In the 1960s, Teledyne Corporation, helmed by the legendary conglomerate builder, Henry Earl Singleton, was looking for undervalued assets.

Argo (then Argonaut) was one such name acquired by Teledyne in 1969.

After riding this empire-building wave, Teledyne ended up with an unwieldy group of assets, and Argonaut was divested and spun off in 1986.

Over the course of its existence, Argo suffered in industry cycles in medical malpractice and workers' compensation.

The company continued to muddle along before the arrival of Mark Watson. A hard pivot towards specialty insurance ensued, with multiple acquisitions of books of businesses or assets, and things quietened for a time.

But as these acquisitions grew, the company started to stumble in different classes, unsure of which part of the industry it should lean into. This led to missed opportunities on the E&S side, as well as reinsurance, as the company tried to perform a balancing act.

We have covered some of these topics extensively in the past, so we’ll skip over the Watson era leading up to the Kevin Rehnberg era.

In our investor day recap from last year, we noted that expectations laid out at that time for an 8%-10% ROE for 2022 were unachievable. In fact, Argo itself has hit this milestone only three times in two decades.

We also posited that reserve noise was likely not behind the company at that time.

As expected, in its Q4 2021 results the company took a clean-up charge, and back then we argued the time had come for a fresh set of eyes with someone new at the helm as owner. Since that note, much has happened.

First, Rehnberg, Argo’s prior CEO, took a medical leave, eventually leading to Tom Bradley, Argo’s chairman, stepping in as interim, then permanent, CEO. The company also disclosed that it was evaluating strategic options in April, with Goldman Sachs advising.

But that was then, and it’s going to be September soon. Typically, when companies announce that they are examining strategic options, they are already somewhere down the path.

These announcements sometimes disseminate this news far and wide to drum up additional interest from potential buyers who might be on the fence. But this waiting period has lasted unnervingly long.

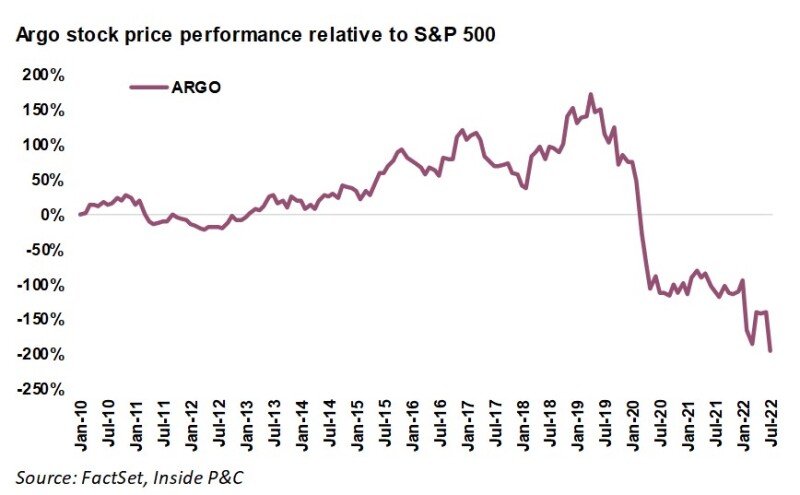

Along with its second-quarter earnings last week, the company gave three updates that were negatively received in the marketplace, leading to the stock selling off by 35% in three days!

The first was the boilerplate language on its conference call about it evaluating opportunities: “We continue to explore a wide range of potential options to maximize shareholder value and take advantage of opportunities in the market.”

However, with this evaluation coming already five months into this process, a combination of company, industry and macro factors are likely limiting any potential interest in this company leading to a complete sale.

The second development was the company announcing a loss portfolio transfer (LPT) with Enstar, which will ship most of the casualty reserves. In some cases, an LPT goes hand in hand with a potential transaction, but the timing, in our view, might also suggest an absence of potential buyers.

The third was an announcement that Dan Plants of Voce Capital was joining the Argo board.

