AJ Gallagher

-

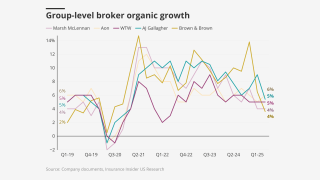

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

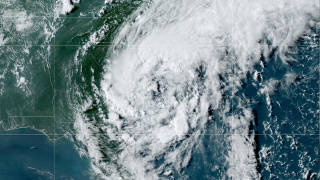

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The executive will officially start in mid-November.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The risk of cyber incidents that cause physical damage is also rising.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The executive left Lockton Re in June after almost six years.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

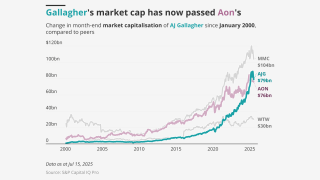

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

The US accounted for 92% of all global insured losses for the period.

-

Apax and Carlyle will continue to back the broker consolidator.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The soft market continued through H1 2025, especially on shared programs.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

He joined RPS in 1999 after a year-long stint as regional manager of Executive Risk.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

Q1 was the ninth consecutive quarter of below-average deal volume.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The firm also reported it paid $82.8mn for Brazilian brokerage Case Group.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

The deal had HSR approval and was waiting on approval from the UK.

-

The book of business comprises both personal and commercial lines.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The executive was most recently chief revenue officer at Aon.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

Gallagher already has HSR approval for the $1.2bn Woodruff Sawyer acquisition.

-

Dickerson has spent over three years at the reinsurance broker.

-

The company said it now expects the transaction to close in H2 2025.

-

Competition for specialty reinsurance talent remains high.

-

The California broker’s pro forma revenue for full year 2024 was $268mn.

-

Gallagher paid out $1.7bn in 2024, additional to its costs for AssuredPartners.

-

The broker attributed the drop to smaller average deal sizes over the quarter.

-

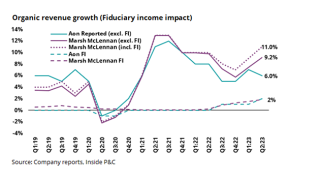

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

AJ Gallagher expects to complete the $13.5bn acquisition of AssuredPartners in Q1.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Bradley was construction team leader for US casualty at WTW.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

The broker cautioned unresolved Russia-Ukraine claims remain a ‘Black Swan’

-

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

Sonville’s hire was reported by Insurance Insider US last week.

-

Sources said the executive will join AJ Gallagher in a regional leadership position.

-

The pair will lead crisis management and financial lines, respectively.

-

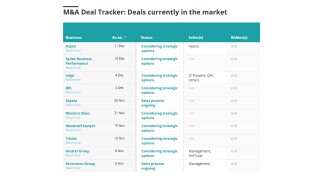

Insight into the current state of the insurance M&A market, powered by the Insurance Insider US M&A Deal Tracker.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The deal is financially attractive, but risks diluting the jewel that is Gallagher’s US mid-market business.

-

The executive said the combined entity could execute 100-110 tuck-in M&A deals a year.

-

The deal represents a 14.3x Ebitda multiple and strengthens Gallagher’s mid-market position.

-

The deal dramatizes the jammed PE deals conveyor, with the playing field tilted towards strategics.

-

If the deal is finalized, it will represent the largest in the acquirer’s history.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

Earlier this month this publication revealed that the brokerages were in advanced talks to secure a deal.

-

Sources said the brokers are in the final stages and could seal a deal in the next couple of weeks.

-

More broadly, the firm is looking at over 100 potential mergers in its pipeline, with ~$1.5bn acquired revenue.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

This publication revealed her departure from Guy Carpenter in August.

-

The above-average tally was driven by a high frequency of mid-sized events.

-

Paul spent five years at Gallagher Re in addition to 10 years at Guy Carpenter.

