Can he keep up physically and mentally with the shifting trends? Does he know if he can pull this off? Is the writing on the wall?

Sometimes, it’s easy to see trends. Sometimes, it’s not. Take the direction of the commercial insurance marketplace. In our outlook published earlier this year, we continued to highlight our discomfort with the narrative that everything was playing out as anticipated with pricing vs loss cost trends.

Although some of the earlier insurance company reporters and brokers were seeking to maintain that narrative, Chubb’s CEO again called it as it is. Yes, yesterday was an active day in the stock market, with the Fed decision and discussion. Even then, if the stock market is a proxy for market color, commercial-predominant insurers reacted adversely to the renewed discussion on pricing adequacy.

Firstly, the loss cost trend is still unclear. We maintain a cautious view on the industry, stemming from our worry that there has been no real precedent for a Covid-like event and the resultant social inflation.

On the conference call, Evan Greenberg maintained his balanced view on this trajectory for his firm. While he stressed that the firm’s Q4 North America business pricing increase of 6.5% was in line with loss costs, he emphasized the particularly challenging environment in casualty.

“Given casualty loss cost trends, rates in most classes need to rise at an accelerated pace,” Greenberg said.

“There is little to no room for forgiveness, and here a special mention to excess casualty and auto-related liability is warranted.”

Secondly, commercial rate and premium growth have been in positive territory for some time although there are signs of plateauing or a downward trend for the group. In our outlook piece we highlighted that if macroeconomic growth slows, exposure contraction could follow, impacting the top line.

The Fed in its discussion yesterday, apart from the quarter point raise, noted that it expected additional increases. If the economy remains overheated, the Fed could get more aggressive which could impact the growth over 2023.

Thirdly, value creators will ride out this cycle better than the rest of the group, as they have in the past. One of the fundamental differentiators for value creators is their ability to take the long view on market conditions. In most cases, the top value creators are synonymous with better-run franchises, which correspondingly also shows up their stock multiples.

As this earnings cycle progresses, some differences are beginning to emerge with regard to optimism in the marketplace. We continue to watch for differences in value creation over 2023-24 as we believe that social inflation has the potential to surprise.

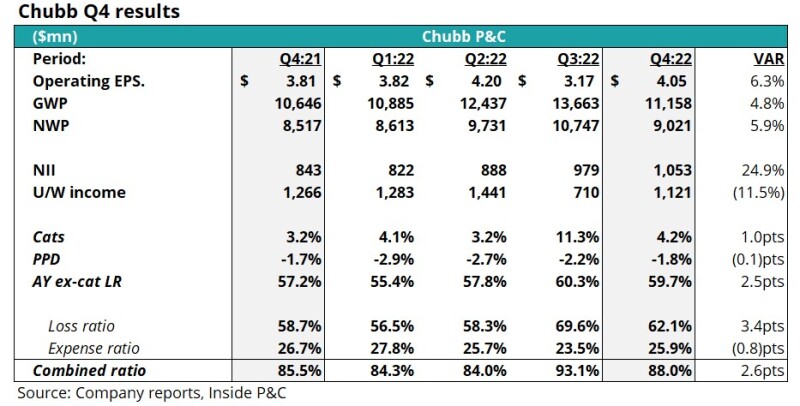

In terms of quarterly earnings, Chubb delivered another set of strong results, with EPS rising 6% year over year from $3.18 to $4.05, falling short of the street estimate of $4.22. Premiums were up, though underwriting income sank by 11.5%. Expenses improved, while the loss ratio worsened both overall and on an underlying basis.

First, the direction of loss cost trends is unclear, but they remain stable for now.

With the Fed announcement yesterday, and after successive months of news on inflation and economic worry, loss costs are top of mind for any carrier earnings conference call. With Chubb however, we know we will get a relatively clear answer.

Chubb is nothing if not consistent, so it was a bit of a (pleasant) surprise this quarter to see the disclosure break from the standard three-line listing of rate/loss cost information. This time Greenberg broke out a detailed view of pricing for the company, as a whole, followed by a drill-down into the lines of business.

The chart below shows the historical three-line information, with the new breakout given this quarter limited to the North America commercial (NAC) commentary.

Chubb loss cost trends since Q2 2021

Greenberg assured listeners the company is on top of loss cost trends, but indicated he is seeing a “lack of recognition of the loss cost environment” in the wider market.

The main takeaway here is that the peer group should not declare victory on the margin expansion thesis as the direction of loss trends still remains uncertain.

Second, pricing remains stable, but is it enough to stay on top of rising loss costs?

Loss costs as a standalone trend are interesting, but pricing trends are necessary context to understand the impact they will have.