Voce has been involved with the company since its initial outreach in early 2019, leading to a change in management team members over the years.

This change coming three years after the initial foray suggests that Argo is no closer to the finish line in terms of potential suitors.

Taking a step back, Argo faces a narrow path forward, whether going it alone or doing a transaction with a partner.

On a go-it-alone basis, it needs to earn back the trust it lost after yet another adjustment. To do this, it would need to deliver several quarters – if not years – with no noise in its numbers.

On the other end, the stock route makes any potential suitor replay the Teledyne strategy of cigar-butt investing.

However, the backdrop of loss-cost inflation, plateauing pricing and unclear macro direction complicate both options. Perhaps at the current multiple, eking out several decent quarters might be the better strategy.

Below is our take on the sale process and the reserves, as well as an updated take-out analysis.

Firstly, market conditions are changing, and potential buyers might wait for the dust to settle.

The recent earnings season has been a mixed bag for the commercial lines insurers.

Pricing has remained more robust than anticipated on the primary side and even more so on the E&S side.

That said, the tone on loss-cost inflation has changed, as was signaled by Chubb’s CEO on the insurer’s earnings call.

Moreover, the macro environment remains uncertain, with talk of a recession waxing and waning by the week, resulting in actions being delayed, deferred, or shelved altogether.

In fact, recently, AIG disclosed that it had held off on IPO’ing its life insurance business until at least September due to an uncertain market environment.

The other problem that is relevant for any insurance consolidation is asymmetric information for a potential buyer.

Yes, the loss portfolio transfer addresses a meaningful amount of reserve risk.

However, the current market environment has already led many franchises to lean into the pricing and specialty market hardening. So as a potential buyer, why would you try to expand at the point of market inflection? Any acquisition at this stage could be a high-risk bet if capital markets and loss-cost inflation trends go sideways.

The other question is, why pick Argo over others?

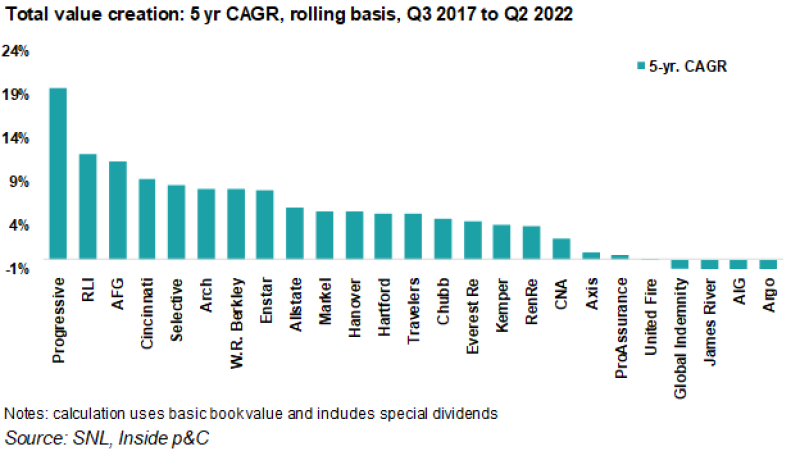

The chart below shows value creation over the past five years. Argo ranks last in this analysis. With the market in flux, one billion plus of dry powder would give you access to other specialty franchisees who might be similarly undervalued, such as ProAssurance, James River, United Fire or Global Indemnity.

Second, the loss portfolio transfer addresses some concerns.

