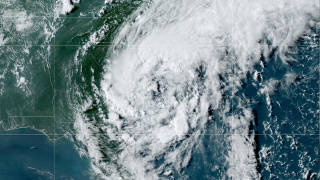

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

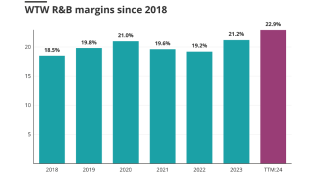

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The executive will officially start in mid-November.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

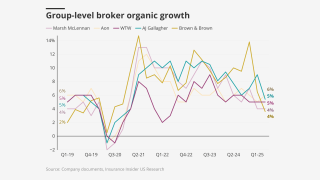

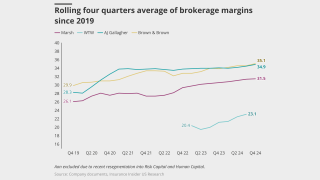

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The risk of cyber incidents that cause physical damage is also rising.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The executive left Lockton Re in June after almost six years.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

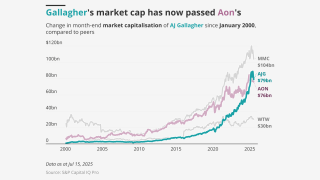

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

The US accounted for 92% of all global insured losses for the period.

-

Apax and Carlyle will continue to back the broker consolidator.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The soft market continued through H1 2025, especially on shared programs.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

He joined RPS in 1999 after a year-long stint as regional manager of Executive Risk.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

Q1 was the ninth consecutive quarter of below-average deal volume.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The firm also reported it paid $82.8mn for Brazilian brokerage Case Group.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

The deal had HSR approval and was waiting on approval from the UK.

-

The book of business comprises both personal and commercial lines.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The executive was most recently chief revenue officer at Aon.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

Gallagher already has HSR approval for the $1.2bn Woodruff Sawyer acquisition.

-

Dickerson has spent over three years at the reinsurance broker.

-

The company said it now expects the transaction to close in H2 2025.

-

Competition for specialty reinsurance talent remains high.

-

The California broker’s pro forma revenue for full year 2024 was $268mn.

-

Gallagher paid out $1.7bn in 2024, additional to its costs for AssuredPartners.

-

The broker attributed the drop to smaller average deal sizes over the quarter.

-

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

AJ Gallagher expects to complete the $13.5bn acquisition of AssuredPartners in Q1.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Bradley was construction team leader for US casualty at WTW.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

The broker cautioned unresolved Russia-Ukraine claims remain a ‘Black Swan’

-

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

Sonville’s hire was reported by Insurance Insider US last week.

-

Sources said the executive will join AJ Gallagher in a regional leadership position.

-

The pair will lead crisis management and financial lines, respectively.

-

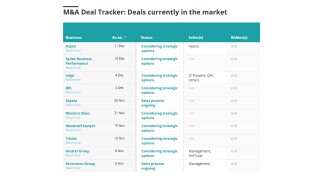

Insight into the current state of the insurance M&A market, powered by the Insurance Insider US M&A Deal Tracker.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The deal is financially attractive, but risks diluting the jewel that is Gallagher’s US mid-market business.

-

The executive said the combined entity could execute 100-110 tuck-in M&A deals a year.

-

The deal represents a 14.3x Ebitda multiple and strengthens Gallagher’s mid-market position.

-

The deal dramatizes the jammed PE deals conveyor, with the playing field tilted towards strategics.

-

If the deal is finalized, it will represent the largest in the acquirer’s history.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

Earlier this month this publication revealed that the brokerages were in advanced talks to secure a deal.

-

Sources said the brokers are in the final stages and could seal a deal in the next couple of weeks.

-

More broadly, the firm is looking at over 100 potential mergers in its pipeline, with ~$1.5bn acquired revenue.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

This publication revealed her departure from Guy Carpenter in August.

-

The above-average tally was driven by a high frequency of mid-sized events.

-

Paul spent five years at Gallagher Re in addition to 10 years at Guy Carpenter.

-

The Plane Talking report said the longevity of the ‘buyers’ market’ is in question.

-

In all, primary insurance renewal premiums have risen 6% so far in Q3.

-

Former Artex managing director Jasmine DeSilva will run the segment.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

The executive was previously Guy Carpenter’s head of sales in New York.

-

-

Sources said that Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

Annual InsurTech funding volume for H1 was $2.2bn, just below $2.3bn for H1 2023.

-

The broker said that rising reinsurance costs after the Baltimore Bridge collapse could put a brake on softening in 2025.

-

CFO Doug Howell said the company has invested around $700mn in M&A this year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Most recently, Richard Harries was CEO at Atrium Underwriters.

-

A quick roundup of today’s need-to-know news, including Chubb’s Q2 earnings call.

-

-

The executive will relocate to Peru and report to CCO Alejandro Revoredo.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

The broker will work to support US client retention and business growth.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

Carriers believe price and exposure adequacy is on the horizon.

-

A deal would mark Amwins’ second LatAm sale, after Lockton acquired THB Brazil last May.