Macroeconomic angst has become the pervasive spirit of the times, with entrenched inflationary pressure and mounting fears of recession omnipresent in the general media.

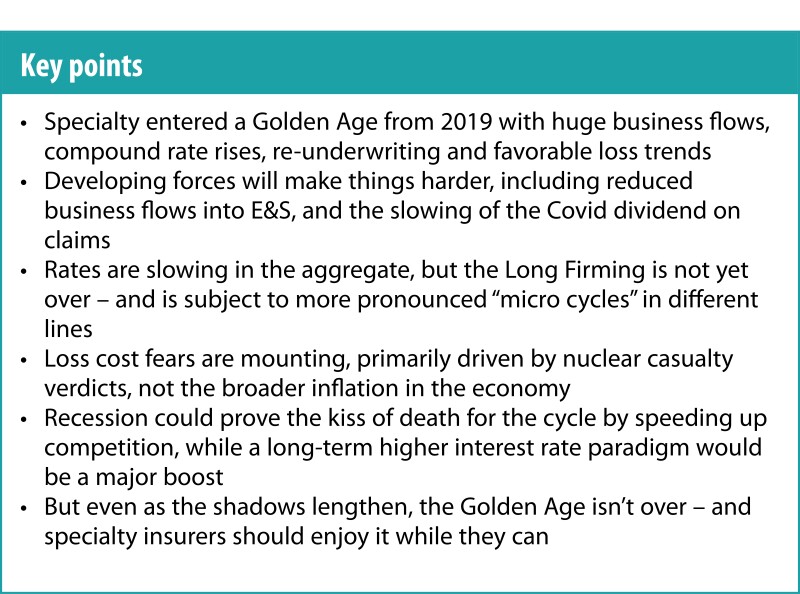

And the commercial P&C pricing cycle, which turned positive with a vengeance in early 2019, has looked poised to meaningfully deteriorate for a number of quarters after peaking in Q3 2020.

But when it comes to the E&S, and the broader US specialty market, it’s too early to call time on what has been an incredibly favorable period. We are just moving into a middle or – perhaps – a later inning.

The specialty Golden Age is not over yet.

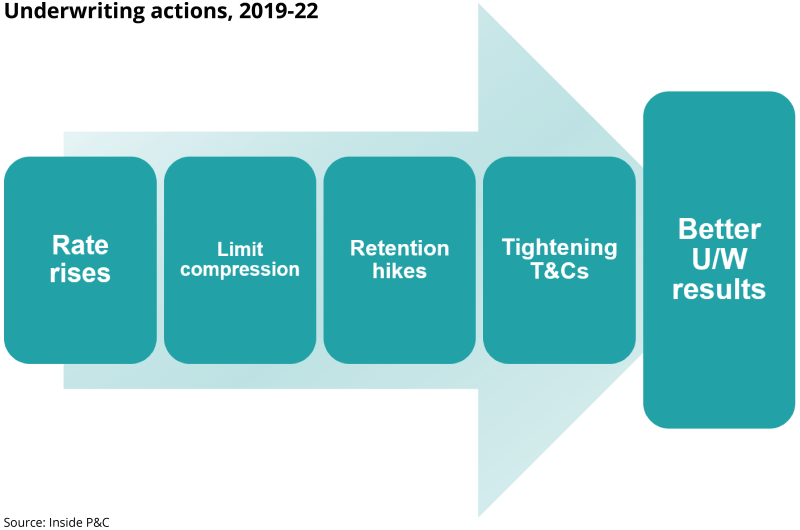

That period has been characterized by surging growth driven by standard lines business passing into E&S, and ~50% compound rate rises across E&S and admitted specialty. Positive underwriting results meanwhile have been supported not only by rate increases, but by the below-the-radar improvement in portfolio quality resulting from a) limit compression, b) retention hikes and c) tightening T&Cs.

All of that has been juiced by a two-year-plus claims dividend resulting from Covid (for those without event cancellation books), with actual claims down 10%-20% vs expected in casualty books. (“Definitely real money got put in the bank,” one senior source said of the 2020 and 2021 underwriting years.)

Specialty insurers have improved balance sheet strength even as they improved calendar-year profitability, with the E&S market posting a combined 89% combined ratio, and specialty insurers with more admitted-weighted books like AFG (86%) and RLI (87%) also posting very healthy numbers that accelerated into Q1.

