In an interview with this publication, the executive added that jury sentiment is driving large verdicts.

“Juries, years ago, tended to rely more on the arguments of causation – did this cause the damage? Now, the fact that there is damage seems to be all that is required,” Francis said.

“The higher the damage case, the more likely there is to be a jury verdict, even if the causation argument and even the standard negligence argument are pretty strong in those cases. The jury seems to look past that and simply award based upon the damages of the injured party.”

Francis was speaking after ProAssurance, a medmal and workers’ compensation specialist, was on the receiving end of four major jury verdicts in Q1, and the litigious environment overall remains precarious.

On the carrier’s recent earnings call, CEO Ned Rand noted: “We made it through 2022 without really seeing any very large verdicts. We have had insureds take verdicts, two in the area of $15mn and two in the area of $40mn-$45mn this year.”

Rand added that the outsized jury awards reflect “underlying anger in the jury pools – a disconnect between proof of fault and the desire to compensate injured parties, and the view that large awards have no consequences”.

In his interview with Inside P&C, ProAssurance’s Francis said:

Recent tort reform in states including Pennsylvania, New York and California has not been in insurers’ favor, with scope to increase claims severity and frequency for medmal insurers

His firm’s strategy is to concentrate on a set of core states – with 75% of ProAssurance business stemming from about 14 states

ProAssurance is managing exposure by offering lower limits and imposing restrictions in “tougher” jurisdictions

Rates in medmal are still falling short of what is needed, with rates for hospitals particularly inadequate

The medmal space is no stranger to doling out millions of dollars due to nuclear verdicts and social inflation. But with larger verdicts occurring more often, plaintiffs and plaintiff expectations are changing, as are jury opinions and expectations.

In recent years, plaintiffs’ attorneys have started to shed more light on malpractice claims. They do this by spending more resources on two aspects: litigation financing and consumer sentiment.

In turn, claim severity has remained elevated and is expected to get even worse as the courts work through their backlogs. Insurers are scrambling to keep up with the rapidly evolving risk landscape as the threshold for being profitable moves higher and higher, given increasing claims frequency and severity.

As a result of the lower volume of non-Covid patients, claim frequency declined in 2020 and 2021 compared to pre-pandemic levels, while severity jumped. However, the market is now seeing a rebound in the frequency of severity.

The year 2022 yielded the highest average verdict within the 50 largest medmal industry verdicts captured, exceeding the record set in the pre-Covid year of 2019, according to Trans Re data. Furthermore, 2022 tied with 2019 for the most $10mn+ verdicts (52) and by far exceeded the record for $25mn+ verdicts with 23 (the previous record was 17 in 2018).

For the first five months of 2023, there have been 24 verdicts of at least $10mn, 12 of which have also exceeded $25mn. If the rest of the year follows in similar vein, the industry will far exceed the records for both $10mn+ and $25mn+ verdicts.

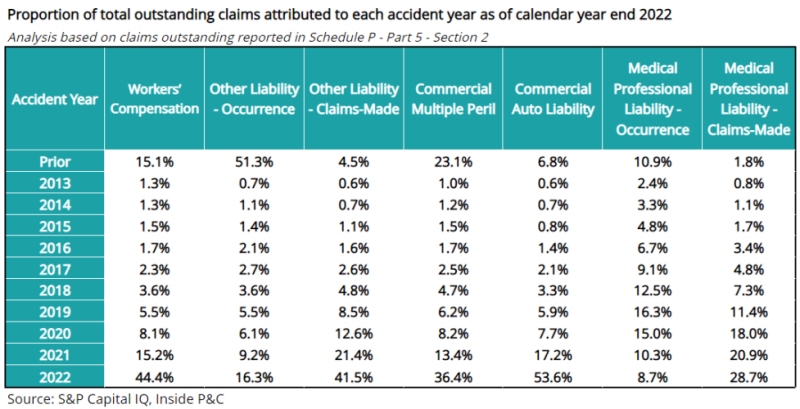

Francis mentioned that one of the claims ProAssurance dealt with this year was from the 2003 report year, and said that while the company has a “handful of claims from that report year” the percentage of claims that old is small.

The Inside P&C Research team noted that outstanding claims data shows that material proportions of overall industry claims and reserves are in the 2012-and-prior bucket.

