Just when things could seemingly not get any better for the personal auto industry, we were hit with the pandemic. As things went from bad to worse and then some, America stopped driving.

For the personal auto companies this was a new normal that fell outside all actuarial possibilities. With driving trends at historic lows, loss-cost trends took a nosedive.

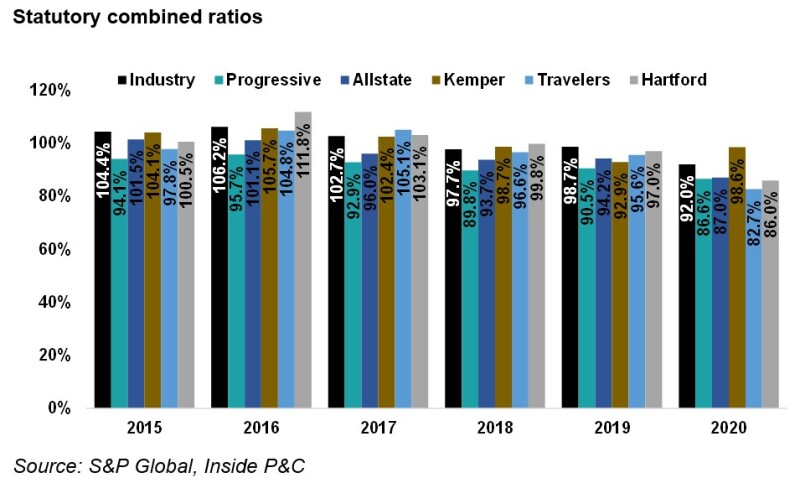

Many companies started some variation of a give-back program which passed on some of these benefits to consumers. Even then, as shown below, 2020 was an exceptionally good year for the personal auto industry and the leading auto companies. The 2020 combined ratio for the industry of 92% was one of the lowest on record, with levels last seen around 2004.

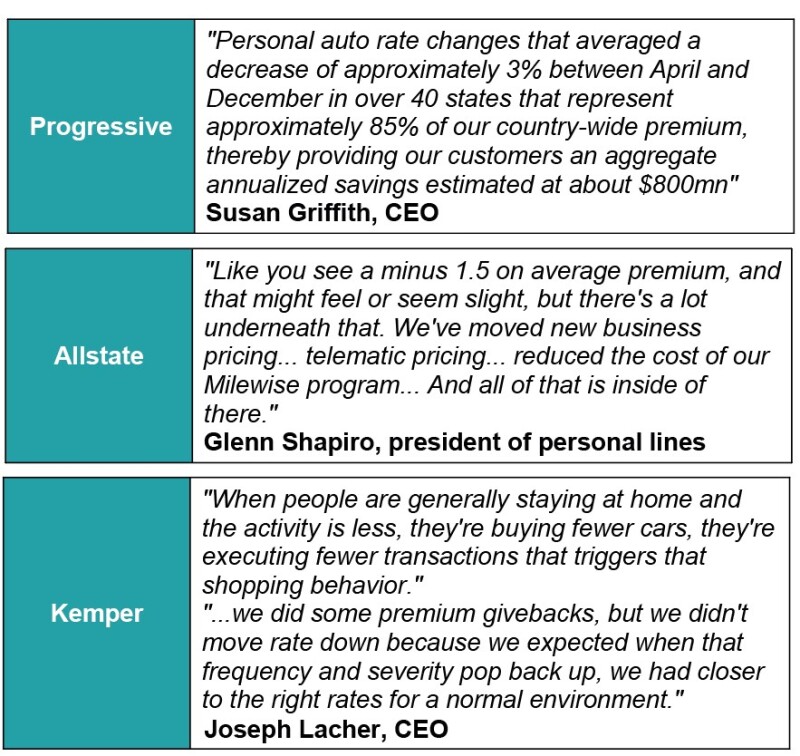

With the rules of engagement rewritten, personal auto companies used a combination of discounts, give-backs and rate reductions to address the decline in loss cost trends.

As vaccination percentages climb, America is re-opening for business. Our driving trend analysis shown in our CPI note highlighted that frequency is reverting to 2019 levels. In other words, all good things must come to an end.

Consequently, we revisited our rate filings analysis as the discussion on loss cost trends vs. pricing adequacy re-emerges.

