“It was the best of times, it was the worst of times…” Charles Dickens, A Tale of Two Cities.

We would be exceeding our remit if we attempted to summarize one of the great classics. Instead, we will simply point out the clear divergence continuing to emerge between two companies with a lot in common.

But first, a detour to discuss the formation of these companies. Progressive started as a mutual company focused on non-standard auto insurance in the 1930s and has stayed close to auto lines of business through its various iterations and cycles.

On the other side of the personal auto market, Allstate was formed around the same time as a unit of Sears (yes, that Sears!) selling auto insurance through the famous Sears catalog and retail stores. Unlike Progressive, Allstate has made multiple detours in its evolution, including selling life insurance and later divesting those operations as well as making several non-auto acquisitions.

In this earnings cycle, an interesting dichotomy continues to play out which has deeper ramifications regarding how franchises should be built and operated over time. On one side of the equation, we have Progressive, which, on its conference call yesterday, talked about its desire to accelerate growth, which it is able to do because of its earlier response to changing market conditions that others are still trying to get a handle on.

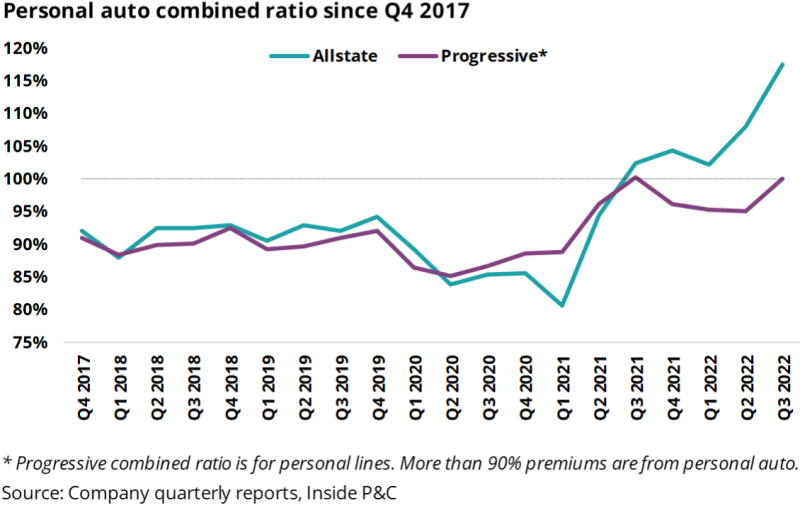

On the other side, Allstate took successive quarterly reserve adjustments on adverse loss trends (we’ll hear more about this today on the earnings conference call). This divergence can be seen in the quarterly results below, with the gap meaningfully expanding over the past few quarters.

In our Axis note we had talked about how various companies in this industry choose whether to stick to their knitting or diversify and end up learning harsh lessons during the process. When looking at insurance acquisitions, it’s fair to say it’s tough to make them work. In most cases they end up being a case of 2+2 = 3 and not 5.

So, would Allstate be in a better place if it had stuck to its core lines? Our note below will list out the various acquisitions which the company has made including several non-auto ones. We will also discuss the value creation later in the note giving readers a perspective on how these acquisitions have performed.

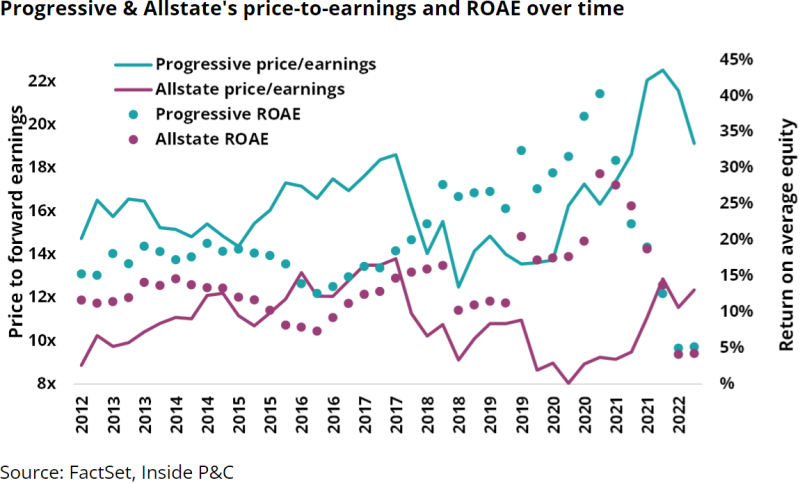

The chart below looks at stock price to earnings vs return on equity performance, showing the continued divergence from Progressive in return on equity and price to earnings multiples over time. With Allstate’s third quarter results and its announced exit from commercial auto due to reserving noise, it remains to be seen if and when this gap narrows.

