Later today marks the opening of ITC InsurTech Connect which will include three days of meetings, presentations, and technology demonstrations. The Inside P&C Research team will be represented by Amit Kumar, and the news team will be represented by Giovanna Bellotti Azevedo. (Email us if you are at ITC as well.)

As is often the case, it is easy to get lost in verbal pitches and talks and discussions on how tech is going to be the disruptor.

The overarching paradigm when evaluating any company/service or enterprise is: what sort of value does it create in the insurance marketplace?

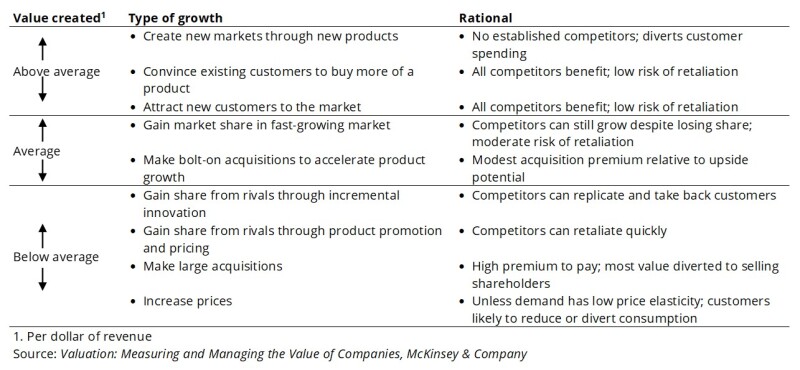

Recall, we highlighted this growth matrix in our recent Hippo investor day note.

We are quite optimistic about the role InsurTech will play in the development of insurance. However not all companies will succeed. Using the table below as a litmus test, one needs to think about the 40,000 ft view before we touch down and ask the franchise the relevant three questions.

The table below essentially asks: what sort of moat exists for what you are developing? Yes, there are many carriers who are not looking to rewrite the book on how insurance is bought and sold.

But the biggest draw at these conferences is companies and services that have a differentiated offering. At this conference we would be curious to hear from companies who fall in the average/above average bucket shown below.

Talk surrounding the $400bn or $150bn marketplace is simply not going to cut it. Taking a step back, insurance is a highly commoditized product. If your product is more of the same, it’s tough to make a case for a meaningful market shift of profitable customers.

Our first question concerns capital. The market performance of the publicly traded InsurTechs, their cash burn, and the present economic and interest rate climate are going to weigh materially on any discussions. Capital is no longer as freely available as it was in prior years, so we expect a realistic evaluation of needs rather than the prior thesis of, “if we build it, they will come!”

The second question is: what problem does this product solve, and where does it fit in? Expect more questions about embedded and partnerships. The lone wolf strategy has been shown to be ineffective based on the anemic performance of the InsurTech 1.0 class.

The stock market performance over 2022 and the shift in interest rates are also continuing to impact how we think about funding in this space. The years between 2014 and 2021 were a time of easy money with low interest rates.

But with the near-doubling of rates and the Fed continuing to signal its pursuit of inflation, the cost of capital will continue to rise. Consequently, we anticipate discussions to focus more on returns on investment and what other options exist.

We have also seen an uptick in discussions surrounding investments from incumbents and we anticipate it to be a theme at ITC as well.

Finally, we expect realistic discussions surrounding the long-term profitability of these products.

The past two years have taught the cohort an important lesson: if there is an expectation for the path to lead to a public listing, the markets are less forgiving in this new normal where we seem to be fighting back a recession on a daily basis.

We discuss these points below.

Firstly, what is the capital situation, and what do the companies’ capital needs look like?

This year is a learning exercise for InsurTech. With the changes in interest rates and the broader shift away from growth, less good money is being thrown after bad money.

We expect purse strings to be tighter than in prior years. We also expect a bigger cohort of seasoned investors making careful decisions, versus money being freely disbursed to anyone with a catchy idea. Consequently, this year, we expect a disciplined tone when discussing and predicting capital needs.

