Kemper: Earlier this week the firm reported worse personal auto loss cost trends, including a 27pt combined ratio deterioration to 119%, sparking worries about the rest of the sector. In its analysis the Inside P&C Research Team found that the company differs from peers in state exposure loss trends – with more than 50% of its book in California - and is playing catch-up on rates.

Earnings season sometimes feels like Groundhog Day – both the movie and the holiday itself.

On the one hand, company management teams come out of their burrows to predict four more quarters of profits, with analysts careful to pay attention lest they catch sight of their shadows (or balance sheets).

On the other hand, listening through call after call (after call) reiterating the same overarching industry themes can make one feel like Bill Murray waking up to “I got you babe” on the radio.

This year was a mix of the familiar and the new. Punxsutawney Phil predicted an extended winter, while Staten Island Chuck saw spring on the horizon closer to home. Earnings calls clustered around much of the same industry analysis and predictions.

And then there’s Kemper.

On Tuesday, Kemper Corp, a predominantly personal auto player, reported its fourth quarter and year-end earnings.

Included in its results was a high level of deterioration from loss cost trends in its personal auto book, with a 27-point deterioration taking its combined ratio to 119%. The company ran up a $257mn underwriting loss and took a ~10% hit to book value.

Management partially attributed the underlying deterioration to supply chain issues and labor shortages.

This deterioration sparked a frenzy of speculation on whether loss costs had hit a new bottom and whether was worse to come.

Is Kemper the earliest in this new cycle? Or is it an outlier?

A hint on this came from Allstate’s report last night. Allstate’s underlying loss ratio “only” deteriorated 15.9 pts for the quarter vs. Kemper’s deterioration at twice those levels.

Having covered Kemper as a sell-side analyst in the past, we knew that the quality of the firm’s book was different vs. the best-in-class writers. Therefore, it would make sense to examine the company and broader factors before rushing to the judgment that a new loss cost deterioration cycle had dawned upon the industry.

We set out to examine the following for Kemper:

1. The impact of state mix in results and regulatory challenges in raising rates

2. Kemper’s loss picks historically vs. other players and the industry

3. Kemper’s rate actions vs. peers

Our analysis of these questions led us to conclude that some of the issues for Kemper are more franchise- and company-specific.

Lacher’s leadership and the Infinity deal

But first, a quick trip down memory lane. Under prior CEO Don Southwell, who was at the company for twenty-plus years, the franchise floundered for a while. When Southwell announced his retirement, Joe Lacher was named the new CEO to turn the business around.

Lacher came to Kemper in 2015 post-Allstate and Travelers with great expectations given his experience at those firms.

To Lacher’s credit, he did bring the combined ratios down from the 100-plus the company had reported for multiple years before his tenure. There was a commensurate positive stock reaction.

After improving results, Kemper leaned further in its non-standard auto book, using its improved valuation as currency for M&A. It purchased Infinity P&C, another non-standard auto player, in 2018 for $1.4bn – or approaching 2x book.

The personal auto cycle for the industry and the company remained relatively stable in 2018 and 2019, and then the pandemic hit. Initially, loss trends dived for 2020 with far fewer miles driven.

However, loss cost trends began to worsen sharply as frequency rebounded through 2021, and severity spiked as the year progressed. Other personal auto-predominant and bundled product writers flagged this through 2021. As insurers dialled down growth and pushed for rate, it looked like the industry was on a path to addressing the issue.

But Kemper’s Q4 2021 discussion raised the tantalizing question of whether trends will get materially worse before they get better? Below we examine the three factors which lead us to believe this is more of an issue with Kemper and its mix than an industry-wide disaster.

Firstly, Kemper is hugely concentrated in California, a state which has seen essentially no movement on rates.

Kemper writes P&C insurance through its two segments – specialty property & casualty and preferred property & casualty.

The “specialty” terminology is easily misunderstood, but it mainly houses the non-standard auto piece.

Most of the non-standard auto business exists in California, Texas, and Florida mainly due to the relatively newer immigrant population, which generally looks for minimum coverage, amongst other things. Most of this market was Infinity’s target clientele.

