One of the pertinent topics over the past years has been the reluctance of the California DOI to allow for rate increases in personal auto. After the initial impact of Covid leading to huge decreases in miles driven, regulators in California asked auto insurers to issue refunds and then halted rate increases altogether.

However, auto insurers in California are finally seeing much-needed rate approvals. Unfortunately, loss cost inflation has ravaged auto insurers during this 32-month moratorium on rate increases.

The following table shows the five insurance groups that have received approvals in California in the past two months – the first since May 2020. Note the double-digit gap between rate need (indicated) and approved rate.

As shown above, we are including the date of the last approved rate increase for each company to highlight the pent-up need for rate.

The meager 6.9% rate increases sit starkly against nationwide auto loss costs that have gone up approximately 20% and nationwide used car pricing that has risen approximately 45% since the last rate increases were approved. This discrepancy will encourage auto insurers to push for more rate.

The Inside P&C Research team has extensively covered the spike in auto loss costs, most recently in our 2023 outlook.

The fourth quarter has also proved to be another interesting one for personal auto, with preannouncements from carriers including Kemper, Horace Mann, Allstate and Travelers, which all flagged the profitability challenges in the space.

The exception to this trend so far is Progressive, which has continued its solitary march in profitable territory.

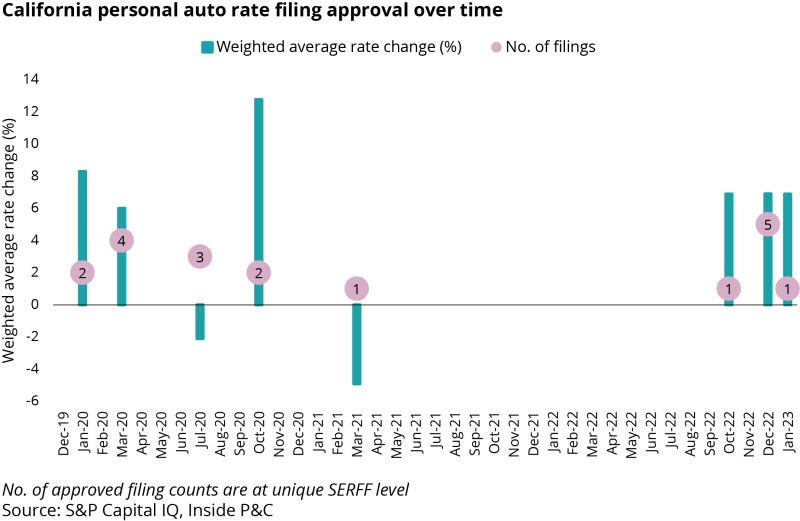

In looking at the weighted rate change taken in the last three years, the lengthy gap in rate-increase approvals sets auto insurers back significantly, especially when considering the time needed for rates to earn into a book of business.

The following chart shows the weighted average rate change taken in California along with the number of filings, by month, since December 2019.

In summary, the actuarial evidence is in the favor of California auto insurers, and regulators will need to yield to unprecedented spikes in auto loss costs.

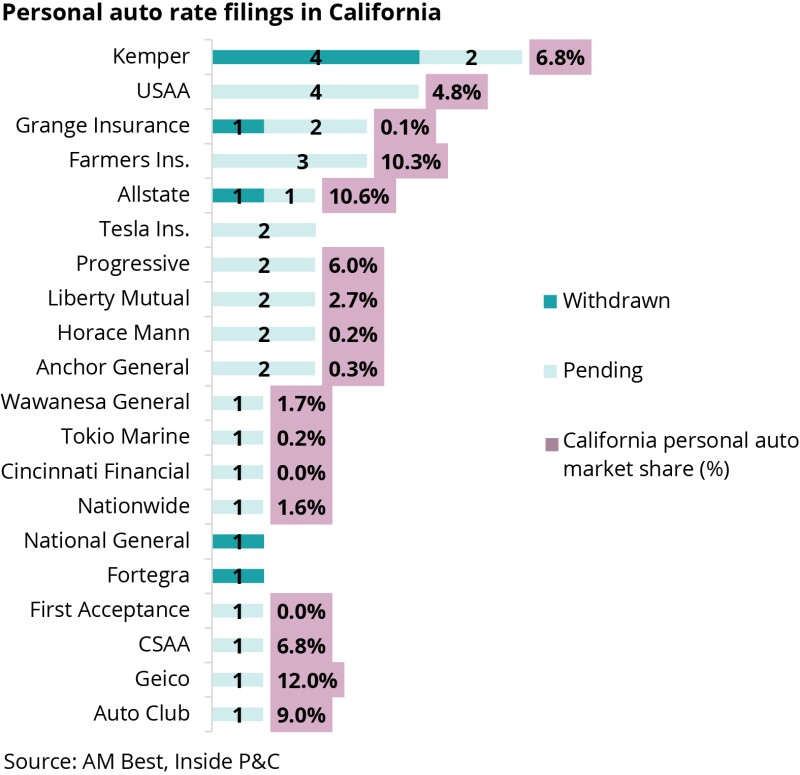

So far only a few insurers have seen rate approval, but there are dozens more waiting in the wings.