-

The Plane Talking report said the longevity of the ‘buyers’ market’ is in question.

-

In all, primary insurance renewal premiums have risen 6% so far in Q3.

-

Former Artex managing director Jasmine DeSilva will run the segment.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

The executive was previously Guy Carpenter’s head of sales in New York.

-

-

Sources said that Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

Annual InsurTech funding volume for H1 was $2.2bn, just below $2.3bn for H1 2023.

-

The broker said that rising reinsurance costs after the Baltimore Bridge collapse could put a brake on softening in 2025.

-

CFO Doug Howell said the company has invested around $700mn in M&A this year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Most recently, Richard Harries was CEO at Atrium Underwriters.

-

A quick roundup of today’s need-to-know news, including Chubb’s Q2 earnings call.

-

-

The executive will relocate to Peru and report to CCO Alejandro Revoredo.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

The broker will work to support US client retention and business growth.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

Carriers believe price and exposure adequacy is on the horizon.

-

A deal would mark Amwins’ second LatAm sale, after Lockton acquired THB Brazil last May.

-

The move is the latest in a series of top-level reshuffles at Gallagher.

-

She will report to Brian Flasinski, Gallagher Re’s new North America CEO.

-

His promotion to chief executive was announced in March.

-

Partington will now be leading Gallagher’s LatAm and Caribbean businesses.

-

AJ Gallagher had also shown an interest in acquiring the Australian retailer.

-

US SCS insured losses YTD already stood at around $12bn prior to these events.

-

This was Gallagher’s largest Q1 deal, followed by $66.6mn for Ericson Insurance.

-

Gallagher expects "little impact" from the FTC’s non-compete ban on the firm’s M&A strategy.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

US SCS accounted for nearly $11bn in global insured losses.

-

Insured loss for Q1 was 10% higher than the decadal average of $18bn.

-

The broker attributed increased capacity to improving profitability.

-

The market remains “delicately balanced” amid global conflicts and claims deterioration.

-

Reinsurers have a "strong desire" for growth, but not at the expense of underwriting.

-

Negotiations around US casualty and financial lines were more stressed.

-

There is more capacity in the market for long-term risks.

-

Concerns around casualty rate adequacy are growing, the executive said.

-

The talks are advanced, and the process is likely to move rapidly.

-

Driscoll and Lubert have been promoted to presidents.

-

Insurance Insider US examines public brokers’ 2023 M&A.

-

The vulnerability updates are the biggest driver of loss changes.

-

The 1 January treaty renewal was “far more orderly”.

-

The recruits join from Ardonagh, Guy Carpenter, Howden and Miller.

-

According to its 2023 10-K, Gallagher spent $3.74bn on M&A activity.

-

The probe concluded in Q4 last year, according to Gallagher’s 10-K.

-

Justin Ward will lead the firm’s production efforts in the expanding MGA market.

-

-

Funding dropped from $8bn in 2022 to $4.5bn in 2023, a 43.7% decrease.

-

In Q3, RPS recorded 7% organic growth, marking a deceleration from 10% in Q2 and 8% in Q1.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

A deal would mark Amwins’ second LatAm sale, after this publication revealed that Lockton acquired THB Brazil last May.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

Based in Brazil, the executive also has prior experience at Liberty Seguros, where he was regional manager, and Chubb, where he was LatAm surety underwriting manager.

-

This follows a challenging period for business last year.

-

The new team is one of several the broker has set up in the past 18 months.

-

Some reinsurers could be heading into 2024 with spare capacity, the reinsurance leader said.

-

The broker said over-placement on some deals was a positive sign for brokers, though reinsurance capacity is still very tight in some areas.

-

Kevin Doyle joined RPS over five years ago as VP for the Western region, and in 2021 he was promoted to P&C Chicago area president.

-

The Insurance Insider US news team runs you through some of the key M&A intelligence from the past week.

-

Hansen’s role will be effective after a transition period with departing COO Chris Brook.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The broker said dynamics were dependent on full-year results, after years of poor returns.