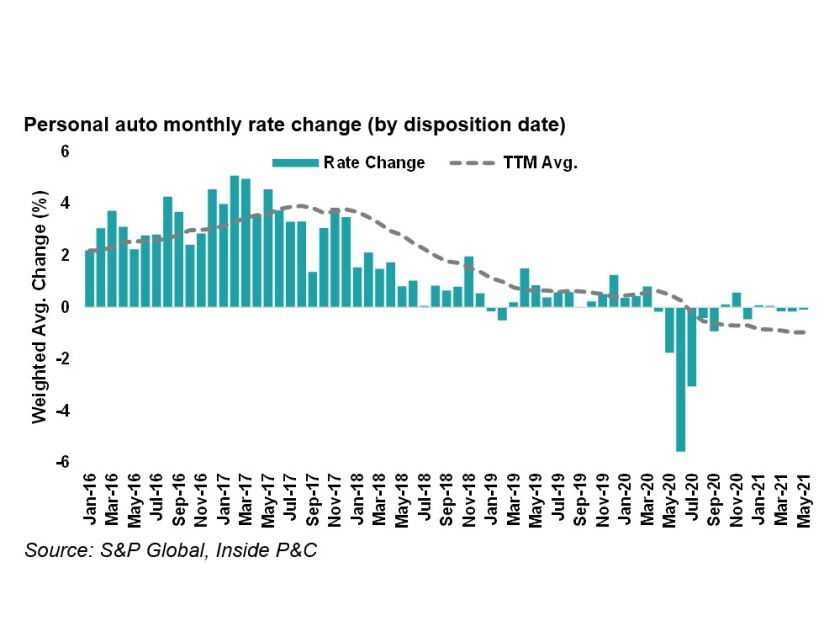

Insurance companies, including personal auto companies, request approval from state regulators for any changes to rate or product filings. Our analysis looks at the weighted average of rate requests – based on the estimated impact on premiums included in the filing – according to the approval date.

Unlike other quarterly statutory filings, product filings are made public on varying schedules depending on state-specific details. Rate approvals can take anywhere between a week to a few months to be approved and, since filings differ across states, there can be some volatility in the data.

Nonetheless, rate filings indicate how product managers view loss-cost trends and how the industry and individual companies are reacting to the market changes.

Rate filings also lead other pricing metrics like CPI that only show several months later when ratings are both approved and have become effective. As we saw in May’s CPI release last week, the cost of insurance has increased significantly since 2020 and is in line with 2019 levels.

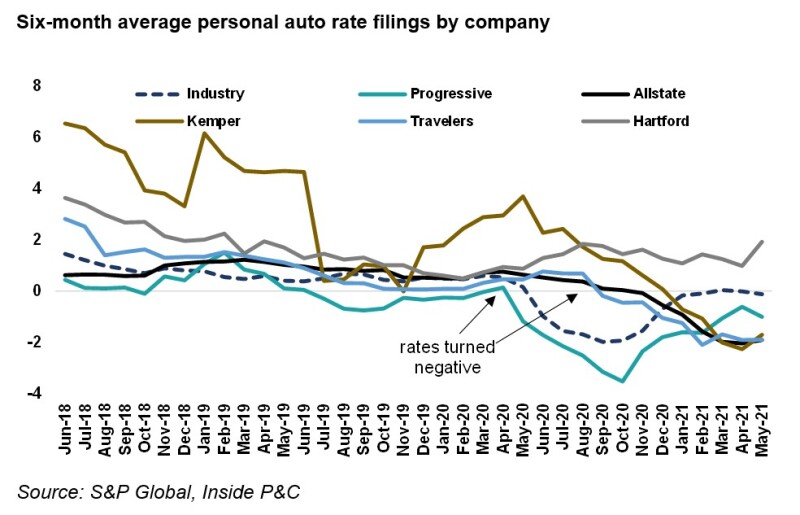

Our latest headline personal auto rate change analysis shows that rate changes are hovering around -0.1% for the industry, after a period of much steeper reduction last spring.

Since January, rate filings for the industry have remained nearly flat, with 2020 seeing negative rates for seven out of 12 months. 2020 was the first prolonged period of negative rates since 2008.

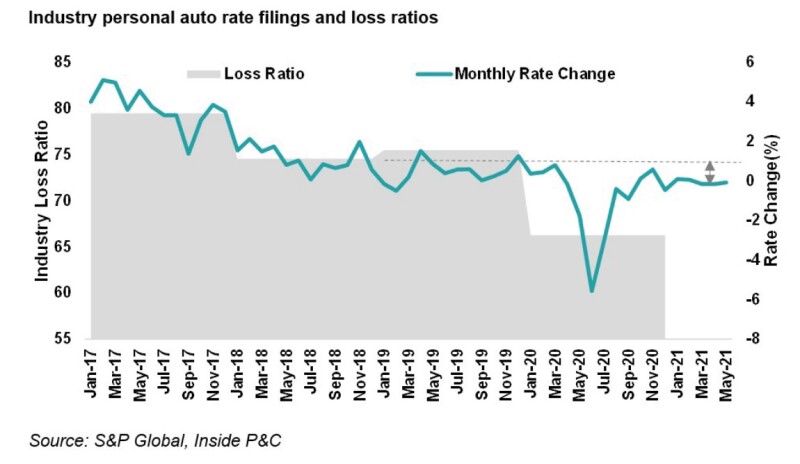

But with driving trends moving alongside the economic recovery, loss-cost trends could revert, necessitating rate action, or compressing margins.

