Bermuda’s low taxes and looser insurance regulation allow quicker formation of companies after significant events. This has put the island at the center of the global insurance marketplace. Multinational carriers are able to lower their taxes by ceding to offshore reinsurance companies, vs the much higher tax rates in the US.

However, these successes have attracted naysayers attempting to address this disparity. Long-term followers of insurance will remember the Neal bill and other attempts over the years to close the gap, all met with varying levels of success.

These efforts culminated in some success with the Tax Cuts and Jobs Act of 2017, with US corporate income tax reduced to 21% and the establishment of a base erosion and anti-abuse tax (BEAT).

Last week, news broke that Bermuda was evaluating (likely) raising the corporate income tax in 2025 under the OECD’s global minimal tax rule. This rule would apply to Bermuda companies that are part of global franchises and have revenues of more than EUR750mn.

As is often the case with discussions on taxation, the idea differs from the actual impact. In the note below, we look at the financial implications, the role of Bermuda (re)insurers in the economy, steps that can be taken to alleviate the pressure, and retaliatory measures that might not gain much traction as we head to the 2024 elections.

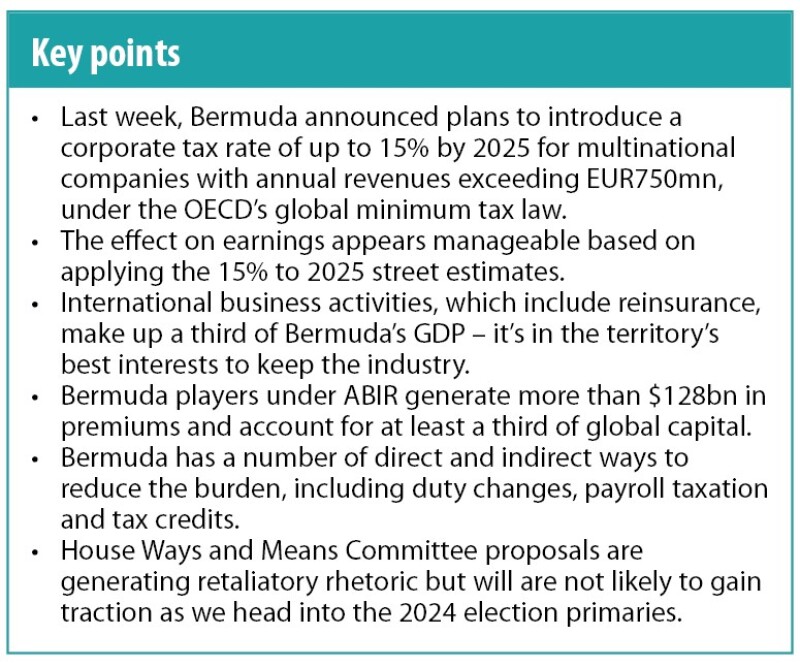

A 2025 tax rate shift would have minimal impact on publicly traded names

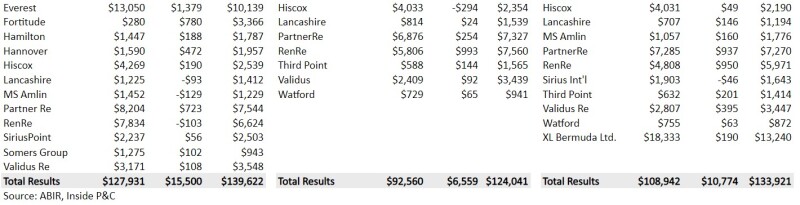

The table below shows the street estimates for Ebit in 2025, with a projection of the impact of the straight 15% tax (we will get to potential offsets later). Original estimates are in the single or low-double-digit range. If we apply a 15% tax rate, the incremental earnings reduction appears manageable, especially taking into account the fact that the 15% can be reduced.

Insurance is one of the biggest drivers of the territory’s GDP, and it will take steps to maintain it

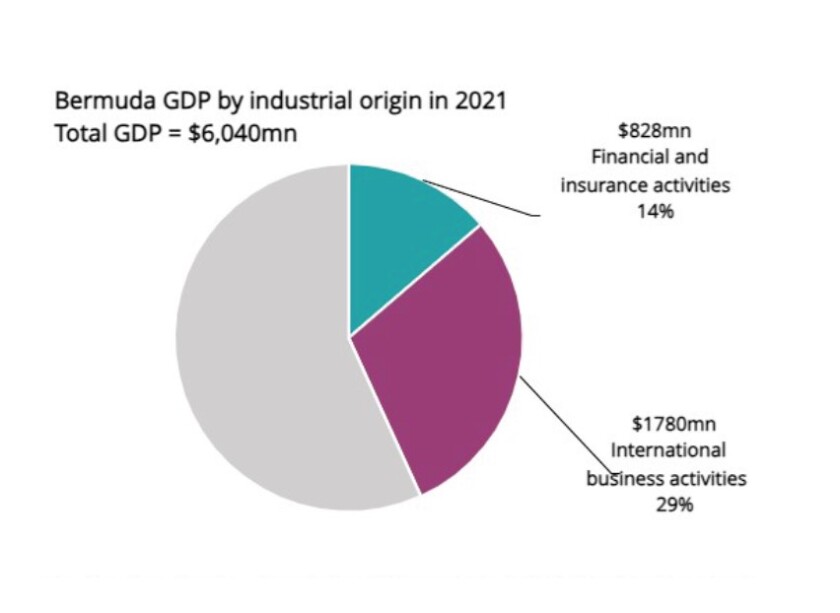

The pie chart below shows that international business, including reinsurance, accounts for nearly a third of Bermuda’s economy.

One of the bigger challenges of the new OECD rules is the “top-up provision” under the Undertaxed Profits Rule (UTPR). Under UTPR, additional tax can be applied to a company's subsidiary by any other country under the OECD, where the company does business to bring the tax to at least 15%. For Bermuda, it made sense to come under the OECD umbrella rather than watch another government like the US tax these companies and benefit from additional revenues.

Using ABIR statistics as a proxy, Bermuda is at least a third of the global market, which makes flight less likely

Using Association of Bermuda Insurers & Reinsurers (ABIR) data as a proxy, several major companies are established on the island and generate close to $128bn in premiums which are at least a third of the global traditional capital of $435bn as of 2022 (AM Best).

For insurers and reinsurers, the island will continue to provide ease of company formation and capital movement, access to a talent pool, expedient regulation, and a central location to access many jurisdictions.

On the other hand, based on our discussions and the draft document, Bermuda could take several steps to address the additional tax burden directly or indirectly. These could include:

Use of tax credits for R&D, property, etc. that benefit economic activity.

Review of payroll taxes providing a modest offset if lowered.

Reducing the overall cost of living, including examining the level of import duty.

Unclear impact of House Ways and Means Committee rhetoric

Adding to the complicated scenario, House Ways and Means Committee Chairman Jason Smith unveiled the HR3665 – Defending American Jobs and Investment Act last month. This tax doesn’t target the Bermuda companies but introduces graduated rates of additional taxation up to 20% on companies with operations in countries identified by the Department of the Treasury as levying extraterritorial or discriminatory taxes on US firms. This means that if any country charges a top-up tax, companies from that country doing business in the US could be open to retaliatory action.

How far this will go is unclear as only around 4.5% of all bills become law. With the election season upon us and the primaries starting early next year, we might not see much movement on this initiative.

In summary, any impact from raising the tax rate appears manageable, with the Bermuda companies factoring this into their planning. Bermuda seems to be taking steps to keep the tax consistent with guidelines and offer other incentives to the companies and employees to stay put.