Last month, a reference to Tesla’s insurance premiums in its Q4 earnings attracted a great deal of attention. Tesla reported an annual premium run-rate of $300mn with growth of 20% on quarterly basis. Approximately 17% of its auto customers use Tesla Insurance which, at this stage, is more of a pass-through (more on this later) vs. its own balance sheet.

This reinvigorated the excitement around Tesla, EVs, and the coming disruption.

Given the staggering 35.2 EV/Ebitda multiple that exists for Tesla, the market does believe its disruption story and its market cap exceeds all six auto manufacturers ranked behind it, combined.

Yesterday, Tesla held its annual investor day which primarily focused on Master Plan 3, laying out subsequent iterations of its products and services.

The company mentioned insurance (twice) in passing which confirms our view that insurance is not on the top of the focus topics for Elon Musk or Tesla. However, $300mn in growth led the Inside P&C Research team to revisit the company’s insurance operations.

Below we discuss EV’s insurance characteristics, Tesla’s insurance market share, EV penetration and the regulatory framework in greater detail:

Firstly, Tesla insurance premiums are a drop in the bucket, and their pricing still a work in progress.

As we showed in a previous note ,Tesla’s total annual auto insurance premium is a drop in the US auto insurance market ocean. Moreover, Tesla’s official US statutory insurance group is a drop in the $300mn of annual premium, as stated by Tesla CFO (and master of coin), Zach Kirkhorn.

That $300mn is primarily generated through partnerships with incumbent insurers, most notably Markel and State National. In looking at the Tesla Insurance Group, which was formed by acquiring the clean insurance shell Balboa Insurance Company in January of 2022, we can find only $6.4mn in direct premiums written as of September 30 2022.

For perspective, the $300mn in premium would place Tesla 85th in nationwide auto insurance market share. And this is with the realization that most of this premium is not written on Tesla Insurance paper.

The potential growth of Tesla Insurance depends on its ability to properly rate, write, and handle claims vs. its partnerships with established insurance providers.

To look at how this premium might be generated, we need to understand how the pricing might develop. The section below goes into the ways Teslas differ from other vehicles and how they rate on safety.

In looking at the particular risks of Tesla and Tesla drivers compared to other types of personal vehicles (both EVs and others) – we see that Teslas and their drivers are generally safer, even given their high-performance status.

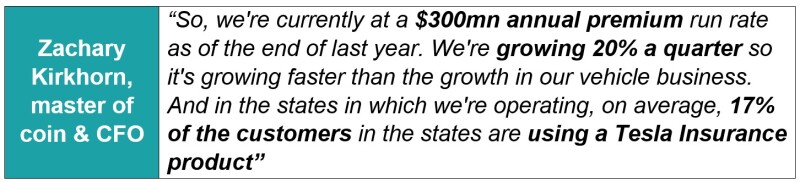

The graph below shows the relative behavior-risk differences of hybrids, compact EVs and Teslas to the traditional ICE (internal combustion engine) vehicles in various risk categories such as acceleration, hard braking and cornering.

We see that Tesla and compact EV drivers have an acceleration risk at a multiple higher than ICE vehicles and hybrids. In the other two categories – braking and cornering – Teslas are at or below the norm.

This would be troublesome, but when we look at crash-rate and distracted driving, Tesla is a better performer.

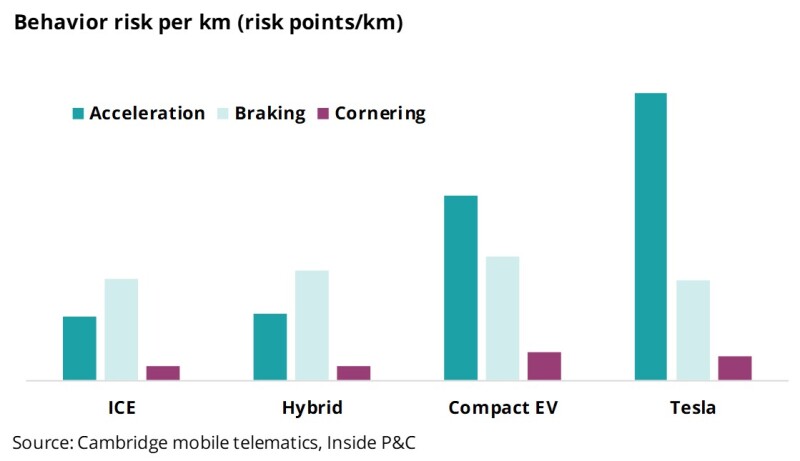

The graph below shows the crash rate for four drivers, each of whom drives two vehicles. One of the vehicles is a Tesla or a Porsche (a comparable high-performance vehicle) or a Honda, or any other hybrid; the driver’s other vehicle is an ICE vehicle.