Beyond the list of acquisitions comes the 800-lb gorilla in the room: the advent of telematics. It would be unfair to compare a direct writer to an agency writer. That said, Progressive did see the writing on the wall, starting out as a carrier where a variation of telematics was already being used along with selling the policy online in the early 2000s!

Allstate’s distribution shifts are a topic for another day but have played a role in where the company is today compared to its competitors.

Apart from distribution, telematics, and loss cost trends, the other trend playing out unequally is what is happening on a state level. Our note looks at wage inflation and car part costs, which are adding to the pressure (depending on the market share by state) for various companies. In other words, if you are stuck in a high-cost auto parts, high-wage inflation state where the regulator is not open to rate changes, it’s a slower process in being able to address the loss cost inflation issue.

The note below looks at these three points in greater detail:

Firstly, a divergent path toward acquisitions has impacted value creation

The need to grow business is a constant in any C-suite. While some insurance executives may indulge this endless desire, others may resist the urge given their acute awareness that their industry has a unique product with an unknown, and deferred, cost of goods sold. Not all growth is equal, and in fact, some growth can be an insurance company’s undoing.

One type of growth is organic growth, which comes from quality underwriting and leads to high retentions and, most likely, increasing rate (usually to keep pace with the macro environment). This seems to be a hallmark of successful carriers.

Another way to accomplish growth is by acquisition. The ability to identify entities which will add value to a company and slap a reasonable price-tag on the acquisition can be a high-wire act.

The following timeline highlights major acquisitions made by Allstate and Progressive’s senior leadership for the past 10 years. Also included are relevant news items that have occurred along the way. Note the distinct difference in the number of items on the two lists, illustrating the companies’ different approaches.

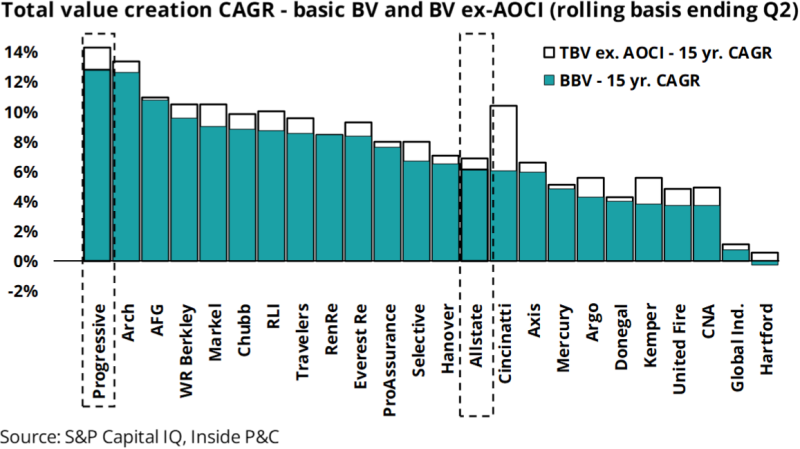

It’s clear that Allstate dips into the acquisition well far more than Progressive. And given the disparity in book values for the two companies, maybe these acquisitions haven’t really added to value creation for the franchise compared to initial expectations. As one can see, Progressive is the industry leader while Allstate is lagging behind considerably.

Secondly, a different approach to telematics has impacted responsiveness to market shifts

The insurer that can fully unlock the potential of telematics may very well hold the key to solving one of the industry’s most pressing concerns: distracted driving. Beyond this elusive goal, telematics also provides a foothold for carriers to increase engagement, modify driver behavior, offer upsells/cross-sales, and deliver better claims experience for their customers.

Allstate offers both a pay-per-mile auto product called Milewise and a pay-how-you-drive product called Drivewise. Milewise requires a plug-in device whereas Drivewise works through a mobile app and is available to both policyholders and non-customers.

Progressive offers Snapshot which, like, Drivewise, tracks driving behavior (but not miles driven). These telematics products all aim to better account for an individual’s risk profile in the pool of insured drivers.

Since its introduction in the early 2010s, the Snapshot product (dongle at that time) allowed the company a better insight into driving habits and risk selection and an ability to appropriately price the product. Since Progressive was more focused on direct distribution, eliminating channel conflict allowed it to distribute this effectively.

For carriers who were dependent on multiple channels of distribution including captive or independent agents, having their agents explain and push telematics was going to be a bigger uphill battle. (When was the last time your auto agent offered a dongle to plug in?)