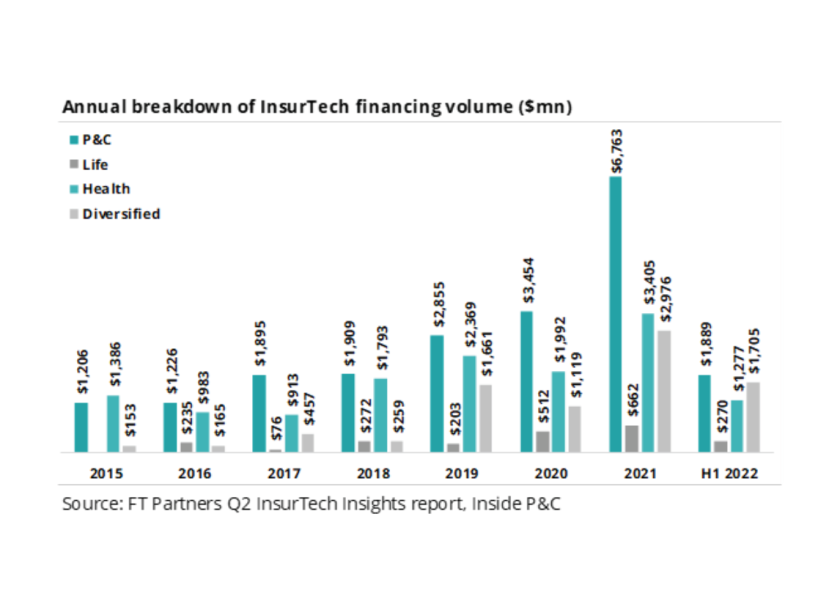

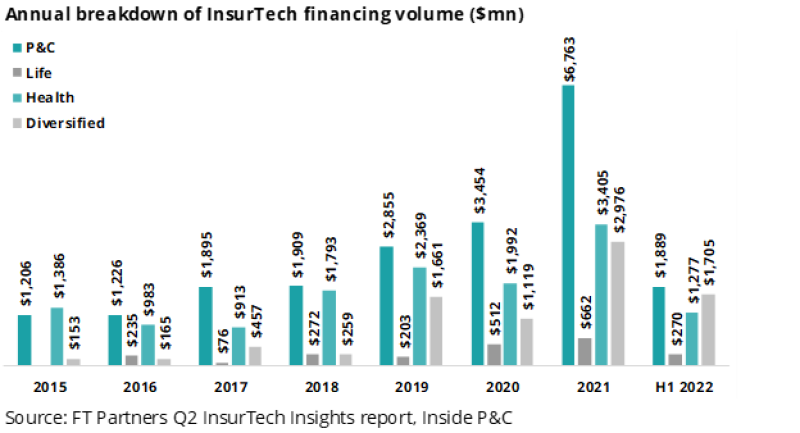

The table below shows that the InsurTech property/casualty continues to be an attractive opportunity and has continued its march, even during Covid-impacted 2021. However, with the bust-up in the SPAC space and pressure from equity markets, investments have slowed for the first half of 2022.

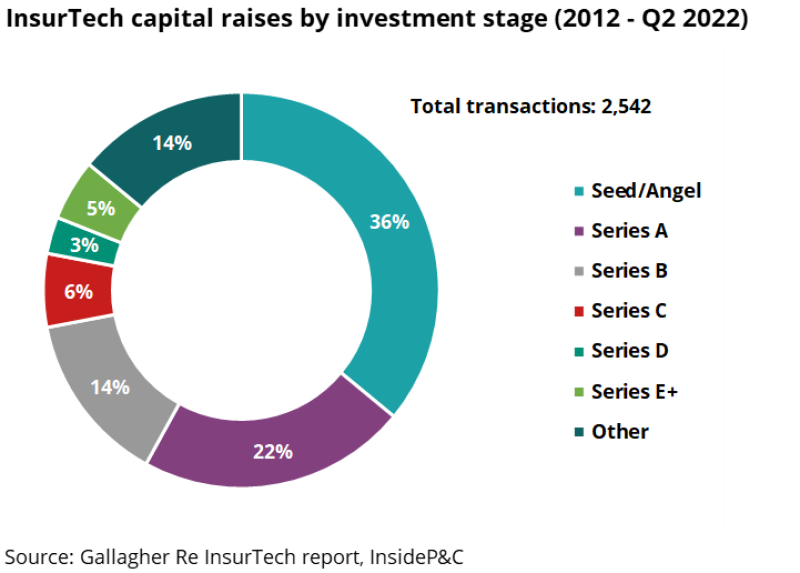

The following chart shows capital raised by investment stage. With the changes in interest rate there could be less desire to seed untested ideas and seek companies further down the innovation cycle. That would result in the pie chart for seed/angel shrinking relative to other pieces.