We see that Teslas are crashing at a lower rate than the other vehicles in the study. This might be related to the distracted driving metric shown on the right-hand side in the graph above.

This graph (above to the right) displays the distraction levels of ICE vehicles compared to hybrids, compact EVs, and Teslas. Distraction is primarily characterized by use of the driver’s phone while the vehicle is in motion.

We see that Tesla has the lowest level of distraction in the study. This is probably attributable to the large in-dash display.

Given that the value proposition of Tesla’s insurance offering is linked to its ability to quantify the safety score of the driver while fully leveraging vehicle data and sensors, we thought it would be a good idea to look into the score and the discounts (or surcharges) assessed.

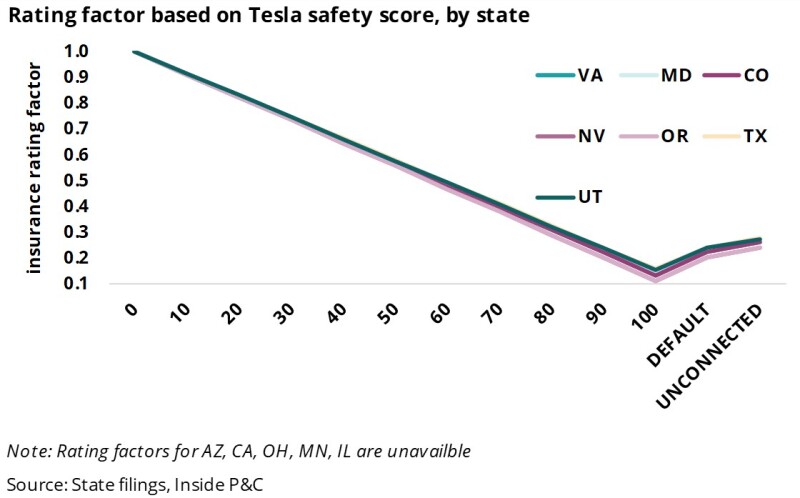

The following chart shows the discount factor for the driver’s safety score for the various states where Tesla Insurance is available (and the scoring table was available). We see that a perfect score would provide ~85%+ discount.

The unconnected score seems generous at ~75% discount. We also see that the safety score factors are linear and about the same among the states, with Oregon and Nevada providing the best discounts, but not by much.

Given that Tesla is properly capturing safe driving (even with the high acceleration risk), a customer should see a very favorable insurance rate if they have a high safety score.

However, it’s clear, with no expanded discussion at the investor day, insurance still is low in terms of priorities for the company.

Secondly, embedded presents a large untapped opportunity.

As we have seen with other OEMs and even resellers such as Carvana, auto sales can provide a platform for insurance sales.

Embedded partnerships aren’t exclusive to electric vehicles but, given the tech-savvy customer base for EVs, and those who would elect to opt in to telematics programs, it’s worth examining the state of the EV market.

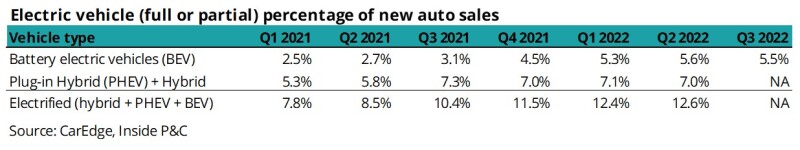

The following table shows the sales of electrified vehicles as a percentage of all new auto sales for the past three and a half years. We split the electrified vehicles into fully electric (aka battery electric vehicles – BEVs) and plug-in hybrids and hybrids.

We see an increasing proportion of electrified vehicles being sold in the US. And if the commercials during the Superbowl were any indication, auto manufacturers would like you to think they are only selling EVs nowadays.

