With many of us staying at home and switching (for the second year in a row) to Zoom holiday parties, it got us wondering: has Omicron had a meaningful effect on driving behavior? And would this be enough to translate into a shift in frequency trends?

Our 2022 outlook published last week highlighted that we anticipated some of the headwinds around personal lines, particularly personal auto, to dissipate by year-end. We based this prediction on the short-tailed nature of the line and pricing action over the past several months.

Below, we look at driving data, state results, and revisit rate changes.

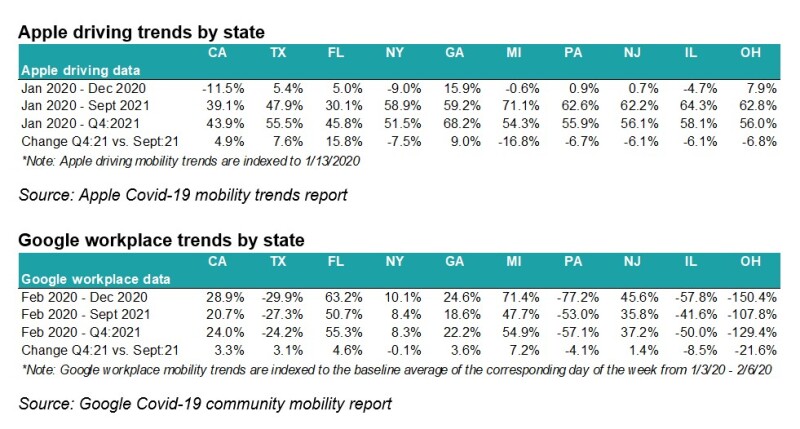

First, a look at Apple and Google mobility data.

Both Apple and Google have been publishing mobility data to give an insight into how various behaviors have changed since the pandemic. This data has also turned into a valuable proxy for how the broader economic recovery is performing. We can also use some data as a proxy for insurance-related items.

Starting with Apple's data on driving trends by state, we looked at how this data had changed over 2020 and 2021 and whether the fourth quarter was an outlier?

This analysis resulted in some surprising findings. The top 10 personal auto states showed that driving behavior continued to recover at year-end vs. September for four states (CA, TX, FL, GA).

By contrast, six states (NY, MI, PA, NJ, IL, OH) declined in mid- to high-single digits.

Furthermore, on a monthly basis, the states which showed a decline in driving declines were more pronounced from September to November of 2021 and then modestly from November to December.

So, Omicron was likely only partly behind depressed driving behavior in some of the heavily-hit states.

We also analyzed Google data, which slices data into different slivers – and picked "workplace mobility" as a proxy since most of the driving behavior is to and from our places of work.

Google's data showed that there wasn't any further precipitous decline in time spent at places of work for all the states in Q4. However, we would note that office data would get influenced by the new normal of work-from-home. So this data might be a weaker proxy for driving behavior.

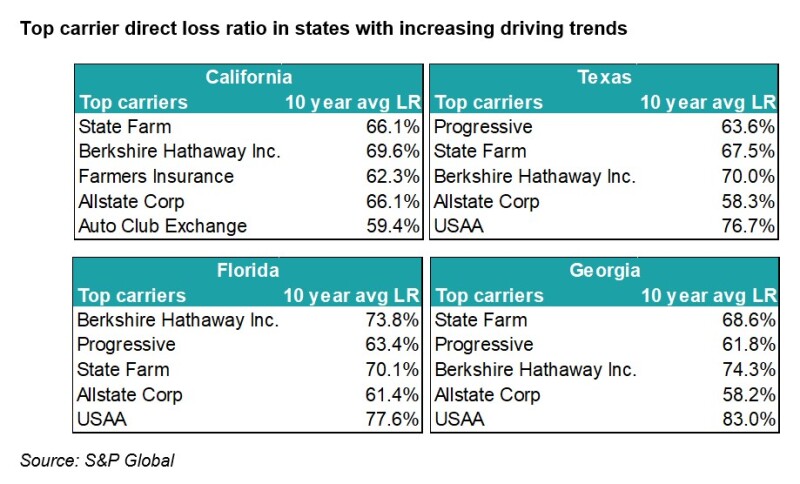

Second, in the Top 10 states (56% of personal auto), states where driving declined only make a quarter of industry premiums.

