In our Q2 2022 note on Lemonade & Root, we drew a parallel to the HBO show, Westworld. Seven months later, Westworld has been canceled and, despite the market’s best efforts, Lemonade and Root have not.

Perhaps the new HBO show, The Last of Us, is a better comparison to the state of these InsurTech carriers, as the main characters from both the show and the companies battle to overcome their grim surroundings. No spoilers here since we have restrained ourselves from googling the end of the video game the show is based on.

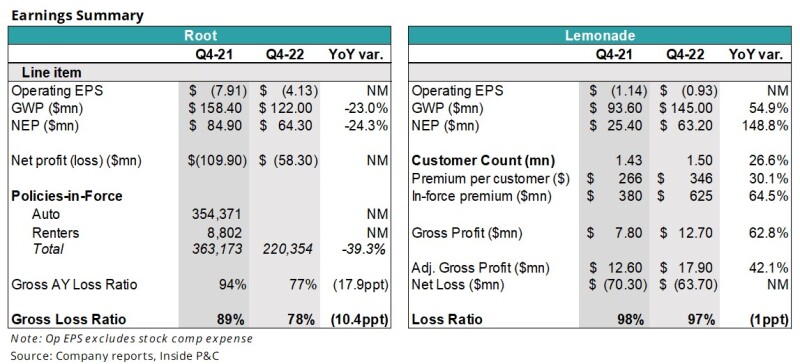

Clocking in at under 27 minutes, the Root earnings call was a no-frills recital of a strong quarter. The tone was subdued, but the results showed that it outperformed expectations (for now).

Lemonade’s call proceeded in a more normal fashion, and it also shared positive results. The following are the earnings summaries for Root and Lemonade.

We see a pronounced slowdown in Root’s business as it trims unprofitable policies and tamps down expenses. We also see that the reporting of Root’s renters’ policies has ceased, and that its loss ratio has improved materially (-10.4 points), year over year.

Another item worth mentioning is the embedded partnerships that Root depends on. According to Root, it grew its embedded new writings more than 8x. However, given that Carvana is a key partner, and Carvana’s net income has dropped from an already negative $135mn to a jaw-dropping negative $1.587bn, year over year, the long-term viability of this partnership is called into question.

However, Root is pursuing other embedded partnerships. It announced an agreement with a “national digital financial services company” (un-named for now), and executives said a third deal is expected soon. Given the difficult position it is already in, all of Root’s plans need to execute in somewhat flawless fashion as its cash position thins.

For Lemonade, while the company’s earnings show growth, during its call, management emphasised slowing down new business, non-renewing undesirable risks and engaging in cost-reduction from automation efforts.

Lemonade did issue its 2023 and Q1 2023 guidance which, when viewed against its fourth-quarter results, might appear conservative. We would caution against premature optimism. Our outlook remains cautious.