InsurTechs also have to convince reinsurer partners, since reinsurance in itself is another form of capital relief. Yes, reinsurers want to build long-term relationships so that when these players get bigger, reinsurers get to share in the upside.

However, recent results have only left the reinsurers holding the bag and revaluating support for these companies. The reinsurance hard market will also result in reinsurers re-evaluating these relationships. Expensive reinsurance may result in InsurTechs rethinking their growth strategies as well.

Secondly, are they considering embedding or partnering vs. attempting to be disruptors?

Not so long ago, many InsurTechs were founded on the premise of disruption. We were told that the personal lines industry, which is $400bn in premiums, was ripe for change. Out of this $400bn, the personal auto business (which is $275bn in premiums) was the first target with its low barrier to entry.

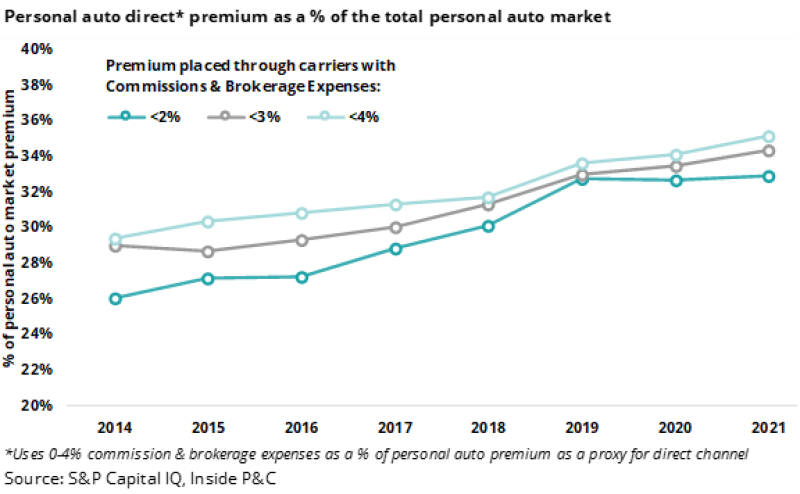

The chart below shows that direct business generates close to a third of the total personal auto business. Going direct has a lower barrier to entry vs. setting up a captive or independent agent network to distribute your product.

Several InsurTechs were able to enter although what remained unclear was true long-term product differentiation. Consequently, most of them ended up scrounging up business from the non-standard auto space. Many of these companies are struggling to stay afloat or have merged with others.

In our “The great embedded insurance pivot: David vs. Goliath, round 2” note, we mentioned how the actual total addressable market was materially smaller than generally stated.

However, there were three reasons why a pivot to embedded made sense. These included (1) lower initial expense outlay, (2) leapfrogging existing distribution channels, and (3) deeper penetration in the marketplace.

Our view was that the pivot to an embedded model was the right move vs. continuing to stand up to the Goliaths of the industry. There has been a greater willingness to partner with traditional and non-traditional companies. Some examples are the Root and Carvana relationship or the recently announced State Farm and ADT tie-in.

