So, in theory, one could put in 10,000 hours and be as good as Matthew Stafford.

But on the other hand, as you go down that path and realize you aren’t getting near Stafford’s levels, you should probably start thinking about the sunk cost fallacy.

At that point, it's better to cut your losses and start thinking of what Plan B looks like.

It would be fair to say that following last week’s reserve charge, Argo has reached that point.

Having covered the company for over a decade, we are all too familiar with its management (current and prior) and book of business challenges.

With the recent reserving adjustment, we think a credibility gap has emerged with the current caretakers, and it's time to start making some tough decisions.

Why do we feel that way? Suppose one examines the landscape of specialty, regional, or reinsurance franchises over the past 20 years. If you do that, you see it is nearly impossible for management to dig itself out once reserving fears set in. Every additional noise creates a “told you so” moment.

With Argo, the fears never went away, so it's doubly difficult for the current management to regain credibility.

We covered consolidation in detail in "Where have all the reinsurers gone?". The list is long, but companies such as Aspen, Allied World, XL, Flagstone and IPC Re all had difficulty getting out of the penalty box.

In the past, we have talked about a six-point plan for Argo, which included (1) breaking up business; (2) reallocating capital to US ops; (3) addressing expenses; (4) leaning into US E&S growth; (5) improving messaging vs. confusion whether it's a Bermuda, E&S or specialty carrier; and (6) exploring a sale.

However, the reality is that this process is a tall order to address, and the issues might turn into a game of whack-a-mole. The problems with the business have lingered, and opportunities surrounding the hard market are close to being squandered.

The current management team has struggled to deliver on the messaging in its plan. While the company continues to find a path to shelve underperforming businesses, it's taking much longer. Argo's Syndicate 1200 is still around, and any growth in US business will be tainted with questions surrounding profitability and reserving.

We do empathize with CEO Kevin Rehnberg's position. After all the issues coming out of the Voce campaign against the company, it would have been challenging for the board to find a credible external candidate willing to take on the job given the reputational risk. Additionally, an external candidate might have rocked the boat even harder. So, Rehnberg inherited a very big ask.

That said, Rehnberg did run Argo's US operations since 2013, so there are questions for him to answer surrounding a major reserve charge showing up this late.

On the other hand, Argo's CFO, Scott Kirk, is an outsider and had dealt with book of business challenges at Aspen – providing handy experience. However, Argo's complex financial situation with multiple books of business in numerous jurisdictions might be resulting in a much steeper learning curve than was apparent from the outside.

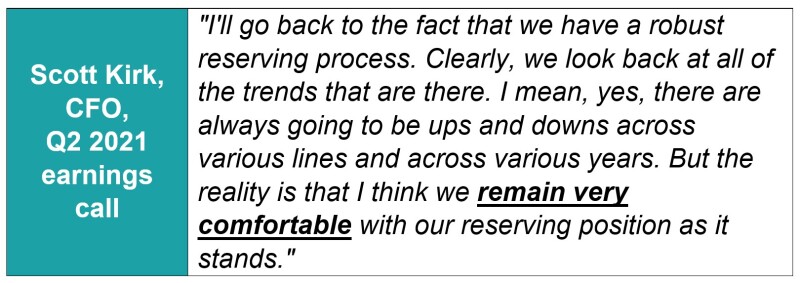

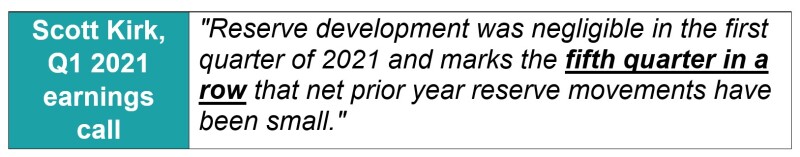

These issues are being further complicated by management commentary. For example, on recent earnings calls, management went out of its way to stress its confidence on the reserves. These indications allowed the stock to stabilize for some time and even perform strongly over 2021, similar to other insurance franchises.