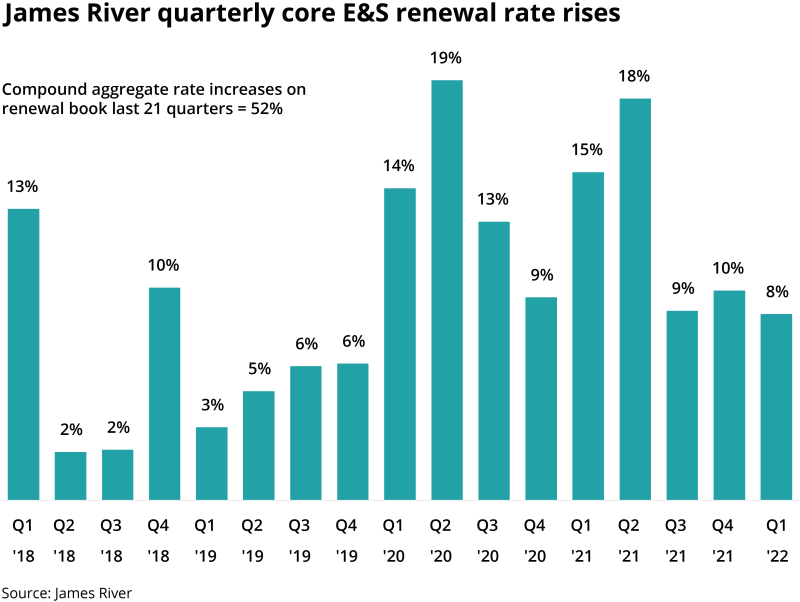

For a long time, almost every indicator – except property cat – flashed green.

The building negative sentiment reflects developing factors that could make life harder on the liability side of the balance sheet over the next couple of years.

New business flows into E&S are weakening. Rate rises in the aggregate are slowing – although it remains a gentle drift down, and one with an ever higher number of micro cycles, including areas where momentum is building.

The loss breaks from Covid are also falling away. The adverse impact of economic inflation to date in commercial lines has been overstated, but it is impacting lines like property where physical inputs and labor costs matter. And, crucially, it is now starting to bleed into medical costs.

Cat-exposed property is a problem, with a run of horrible results, and the significant upward inflection of reinsurance pricing at July 1 – along with big retention increases – is squeezing returns and pushing volatility upstream to insurers.

Moreover, fear of loss-cost inflation driven by exuberant juries that disregard contracts, policy language, and proportionality – exploited by hedge fund-backed litigation financing – are frightening the industry even as it prices for mid-to-high single-digit loss inflation in casualty books.

A recession could finally give the kiss of death to the Long Firming by driving up competition for business as insurers face stagnating growth.

Public investors are very forward looking, and so have been looking hard for signs of fading momentum as macroeconomic challenges like real inflation and slowing GDP growth that are hurting other sectors impact insurers.

But for carriers, micro factors are more important in determining performance, and reported results will in any case significantly lag mounting challenges.

Moreover, if we do pass into a longer-term new paradigm on interest rates (which is still uncertain given the lack of political stomach for real economic pain), there is plenty of scope for all carriers to end up ahead given their higher gearing to bond yields than underwriting results.

All told, it’s still a great time to be a specialty insurer. But the shadows are lengthening on the Golden Age...

The end of the Long Firming?

The market is transitioning out of the Long Firming, but commentators have been made to look foolish calling a sharp drop off in rate rises for multiple quarters now.

And sources again suggest that this is unlikely to be shown in Q2 results, with a little more slowing likely in the aggregate. Specialty writers are uniformly ahead of budgeted rate for the year-to-date, and some are still in double-digit territory in Q2 across their books.

Despite the aggregate slowing, multiple sources stressed that micro cycles are becoming even more pronounced, as rates reflect dynamics within individual markets.

“The market is all over the place on rates,” one senior wholesale broker said.

Financial and professional lines – across D&O, E&O and FI – have shown the biggest deterioration in market conditions, particularly on excess layers. Rate reductions are achievable in excess D&O – sometimes substantial reductions, even as rises on primaries continue. Rate rises in non-medical professional liability are also fairly anemic, and some suggested rate reductions can be achieved for some clients here as well.

Cyber remains very hard – even if it is slowing up – and transactional liability after 30%+ rises last year is moderating amidst low deal volumes.

One wholesale broker said staff at his firm are having to work harder than ever to scrape together enough property capacity for clients

Excess casualty pricing has also slowed substantially, although single-digit increases are still being achieved in E&S and large account business. Construction momentum has eased too, although volumes are strong.

Particularly in financial and professional lines – but also to an extent in excess casualty – there are fears that an unholy alliance of start-up MGAs, proliferating fronting companies and reinsurers intent on getting access to primary risk are chasing down the market.

Other parts of the market, however, are becoming more challenging for brokers. One underwriting source suggested that their book was achieving 12%-13% increases on E&S property, with another pointing to an acceleration from mid-to-high teens through the quarter.

The most stressed pockets of the E&S cat property market are achieving 30% rate rises, with one wholesale broker suggesting that staff at his firm are having to work harder than ever to scrape together enough capacity for clients.

Excess hospitals business is also harder than it was six months ago, reflecting a loss environment that includes sexual molestation claims. The micro climate of New York construction too has become even harder than before, while marine and aviation have been given a rating boost by Ukraine-driven pain, sources said.

Slowing business flows

Growth in submission flows has slowed materially, with sources estimating 8-15% year-on-year increases in recent months, versus 20%+ and at times 30%+ over the last couple of years. This reflects the slowdown of the tidal flow into E&S, as admitted markets call time on multi-year remediation work and seek to return to growth.

In certain areas – D&O being the prime example – business has started to flow out of the wholesale channel as retailers find capacity pressures easing.

