As we looked at the earnings and listened to the earnings conference call, we couldn't help but think about the similarities and dissimilarities that Argo Holdings faces in its own franchise. In our piece titled It's time to think about a sale of Argo, we highlighted how activism and the challenges surrounding the franchise would result in management walking a tightrope.

But are some of the same issues applicable to James River? In our last piece on James River, we had noted,"E&S underwriters are confident that 2022 and the succeeding years will be good years. The cloud on the horizon is cat-exposed property, an area where James River hardly plays.

"This leads us back to the $64,000 question: Does James River have a solid enough core franchise once we move beyond Uber and the casualty reinsurance issue? Does it have the team and capabilities to take advantage of the fair winds in E&S?"

Last night, James River's stock closed down 19.5% after its Q4 results of a $1.81/share loss vs. Street expectations of +$0.05/share. James River stock now trades close to its IPO value of $21/share. Along with its earnings, James River disclosed a loss portfolio transfer with Fortitude Re for a majority portion of its Casualty Reinsurance units reserves.

But does this reserve adjustment following its prior reserving issues in other parts of the book leave a cleaner franchise to benefit from the marketplace? Do we give credit to the relatively newer management in place? Or do we acknowledge that the prior CEO and founder who remains as the non-executive chairman was at the helm when most of the book currently developing adversely was written?

It is unlikely that the recent reserve charge and the noise coupled with the stock move would have gone unnoticed. The charge could result in activists, investment banks, and other insurance/non-insurance companies dusting off their playbooks.

Over the past two months, insurance companies have alluded to the resilience of the E&S, specialty, and commercial insurance marketplace. If one entirely agrees with that narrative, rate-on-rate action continues, and if loss costs remain stable, a significant margin expansion might be around the corner.

Although we do not fully subscribe to that notion, the time would be now for any potential partners to seriously evaluate this franchise before we are back in the throes of a softer market.

But the question that will be paramount on everyone's mind is whether James River possesses a strong enough core E&S franchise to be attractive enough for activists and other players to show an interest in the firm.

Our note below evaluates the potential for takeout/activism valuation, the reserve adjustment, along with the broader trends in the E&S marketplace.

Firstly, the reserve charge creates an opportunity for activism or solicited/unsolicited interest

Most industry observers are familiar with Voce's role in changes at Argo Holdings. But beyond Voce, activism is still in its infancy in the insurance space. As previously noted, unlike other industries, in insurance would-be M&A buyers face information asymmetries and run the risk of undiscovered information. Additionally, there have been more challenged sellers vs. willing buyers.

That said, activists seem to be getting more involved vs. historical trends and may feel emboldened after seeing some of the traction they seem to be getting. The time horizons when investors stood silently for years and waited for management to right the ship have also changed. Data analysis has become cheaper and more accessible, and even investors new to the space can quickly ramp up. The list below shows some of the activists in this space. If a high-profile activist investor took a stake and pressed the mgmt./BOD for a sale, would they be able to resist these pressures considering the stock's valuation?

Activist investor action in selected firms

Source: Company reports

A similar thought process could also play out for entities looking to benefit from the E&S market momentum seen in recent years.

James River's stock move yesterday creates an opportunity and also a hindrance. The reserve adjustment of $115mn equates to 19% of Q3 tangible equity.

