As New Yorkers, watching the Lightning lose after steamrolling the Rangers on their way to the championship felt pretty good, but even we expected Tampa Bay to retake the Cup this year.

After all, they had been the favorite for much of the season and were the two-time consecutive defending champs, reminding us of the legendary New York Islanders of the early 1980s. That comparison fell apart on Sunday night. In most things, especially sports, you never know if next year will be as good as the last.

Over the past year, insurance brokers have felt like the Tampa Bay Lightning.

Following the Covid crash of 2020, brokers entered what we termed a “super-cycle” consisting of a sustained uptick in P&C pricing, a strongly rebounding economy and buoyant demand resulting from clients’ heightened appreciation of risk. These dynamics combined resulted in record organic growth.

The rising tide of the super-cycle buoyed brokers' results over multiple quarters, driving significant stock market outperformance and drawing Warren Buffett in as an investor in two of the Big Three.

Still, signs of slowing and a possible turn of the tides may leave future results far short of expectations, which still look elevated.

The note below will detail how things will get harder for the insurance brokers from here, with scope for the weakening economy and slowing P&C cycle to miss estimates in coming quarters.

Firstly, slowing GDP growth will read across directly to weaker organic growth for the brokers.

Unlike insurance underwriters, brokers’ results are closely tied to market conditions and are the first movers when the pricing cycle turns.

As a result, brokers have generally outperformed the rest of the insurance market through the hardening phase of the P&C cycle. Still, the brokerage super-cycle that yielded above-average organic growth for insurance brokers through 2021 appears to be ending, or at least slowing.

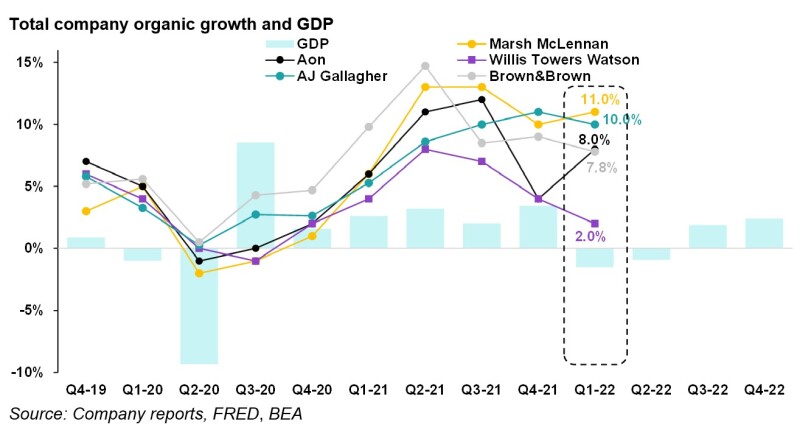

The chart below details brokers’ total company organic growth compared with US GDP and shows how organic growth shot up during the super-cycle, coinciding with the post-Covid economic recovery.

But it also shows that much of the brokers’ organic growth was pulled forward in expectation of a longer recovery, which may lead to a decline in organic growth as expected economic performance fails to materialize.

Unlike longer-tail insurers, brokers are a 1:1 income statement story. As clouds continue to gather on the perceived direction of the economy, the outlook for GDP remains unclear.

We have discussed the potential for a recession, but even talking about a recession can have a psychological impact on investors. Buyer behavior continues to change, and it might just be that the GDP forecasts are still too rosy.

Since broker growth and GDP are correlated, with smaller brokers having even stronger correlations, there is a possibility that brokers could come under greater-than-anticipated pressure. Most of the brokers attempted to hold the line on the last quarter's conference call, but what goes up must come down.

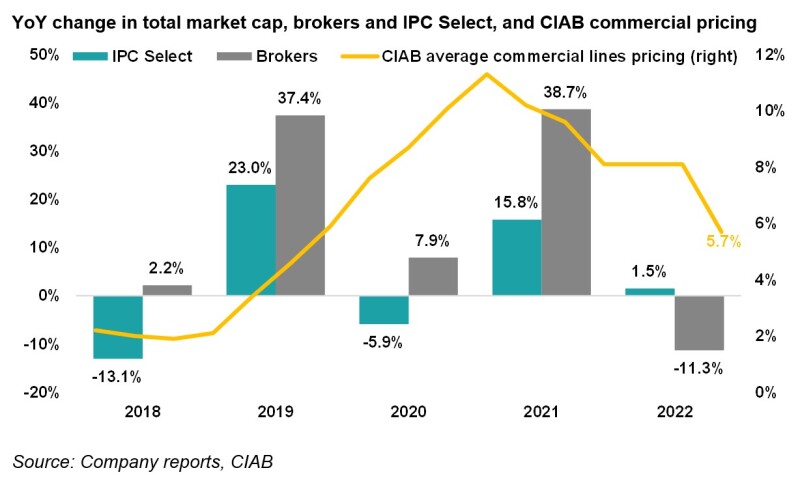

Secondly, brokers’ stocks have materially benefited from the super-cycle but will likely face continued pressure due to deteriorating conditions.

