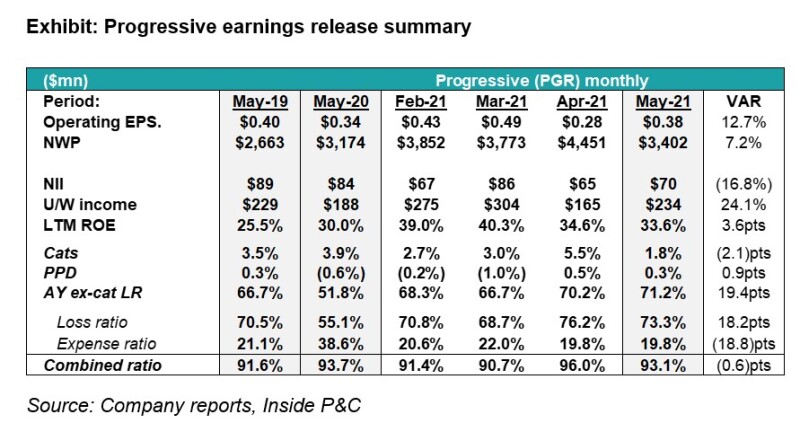

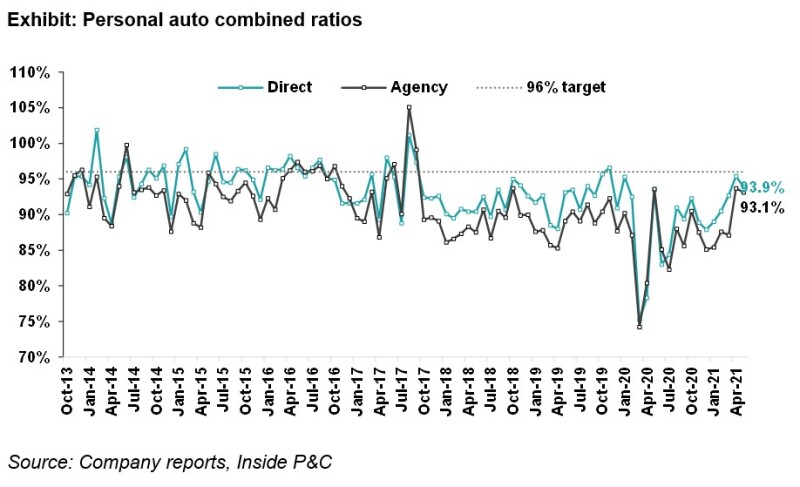

The combined ratio for May was 93.1% (down 0.6pts YoY) and was well below 96% target across all segments.

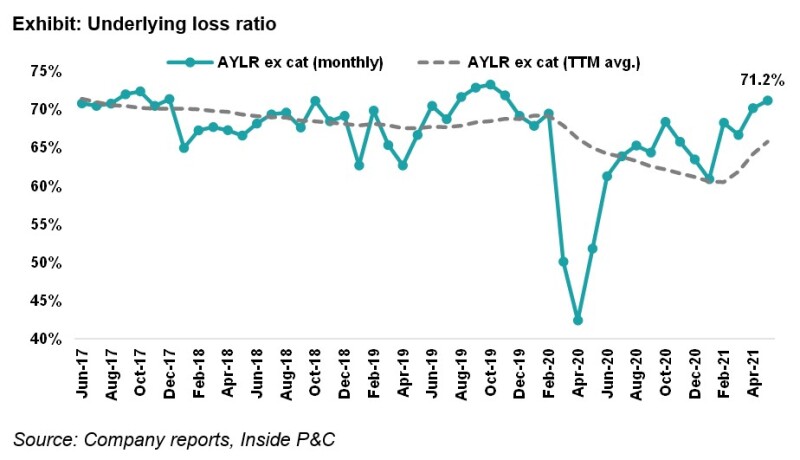

Taking a step back, Progressive’s results are reflecting the increase in auto accident frequency from pandemic lows. Progressive’s underlying loss ratio has progressively increased over the past few months (71.2% in May vs. 70.2% in April and 66.7% in March).