-

The senior retro/specialty broker spent 26 years at Willis Re, which was acquired by Gallagher in 2021.

-

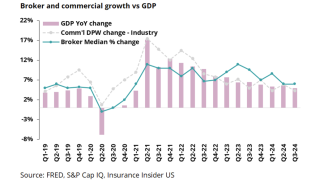

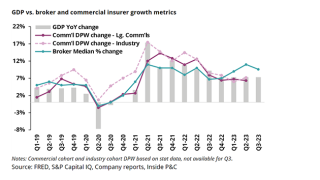

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

The transaction follows the acquisition of Candence Insurance for over $900mn and Eastern Insurance for $510mn.

-

Increased private investments by (re)insurers have been a “theme of the year” according to Johnston, who described the year as “one of consistency.”

-

The economic losses from the event are expected to exceed $10bn, the report added.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The unit almost doubled its organic growth rate from 11% in Q2, while in Q1 the division posted 12% organic growth.

-

Excluding both pending acquisitions, Gallagher has around 45 term sheets signed or being prepared, representing more than $450mn of annualized revenue.

-

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

Pat Gallagher, who previously held the role of president since 1990, has “no plans to retire” and will remain as chairman and CEO.

-

The agreement comes a month after Inside P&C revealed that the Southern bank had retained Morgan Stanley to run a sale process of its insurance business.

-

Climate change is causing an upward trend in losses, but it should not be conflated with the impact of seasonal variability, according to Gallagher Re.

-

The broker said that $100bn+ loss years have become the “new normal”.

-

Looking to the key Q4 renewal period, Gallagher said there is “little to suggest a drastic shift in conditions”.

-

The report also highlighted general liability policies as an area of potential exposure to insurers.

-

Gallagher Re’s chief science officer warned that US SCS activity will keep rising.

-

He will be responsible for oversight of all aspects of the practice and leading the firm's growth in the market.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Eastern Insurance Group, a wholly owned subsidiary of Eastern Bankshares, is the third largest bank-affiliated insurance brokerage in the US, according to the company’s announcement.

-

Most of the broker’s clients have incurred losses below or about equal to ceded premiums and only one with losses exceeding ceded premiums.

-

The impact of the Hawaii wildfires on the wholesaler’s Q3 contingents is anticipated to be between $2mn to $4mn.

-

The executive will move to the (re)insurer after almost two years at Gallagher Re, a company he joined after the acquisition of Willis Re in late 2021.

-

The repercussions of the war between Russia and Ukraine continue to affect several countries, including Egypt and Somalia, as a result of grain-supply interruptions.

-

The latest loss estimate is little changed from those in the reinsurance broker’s pre-landfall report Tuesday and aligns with estimates from Moody’s RMS pegging Idalia as a $6.3bn loss event.

-

The appointment confirms this publication's report earlier this week that former Howden treaty specialists Posada and Ivan Monroy are joining Gallagher’s regional unit.

-

The role was originally slated to be taken on by now retired James Kent, former CEO of Gallagher Re.

-

The question of how to finance the private brokers no longer begins and ends with a PE flip.

-

Gallagher Re's latest Global InsurTech report has shown that Q2 funding dropped below $1bn to the lowest quarterly investment level in three years.

-

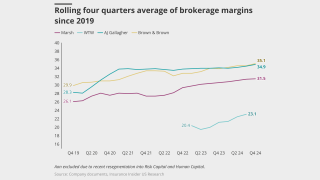

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

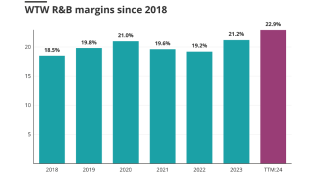

WTW is quietly sounding out market executives for a potential relaunch into reinsurance once its two-year non-compete agreement with Gallagher Re ends in December, this publication can reveal.