The InsurTechs, including Root, Metromile and Lemonade, saw their short interest as a percent of float dip 4pts, 3.7pts and 2.8pts, respectively, over the two-week period, with all other stocks covered remaining within 1pt of their short interest levels in the last reporting period.

Lemonade and Root remain the big two highest shorted insurance stocks, with short interest of 33.3% and 31.9%, respectively. This reporting period's short interest in both companies is more than triple the short interest in any other company covered. Root has significant private equity and insider ownership, limiting the public float compared to industry peers, which skews Root's short interest metric higher than it otherwise would have been. Metromile and HCI rank a more distant third and fourth with 9.9% and 7.4% of float shorted, respectively.

To short a stock, investors typically borrow shares of that stock from a brokerage to short-sell on the open market and to later repurchase the less-expensive stock after the price falls and return it to the brokerage. This process involves a stock loan fee charged per share and is usually 0.3% of the stock price, annualized. For stocks that have more short interest from investors, the stock loan fee can be higher.

The chart below illustrates the change in stock loan fee rates over the past week for InsurTech firms, which shows that short-sellers are willing to pay more to short InsurTechs. InsurTech stocks, including Hippo, Lemonade, Root and Metromile, have all settled at a stock loan fee rate of approximately 1%.

As the earnings season continued, roughly half of the covered stocks notched gains, while the others reported losses over the two-week reporting period. Kinsale Capital’s stock price increased 13.2%, the fastest rate of growth for covered firms.

James River’s stock experienced the steepest drop, falling 17.9% during the two-week reporting period. The stock dropped earlier in the month on news of heightened third-quarter losses due to Hurricane Ida and other storms, and the stock fell again as the firm confirmed those losses in its earnings report.

InsurTechs, including Hippo, Metromile, Root and Lemonade, saw stock dips of varying sizes over the last two weeks. Root’s stock dropped 8.7%, while Lemonade experienced a 5% drop. Metromile and Hippo saw stock declines of 4.7% and 2.5%, respectively, over the course of the two-week period.

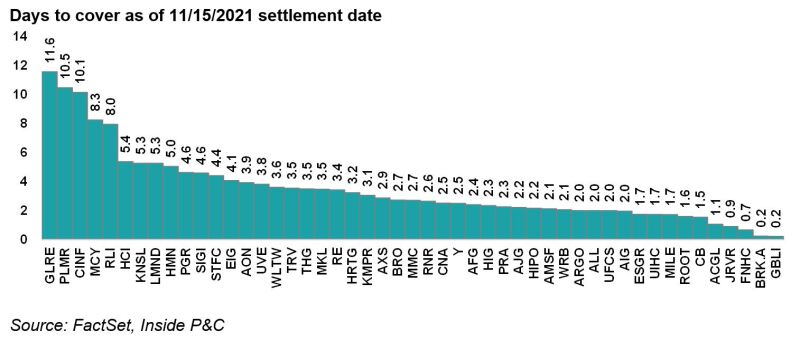

Most firms saw their days-to-cover fall, indicating that their stock volumes were up compared to the prior reporting period. HCI continued to see significant declines in its days-to-cover, decreasing by 2.2 days to 5.4 days. Last month, HCI had the lowest stock volume of firms covered, but after consistent drops in days-to-cover, it now sits in sixth place.

Greenlight Re, one of the few firms to slightly raise its days-to-cover over the two-week period, now has the lowest stock volume of firms covered, and the highest days-to-cover, at 11.6 days.