Arch Capital

-

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

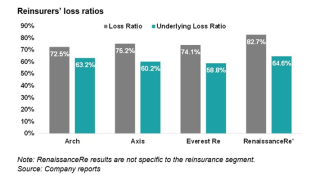

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The appointments will be effective as of August 1.

-

The unit will include both ocean and inland marine coverage.

-

Ed Short was previously VP, digital partners, at Arch.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

The days of 30%+ growth are probably behind the firm, he said.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

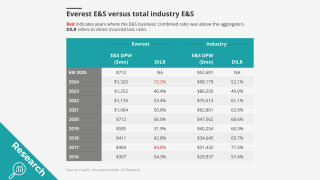

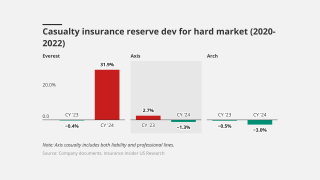

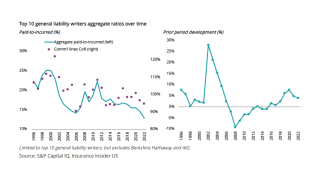

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

The company, meanwhile, is bullish on E&S US casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

Tim Watson most recently served as a senior credit and political risk underwriter.

-

Jelle Ouwehand joined Arch from Marsh, where he was a senior terrorism, PV and war broker.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

Both appointments are effective immediately.

-

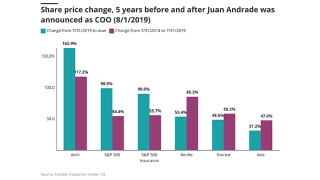

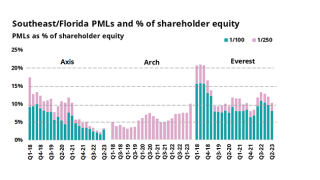

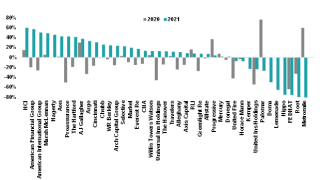

Arch stands out among hybrids, but Axis and Everest grind it out.

-

Arch is assuming an industry loss related to Helene in the $12bn-$14bn range.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

The chief executive will also receive a yearly bonus of 200% of base salary.

-

Arch announced the retirement of CEO Marc Grandisson on Monday, with immediate effect.

-

The executive has been group CUO since 2021.

-

He replaces Richard Goldfarb, who will remain as head of strategy.

-

The carrier writes all of its E&S business in the state through Arch Specialty Insurance Company.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty and Skyward Specialty.

-

Mark Lange, chief middle-market executive, will oversee the new businesses.

-

The slowdown was based on a conviction of “higher likelihood of frequency events” this year.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Both parties expect to close the transaction on August 1, 2024.

-

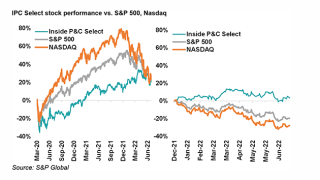

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

A standalone syndicate could offer capital, trading, and licensing advantages.

-

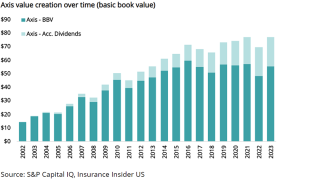

Industry trends show the Axis book value growth goal may be hard to hit.

-

-

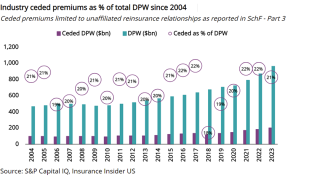

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

Strack has worked at Arch for close to four years.

-

There was no material development on long-tail casualty lines across all years, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Kirsten Valder has been with Arch for 10 years and before then was a partner at Kennedys Law.

-

Will Arch’s new acquisition be another success story, or more trouble than it’s worth?

-

The deal includes an LPT of ~$2bn loss reserves for 2016-2023 years with Arch Re.

-

Doppstadt and Paglia have served on the board for 14 and 10 years, respectively.

-

Joe Morrello joined the firm in 2022 after serving as E&S property head at Beazley.

-

Vanessa Hardy Pickering and Lester Pun have also been promoted.

-

CEO Grandisson described Arch as "bullish" in its prospects for 2024.

-

Given a number of complexities, the landing zone on a take-out price is small.

-

Earlier in the process, sources linked Sentry Insurance with a bid for the E&S insurer.

-

With mixed results in the reinsurance space, the specialty pivot remains a "show-me" story.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

Participating in the funding round were Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners and Arch Capital.

-

The deal follows this publication’s report that the Bank of America-run sale process of Castel was drawing robust interest.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The consideration is expected to be around $140mn plus a $25mn dividend.

-

The five-person underwriting team will be led by Ian Lewis, who has been named head of intangible assets.

-

The executive noted “increasing evidence [that] casualty rates widely underpriced and oversold during the last soft market need to increase.”

-

The Inside P&C news team runs you through the earnings results for the day.

-

The executive will oversee all aspects of managing direct insurance operations at the business.

-

Patin will oversee Somers’ overall investment strategy and direct its investment managers.

-

In addition, Arch Re global CUO Pierre Jal moved to Zurich to take over as Europe CUO, while president Matthew Dragonetti expanded his scope to lead client-centric initiatives.