However, after three years of booming growth that has broadly doubled the E&S share of the US P&C market to ~20%, WSIA figures are understood to show premium growth in excess of 30% in April and May.

Specialty underwriting sources acknowledge that the Long Firming is transitioning out, and are concerned that rate and loss-cost trends will potentially cross-over later in the year, with scope for a soft market outside stressed areas next year.

“The market is now in flux on rates – we are in a transitioning market,” one senior underwriting source said.

Nevertheless, the pace of change is hard to call. Book value hits of 15-20% through Q1 could also tamp down competition, although the impact will be highly differentiated by company depending on business mix and how tight they were running capital.

Property rates also look set to follow a different trajectory, with all signs pointing to an acceleration of hardening for cat-exposed property.

After a period when primary pricing moved reinsurance pricing on a lag, the market is at last set for some old-fashioned reinsurance-driven hardening.

Multiple specialty insurers said that they had seen 20%+ rate rises on their cat XoL treaties, doubling of retentions and either unavailability of quota share – or access only with 21%-24% cedes that do not even cover costs.

As such, sources said that they have been left with more volatility and higher costs that will require ~12% rate rises just to keep pace, as they also struggle with inflation and understated values. As more treaties renew and this challenge is universalized, it could cause a pick-up in cat de-risking, which has been more modest to date than with reinsurers.

Loss cost inflation fears

With some estimating loss-cost inflation in property at a little over 10%, and concerns around incredibly painful demand surge if there is a major cat event, property is the part of the commercial lines market experiencing the most pronounced adverse claims trends.

Casualty lines have been less heavily impacted to date, with lots of the major drivers of real inflation not inputs to loss costs. However, there are signs that some important factors that would drive casualty trend higher are now moving, with medical care services inflation up 0.7 points month-over-month to 4.8% in the June CPI numbers.

The bigger concern remains the nuclear verdicts that have started to emerge from the courts again, with multiple underwriting sources suggesting they were seeing severity on similar cases materially higher than in 2019.

Property is the part of the commercial lines market experiencing the most pronounced adverse claims trends

Private messaging from some executives at specialty underwriting firms matches public rhetoric from first quarter calls that shock casualty losses are again emerging as a result of the combined effects of an aggressive plaintiff bar, heavy litigation financing, accommodating judges and juries mistrustful of corporate America.

One senior source said that it was the US casualty market that kept them awake at night, and that they expected one of a number of different scenarios to drive major loss emergence over the next couple of years.

Another said they were confident when they looked at trends in the rear-view mirror, but said that if loss-cost inflation lands at 8% for a settled period, then they will not have secured enough rate by the time the claims come due in five to seven years.

Multiple sources represented the $1bn settlement from the collapsed Surfside condo in Florida, as evidence that claims will emerge that are totally untethered from prior expectations.

Macroeconomic issues

The market is closely monitoring the impact of macroeconomic trends as the Fed seeks to quell inflation by aggressively raising rates.

A recession in Q4 or in early 2023 is perceived as a possible cycle killer.

A recession would put downward pressure on economic activity, squeezing growth. This would likely accelerate a trend that is already evident of insurers working increasingly hard to defend their existing books.

“New business is tough to get in a recession,” one underwriting source acknowledged.

However, the deflationary impact of a recession would potentially be helpful for loss-cost trends across a diversified book of business, with the Global Financial Crisis preceding a long period of benign inflation.

In some pockets, loss cost inflation could however be stoked by a recession, with areas to watch including D&O (where claims frequency has accelerated already over the last quarter), trade credit, EPLI, and potentially workers comp.

Some market watchers believe that with the unprecedented economic conditions resulting from the pandemic, vast monetary stimulus and the dismantling of global supply chains that there is scope for an atypical recession that may impact P&C differently than prior economic contractions.

After a long period of ultra-low interest rates, insurers – which operate like leveraged bond funds – finally have access to attractive new money yields. Ten-year Treasury bonds have moved out from 1.7% in March to 2.9%, and were above 3% for a number of weeks in June.

Typical specialty insurers have durations of four to five years, meaning that this positive effect bleeds in over a multi-year period, with the offset of losing the benefit of significant equity returns during the long bull market. Insurers are still in wait-and-see mode, with scope for the Fed’s shock therapy to move rapidly into reverse if a recession is triggered and inflation brought under control.

Enjoy the good times...

The Golden Age isn’t over yet, and certainly there are specialty underwriting executives that can’t quite believe the streak of luck they have had, particularly given that it has come against a global backdrop of pandemic, political crisis, historic inflation and geopolitical instability.

But all good things come to an end in insurance. Good news ultimately begets bad news.

Specialty insurers should be in a period of peak earnings in 2022 and 2023, and well run businesses should have rebuilt some balance sheet strength for the soft market to come. But growth will come off its current pace, and a key question will become the extent to which the standard lines market repatriates business.

Much of the business moved no doubt as a result of cyclical factors, but there is a widespread feeling some business such as wind-exposed habitational risk, wildfire-exposed high-net-worth property and residential construction may have made a structural move to E&S.

Just how much is cyclical and how much is structural will be a key question over the next couple of years. But for now, specialty insurers should just try to enjoy the good times.