We also acknowledge there has been activist pressure for a sale for some time, after a second activist emerged in September last year. Our investor day recap noted that the reserving question might keep potential suitors away. So perversely, the reserve adjustment announced last week might reduce the fear of an asymmetric information gap.

Argo's stock has fallen 22.6% since the investor day vs. S&P 500 at -12% and S&P 500 Insurance at +18.5%. During 2019 the stock was trading comfortably in the $70s, but closed below $40 yesterday.

This stock performance creates a significant challenge for whatever actions the management team undertakes from this point onwards and how they will be received. Having agreed to cease its activist campaign after Mark Watson’s exit as CEO, the ball is back in Voce’s court, with the market waiting to see if its confidence in the current management team survives the charge.

The note below looks at the reserving discussion, expectations set at the investor day, and potential buyers and valuation.

Firstly, the reserve charge was not a surprise.

Last Tuesday, Argo pre-announced several items that will impact its Q4 results. After a fourth-quarter reserve review, Argo noted an expectation of prior year development of $130mn-$140mn. The most significant piece of this development related to construction defect (CD) risks within its US operations, apart from reserve increases in its run-off operations. Argo also noted that the CD issue was from 2017 and prior underwriting years, which the company believed have been "significantly remediated or discontinued." That said, in the past, management has alluded to reserve stability before taking a charge.

Taking a step back, first, we need to understand the nature of CD business.

Put simply, as the name suggests, a construction defect will arise from code violation, unsafe construction, deficient design or sub-surface defects – to name but a few. The tail of these losses can be long, and industry news websites have been talking about them for decades. CD issues have dogged Argo's books for some time and has reared its head via adverse development in the past as well. So we do acknowledge the challenges inherent with this class of business.

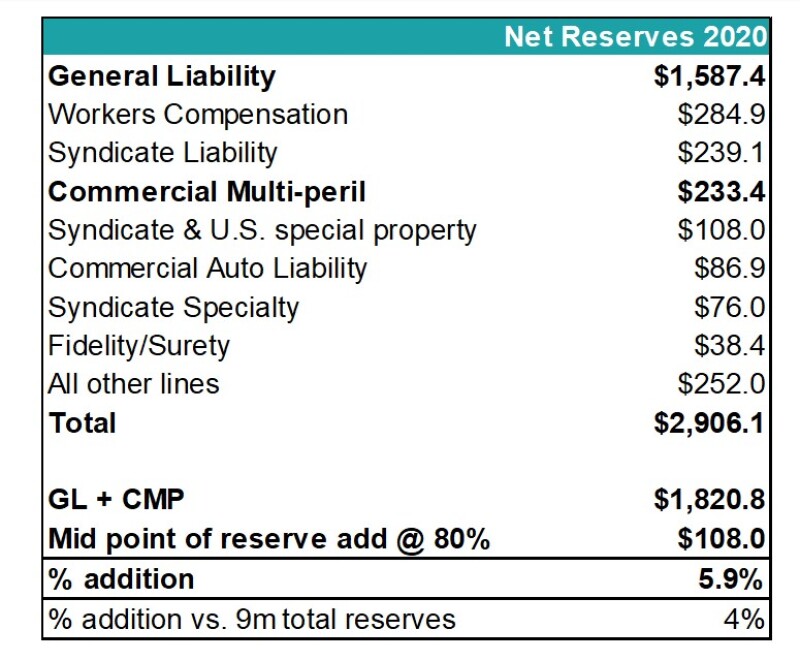

Argo does break out the broader reserving classes in its 10Q and 10K. Assuming the construction defect lies in general liability and commercial multi-peril lines would equate to ~6% of those reserve buckets, taking a midpoint of reserves at 80%. It is also likely that the CD is spread out in other lines. Overall, the recent reserve charge equates to approximately 4% of total reserves.