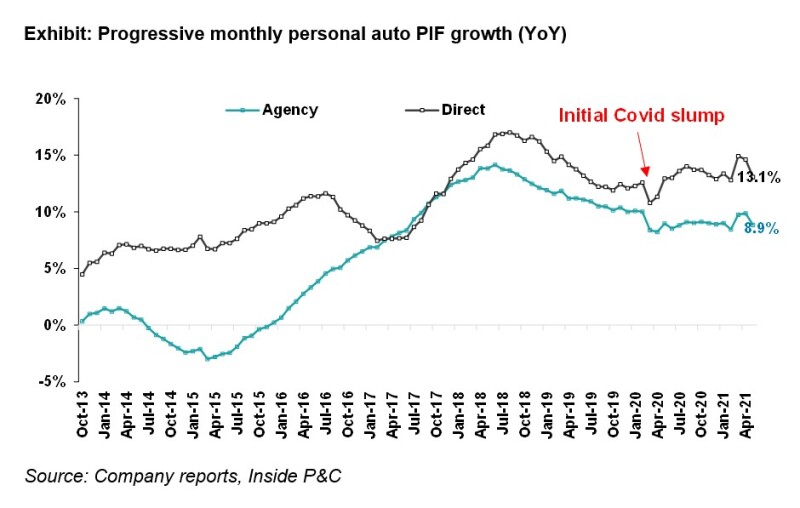

Another trend that we have been watching closely is the direction of its PIF growth. Progressive’s policies in force (PIF) growth even though up 11.2% YoY (0.7% MoM) is lower than March and April (12.1% and 12.3% respectively).

Are these the first signs it is hitting the growth wall, or is it too early to come to a conclusion?

Investment income declined 14.1% YoY but is in line with the YTD average. Given the low-interest rate environment, investment headwinds are anticipated, with book yield declining from 2.6% to 1.9% over the past 12 months.

The key takeaway from May’s results is that margins have returned to pre-pandemic norms.

The underlying loss ratio of 71.2% is higher than May 2020 (51.8%) and May 2019 (66.7%).

While May’s results were strong, the results do not relieve worries of further margin compression as companies continue to compete for share.

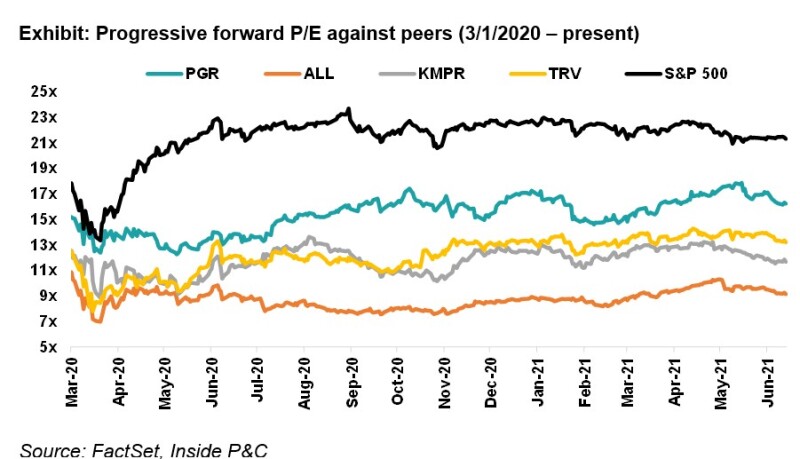

The stock trended down along with Allstate on the earnings report, reflecting some of these concerns.

We expect margins to compress further as frequency trends normalize and carriers continue to compete for share. This means Progressive will need to maintain strong profitable growth to avoid treading water on earnings.

Comparing the underlying loss ratio for May vs. 2019 levels, we see May 2021 is 4.5 points higher than May 2019, but still below October 2019’s high of 73.3%.

Progressive’s stock has been under pressure this month but has maintained its multiple vs. the peer group. Investors have been anticipating increased competition on the personal auto side with the reversion in frequency benefits as carriers balance reverting loss cost trends and rate action.