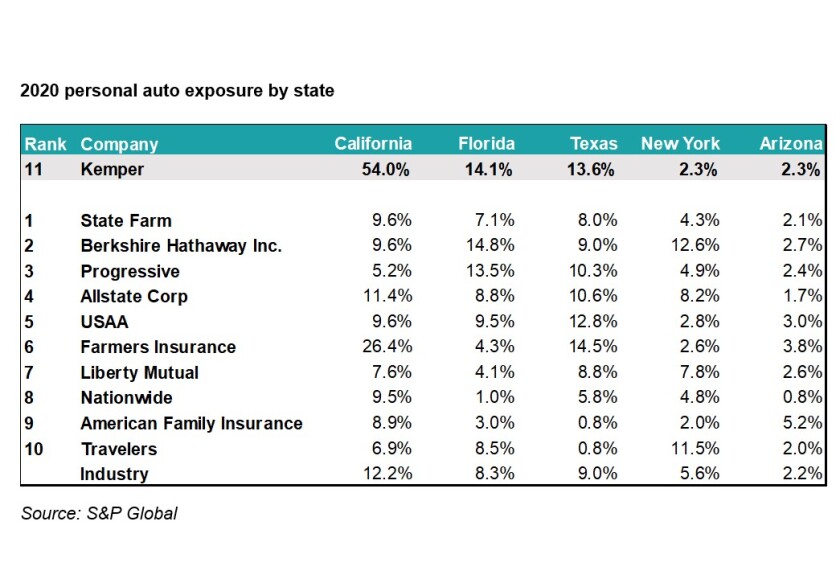

As shown below, Kemper’s state mix has shifted materially since the Infinity acquisition, and approximately 50% of it comes from California. This concentration made it more susceptible to the associated vagaries of the state.

The broader personal auto market is more evenly distributed, with only 12% of industry premiums coming from California. Kemper’s publicly traded peers such as Allstate, Progressive, and Travelers books are more balanced with their exposure to California in the mid-single to low double-digit range (although Farmers also has outsized exposure).

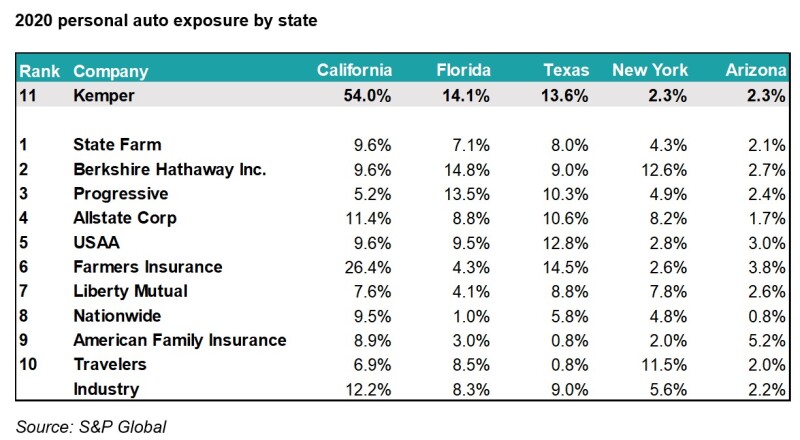

On Kemper’s earnings call, there was an extended discussion on the rate approval process in California and the problems surrounding it. Below we show the approved private auto rate hikes since 2019 in select states. California is a clear outlier on the low side with no rate rises approved since 2021, and very few even back to 2020. Hence it makes sense that a predominant California writer will run into these headwinds.

Kemper’s management expressed optimism on pursuing rate action in California going forward. However, as recently as November 2021, Insurance Commissioner Ricardo Lara was pursuing Allstate, CSAA, and Mercury General around insufficient premium rebates during the earlier part of the pandemic.

A 119% combined ratio will not go unnoticed, but the political pressure on the industry leads us to believe that achieving rate traction in California will be a slow grind.

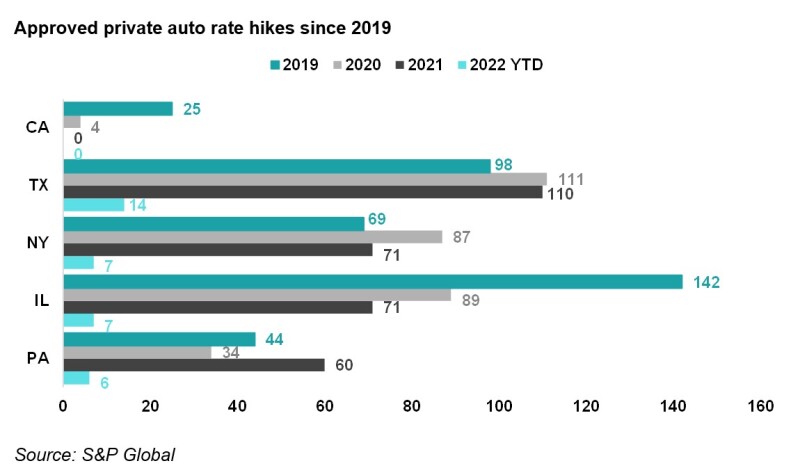

Secondly, does Kemper's loss ratio pick vs. other carriers' trend line look different?

During its fourth-quarter earnings, Kemper disclosed that its underlying loss ratio pick in its specialty P&C and preferred books went up by 28 pts. We looked at initial picks for the universe of personal auto carriers.

Interestingly, even after the addition of Infinity, Kempers’ loss picks improve vs. the industry start improving instead of being worse.

