AJ Gallagher

-

The firm adjusted 2022 projected revenues for the acquired Willis Re book down by $10mn from its 2020 figures due to forex and Ukraine changes.

-

The broker has distributed top jobs among former Willis Re and legacy Gallagher Re staff.

-

RPS also said it separately that it launched a real estate appraiser E&O product.

-

An internal announcement from James Kent reveals the first outlines of what the future will look like for the #3 reinsurance broker.

-

The acquisition of Willis Re last year transformed Gallagher into a top-three reinsurance player.

-

Sources told this publication Tom Draper would become head of insurance at the expansive MGA’s European operation.

-

Despite an increased risk environment, capacity has increased for political risks, trade risks political, trade risks commercial and non-trade insurance, the broker said.

-

The protracted firming phase of the cycle continues, with E&S firmer than the admitted market.

-

The two brokers reported quarterly earnings and were optimistic about the coming year.

-

CFO Douglas Howell told analysts that the giant broker currently has $4bn to spend on M&A opportunities over the next four years.

-

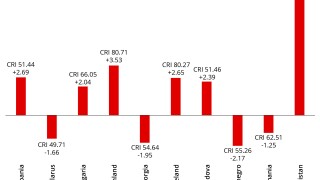

The consolidated organic growth number was Gallagher’s best of the year, and a sharp increase from its 2.6% growth level a year ago.

-

Hvidsten had worked at Willis Re since 1997, before it was bought by Gallagher, and will continue to serve as a consultant to the firm.