AJ Gallagher

-

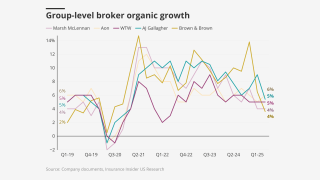

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The executive will officially start in mid-November.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The risk of cyber incidents that cause physical damage is also rising.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The executive left Lockton Re in June after almost six years.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

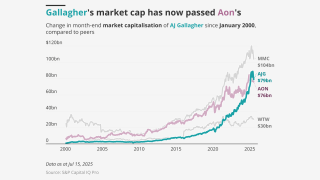

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

The US accounted for 92% of all global insured losses for the period.

-

Apax and Carlyle will continue to back the broker consolidator.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The soft market continued through H1 2025, especially on shared programs.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

He joined RPS in 1999 after a year-long stint as regional manager of Executive Risk.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

Q1 was the ninth consecutive quarter of below-average deal volume.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The firm also reported it paid $82.8mn for Brazilian brokerage Case Group.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

The deal had HSR approval and was waiting on approval from the UK.

-

The book of business comprises both personal and commercial lines.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The executive was most recently chief revenue officer at Aon.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

Gallagher already has HSR approval for the $1.2bn Woodruff Sawyer acquisition.

-

Dickerson has spent over three years at the reinsurance broker.

-

The company said it now expects the transaction to close in H2 2025.

-

Competition for specialty reinsurance talent remains high.

-

The California broker’s pro forma revenue for full year 2024 was $268mn.

-

Gallagher paid out $1.7bn in 2024, additional to its costs for AssuredPartners.