Secondly, investor day expectations seemed high.

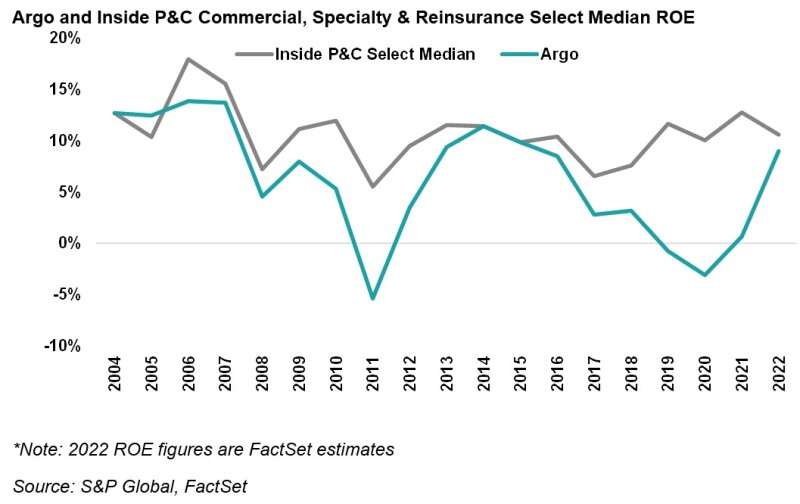

At the investor day, Rehnberg had outlined a path to double-digit ROEs. The target seemed aspirational at best, with Argo having achieved a double-digit ROE only three times in the past 20 years.

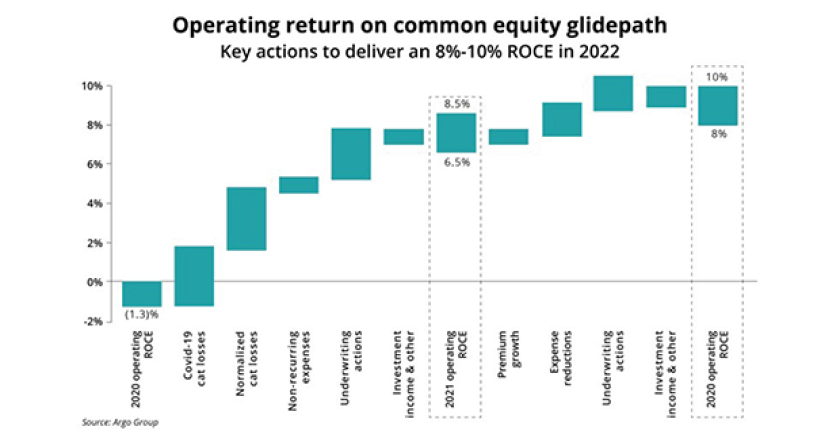

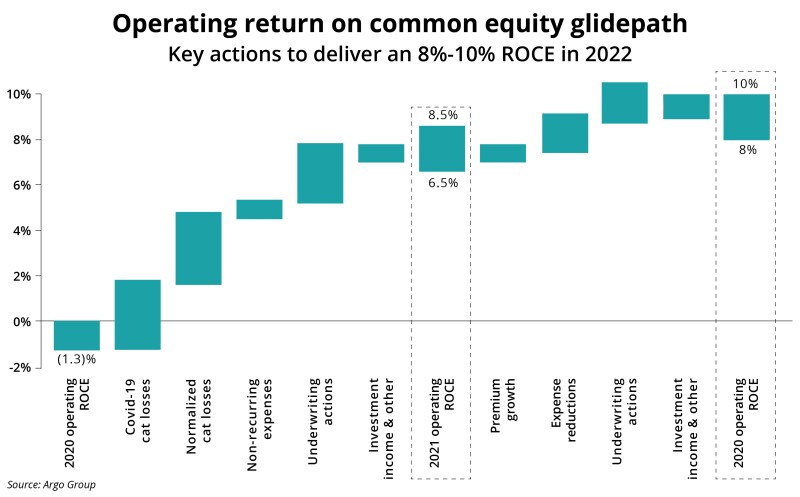

In the presentation at that investor day, the company anticipated a 6.5%- 8.5% ROE for 2021 and 8%-10% for 2022. Argo hit an 8% ROE for the first nine months of 2021. But as is too often the case with Argo, the Q4 2021 reserve adjustment erases many of those gains.