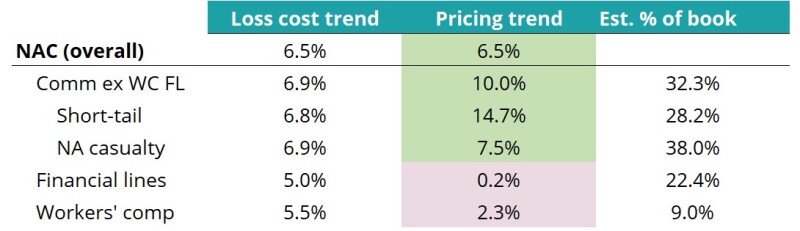

The chart below shows the loss costs discussed above, along with the pricing increases and the estimated portion of the P&C book to which it will apply.

Chubb NA commercial loss cost trends vs pricing trends

On the call, Greenberg commented that the company was still seeing a favorable rate environment in most lines, and this chart supports that, looking at the overall number.

The areas of concern would be financial lines and workers’ comp, which are not accelerating as quickly as loss costs.

Greenberg drew attention to these, specifically indicating his belief that the industry should be vigilant on the evolving direction lest they misprice the business. The chart shows the relative portion of Chubb’s book affected by these trends, coming in at just under one-third. The other two-thirds have pricing ahead of loss costs and should benefit from the difference over time.

Another metric to examine for context is premium growth. The chart below shows the premium of Chubb against other commercial-predominant carriers who have reported so far, along with the producer price index for product and other non-auto liability insurance.

Commercial-predominant NWP growth vs producer price index change (YoY)

These changes include all factors that affect premium, not just the pricing, but still serve as a proxy to give us a sense of how the companies are changing relative to the cost as indicated by the PPI.

We can see the delayed reaction as the cost escalates and NPW growth is relatively flat, followed by the Covid spike in rate as the growth in cost slows.

For now, pricing is generally keeping up with loss costs, but as we showed in our outlook, any slowing of growth in the economy could impact the top line. Additionally, if loss cost trends worsen and rate change does not keep up the industry will have to potentially navigate margin compression

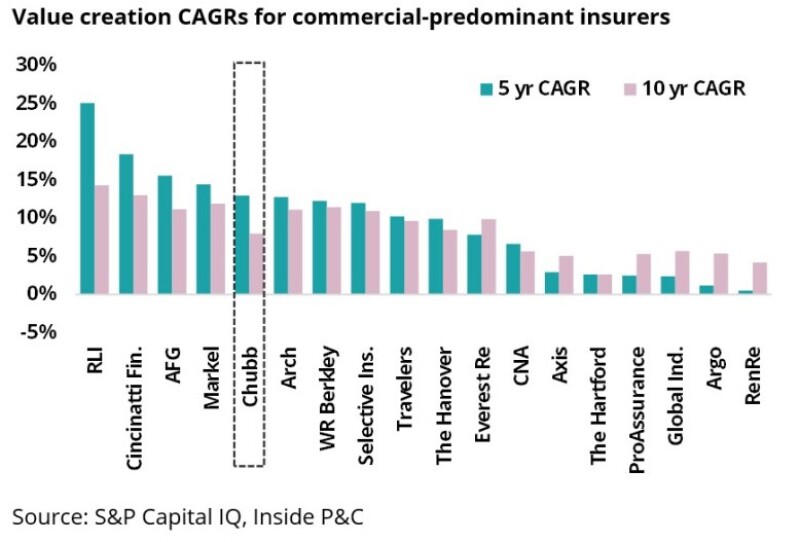

Third, Chubb’s disciplined stance on rates and loss costs make it a leader in value creation.

One performance indicator we often revisit is value creation. This metric looks at the evolution of the carriers’ book value (plus special and common dividend), over time, and helps us stratify the cohort to see whose strategies are really delivering – usually those taking a longer-term view of market conditions.

The chart below shows Chubb’s value creation CAGR over the past five years and the past 10 years. Beyond the true E&S peers, Chubb ranks at the top of the commercial cohort.

Chubb’s longer-term view of the marketplace, and balanced stance on rate and loss cost, has enabled the company to remain the top quartile of value creators.

Taking a step back, companies who took an optimistic view of loss cost trends could see earnings pressure by year-end and into 2024, and we would not be surprised to see this list change when this analysis is repeated a year from today.

In summary, Chubb’s more cautious view on loss cost vs rate trends has helped it to be a leader in value creation. With the economy uncertain, any change in factors contributing to exposure could affect carriers’ top lines, so keeping an eye on whether rates are accelerating in step with loss costs will be key to weathering difficult times such as these.