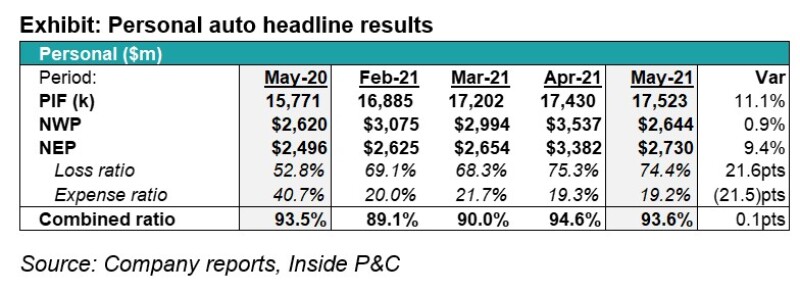

Personal auto: Higher frequency impacting underlying results

As we recently discussed, with several American states lifting restrictions and vaccination rates rising, the number of auto accidents has increased from the 2020 lows. With the benefits of lower frequency fading, 2020’s industry results will likely be unbeatable for personal auto carriers. Instead, the focus is on maintaining profitable growth as loss cost trends emerge.

Progressive’s May results show strong top line growth and stable underwriting performance.

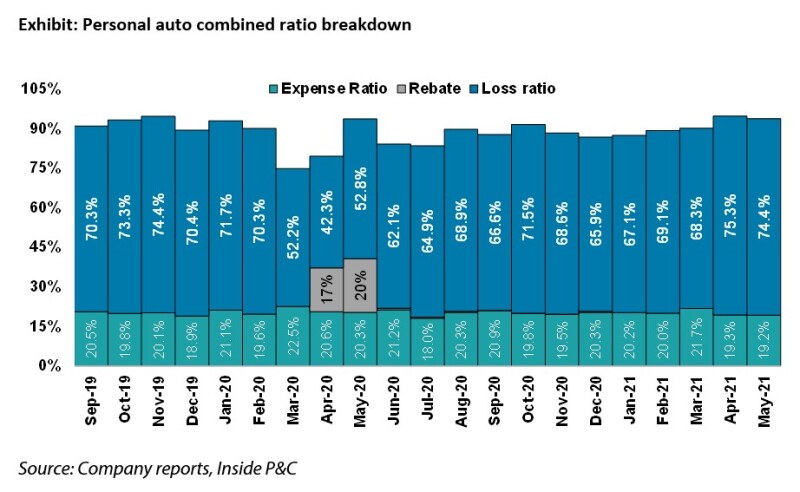

As shown in the chart below, May’s loss ratio of 74.4% is up 21.6% YoY, given the unfavorable comparison with May 2020. The expense ratio is slightly lower than previous months. Note that May and April 2020 included rebates from the company.

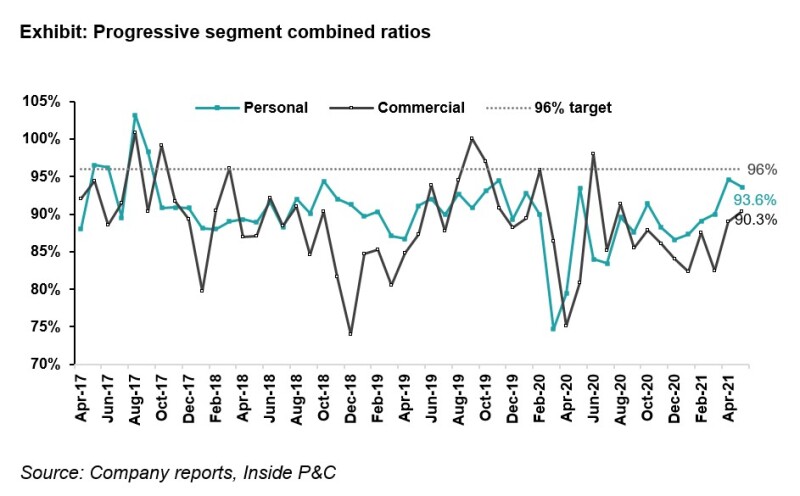

The strong performance has been seen in both direct-to-consumer and agency. In the chart below, we show the combined ratio remains well below the company’s 96% target but has continued to tick up over the past few months.