The current Street estimates for 2022 are at $4.36/share, which translates into an ROE of 9% and is within management's guidance.

But what has history shown us? We examined commercial, specialty, and reinsurance franchises over the past 15 years to look for persistency of returns as well as a reversal in returns.

As the chart below shows, the variability year to year remains in a tight band for the broader cohort. So a reversal of +10% is a tough ask for any franchise. We also examined individual company ROEs on a sequential basis, and excluding hurricane and mortgage crises, a double-digit reversal in ROE was more of an exception than a rule. So, perhaps, Argo will hit its expected ROE mark, but to do so it would have to be an outlier versus the historical trend for the P&C group.

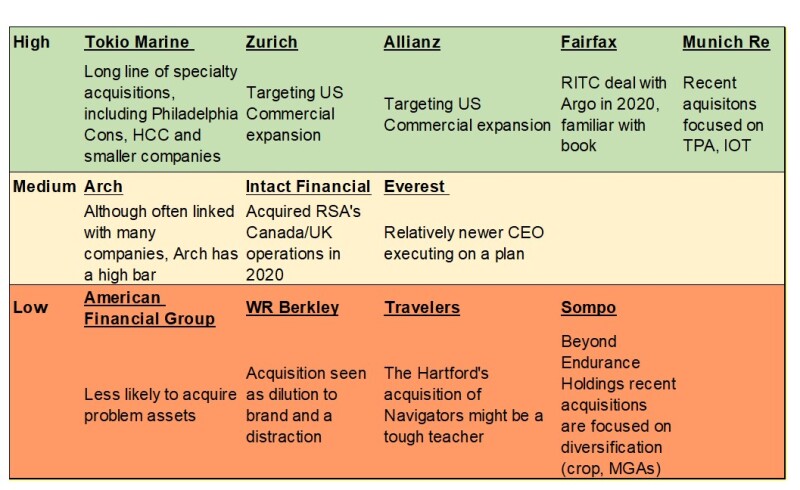

In our piece on consolidation, we discussed the likelihood that Argo will feature in the next round of consolidation.

For better or worse, this industry has seen meaningful consolidation over the past 20 years or so. This trend was partly accelerated by the continued decline in interest rates, with investment income no longer providing relief. With underwriting in focus, risk selection became paramount, and smaller franchises that couldn't keep up were acquired or merged.

Based on the recent reserve adjustment, some evaluators might apply additional reserving haircuts, as shown in our analysis below. We do want to caution that this analysis is subjective. Our base case current tangible book value (TBV) is $40/share, factoring in the pre-announcement. A range of further reserving haircut scenarios from 0% to 10% gives us a TBV range of $33/share to $40/share.

After the reserving haircut, we applied different takeout multiples at different reserving levels. Since a take-under is unlikely, a premium to the adjusted tangible book gives us a range from the mid-40s to a $60/share.

This range compares to a pre-charge 30-day volume-weighted average price of $53.4/share, and the current stock price of ~$40/share. This price range would equate to a 50% premium to the current stock price on the top-end.

History has taught us that the buyer often emerges from the left-field regarding who could be likely buyers of Argo. We have learned this lesson from acquisitions such as PartnerRe (the first time round), XL Capital, Allied World and Validus, to name a few. That said, below is our take on potential buyers for Argo.

In summary, the recent adverse development means that the honeymoon period with this management team is over. At this stage, an outside set of eyes with a culture of excellence around underwriting and reserving would be better equipped to deal with Argo's challenges.