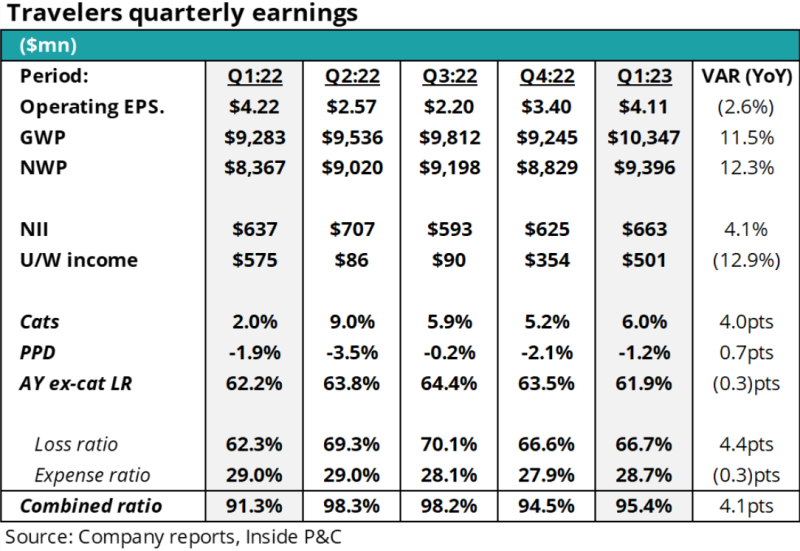

Travelers beat EPS estimates by 15% ($4.11 vs $3.56). Travelers’ stock closed up 6%, which was its largest single-day gain since March of 2020.

The following table shows the company’s earnings for the first quarter of 2023 as well as the four prior quarters.

Catastrophe losses were higher than anticipated, and a one-time tax benefit of $211mn helped reported earnings vs consensus estimates. Taking a step back, underlying reported trends remained strong.

Below we will discuss Travelers’ top line growth in commercial, personal lines rates, and exposure to commercial real estate.

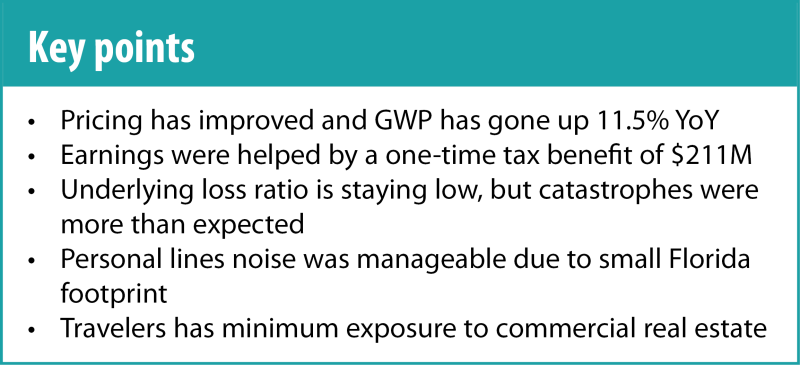

Firstly, commercial pricing improved, which could bode well for other commercial carriers.

Commercial lines pricing for Travelers has improved this quarter, and this could indicate that the peer group will see improved pricing as well.

The following table shows commercial lines renewal rate change for Travelers, key competitors, and commercial lines pricing survey results for the past five quarters.

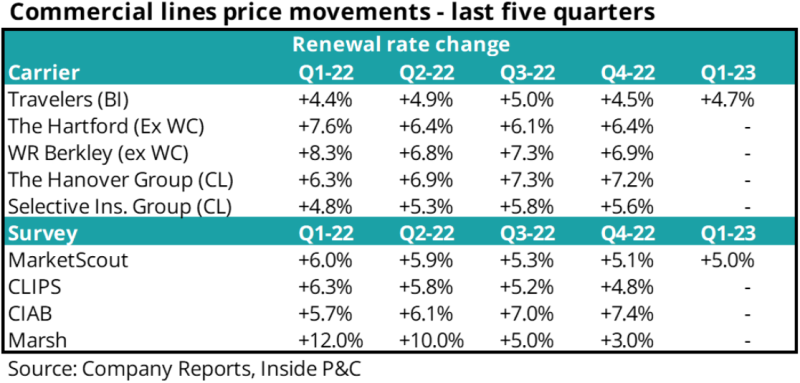

Digging deeper into Travelers’ business insurance, we are sharing the pricing story beyond the five quarters shown above.