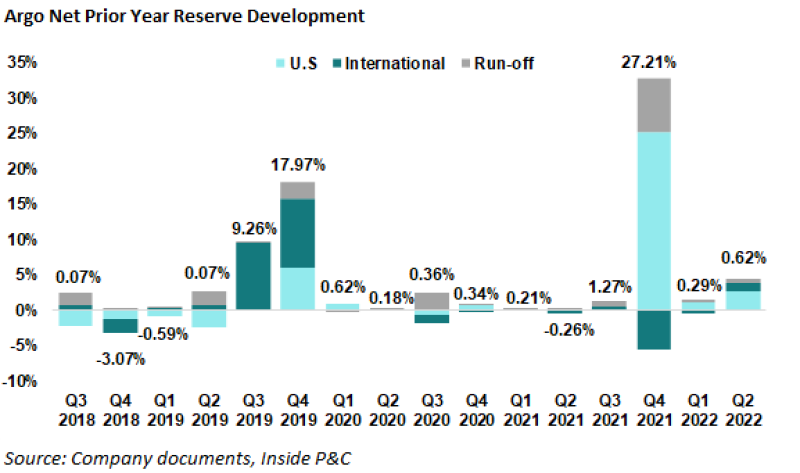

One of the challenges with Argo has been gaining some comfort on the reserves at the company. A pattern seems to repeat every few quarters, with a string of quieter quarters followed by a reserving adjustment. The chart below shows this movement over time.

The trends shown below could deter potential suitors.

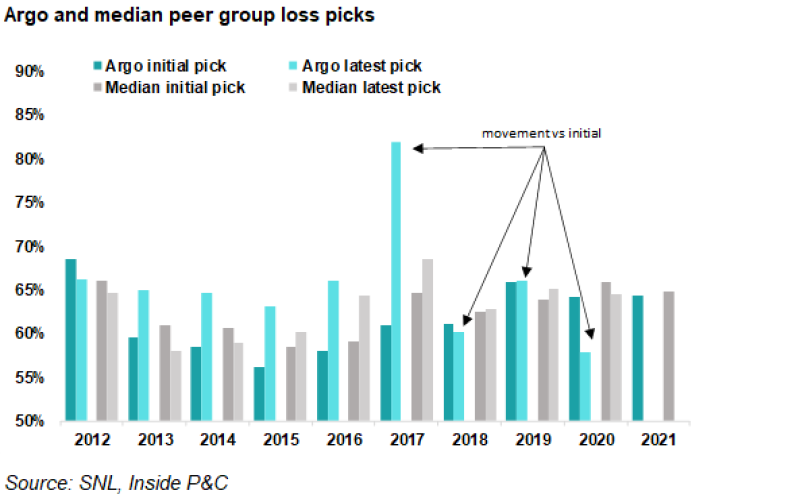

In the chart below, we refreshed our prior analysis, comparing segments that house the commercial exposure with several other commercial-predominant carriers. (For a complete list of caveats associated with any Schedule P analysis, please click here for our prior note.)

Nevertheless, Argo’s results have shown a more significant variation than its peer group. The LPT covering 2011 to 2019 commercial casualty classes initially accounts for $746mn of reserves.

Any potential suitor could end up applying an additional haircut, as shown in our analysis in the next point.

Thirdly, the recent stock move makes any offers tough medicine to swallow.

