AJ Gallagher

-

AJ Gallagher expands into the wholesale commercial surety bonds business with its buyout of Little Rock-based Alpha Surety.

-

Carriers may reconsider perceptions on property claims arising from violence, fire and water damage, after data on claims costs and causes was published in a report by AJ Gallagher.

-

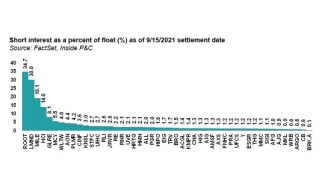

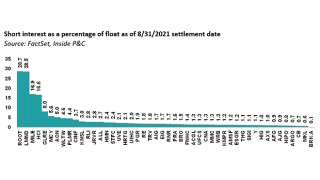

Without any major catalysts, the short interest for the industry was muted, with movement centering around InsurTechs once again.

-

AJ Gallagher will offer agricultural insurance coverage to clients in Louisiana, Arkansas, and Mississippi.

-

The broker's quarterly investor day presented an optimistic growth and margin expansion outlook for the remainder of the year and 2022.

-

Pressure on Root cools following stock price dips, but persistent short interest in InsurTechs suggests that prices haven’t bottomed out yet.

-

A complex web of factors are creating uncertainty around the likely insured loss, but much early discussion centers on a $20bn-$25bn range.

-

The two brokers have also agreed to non-solicitation clauses in their new deal.

-

The executive also praised Willis Re's management team for pushing for the best outcome for clients.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

AJ Gallagher turns working partnership with Turkey’s Brokers’ House into ownership stake.