The following chart shows 13 quarters of Travelers’ business insurance (BI) including metrics for renewal premium change, renewal rate change, and underlying combined ratio.

We see that BI pricing remains stable and underlying trends improved over time as higher rate is earned in. The conference call included several questions on the potential direction of top line vs underlying margins with the company maintaining its stance of nothing unusual on the horizon.

Secondly, personal auto results did not see the level of noise seen in Progressive’s March results or The Hartford’s pre-announcement.

Travelers’ competitors have announced adverse development from their auto books. However, Travelers’ results were not reflective of any massive reserve adjustment.

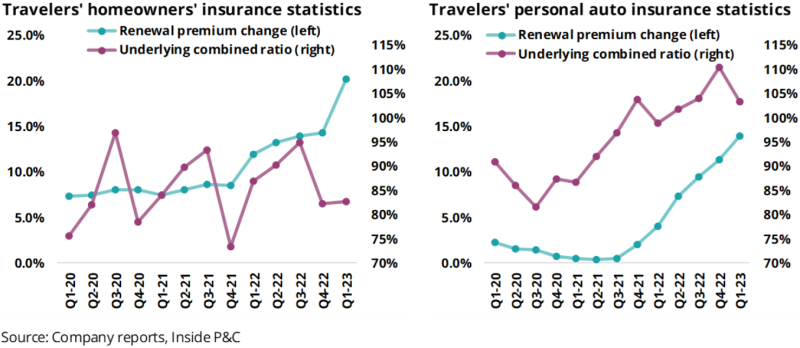

The following two charts show Travelers’ homeowners’ and personal auto performance characterized by renewal premium change and underlying combined ratio.

For homeowners, there is no discernible trend in underlying combined ratio, and the current level appears manageable at 84%. Renewal premium change is trending up, and it should help Travelers stay on top of exposure growth.

For Travelers’ personal auto business, we see a rising trend in underlying combined ratio. One point doesn’t make a trend, but we do see a reduction in underlying combined ratio this quarter compared to fourth quarter of 2022.

Within personal lines, Florida remains an area of concern for the industry. During the earnings call, management was asked if they had seen a claims pattern reflective of what has been seen at other peers.

Management answered the question saying the company’s 2% market share has limited that level of activity. While this is true regarding market share in the state, Florida is Travelers’ second highest concentrated state for auto insurance – coming in at 9.3% (~$508mn) of Travelers’ 2022 auto direct written premium. So, while Travelers isn’t a major player in the state, we do maintain a wait and see attitude.