Those decisions continue to play out as Progressive fine-tunes its Snapshot product and its ability to react to changing market conditions. Meanwhile, Allstate offered its first telematics programs back in 2012, and as of June of this year, Allstate had over 2.5 million telematics policies out of 26 million total auto policies.

In other words, Progressive was much further along the telematics curve and data analysis compared to the competitors.

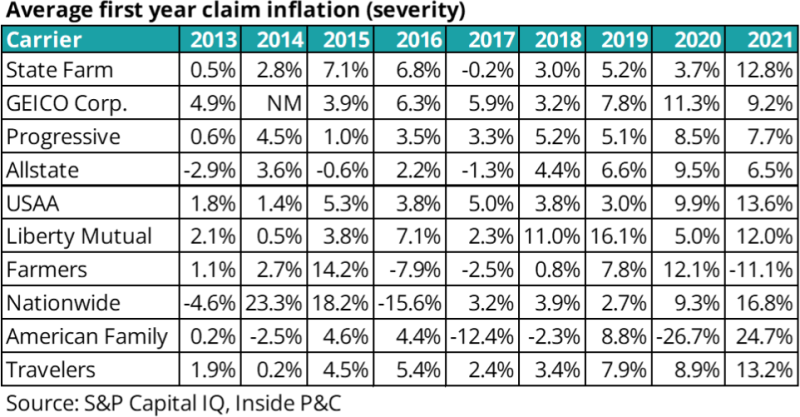

Another way to assess the efficacy of telematics is to look at how claims inflation has trended over time using schedule P data. The chart below shows again that Progressive, even with its higher premium growth, has seen less runaway claims inflation than most of its peer group. This is most likely a function of Progressive’s telematics, which indicates issues earlier than competitors, and enables the company to pursue rate action before the rest of the cohort.

Thirdly, state distribution and slower rate activity has added to the pain

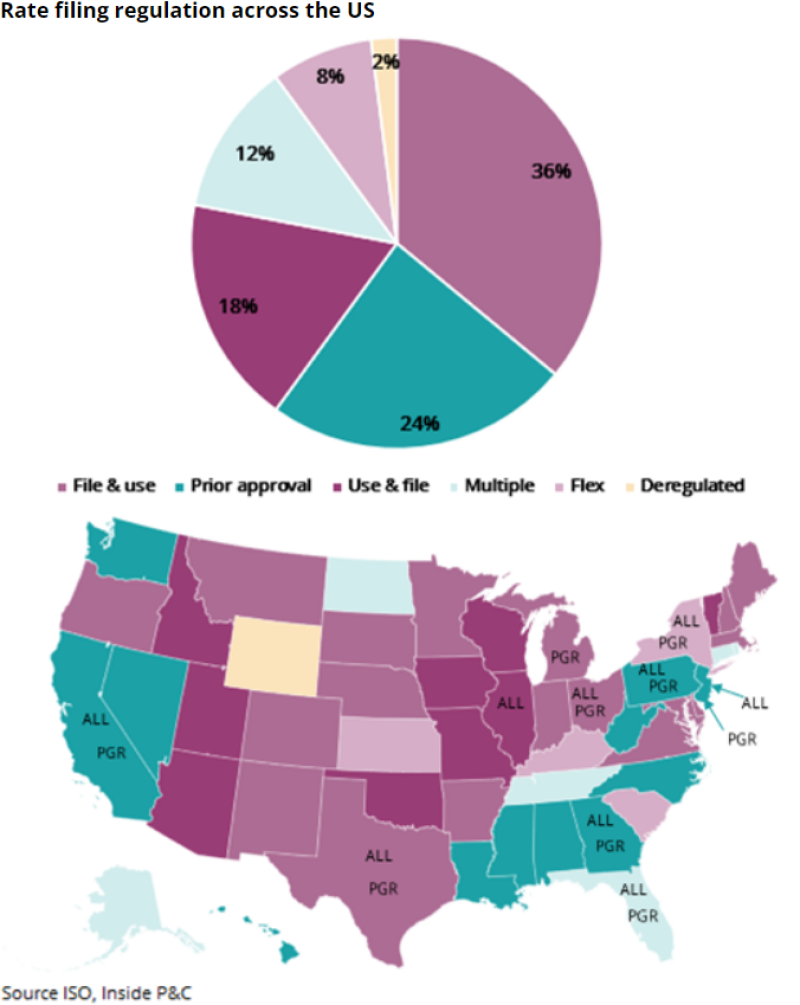

Any analysis of auto insurers’ rates requires state-level consideration. A carrier’s actuaries may produce compelling exhibits demonstrating a certain rate indication, but they are at the mercy of each state’s department of insurance to obtain the needed rate.

