Since launching in 2020, Bermudian Vantage has grown combined group gross written premium to over $800mn as of the end of last year by focusing on talent, technology and riding the strong growth in the E&S market, CEO of insurance Alex Blanco told Inside P&C.

When launched, Vantage had a rough benchmark of achieving about a 75:25 split insurance to reinsurance, according to founder Greg Hendrick, and the carrier could end up around those numbers, possibly 70:30, at the end of 2023, Blanco said.

“From early days, we embarked on building a specialty franchise, always envisioning an insurance and reinsurance platform. So ultimately, the relative size between insurance and reinsurance, while important, really must be put through a larger, more meaningful length lens of the entity that we're trying to build,” Blanco said.

This publication revealed in December that Vantage had stopped writing property cat reinsurance risk on its balance sheet, an underperforming class of business at the time, and instead was offering clients collateralized capacity using third-party funds. Blanco called the pivot “an incredible story” given the capital committed to do it.

Not having legacy claims or systems has been instrumental in the carrier’s growth and what Blanco described as Vantage’s more nimble stance compared to competitors.

“The lack of legacy claims clearly has benefited us, because though we lacked legacy claims, we do not lack legacy insights. Such that we're able to see those opportunities and be more deliberate on how we're constructing our portfolio, understanding the profitability and pricing on those lines.”

A focus on IT infrastructure and data from inception, with about 10% of staff focused on data-empowered underwriting, has also borne fruit in faster processing and product origination, according to Blanco.

“Since we're free of that legacy technology and we're free of a disjointed data architecture, that grants us the opportunity to design and build solutions that are far more efficient,” he said.

The company has reduced its new business processing by more than 20% to an average of eight minutes per submission and is able to launch products supported by tech enablement in around three months, he said.

Blanco was named CEO of insurance in November 2021. A veteran with more than two decades in the business, he had previously served as Axa XL’s CUO for specialty in the Americas.

E&S growth

The carrier has taken advantage of the rise in risk migrating to the E&S space as complexity grows.

Challenges such as Covid, nuclear verdicts, social and headline inflation and climate change have added to the need for more nuanced underwriting and the growth in E&S. Vantage was set up to service this need, Hendrick told Inside P&C at launch, and Blanco emphasized that point.

“When you're free of rate and form, when you understand that the risks are getting more complex, the natural habitat for those types of risks should reside in the E&S market, simply because the market has to has to become more comfortable with them,” he said.

Second-quarter results and executive commentary from US carriers suggested that the “Golden Age” this publication has previously discussed for the E&S market continues, though rate rises are tapering.

Given increasingly complex risk, Blanco said he anticipated strong E&S demand to continue. “It would be prudent for us to continue to look at that as opportunistic and as part of our growth for the future.”

The lack of legacy claims has benefited us because, though we lacked legacy claims, we do not lack legacy insights

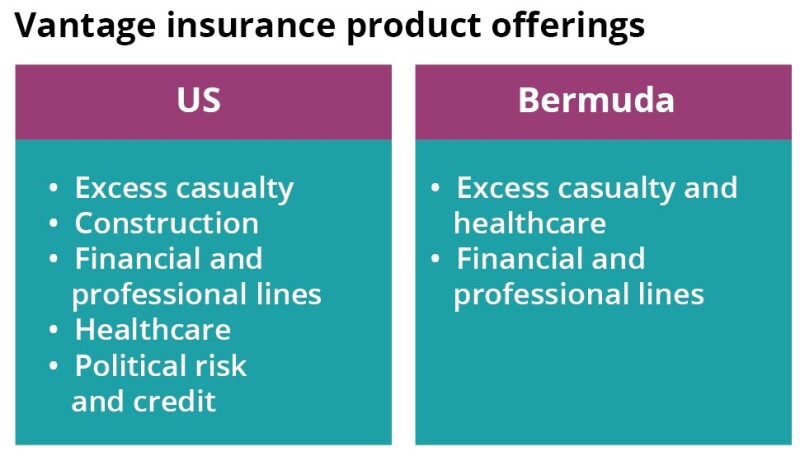

Vantage expanded into the US non-admitted market with the acquisition of an Illinois-domiciled domestic surplus lines insurance company in July 2021.

It later purchased an admitted lines carrier to accelerate the build-out of its US insurance operations following a $200mn capital injection from existing private equity-backers Carlyle and Hellman & Friedman. That purchase was a part as a result of a commitment to broker partners to offer admitted products as well, Blanco said.

Opportunities

In terms of expansion, Blanco said the carrier would add “a minimum” of two products in 2023, though he declined to name them. “That again, we'll focus on E&S market where we think there is some dislocation and opportunity to distinguish ourselves.”

Other opportunities pertain to end-markets, Blanco said, given that Vantage’s products presently target mainly upper middle-market or large corporates. “I see an opportunity for us to focus on SME business and middle-market clients.”

On longer term goals, he said Vantage is aiming to “be recognized as a specialty insurer of choice and an employer of choice”.

Recently, the insurer hired senior personnel in construction and environmental liability, as well as excess casualty – areas in which it is planning to expand further, according to Blanco.

In April, Vantage appointed Heather Longo to head up its retail excess casualty business, and the prior month promoted Andrew Lea to CUO for cyber and professional liability E&O.

In May, it promoted Richard Wall to head its US financial lines business, and the carrier remains firmly committed to D&O despite sharp recent rate declines.

“D&O is experiencing a rate environment that is on the heels of – depending on when you started, two and a half, three years ago – generational high rate increases. So the question really becomes what the loss ratio looks like after multiple years of rate increases,” Blanco said.

Given those hard market years, Vantage has “strong conviction” in its D&O business and management liability and financial lines, the executive added.

“We do believe there's rate adequacy in that portfolio but obviously we make sure that we are monitoring it closely to determine where that portfolio goes.”

D&O pricing declined 26.8% in Q2, according to Aon’s latest report, though it rose almost 100% in some quarters of 2020.