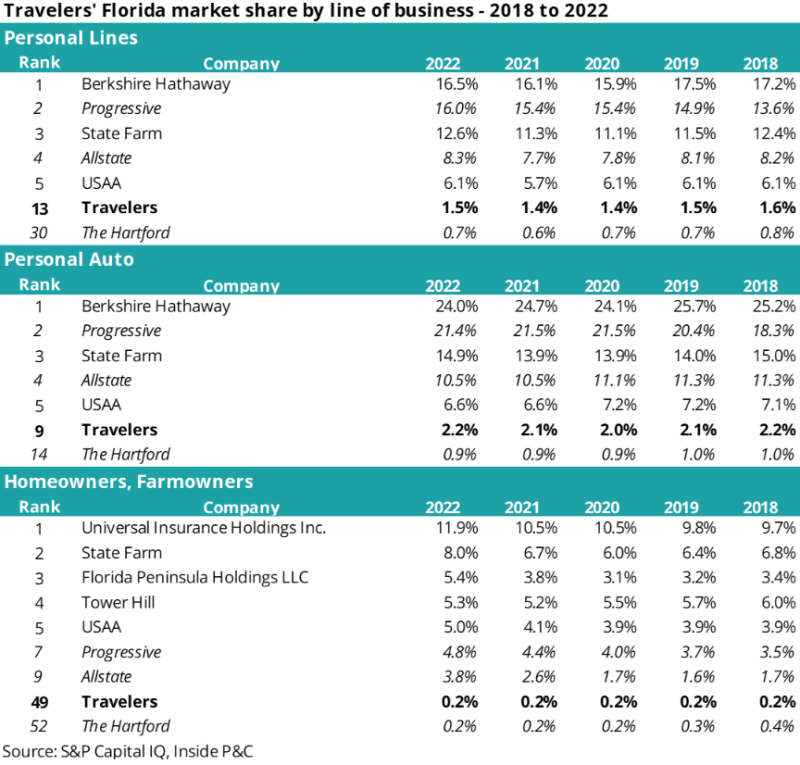

Looking further at Florida, the following table shows five years of market share data for carriers in personal lines overall and for the individual lines of auto and homeowners. The table shows the top five carriers as well as Travelers and key competitors – Progressive, Allstate and The Hartford.

As we see above, Travelers’ market share of 2% has been steady for five years. The company has negligible exposure to the homeowners’ market in Florida, but because of its 9th rank in auto insurance, the company is 13th overall for personal lines.

Except for The Hartford, other key competitors of Travelers have significantly more premium in the beleaguered state.

Thirdly, commercial real estate exposure looks to be a non-factor as discussed in our invested asset note.

Many financial market participants have been warning of upcoming challenges to commercial real estate, and we have examined the exposure to insurers in a recent note on investments and in our earnings preview.

Travelers’ executives made mention of this hot topic and also shared a new exhibit highlighting the company’s relatively nominal risk to commercial real estate.

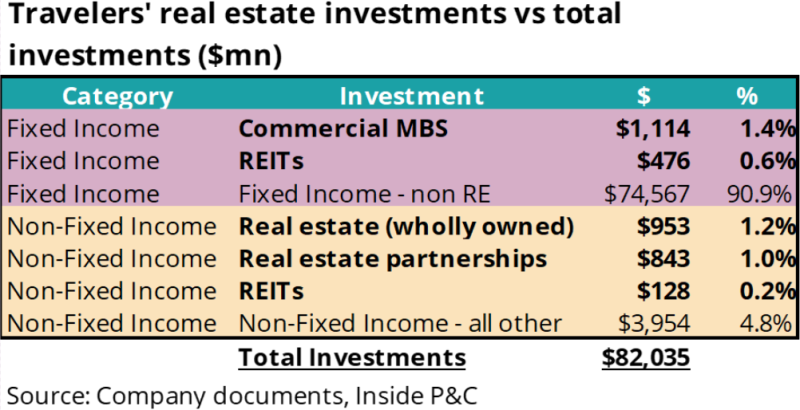

The following table shows Travelers’ total investments divided into fixed income vs non-fixed income and shows the real estate exposure in both investment categories in bold font.

We see that, of the $82bn in total investments, real estate exposure represents 4.3% (including securities, trusts, wholly owned real estate, and real estate partnerships).

As we shared in our 2022 investment note, the minimal exposure to real estate holds for the larger P&C industry. Recall our table showing the direct real estate owned by P&C insurers and the de minimis exposure it has compared to overall investments.

In summary, Travelers posted a strong quarter bolstered by top line commercial growth, lack of noise in its auto and homeowners’ books, minimal personal lines exposure to Florida, and manageable holdings of real estate investments. Catastrophe activity was up higher than expected, but the one-time tax benefit of $211mn helped offset it.

Near-term, some of these trends might show up for other commercial predominant franchises as well. Longer-term, we continue to remain cautious on social inflation picking up as the backlog in the court-system clears out.