This trend leads us to surmise that the loss environment went in one direction while the loss picks went in another. This split was due to a belated acceptance in the fourth quarter that the firm needed to rethink loss picks, resulting in an uptick in the underlying loss ratio.

Thirdly, Kemper seems to be playing a late catch-up game on rates.

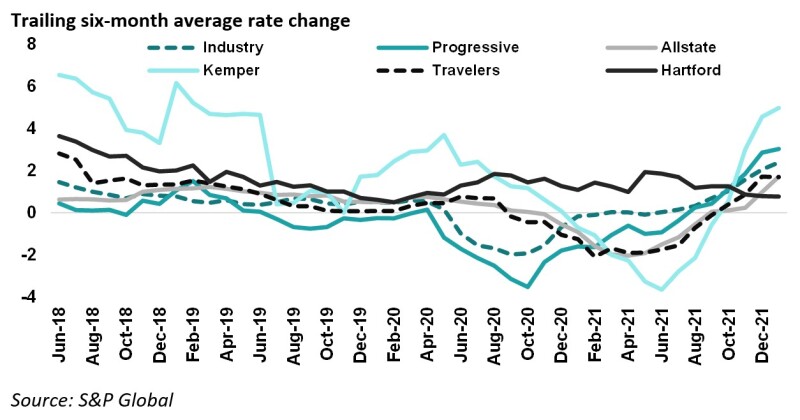

We have previously published notes which show the industry is working to take rate.

On its call, management noted the firm filed for an 8% rate increase in two-thirds of its mostly non-standard book for Q4 2021, and was looking for an additional 7% rate on 60% of its book for Q1 2022.

It was also in the process of filing double-digit rates in its preferred auto book. Kemper also disclosed that approximately half of its book was 6-month policy terms, while the remainder was 12 months.

This split means that it might be a while before pricing actions translate into addressing the loss cost worsening. Some of Kemper’s peers skew heavier to six-month policies, allowing them to turn around their book quicker.

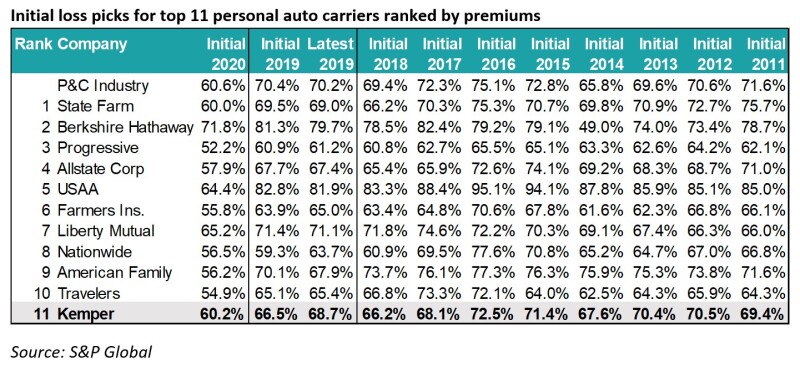

Below, we pulled the rate filing data to look at Kemper relative to other personal auto writers. We acknowledge that this comparison is not apples to apples since we are comparing packaged writers to auto predominant carriers.

Nonetheless, as we discussed in our outlook, Progressive continues to respond earlier than the industry on the strength of its telematics. On the other hand, as shown below, Kemper seems to be the last one reacting from a rate perspective.

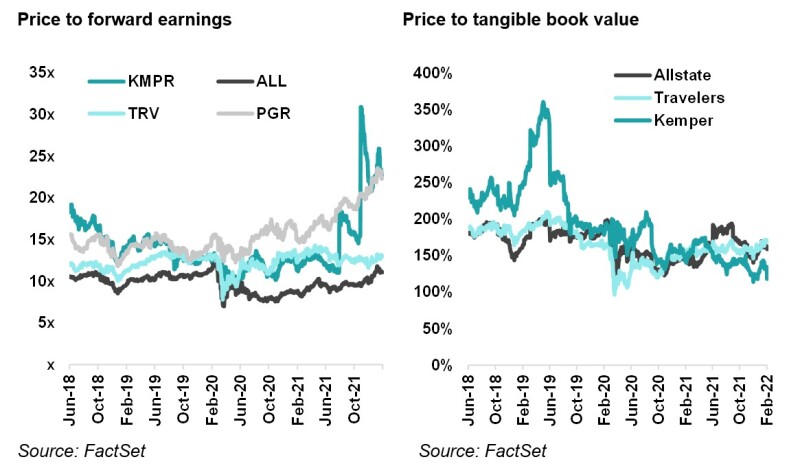

The charts below show the valuation difference for this peer group.

In summary, Kemper’s results and our analysis reflect company-specific and exposure trends. Personal auto carriers continue to react to the change in loss cost trends seen initially in 2021. As a result, carriers that were ahead of the curve will have the first-mover advantage, which will translate into better value creation over time, something seen consistently with Progressive.

xx