The personal auto segment saw 11.1% YoY PIF growth (0.5% MoM), with agency PIF up 8.9% YoY and direct-to-consumer PIF up 13.1%. Growth in the direct-to-consumer segment continues to outpace the agency segment, a trend we would expect to continue throughout the industry.

Commercial: Top line growth accelerating in 2021

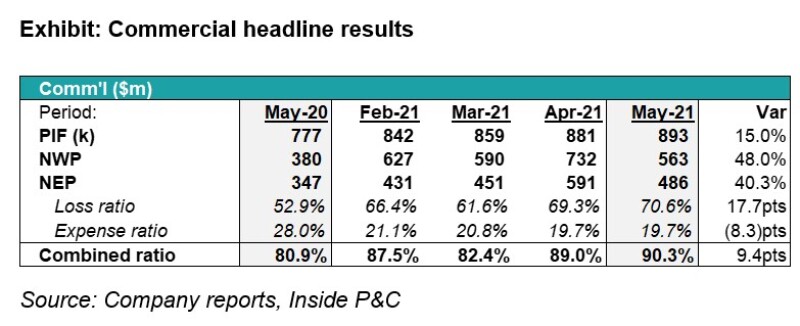

Progressive’s commercial segment continues to see strong growth, with PIF up 15% YoY and net written premiums up 48% YoY.

Progressive gressive protectiverecently completed its acquisition of Protective, which will expand its position in the long-haul trucking space. However, as we discussed in the past, the benefits of this acquisition vs an organic push are not immediately clear to us. We’ll look to next month’s earnings for more color, as well as the August investor call focusing on the commercial segment.

The combined ratio remained well below the 96% target, but the loss ratio of 70.6% was higher than both May 2019 and May 2020’s loss ratios, 66.1%, and 52.9%. Monthly variability in results is common for the company’s segment.

Property: Catastrophe losses drive profitability

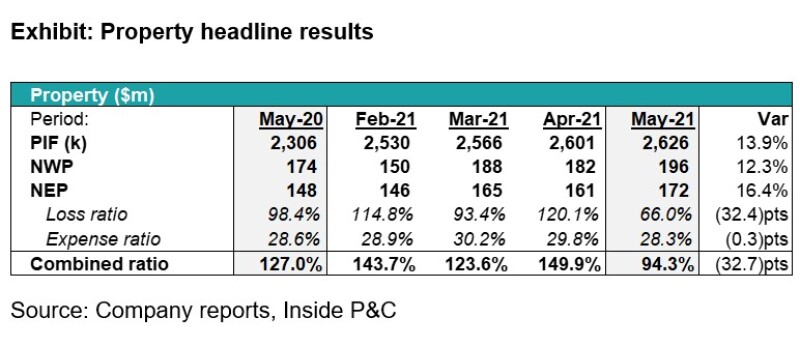

The property segment is important to Progressive as it aims to capture further the benefits of bundling auto and homeowners. The company has consistently seen PIF growth in the low teens throughout the pandemic and 2021 and has noted this growth helps it obtain new auto customers in both its direct and agency segments.

The company has specifically pointed to property helping to grow market share for the preferred auto segment “Robinsons” (the families looking for more extensive coverage).

While the property segment has seen volatility in the past, the company noted on its first quarter call it is making changes to rates and modeling to improve consistency of results.

In the chart below, we see that catastrophe losses have driven the profitability of the business. May saw 13.9% in catastrophe losses vs. 59.0% last month and 44.7% in May 2020.

In summary, Progressive has succeeded thus far this year in maintaining top-line growth in an increasingly competitive market. May’s underwriting results were stable compared with pre-pandemic norms but are a strong signal that the frequency benefits from Covid are beginning to fade away.