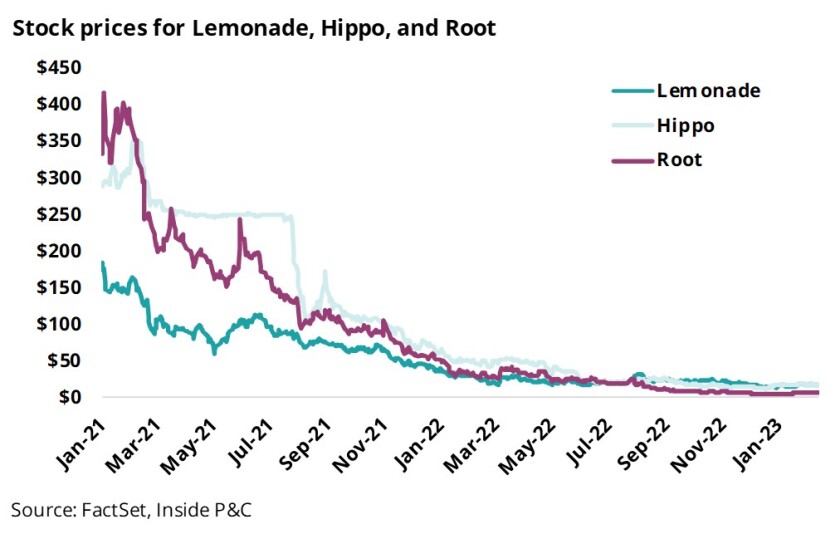

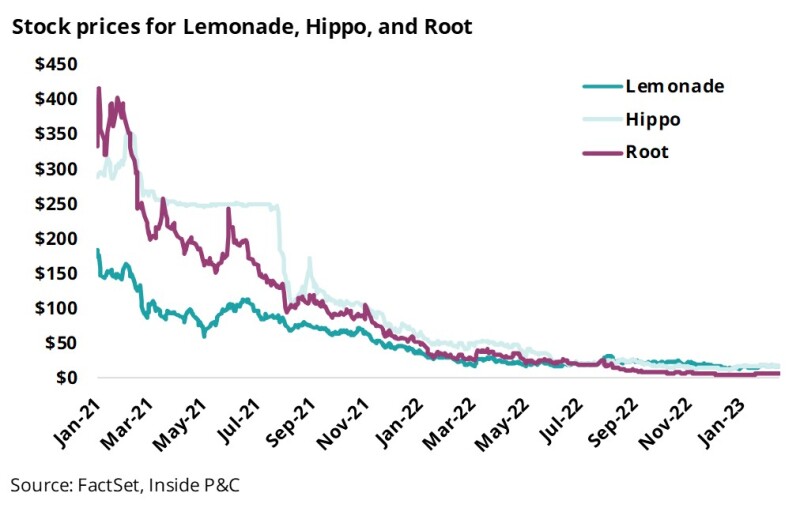

It’s been a rough couple years for stockholders of both of these companies. Adding Hippo to the list, we see that these three companies are currently worth pennies on their IPO dollar.

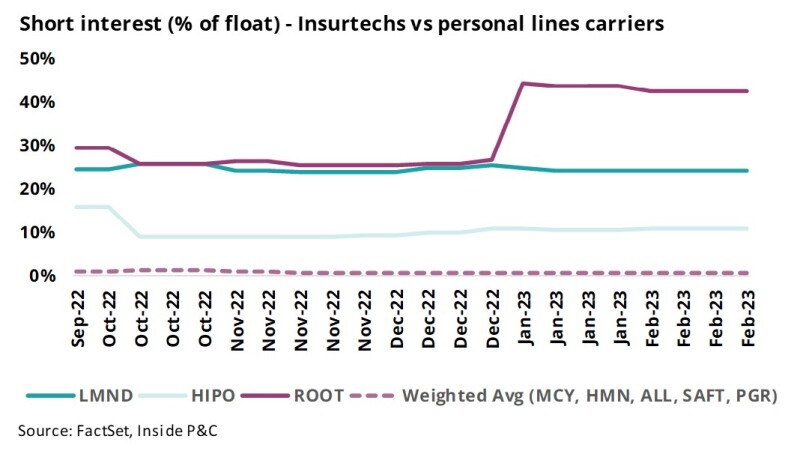

Moreover, these companies stand out in another undesirable way; they are highly shorted companies – an indicator that many market participants are betting on their failure.

We looked at the short interest (as a percentage of float) of the InsurTech insurers against incumbent personal lines carriers. While most established personal lines insurers have meager short interest (most in the 1%-3% range), Lemonade, Hippo and Root are multiples higher, and have been in this position for some time.

These charts warn of a dire situation for the InsurTechs, and it’s all about attempting to walk back from the abyss. We are not convinced that this quarter is the beginning of new trend lines. The note below examines the state of the InsurTechs in the wake of Lemonade’s and Root’s earnings.

Firstly, loss ratios are being reined in, but one quarter does not make a trend.

The so-called InsurTechs are centered around growth. However, unlike growth stories in pure tech companies, not all insurance growth is good.

Cost of goods sold is not known at the time of sale, and therefore aggressive growth may initially look great, but as loss costs outpace premiums, growth comes back to haunt these ambitious insurers.

Root’s and Lemonade’s managements, on the surface, may have turned the corner this past quarter, but the proof of this would have to unfold over several quarters of no noise. No “but for”, no adjustments, just pure, clean improvement in underlying loss ratios.

