Prior to 2008, the mere mention of AIG conjured up images of a behemoth involved in several businesses in diverse segments and jurisdictions. In fact, the New York Fed outlines close to 12 different items that expand on AIG’s integral role on Wall Street and Main Street. Much has changed since 2008, with the new and improved version resulting in the stock recovering to its best levels in recent years.

Along with AIG’s meandering path to a double-digit return has come a long list of CEOs, internal and external, who tried to find a way out of the company’s challenges. Clearly some succeeded more than others, and hindsight is often 20/20. That said, we thought it would be an interesting exercise to look back at the path and promises made along the way.

The chart below shows AIG’s stock performance over time overlaid with the CEOs over the years. Yes, we acknowledge that stock performance is not a perfect measure of a company’s results. That said, AIG’s stock moves have played a role in internal and external pressure to course correct and has also resulted in shorter tenures than anticipated.

When one looks at the history of AIG from the start of the mortgage crisis, and the steps taken over that time, a few things begin to distill.

Firstly, a desire to keep most of AIG intact, which led to a belated acceptance of challenges the company faced. Secondly, even with a better understanding of challenges, a digression into trying to be too out the box on strategy led to additional delays and distractions. Thirdly, an embrace of a slimmer organization including dispositions translated into easier control and focus on getting the core engine back on track. We discuss these points in greater detail below

First, the initial turnaround focus got bogged down in excessive deliverables

After the quick handovers from Martin Sullivan to Bob Willumstad to Ed Liddy, Bob Benmosche played the role of righting the ship during his tenure. Benmosche also slowed down the initial fire sales of AIG’s properties and ended up repaying the treasury loan with the profit.

Although activists had been circling the firm for a while, these efforts ramped up during Peter Hancock’s term.

We acknowledge that it's easy to comment as observers about what could have been done when looking back vs being in the driving seat. With that benefit, it did appear that Hancock bit off more than he could chew. The table below shows these competing priorities, but we believe a combination of slowness in divesting underperforming businesses, the focus on tech, optimistic guidance and the concept of modular business proved to be a tall order to fulfill.

The pressure from activist investors was also relentless on breaking up the company. Not only did Hancock not consider the idea, he was a vocal opponent of any separation which essentially put a target on his back in the event of any missteps. Things did end poorly when AIG announced a meaningful reserve adjustment in 2017.

The baton was eventually passed onto Brian Duperreault and Peter Zaffino, who was his deputy at that time. While Zaffino continued fixing up the general insurance business, AIG’s stock performance still lagged due to challenges from prior years continuing to come to the surface.

However, Duperreault continued to repeat the mantra from his start of not breaking up the company, notwithstanding the pressure from activist investors that began before his tenure. This essentially culminated in a sooner-than-expected handoff to Zaffino and an accelerated timeline to right-size the company to a manageable level.

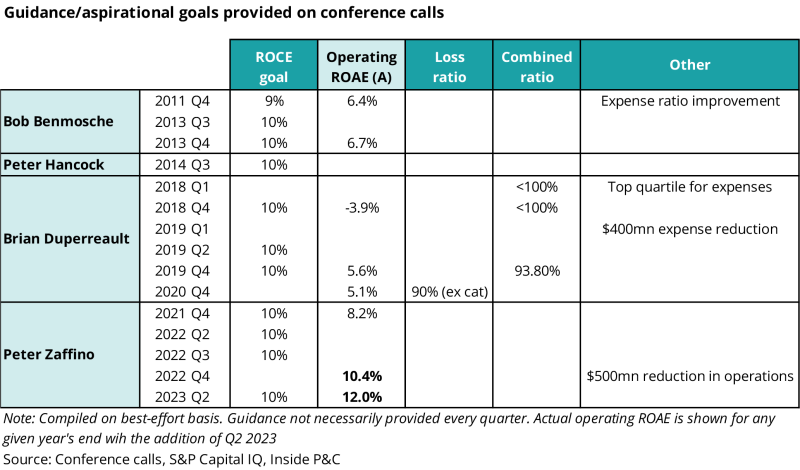

The table below summarizes the stated goals of each CEO since the financial crisis, some more tangible than others.

We would emphasize here that the list is promises made, not objectives completed. So while we see a very long list in Hancock, for example, vs a smaller list with Zaffino, this goes to our point that the company got bogged down in aspirations during the earlier days.

Zaffino’s leaner AIG 200 list, which still had four major undertakings, was a bigger success because it focused on the core objectives needed to shift the business.

This narrower focus allowed the company to finally hit some of the goals from earlier as well, with the company producing its first underwriting profit in years, as well as hitting a 10% RoE (temporarily), both of which were major milestones. These results took place under Duperreault, but as the CEO himself said on different earnings calls, they were driven by Zaffino’s work as CEO of GI at the time.

The earlier work on these more essential goals helped the company hit critical goals after Zaffino took over, such as its sub-90 accident year combined ratio (ex cat) in GI for 2022 – the best results since the financial crisis. Overall, the company has had more than $7bn in cumulative improvement in underwriting profitability since 2016.