Historically, industry loss ratios have tracked closely with personal auto rate filings.

In the chart below, we see that year to date, the monthly weighted average of filings has been near zero vs. 2019 when rate filings averaged around +0.5%. To close this gap, either rates will continue to rise for the remainder of the year or 2021’s loss ratio will be lower than 2019 but greater than 2020.

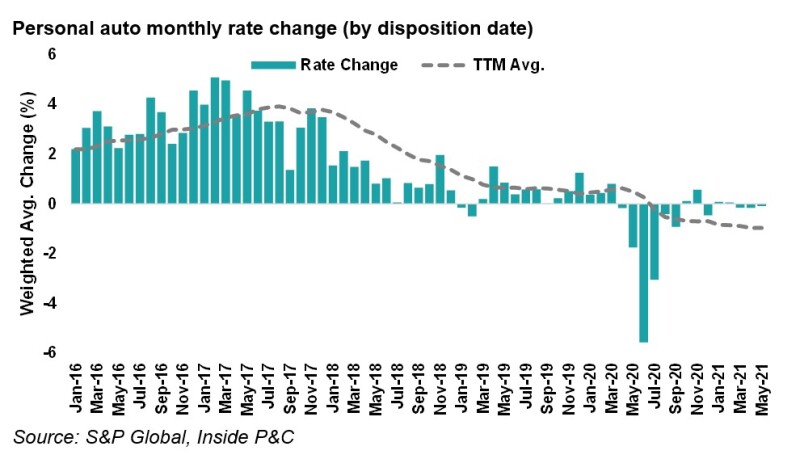

A closer look at the personal auto rate filings shows some companies were faster in reducing rates than others.

While, on average, the industry started reducing rates in June 2020, Progressive’s rate declines were the most discernible. Our analysis shows the company’s average rates were negative in 2019 and showed a slight uptick in early 2020 before the pandemic led to further declines.

On a rolling six-month average, our analysis still reflects negative rates for most companies, but on a monthly basis, May was a turning point for Allstate, Kemper, and The Hartford, after seeing negative rates in April and March. It is too early to tell if this is temporary volatility or a sign that rates will start increasing again.

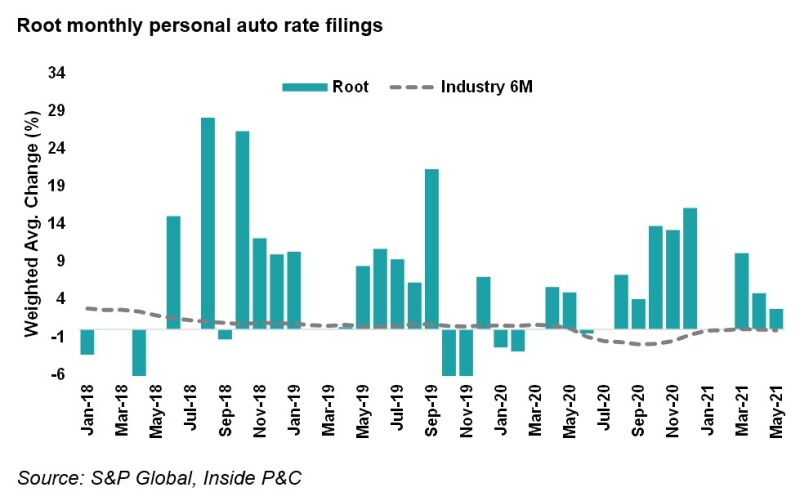

expected, the variability around monthly ratings is particularly pronounced. As the company builds its book of business, there is little correlation between its rate filings and industry trends. Consequently, we would caution against making a simplistic comparison of Root vs. other insurers at this time.

saw Kemper lowering rates year to date, earlier this year Kemper’s CEO pointed that trends in California, where a majority of the auto book is, did not warrant further rate declines and that customer rebates were generally sufficient in taking into account the loss-cost benefits from the pandemic.

In summary, overall, it appears that the industry is focused on defending and/or expanding its market share by keeping rates flat. A faster-than-expected economic recovery could result in a quick reversal in personal auto loss-cost trends and necessitate rate increases down the line.