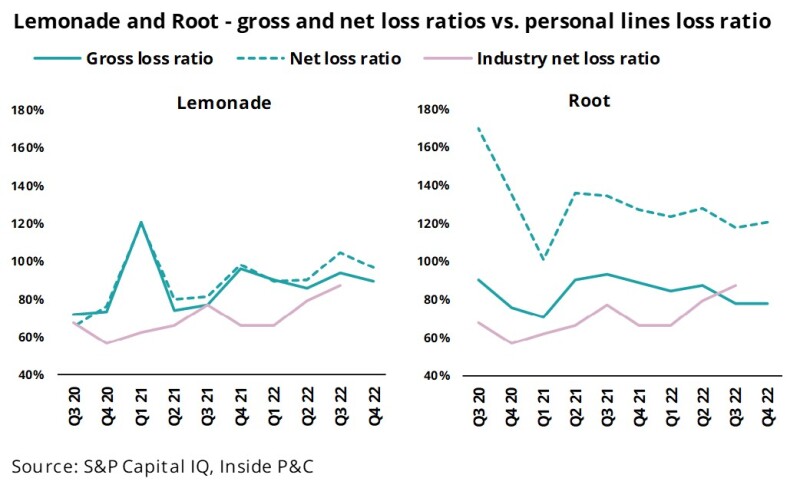

The graphs below show gross and net loss ratios for Lemonade and Root with the overall personal lines loss ratio also shown as a basis for comparison (industry data through 3Q 2022).

Both Root and Lemonade cede much of their premium to reinsurers and, because of the smaller premium, their net loss ratios can climb much higher than their gross loss ratios and, in many cases, can be meaningless to look at.

In a previous note, we spoke of the difficulty these companies might have in reinsuring their books, but as discussed on earnings calls for both Root and Lemonade, reinsurance treaty renewals did not pose existential problems. What gives, reinsurers? This does tie in with our overall skepticism that reinsurers can walk the walk after talking the talk.

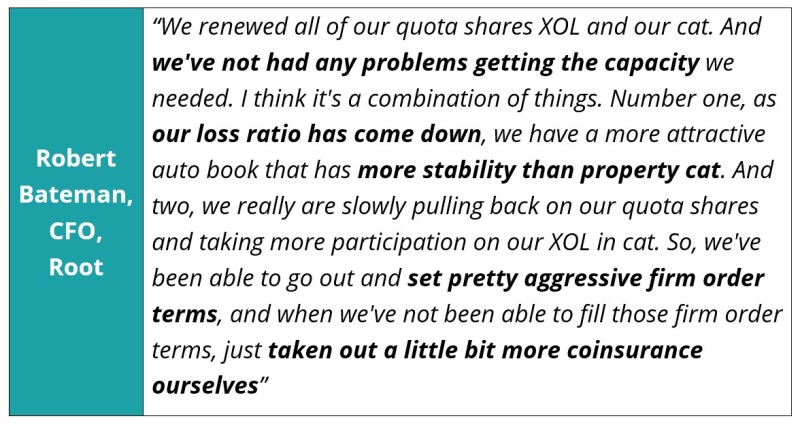

On Root’s call, the CFO spoke of the company’s success in placing its program and highlighted the company’s more attractive position as an auto insurer. However, he did mention the utilization of co-insurance when some firm order terms weren’t met.

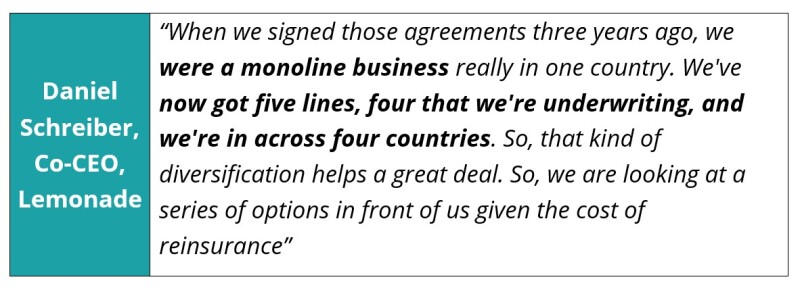

For Lemonade, due to its three-year quota share agreement, its program was not under the January 1 deadline but rather will come up for renewal at the end of June. However, Daniel Schreiber, Lemonade’s co-founder and co-CEO, made mention of the company’s increased diversification.

In our outlook published on January 4, we had noted our cautious stance for the mid-year renewals. Perhaps the InsurTechs are continuing to bank on cheap reinsurance capacity.