Brokers are the most vulnerable sector to pricing cycle turns. Brokers experienced an outsized benefit in stock prices compared to the Inside P&C Select group of insurance firms through the hardening phase of the cycle.

But, as shown in the chart below, brokers have also experienced an outsized negative impact on the total market cap from this year’s ongoing stock market decline, falling 11% year-to-date. They are down more sharply from April peaks, with Brown & Brown down 20% and Aon off 19%.

As the economy struggles and the stock market continues to take a hammering, brokers may continue to feel the most acute pressure due to them being the first derivative of cycle change.

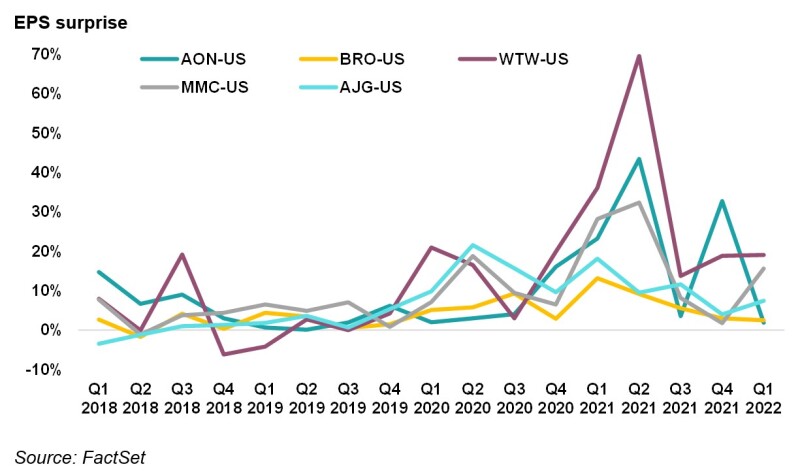

Thirdly, broker estimates have remained optimistic – setting the stage for possible misses in upcoming quarters.

The chart below shows that brokers beat EPS estimates by a considerable margin through the super-cycle. Still, as the pricing cycle has begun to turn, results have recentered closer to consensus estimates.

The decline in EPS surprise indicates that broker quarterly performance is falling out of the period of better-than-expected results that defined the super-cycle.

Brokers have also seen upward pressure on staff costs as a result of the War for Talent, which they have been able to absorb due to higher growth and lower travel and entertainment (T&E) costs. Slower growth and reduced T&E benefits as the economy normalizes will test the brokers’ ability to control margins.

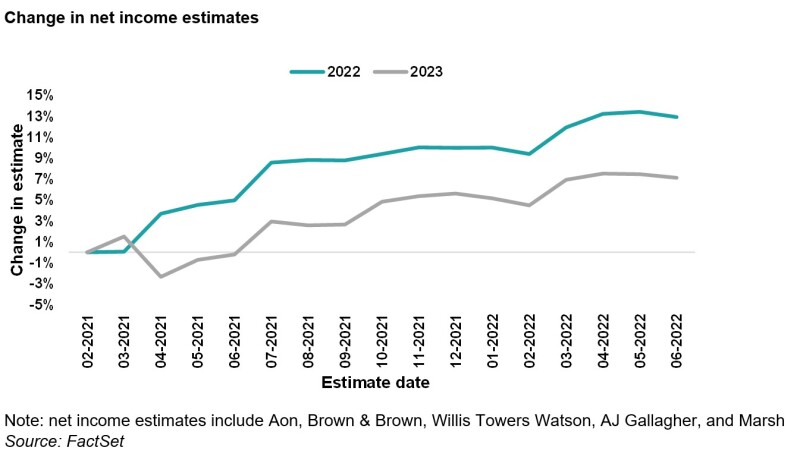

While brokers’ EPS results have returned to expected levels over the past few quarters and continue to slow, estimates have remained optimistic. The chart below sums the adjusted net income for the group in aggregate and shows numbers rising through 2022.

In conclusion, conditions are set to deteriorate for the brokers after a period of historic tailwinds. Deteriorating macroeconomic conditions and slowing rate rises will weigh on organic growth and, with analyst estimates still optimistic, there will be scope for investors to be unpleasantly surprised.