The charts below show the regulatory breakdown of the US by state. Both Allstate and Progressive’s top 10 states (as per year-end 2021), which represent 62% and 56%, respectively, of the companies’ total direct premium written, are indicated on the map below. The pie-chart shows the regulatory distribution.

The prior approval states generally represent the most difficult places to take rate. Compared to Allstate, Progressive’s premium distribution is a bit lighter in California. In other words, it important to get the pricing right early on otherwise a bigger course correction may be slowed by regulators who might have a different agenda.

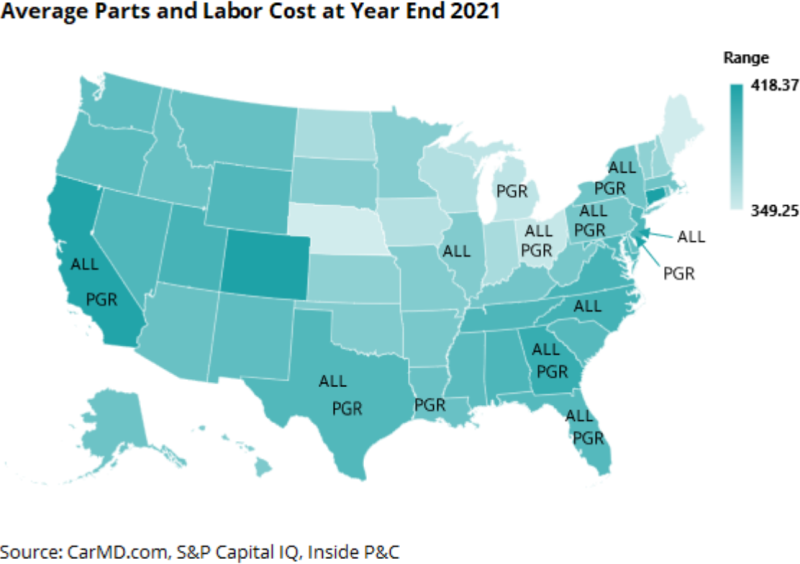

In our prior notes we have discussed the CPI data, which shows a correlation between wage inflation, auto repair costs and state distribution. For this note we looked at average cost of parts and labor, by state, using carmd.com data. We also plotted the top 10 states for Progressive and Allstate.

The map below shows the average cost of parts and labor by state at the end of 2021 with the darker shading meaning a higher cost. Both carriers’ names are labeled on their top 10 states by premium. We were surprised to find a degree of overlap between the two carriers.

It might not be a stretch to surmise that the quality of book issue is also playing a role in divergent underwriting trends shown earlier in the note.

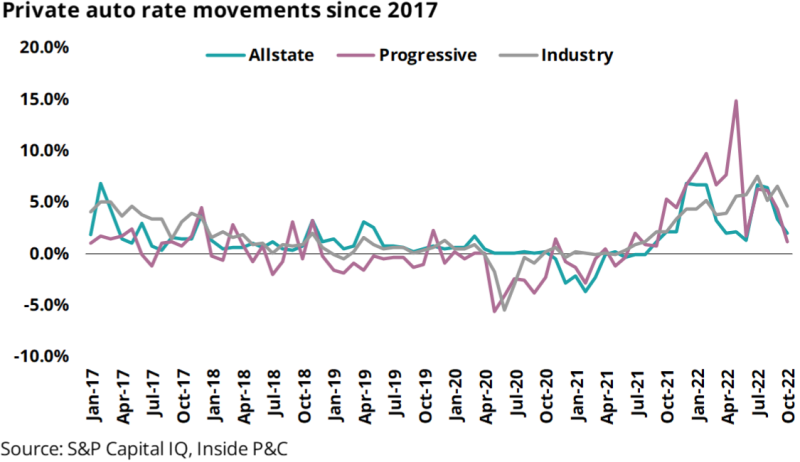

With repair parts, wage-inflation and supply chain issues impacting the industry, it also makes sense to revisit the rate filing trajectory. The chart below shows that coming out of the pandemic, Progressive reacted quickly.

With much of the market still striving to get a handle on the loss cost inflation, this will present another opportunity for Progressive to press the accelerator on growth and pick out market share from other carriers.

In summary, companies such as Progressive, with a differentiated telematics offering, were earlier in reacting to the changing inflationary trends while many other leading franchises such as Allstate are still playing catchup. This will further benefit Progressive as it gets to pick, choose, and grow at the expense of carriers pursuing a course-correction.