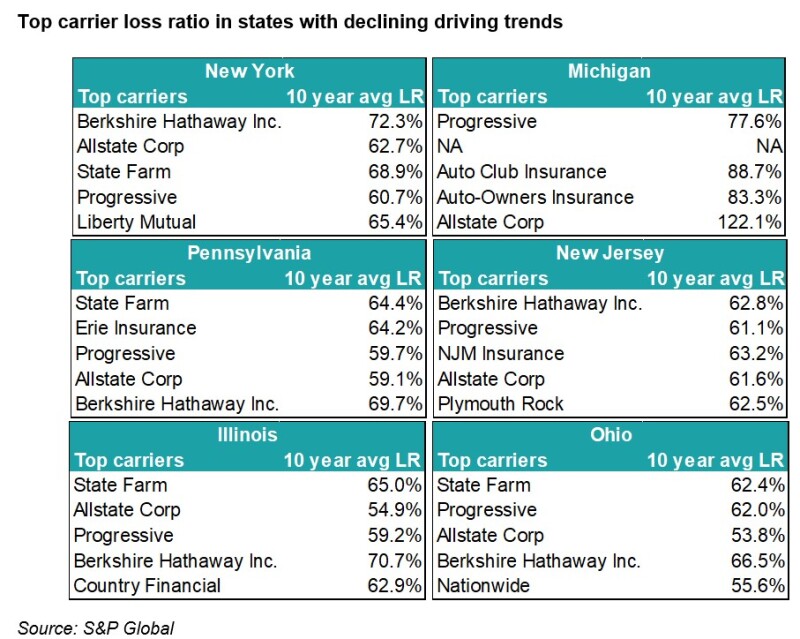

We also looked at the carriers that are leading writers in states where driving behavior has declined as per Apple’s data.

The states where driving declined (shown below) account for only 22% of total industry personal auto premiums vs. 34% for the four out of the top 10 states where driving behavior showed an uptick in Q4 2021. This data also reveals that the top writers generally stay unchanged across states, so it will be interesting to see during earnings if the performance varies meaningfully across writers.

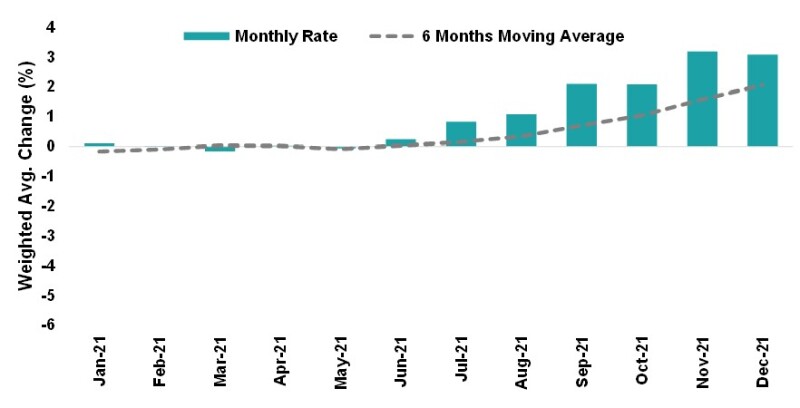

Third, recent rate changes have trended up.

Our examination of rate filings indicates that filed rates are beginning to get closer to mid-single digits in recent months. As personal auto companies pursue rate adequacy over top-line momentum, we expect this trend to continue.

In summary, personal auto carriers' results in the fourth quarter of 2021 and the first quarter of 2022 might end up being noisier due to Omicron's impact on driving behavior. That said, recent data in the press indicates that we might have crossed or are fast approaching the Omicron Covid peak, so any effect on personal auto loss trends might end up being transitory.