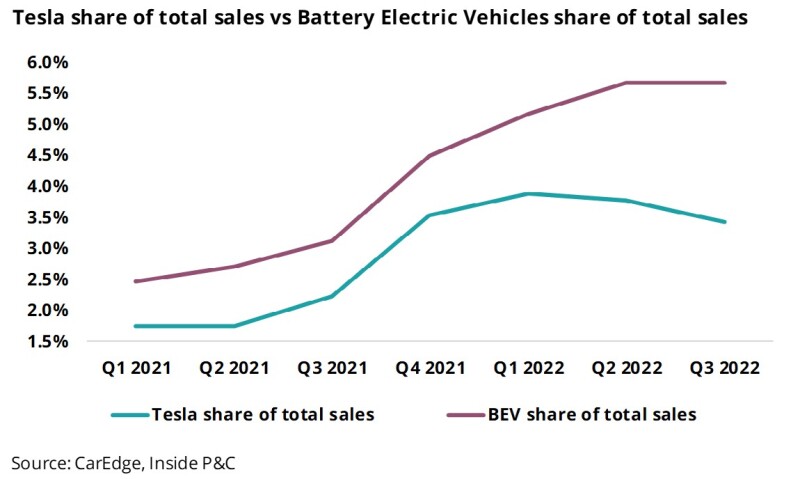

Tesla has the lion’s share of EV sales, but we see that market share fading.

Taking a step back, EVs are still a small proportion of the wider landscape. For any insurance company looking for an embedded-type partnership, it will take a long time to generate meaningful market share.

On the other hand, there is the challenge of how to tie in the current mobile/telematics solution towards an embedded partnership.

We have talked about the Carvana and Root partnership in the past. But take note that Root was only being offered at point of sale, and little if any telematics data was leveraged to price those new customers.

This presents the quandary of how to satisfy public or private investors who are not willing to be tied down for years to earn a respectable rate of return.

Lastly, the regulatory component poses opportunities and challenges.

We frequently comment upon the regulatory conditions in P&C insurance, especially with respect to personal auto. Most recently, we examined auto regulation in California, and how regulators in the state prevented auto insurers from raising rates when the insurers desperately needed to catch up to inflation.

The regulators in states that auto insurers choose to do business in will exercise some authority over their business goals and, as California has shown, the regulators could have undue influence.

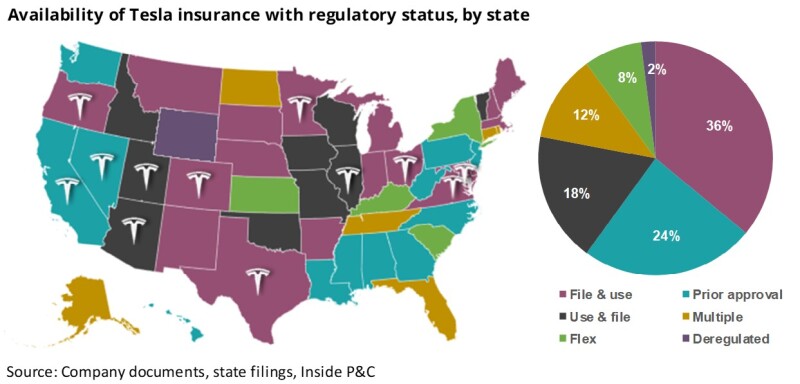

The following graphic shows the states where insurance through Tesla is available along with each state’s insurance filing requirements,

We see that Tesla is in 12 states, the majority being file and use. The file and use regulation is a bit easier to navigate from an insurer’s point of view. California and Nevada are Tesla’s only prior-approval states.

While a state like California presents challenges, the decision to choose more flexible states provides Tesla’s insurance plan with a bit more room for trial and error as the company feels out the insurance market.

Beyond the particulars of any given state, we know that departments of insurance are mandated with protecting customers from discriminatory rating factors. This discriminatory rating can present itself when insurers use proxies such as credit score, gender, occupation, marital status and home ownership to assist in segmentation and pricing. In this regard, telematics should be viewed as a regulatory darling given the potentially discriminatory proxies it seeks to supplant.

But rate-making is only one part of the equation and claims handing and servicing is equally important. So even though Tesla is looked at favorably at the moment, depending on which way the political winds are blowing, other factors could suddenly see the company fall out of favor.

In summary, Tesla Insurance is still in its infancy, and we struggle with the notion of it becoming a near-term insurance disruptor. We believe these developments present more of a learning opportunity for embedded partners: strike now and wait for efforts to pay off, albeit in the longer term; continue to wait and struggle to stay relevant, as we have seen with the prior public class of InsurTechs.