We know the InsurTechs rely on reinsurance above and beyond the normal P&C insurer. Reasonable treaties, from the perspective of both insurer and reinsurer, are critical to the operations of the InsurTech carriers.

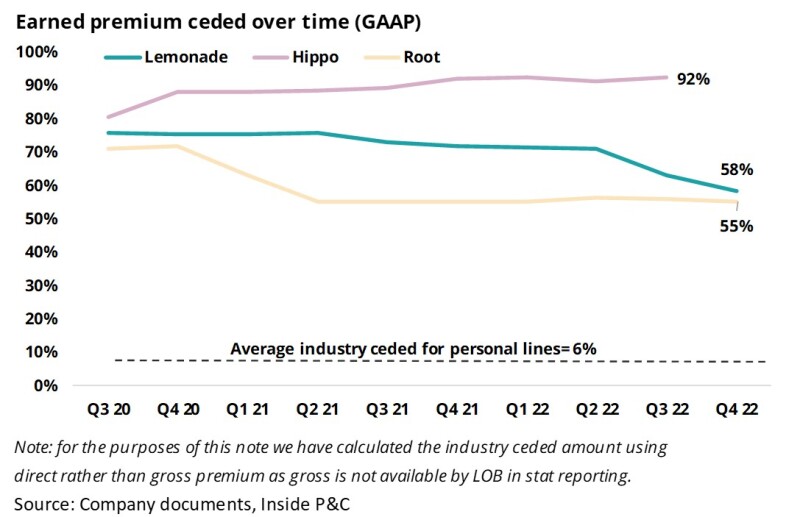

The graph below shows Lemonade’s, Hippo’s and Root’s ceded earned premium from Q3 2020 through Q4 2022 (Hippo goes through the third quarter of 2022 since it has not yet reported fourth quarter results).

We see the beginnings of a descent in ceded earned premium, thought they are far from the average industry ceded premium of 6%.

The InsurTech carriers’ ability to wean themselves off their reinsurance need is highly dependent on these lower loss ratios that they seemed to have achieved this past quarter. The mid-year reinsurance spend and treaty structures will be a good indicator of how the market views the InsurTechs’ ability to achieve consistently low loss ratios.

Secondly, the claim that peak cash burn is behind us should be taken with a pinch of salt,

Both Root and Lemonade have seen their stocks outperform the S&P in 2023 (Root +10.7%; Lemonade +16.3%; S&P500 +3.7%). This could be partly attributed to the idea that growth stocks are back in vogue if investors believe a recession is less likely.

We are permanent pessimists, so we will wait for a few quarters to break out the champagne here.

Root shared that it had utilized $400mn in 2021, $200mn in 2022, and is expecting a similar level of $200mn for 2023. It attributes most of the cash burn to the loss ratio, which rate action and more selective underwriting should help solve.

In addition, we saw a significant reduction in expenses for both companies. This begs the question – is it all about survival here? Is the growth story dead?

Or is it about navigating market cycles long enough to get invited to the prom?

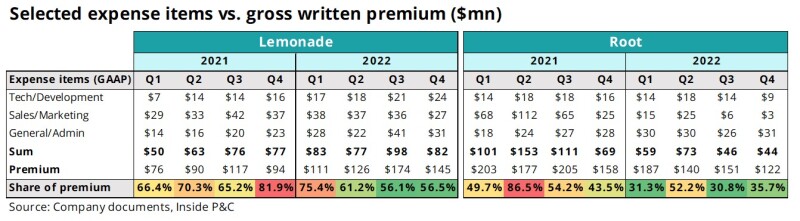

The following table shows a breakdown of expenses, as well the ratio to the gross written premium, by quarter.

We see an overall decrease in expenses in both nominal terms and with respect to written premium. Pay particular attention to Root’s sales/marketing expenses in Q3 and Q4 2022. This expense line item has decreased 87% year over year!

That said, you can only strip down to the bone before there’s nothing left to strip. Lemonade attributed its expense reductions to its focus on automation.

We are not drinking the Kool-aid.