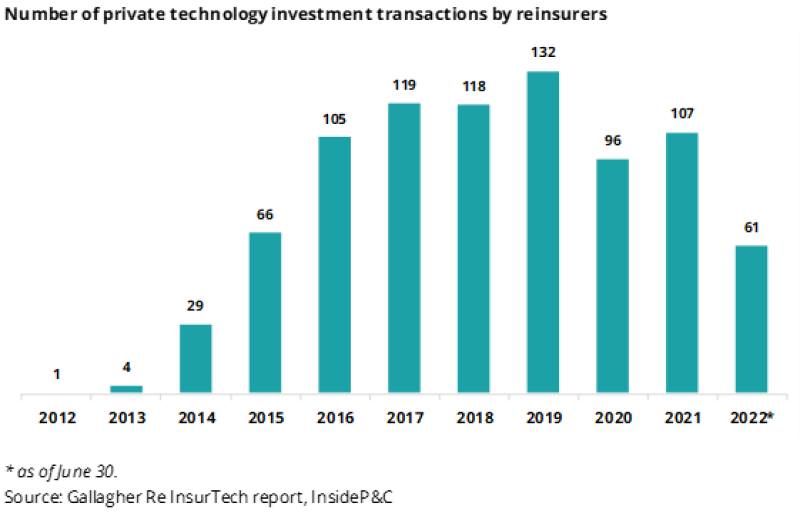

Apart from the primary insurance relationships, even reinsurers are stepping up their investments in this space. The chart below shows private technology investments by reinsurers over time. This is reminiscent of when brokers and primary casualty insurers played a meaningful role in creating the Bermuda reinsurers in the 1990s as well as after Hurricane KRW in 2005.

Thirdly, what is the profitability endgame?

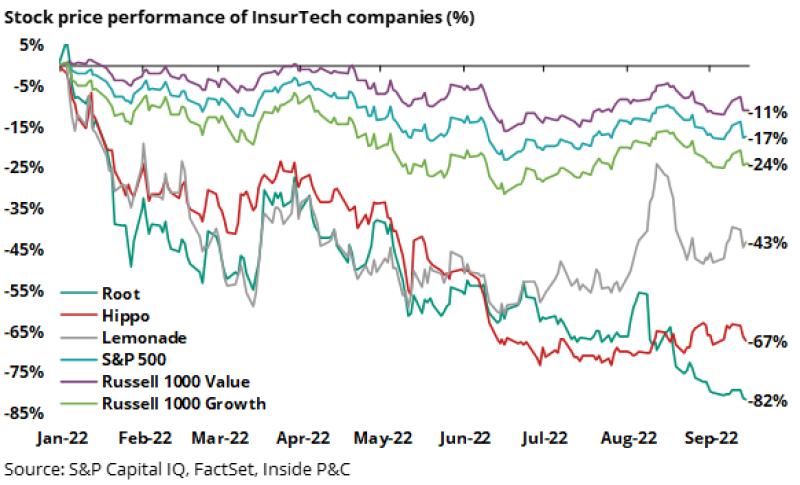

The chart below shows year-to-date performance for some of the public InsurTechs. We have also added the performance for Russell 1000 Value and Growth indices. These indices help us understand how the investors are positioning themselves based on the current macro climate.

Note the pivot away from growth for much of 2022 with the Growth index change of -24%, worse than the S&P 500 of -17% and Value being the best performer at -11%.

For much of the initial class of InsurTechs, the focus was on growth mimicking other fintech players. But the differentiator less discussed was the cost of goods sold (COGS). As we have mentioned several times in the past, insurance is one example of a product where COGS is not known. It could be anywhere from months to decades before we fully know.

Consequently, assumptions on loss-cost and social inflation are paramount when evaluating pricing. As InsurTechs learn hard lessons, investors are demanding a clear line of sight to profitability.

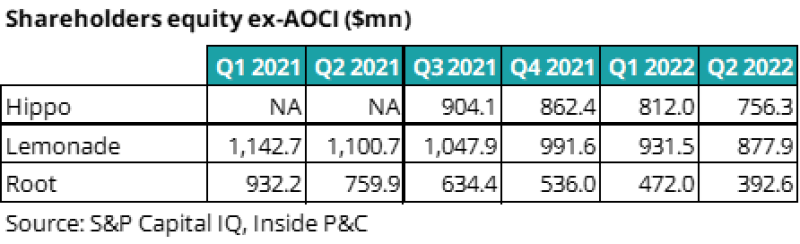

The table below shows shareholders’ equity (ex-AOCI) for three publicly traded InsurTechs and the decline in their capital base that has led to shifts in strategy.

Our point here is not about their individual performance but rather that, as their capital base erodes, tough decisions will need to be taken concerning revising or abandoning prior strategies, needing to raise additional capital, or reducing workforce. All these decisions might avert a crisis in the short term but sometimes are akin to kicking the can down the road.

Consequently, we anticipate discussions will focus on the long-term profitability of the product rather than a shift in market share. Applying a healthy dose of skepticism to these timelines also makes sense to us.

In summary, we anticipate that discussions will broadly take a high-level view on the real value paradigm of the product and then delve deeper into capital, possible partnerships, and return on investment prospects.