Yesterday was the second and final day of our Inside P&C North America Conference. Fireside chat speakers included Eric Andersen of Aon, Rob Bredahl of TigerRisk and John Trace of Guy Carpenter.

For those who missed the live panels and fireside chats, you can view recordings here.

The reinsurance panel featured John Jenkins (Scor SE), Jed Rhoads (Markel Global Re), Trevor Carvey (Conduit Re), and Lisa Butera (Swiss Re).

The cyber panel included Erica Davis (Guy Carpenter), Elizabeth Johnson (Ascot Group), Evan Taylor (NFP) and Sridhar Manyem (AM Best).

The conference reflected the ways in which insurance and risk management are making their way into more boardroom conversations than ever before. Risk awareness has been heightened over the past year due to the pandemic as well as recent natural catastrophes, headline cyber attacks and other nuclear verdicts. Speakers were optimistic that this would translate into additional insurance demand and opportunities to better address risks.

Aon’s Eric Andersen also presented an optimistic view for the company after its terminated mega-merger. Andersen viewed the merger attempt as a learning experience and touted Aon’s new executive committee, operating model and a brand launch as steps forward. He also highlighted the Aon United strategy as a streamlining of internal business procedures that the firm will utilize to better meet complex client needs.

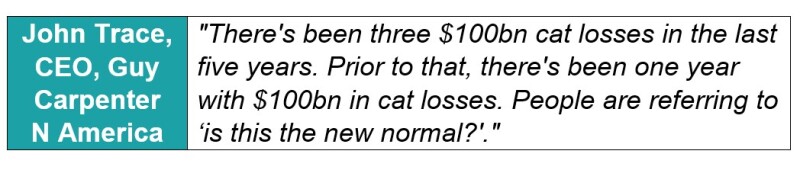

Similarly, John Trace of Guy Carpenter pointed to further growth opportunities in public-private partnerships (such as the MetroCat Re cat bond with the NYC MTA), along with MGAs and InsurTechs.

Optimism among speakers and panelists extended to the cyber market, reinsurance pricing and what inflation could do to the industry.

First, this appears to be a pivotal moment for cyber insurance.

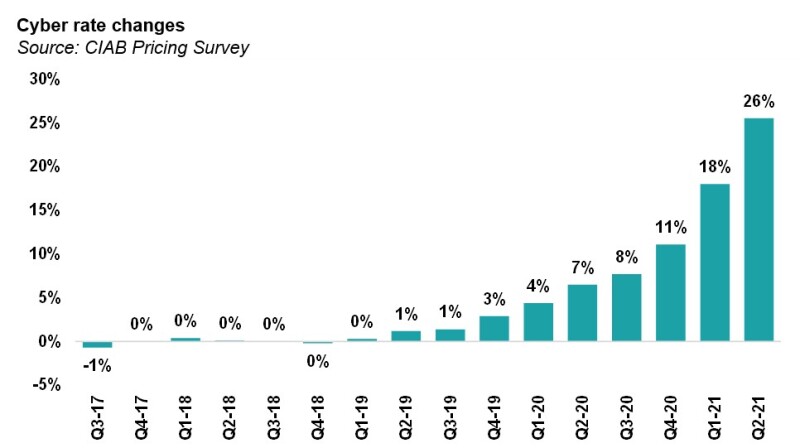

Given its limited loss history and relatively early modeling capabilities, the quickly evolving cyber market was described multiple times as not having reached its full potential. The line has seen double-digit price increases as well as the addition of co-insurance and sub-limits, but confidence in its pricing accuracy was still limited.

The chart below shows how CIAB rates have increased in recent years.

As AM Best’s Sridhar Manyem’s analogy has it, trying to measure the height of a tree by using its shadow is useful, but if you take too long focusing on the details the sun will move and your effort will be meaningless.

Given that even established risks can see significant gaps between modeled and live events, panelists emphasized that the modeling is only part of the equation and needs to fit in with the insured’s total risk strategy.

With a combination of the long-term risk of casualty lines and the short-term nature of property catastrophe, cyber has been one of the most heavily reinsured lines. Just as reinsurance played a major role in providing capacity for property catastrophe in 2005 after KRW, the reinsurance segment is crucial for a growing line like cyber.

Panelists noted some new capital was entering but was closely scrutinizing its participation and would not tip the scale in terms of rate increases.

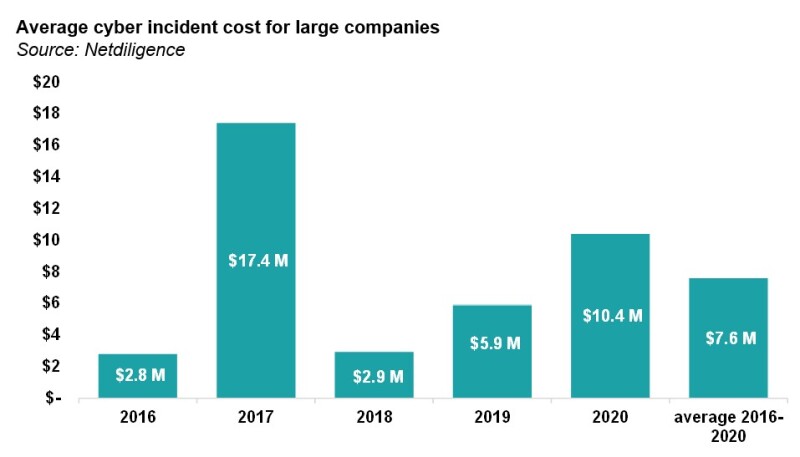

The chart below details the average cyber incident cost for companies with annual revenue between $2bn and $30bn. Globally, more than $1.5tn is lost to cyber crime each year.