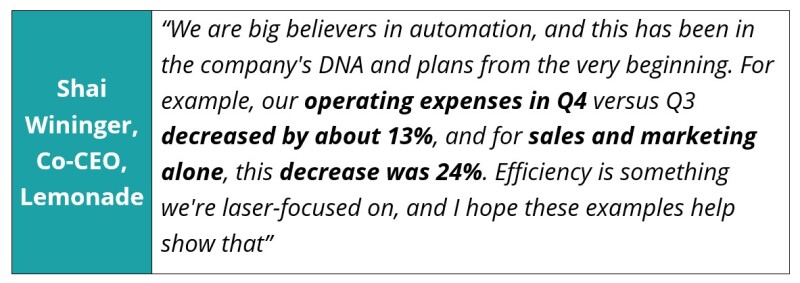

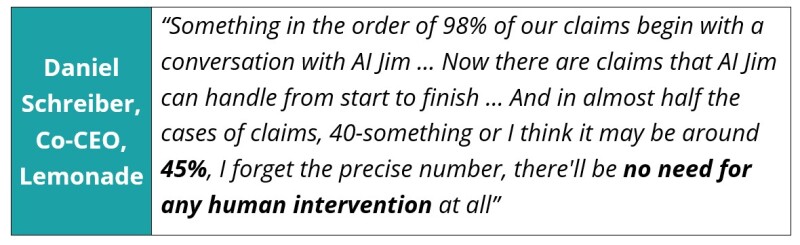

Digging deeper into the concept that automation can limit cash burn (by way of lowering expenses), Schreiber shared the efficiency of AI Jim, Lemonade’s virtual claim assistant.

If we do see 2023 and beyond pan out with no noise, we will revisit our opinion on the InsurTechs’ capital adequacy.

Lastly, aggressive rate action vs. loss cost inflation is a trend to watch in 2023.

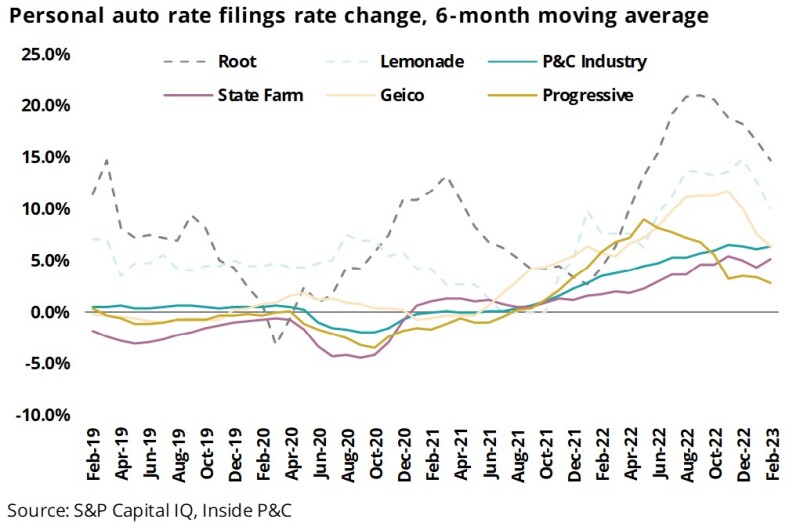

A common theme, especially for personal lines insurers, since the inflationary environment has really taken hold, has been aggressive rate action. Root and Lemonade are no exceptions and, in fact, both companies are outpacing the average rate increase taken by all auto insurers.

For 2022, Root had 50 rate filings with a cumulative rate increase of 29.9%. Compare this to the personal lines industry, which increased rates an average of 9% last year. Lemonade had seven auto filings in 2022 for a cumulative rate change of 15.3%

The following graph shows the six-month moving average for personal auto rate filings’ rate change from 2019 through the end of February 2023. We are showing the two InsurTech companies as well as incumbents and the average for all P&C auto filings.

If rates going up so much is the corollary that they were materially lower when writing the business, could it be partially true that the policyholder was mainly attracted due to the lower rates?

So, as InsurTechs raise rates (far above average rate increases), why wouldn’t the better piece of the renewal book move towards a more established player?

In summary, the InsurTechs live on, and their managements continue to dig themselves out of a hole. In our view, the best course for this cohort remains to find an incumbent partner and put their shareholders out of their misery.

The counterpoint could be that these companies have, in fact, found religion and results will continue to improve from a combination of culling underperforming book, rate actions, expense initiatives and collaborations.

This calls for another segue to our mention of McKinsey’s “The Journey”. Recall, that the study found it was tough for underperformers to be able to break out of their patterns and transform into out-perfomers. If that is the case, will inching back from the abyss prove to be a Sisyphean task?