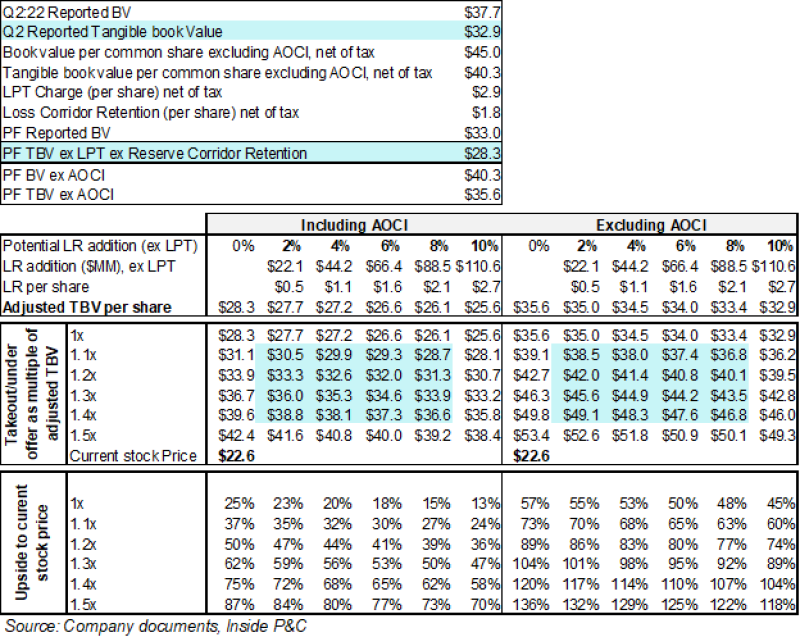

At the start of the year, Argo was trading at $58.11 per share, close to three times its current stock price of $22.62. We revisited our earlier takeout analysis and updated it for the announced and potential adjustments

Our analysis shows a takeout value of low- to mid-30s on an adjusted tangible book value basis. Due to the recent interest rate shift, we also added an analysis that excluded AOCI. Excluding AOCI shows a takeout value in the high-30s to high-40s. This gap between current stock price and computed numbers may prove too wide a bridge for potential suitors to cross.

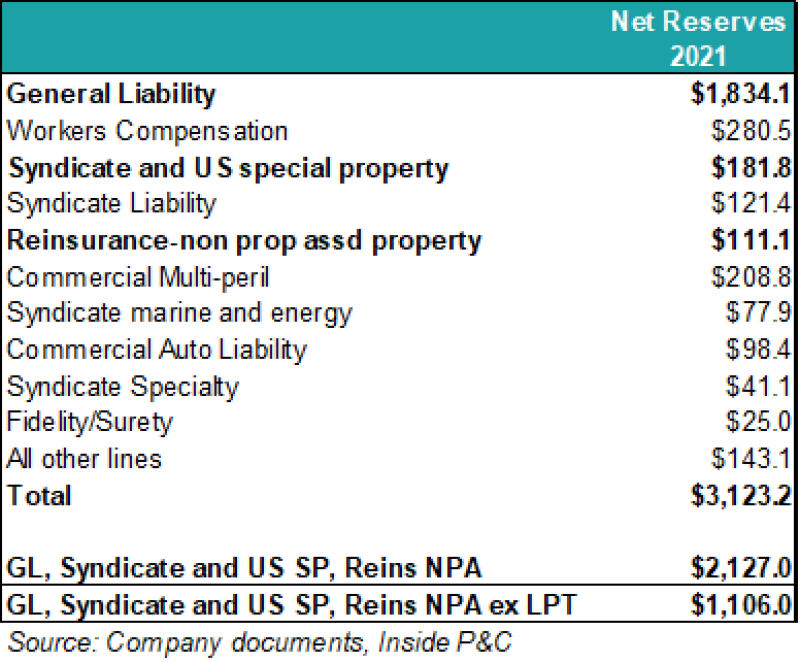

We backed out the LPT reserves from the GL, Syndicate, and US SP and Reins NPA buckets for our reserving adjustments. This gave us a remaining bucket of approximately $1.1bn of reserves, which have seen some noise.

We would again caveat this analysis as high-level and note that any potential buyer would have access to much deeper data.

On the book value side, we have adjusted the numbers downwards for the $100mn charge for Argo’s LPT with Enstar. Argo will take this charge in the third quarter of 2022.

We also adjusted book value for the $75mn loss corridor, which Argo will retain above the LPT.

The loss portfolio deal calls for Enstar to provide a ground-up cover of $746mn and an additional $275mn of cover in excess of $821mn up to a policy limit of $1.1bn. Argo will also retain a loss corridor of $75mn up to the above-mentioned $821 million. The charge reflects the fact that the premiums paid for the cover exceed the $746mn.

In summary, with the newly announced LPT and board changes, Argo is likely digging in for the long haul after getting tired of waiting by the dance floor. This might allow it to continue plugging away on its re-underwriting and expense rationalization. Ceteris paribus, a stronger Argo just might emerge on the other end.