The team also examined reserves per outstanding claim, which show case reserves for medmal claims have declined in recent years. (See: Is a social inflation tsunami on the horizon?)

Francis continued that recent tort reform has not been in insurers’ favor, and is expected to lead to increased claims frequency and severity.

In Pennsylvania, effective January 1, the Supreme Court no longer requires that medmal cases be filed the county in which the cause of action arose. This eliminates a key part of Pennsylvania tort reform dating back to 2003, and will lead to more cases being filed in venues such as Philadelphia County.

The legislation allows plaintiffs to choose where to file a case, thereby setting themselves up for the best outcome.

“Philadelphia is similar to Cook County, Illinois, and Miami-Dade – it is just a very plaintiff-friendly venue, and it has been for a very long time, so that part of it is not new,” he said.

“The size of the verdicts… usually, you're not going to get that in a rural county, but you're going to get it in a big city like Philadelphia or Chicago.”

In New York, the revamped Grieving Families Act, or Senate Bill S6636, which overhauls the state's compensation policies in wrongful death cases, has passed the state Senate and the Assembly. The bill was introduced last year but was ultimately vetoed by Governor Kathy Hochul.

The act provides a statutory cause of action for emotional damages that did not exist before, and expands the definition of a family member who can claim damages. The bill would retroactively apply to pending cases.

The size of the verdicts… usually, you're not going to get that in a rural county, but you're going to get it in a big city like Philadelphia or Chicago.”

Also, effective January 1, California's Medical Injury Compensation Reform Act (Micra) increased the non-economic damages cap to $350,000 in non-death cases and to $500,000 in wrongful death cases.

Non-economic damages include compensation for pain and suffering, loss of companionship, moral support and/or intimacy, and loss of enjoyment of life.

Meanwhile, Nevada is following California’s lead with a bill that increases the cap on non-economic damages in medmal lawsuits.

Recently, an Illinois appellate court also declared the state’s law of tacking on 6% in pre-judgment interest to personal injury and wrongful death verdicts to be constitutional.

Geographic exposure

When asked if the company is lowering its exposure to certain geographies to arm itself against these large verdicts, Francis responded, “Yes is the simple answer.

“Certainly, this is not something that occurs just immediately because we lost four cases in the first quarter. As we look at exposure and as we look at those severity trends, we have to consider how much exposure we have in a particular venue.”

The executive added that the company is also revamping its strategy in certain specialties in those geographies.

“We entered into a strategy to concentrate largely in a set of core states that we have a lot more history in, that we have more predictability of loss in,” he said.

“Probably around 75% of our business comes from about 14 states, whereas a smaller percentage comes from the remaining 36 states and the District of Columbia”.

At the end of 2022, ProAssurance disclosed that five states, Pennsylvania, California, Florida, Alabama and Texas, represented 45% of its direct premiums written for the year. Also, on a combined basis, Pennsylvania, California and Florida accounted for 34% of its direct premiums written for 2022.

Along with the states above, the company detailed Illinois, Michigan, Missouri and Vermont as its states of domicile.

Probably around 75% of our business comes from about 14 states, whereas a smaller percentage comes from the remaining 36 states and the District of Columbia

On a state basis, Francis said that although Micra has enforced new rules, at least “they are predictable”.

“We know that rates are going to have to go up over time there because the loss payments that will be allowed are going to increase, but we believe that that's something that is manageable, even though not desirable.”

For Florida, the executive said the carrier manages its risk by restricting the limits it offers “in those tougher jurisdictions”.

For example, for companies in Dayton or Broward County, the carrier sells $250,000 limits because the physicians can’t afford more, and “if they could afford it, the physicians couldn't afford to pay the premiums”, Francis said.

He added that a large portion of physicians in Florida don’t buy medmal insurance.

MPL pricing

Earlier this year, sources told this publication that miscellaneous medical service providers are seeing 5% increases, physicians are seeing 8% to 12% rises, long-term care facilities are seeing 15% increases and more, and hospitals are experiencing rises of 15%-25%.

Francis countered that these increases are what should be in the market, but are not.

“That's probably the need, but it's not what's out there,” he said.

Rates especially need to increase for hospitals, specifically hospitals that buy excess towers, the executive added, as well as senior care facilities and physicians.

“There are rate increases that are required for those exposures. We've seen some happen, but probably not quite as much as we would have expected and that is needed at this point,” Francis concluded.