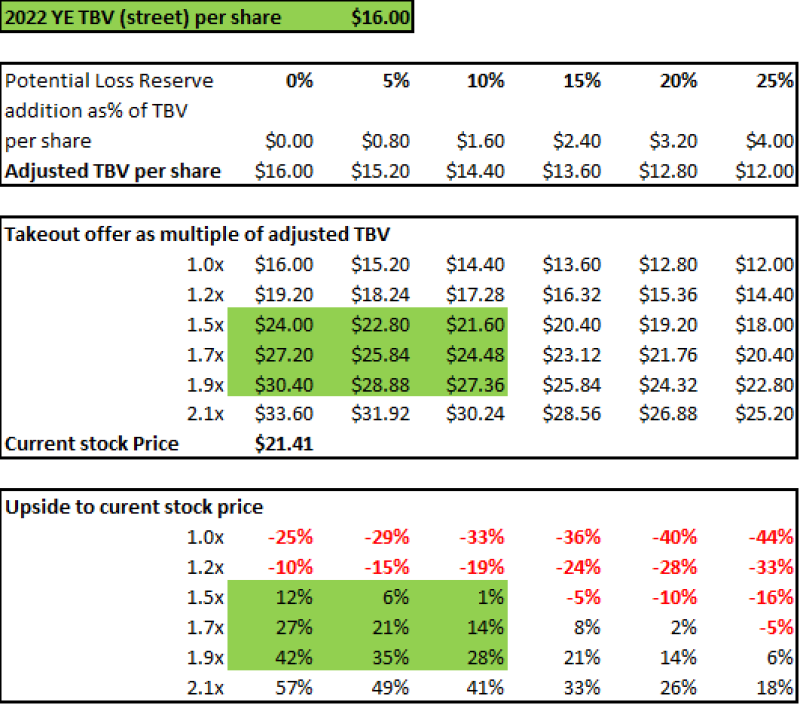

Even though the stock is trading close to IPO price, some of these suitors may ( or may not!) apply additional reserve adjustments, as shown in our analysis below. We do want to caution that this analysis is subjective. Our base case year-end current tangible book value (TBV) is approximately $16/share based on recent street estimates, which may not fully reflect other capital management actions. Further reserving haircut scenarios from 0% to 25% gives us a TBV range of $16/share to $12/share for year-end 2022.

After the reserving haircut, we applied different takeout multiples at different reserving levels. Since a take-under is unlikely, a premium to the adjusted tangible book gives us a range from mid $20s to the low $30s.

This range compares to a pre-charge 30-day volume-weighted average price of $27.37/share and the current stock price of ~$21.41/share. This price range would equate to a 60% premium to the current stock price on the top-end.

That said, not long ago, the company was trading in the $50s, which sometimes can create a psychological barrier for management to come to the table willingly.

James River takeout offer upside

Source: FactSet, Inside P&C

Secondly, the retroactive reinsurance arrangement for Casualty Re reserves addresses a potential overhang

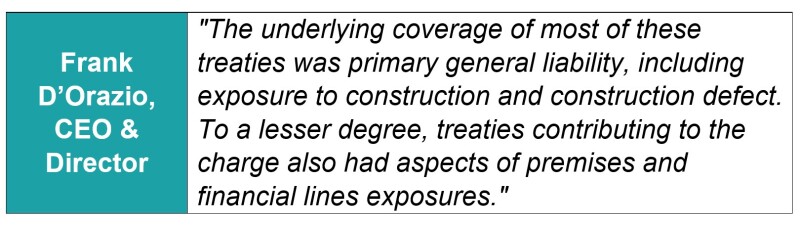

On its Q3 earnings call, James River had highlighted that it was in the process of a deeper dive on casualty reserves. Earlier this year, press reports had indicated some market discussion surrounding a potential disposition of this business. This change had followed bringing in a new actuarial head, so the reserve charge in itself was not a surprise. What was a surprise was the larger than anticipated $115mn of adverse development related to "a limited number" of treaties from underwriting years 2014-2018.

Apart from the addition, James River also entered into an LPT/retroactive retrocession arrangement for the majority of its casualty re segment with Fortitude Reinsurance Co. Under the terms of the deal, the cover is on the 2011-2020 underwriting years. The aggregate limit is $400mn, which translates into a net cover of $65mn ($400mn-$335mn).

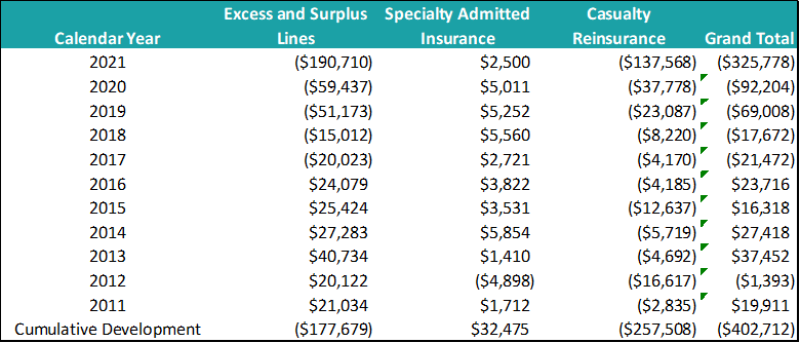

We thought it would be interesting to look at the historical reserve movement by segment, which is disclosed in James River's 10K. Note the reserve movement in its E&S segment emanating from its commercial auto exposure via Uber.

As of the 2021 10K, James River total reserves were $1.399bn comprising $869.5mn of E&S Lines reserves, $104.7mn of Specialty Admitted Insurance Reserves, and $424.9mn Casualty Reinsurance reserves.