The panel also touched on federal involvement in private companies’ cyber risk. The pandemic proved there is a need for private-public relationships in responding to new risks, particularly given how other countries have partnered with private companies (defensively and offensively).

Second, despite the well-capitalized position of the reinsurance market, the view was bullish on renewals.

Although the sentiment is repeated nearly every renewals season, panelists echoed the “enough is enough” view. Even after two or three years of underlying rate increases for both insurance and reinsurance and excess new capital, reinsurers feel "loss fatigue" after significant capital losses, something that Covid intensified.

The combination of the pandemic, social inflation, frequency and severity increases, and climate change has encouraged reinsurers to pursue more rate, tighten terms and conditions, and reduce limits. All of this will help the industry stabilize and grow despite challenges. As a result, panelists expressed their optimism about the upcoming renewal season.

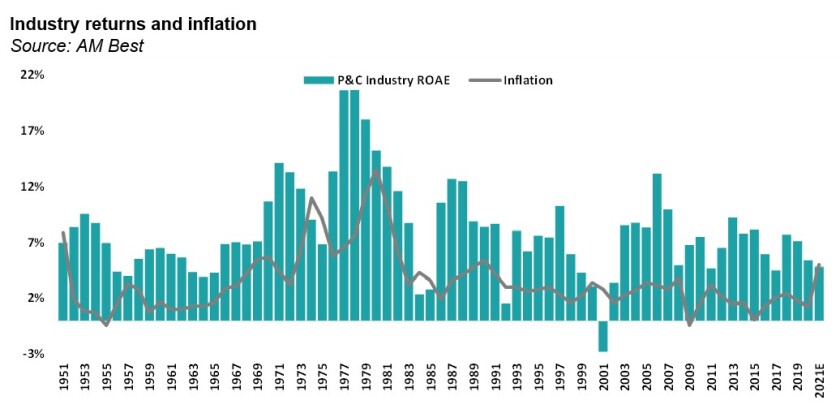

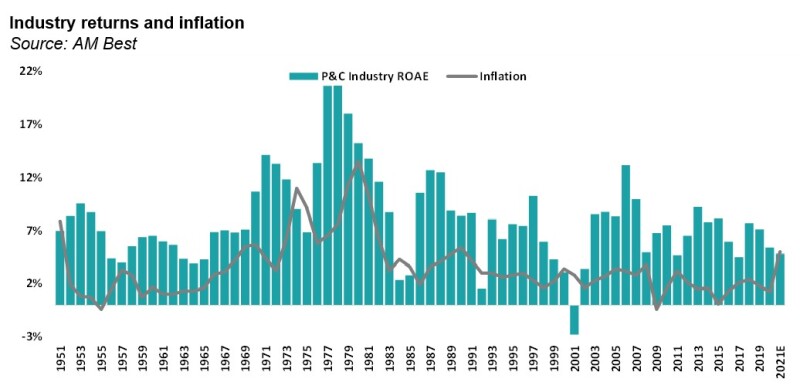

Third, financial inflation has historically been a positive for P&C Industry.

Brokers have previously remarked on the benefits of inflation for their business, partly because it sustains pricing momentum.

From the carrier perspective we see that, somewhat surprisingly, inflationary periods have historically been high return periods for the industry. Given that inflation means higher claims, insurers are at a disadvantage if future claims are higher than anticipated. However, moderate inflation can come along with enough economic expansion and higher investment returns to tilt the scales.

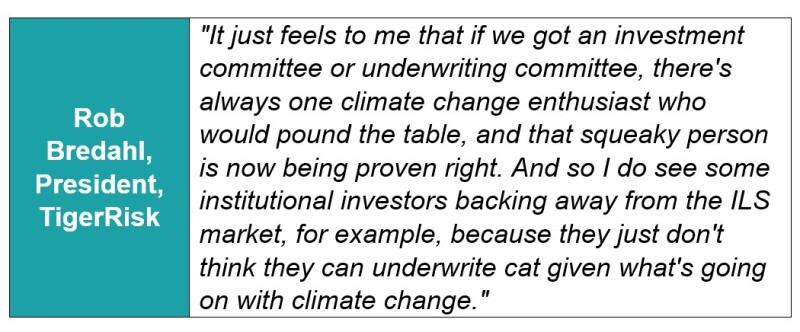

Finally, reinsurers see risk and opportunity in climate change.

Panelists and speakers agreed that current pricing has not fully encompassed the effects of climate change, noting that some ILS funds have lowered capacity.

With challenges come opportunities. The conference concluded with a sense that the changing dynamics in the industry are providing ample opportunities for players to adapt and innovate. While legacy players might have a head start, the field is wide open.