Andrade took over from Everest Re’s prior CEO, Dom Addesso, in early 2020. At that time, there was much discussion on what it meant to hire a Chubb alumnus to take charge of Everest and how things would be going forward.

This got us thinking. Over the years, some CEO announcements have been met with more optimism than others. An example of this would be AIG, which has seen multiple CEOs over the past decade, each presenting their own strategic initiatives to improve performance.

But are these new CEOs actually able to realize the vision they set out to achieve?

We have often compared reforming large insurance franchises with turning around a battleship. It takes several years for the corrective actions to show up.

Additionally, having a strong team of "number twos" is essential, as an individual can only handle so much, especially when changing the culture of a franchise.

Unlike other industries, the average tenure of an insurance company CEO is on the longer side at 10 years or so (the S&P 500 average is ~eight years). This intuitively makes sense since it takes longer for things to work out at an insurance company.

As in other industries, most CEO successions are due to retirement, with a smaller portion attributed to “forced” or unplanned CEO departures. It would appear these CEO changes in insurance are related to the following:

long period of below peer valuations

several periods of negative reserve development resulting in a reduction to equity

inability to realize benefits from acquisitions or poor choice of acquisition/merger partners

reluctance in disposition/separation/sale of underperforming assets

large losses from catastrophes, or attritional losses putting company ratings in jeopardy

That said, the above events have to occur with some frequency before we get to the point of jettisoning the leadership and looking for internal or external candidates. Insurance is still old school, and management teams generally get the benefit of doubt when things go sideways, at least initially.

We discussed the changing landscape in our activism piece, where we highlighted how a new roster of activists was beginning to show up in this space.

Recently, we have seen an uptick in insurance company CEO changes apart from the usual founder CEO exits. This brings us back to the question – is there a way to compare the performances of new and former CEOs?

There are some studies out there that have look at relative stock performance and absolute stock performance and tenure.

If we were to simplify the conclusions of some of these studies, the surprising observation is that although there could be stock movements near-term, in the longer term the comparison begins to approach the law of averages!

In insurance, value creation can be as important as, if not more important than, stock returns when comparing the quality of performance in a peer group.

Consequently, for our analysis, we used a combination of stock returns relative to market returns and book value returns (total value creation) as a proxy of CEO performance.

Our results showed an interesting, although not a completely surprising, dichotomy.

Although longer term, stock performance should track value creation, this is not always the case. This makes sense, since in the short to medium term, managements’ strategy could appear to be paying dividends, resulting in a positive stock performance.

However, when problems are discovered, the mantle is passed on to a new leader who might end up creating more value – although the stock price might not always follow through.

Stock performance takes time to recover when a new CEO takes the helm

The annualized stock performance (relative to the S&P 500) showed prior CEOs seeing higher stock price gains than the current group of CEOs (averaged 2% vs. -8%). This corresponds with the CEOs' tenure, given that the past CEOs we looked at had a longer tenure than the current term of the companies’ CEOs.

The new CEO's performance is also a reflection of prior management, as management often inherits problems that would lead to a depressed stock performance. For example, earlier this year, we saw Everest Re announce a $400mn reserve strengthening and the stock take a temporary hit.

Progressive was a meaningful exception, with current CEO Tricia Griffith serving since 2016 and achieving higher stock returns than previous longtime CEO Glenn Renwick. Kemper’s current CEO Joseph Patrick Lacher Jr. also saw stock gains, despite serving less time than previous CEO Don Southwell.

Value creation is a coin toss when comparing the previous CEO to the new CEO

When you work in this industry for a while, you witness different leadership styles and different strategies. But, most CEOs, especially new ones, are quite optimistic in their ability to chart a course and navigate past prior struggles. After all, a CEO’s role is partially about motivating their old or new teams to get the most from them. So we were definitely surprised by the results of our analysis.

While the shareholder value creation (book value and dividends CAGR) was slightly higher for the previous CEOs (11% vs. 10%), there were some material exceptions here. About half the companies we looked at saw better value creation with the new CEO.

Yes, there are some caveats with this analysis. And one can easily argue that broader market conditions and the interest rate and economic conditions will alter the trajectory of book value growth.

Even then, we expected a bit more of a separation. Perhaps, this goes back to our point regarding insurance franchises – especially larger ones – being like battleships. It takes a while for the ship to turn around and then get going on the new course.

And then, of course, you are dealing with an industry where often the cost of goods sold might not be known for years.

Are there signs of complacency with longstanding CEOs?

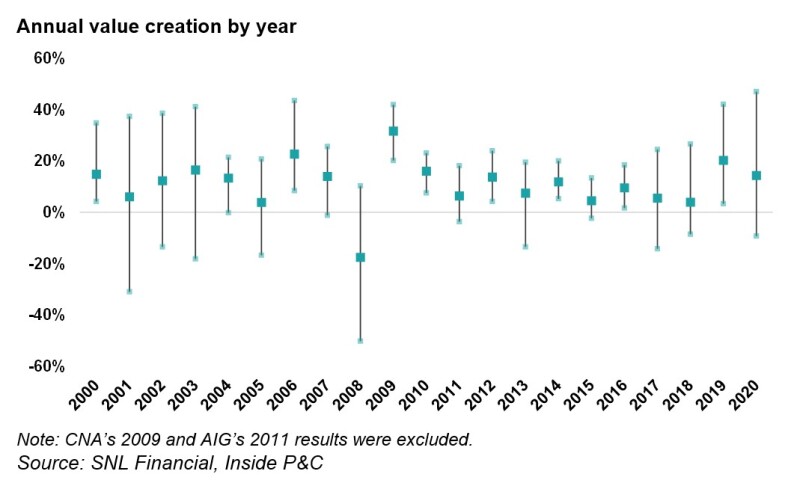

We did find that that the median annual value creation grew gradually after one year, three years and five years in the role (from 9% to 11%). Even with aggressive measures, turning around a book of business can take years in insurance, so a multi-year timeline is realistic for management goals.

For CEOs serving over five years, the median annual value creation for their total tenure was 10%, lower than the five-year median of 11%. Thus, it appears that additional years of service did not produce any added value after the first five years.

The difference in value creation was particularly stark during times of crisis

A 2009 study from the University of Iowa compared CEOs in the insurance industry during times of crisis and found that “high quality managers” were able to remove their firms from regulatory scrutiny faster, lower the risk of insolvency and lower the cost of insolvency if it were to occur.

We looked at whether there was a significant difference in performance during times of distress depending on the CEO’s tenure. We found that companies that fared better in 2008 also had CEOs with somewhat higher tenure.

However, this didn’t hold true for the recovery. By 2019, the companies with the highest value creation had CEOs with slightly smaller tenures. It seems that tenure does not provide a full view of a CEO's capabilities and ability to react to a crisis.

In summary, it would appear that hiring a new CEO in itself will not fix some of the deeper issues plaguing insurance franchises, and companies would be better served by building a stronger team.