Following the LPT, the focus now will be on prior E&S years and the possibility of the LPT being exhausted. In the opening remarks of the earnings conference call, management attempted to assuage any fears surrounding other pieces and disclosed that the reserving review had not resulted in material movements. Even so, James River continues to be a show-me story, as evident by the tone of the questions on the conference call.

Reserve development by segment

Source: Company reports, 10K

Thirdly, E&S has been a bright spot for the industry and made this franchise attractive

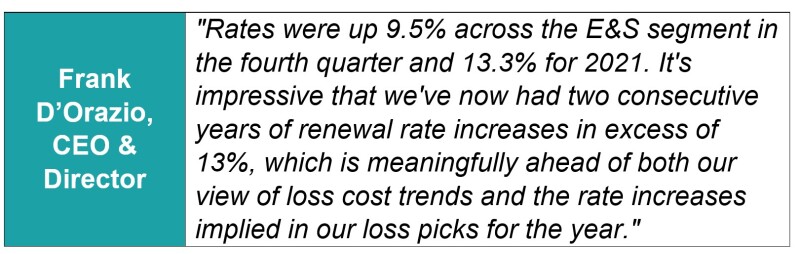

On the conference call, management noted the 9.5% rate increase in this book for Q4. Historically, E&S has outperformed broader commercial lines on an underwriting basis. So, the rate increases, in theory, should translate into margin improvement. But, of course, this does assume that loss costs remain stable and pursue the trajectory seen before a Covid-enforced shutdown of the system.

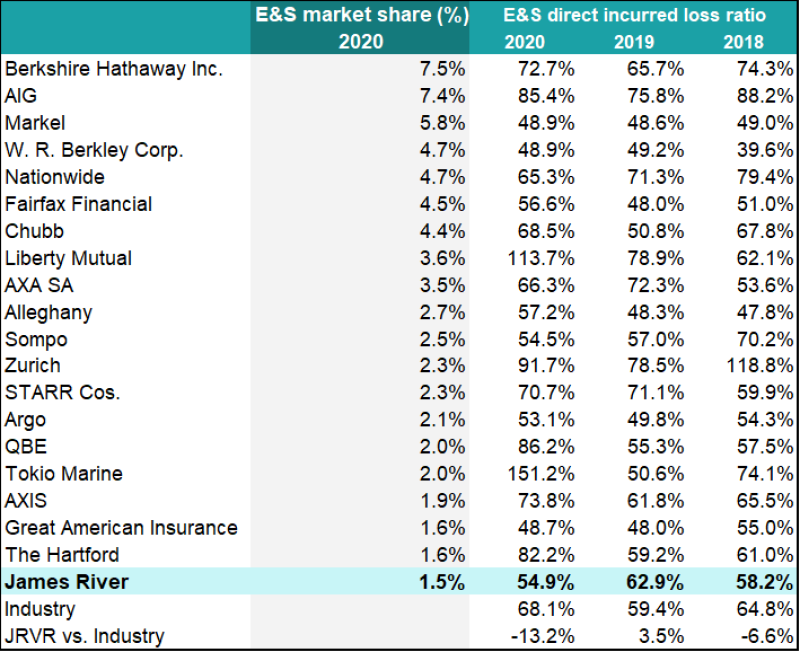

Based on S&P Global direct written premium data (excluding Lloyd's), James River is ranked 20th with a 1.5% market share. On a GAAP basis and using yesterdays' earnings release data, James River's gross written premium grew by 19.2% for 2021 and has shown an 18% CAGR growth since 2013. The company does have additional room to grow as it refocuses on E&S.

Our Argo piece highlighted Tokio Marine, Zurich, Allianz, Fairfax, and Munich Re as potential buyers. Recall, Fairfax's purchase of Allied World at that time had allowed it to leapfrog to the fifth place from its prior of 11th in 2016. So for franchises looking for a foothold in the E&S space with an SME focus, James River presents an interesting opportunity.

The chart below also shows the loss ratio by different franchises, which can sometimes appear unusually high or low due to intercompany arrangements. On the surface, the book is performing better

Top 20 E&S firms by DPW

Source: S&P Global

In summary, although the recent reserve charge and the funds withheld retrocession arrangement brings clarity vs. the reserve overhang, the stock performance might leave the company vulnerable. Activist investors or unsolicited suitors might view this as an opportunity to buy a decent E&S franchise at a discounted valuation.