-

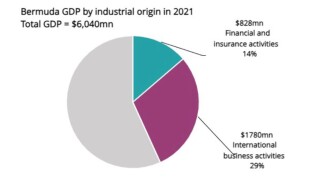

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

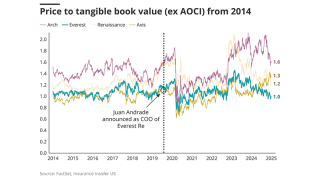

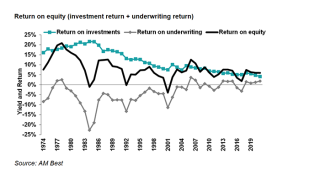

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

-

CFO Morin said Arch was able to deploy more capacity, resulting in a significant premium growth for property lines.

-

Sources suggest that, based on a multiple of 15x-17x Ebitda, the business could be valued at £300mn-£375mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive, based in Morristown, New Jersey, will be responsible for the company’s US reinsurance operations.

-

Under terms of the partnership, Arch Capital has acquired a minority stake in the Bermuda-based MGA.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Reinsurers have mostly grown since before the Covid crisis, but the type and timing of growth affects value creation,

-

Early private deals have provided far more stability in this year’s renewal than last.

-

Everest Re’s $1.5bn capital raise could be part of a continued pivot, or an early indicator of a shifting marketplace.

-

The pair will be responsible for managing underwriting activity across their respective lines.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

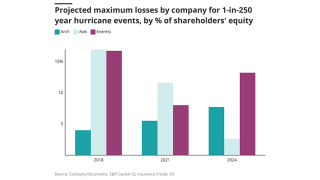

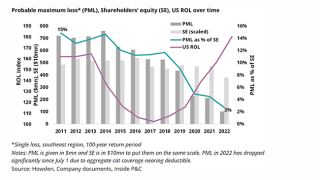

Arch plans to “take advantage” of these favorable market conditions, and may expand PML to 10%-12% of shareholders’ equity by July 1, from the current 8.1%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company also reported top-line growth of 25.8%, with gross premiums written during the quarter totaling $4.8bn.

-

The Bermudian increased its cat load to $100mn-$120mn in Q1 2023, compared to around $80mn a quarter for 2022.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Pre-tax current accident year net cat losses for the insurance and reinsurance segments totaled $34.6mn for the quarter, nearly half of the $72.3mn figure posted in Q4 2021.

-

The executive will report to Brian First, president of Arch Insurance North America, as a member of the executive leadership team in the region.

-

Enstar is conducting due diligence around taking on the rest of the Argo back book.

-

Brian First was previously CUO of programs, property and specialty at Arch.

-

Across the P&C industry, sentiment expressed on Q3 conference calls has improved since pandemic lows.

-

In his new position, the executive will report to Arch’s head of cyber and technology E&O, Marcus Breese.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

Discussion on Q3 earnings calls focused heavily on the supply-demand imbalance in cat capacity, as executives discussed how they would navigate a challenging January renewal.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In a Q3 earnings call today, Arch CEO Marc Grandisson also told investors that events like Hurricane Ian “almost always result in opportunities”.

-

The cat and expense developments offset favorable reserve developments during the quarter, as the Bermudian released $178mn.

-

Arch’s estimate is commensurate with a range of expected insured losses across the global P&C industry of $50bn to $60bn.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Arch Capital CEO Marc Grandisson told analysts on an investor call today that the industry has started incorporating higher inflation into models.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Bermudian also reported margin improvements and top line acceleration despite a decline in mortgage gross written premium.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

CEO Marc Grandisson said most of Arch’s exposure to the war comes via Lloyd's aviation, marine war businesses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm recorded a third consecutive margin improvement in the first quarter of 2022 as its core loss ratio narrowed by 2.7 points to 49.3%.

-

A New Jersey judge writes a scathing decision criticizing hospitality firms for attempting to claim physical damage from virus and misinterpreting policy language.

-

The CEO also said that price increases in property cat were insufficient for the company to allocate more capital to the line.

-

The (re)insurer’s GWP surged 32%, helped by strong gains in both its insurance and reinsurance divisions.

-

Chicago-based Evertas will write crypto-asset policies on behalf of Arch and aims to expand relationships with other carriers.

-

The company also named Scott Montgomery as the division’s president and Lisa Pickard as chief strategy officer, among other moves.

-

Inside P&C’s news team runs you through the key developments from the last week.

-

CUO Peder Moeller has been promoted to CEO for the firm’s US reinsurance division, taking over from Ken Vivian after his retirement.

-

Lisa Packard, a long-time Arch facultative executive, has also been named chief strategy officer for the US reinsurance division.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Liz Cunningham, Watford’s chief risk officer, has been named its new CEO, as the company said that ratings agency AM Best had affirmed the outlook on its A- FSR to "stable".

-

Reinsurers take stock of a changing catastrophe landscape and plot contradictory courses.

-

The CEO said his company is ‘convinced’ the firming cycle has legs, while also acknowledging the company “relied heavily” on its mortgage unit when returns in P&C were less attractive.

-

Underwriting profits soared by 66% to $174mn, with a $234mn underwriting gain in mortgage outweighing losses in insurance and reinsurance.