We’ve written more about the success of AIG 200 itself in a prior note, but would remind readers that the goals were all hit, including $1bn in expense savings, two quarters ahead of schedule.

Second, the pain of righting commercial lines proved longer lasting

We often talk about the problem of cost of goods sold in insurance. This becomes even more critical in a longer-tail line where a meaningful gap can exist between when the policy was written and when claims were reported and develop over time.

One of the challenges when being handed the reins of a publicly traded turnaround company is the immediate investor expectation for achievable return goals. This pressure started growing rapidly once Benmosche pulled the company back from the precipice.

The table below shows guidance and aspirational outlook metrics over time. One thing that remained constant is the desire to produce a double-digit RoE. We would also note that over the years, various CEOs might have used different levels of adjustments, so the comparison below might not be apples to apples.

That said, one of the challenges of talking about a double-digit ROE was it magnified the miss whenever AIG reported a difficult quarterly result.

One can see that under several CEOs’ tenure this gap was quite wide and only started narrowing once the corrective actions began to deliver. Of course, it wouldn’t make sense to discount the efforts of other CEOs, but this took on a new urgency under Zaffino vs. other competing priorities.

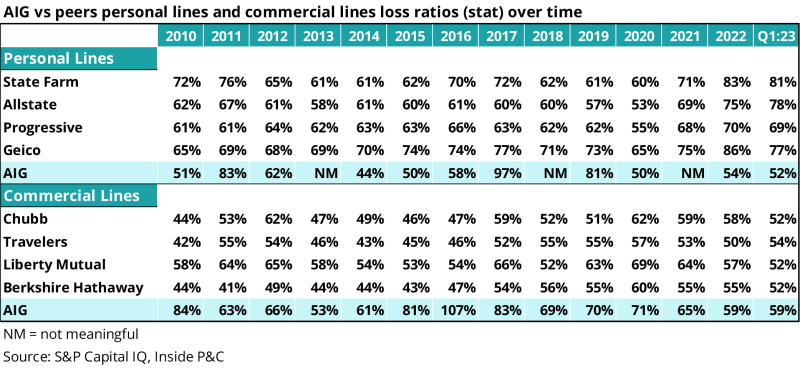

The chart below shows commercial lines loss ratios over time; one can see a meaningful gap between AIG and its peers over a period of time. What followed during Hancock's time was reserve charges, exits, and an adverse development cover. Under Zaffino's watch, commercial lines results have continued to trend in the right direction and narrow the gap, which allowed it to pursue top line growth discussed below.

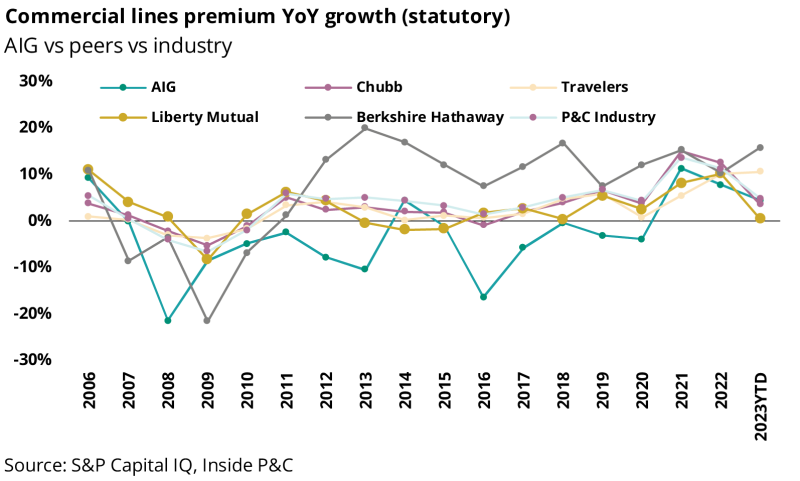

The chart below shows top line growth over time vs AIG's peer group. Historically, AIG lagged as it focused on culling underperforming pieces of its book or reducing catastrophe volatility.

This eventually worked in its favor, as the company could deploy capital aggressively in the current hard market. Though we have passed the mid-2021 peak in commercial pricing (based on Clips data), the strong pricing has continued, with rate on rate over the last three years leaving the market significantly elevated.

Although much debate exists on the future direction of loss costs from here, an improved book of business will ultimately translate into a higher return profile over time.

Third, less is more in AIG's case

Revisiting the earlier list of CEO priorities, one thing we saw in more than one tenure was CEOs emphasizing the need to trim businesses. Whether the focus was on “non-performing” or on “non-core” entities, cutting back was a major priority for more than one leader.

Initially, however, this proved to be somewhat difficult given AIG’s nature and history. Looking back, AIG wasn’t necessarily the behemoth it was at the time of the crash, or even as big as it is today. It was a smaller company that grew to size, mostly through strategic acquisitions.

It is a hard thing logistically, or even sentimentally, to move away from the core philosophy on which a company is grounded, and there was an initial desire to keep the AIG pieces together. But as the strategies show, leaders understood that during a difficult time it was essential to focus on the survival of the core business, though their level of execution varied.

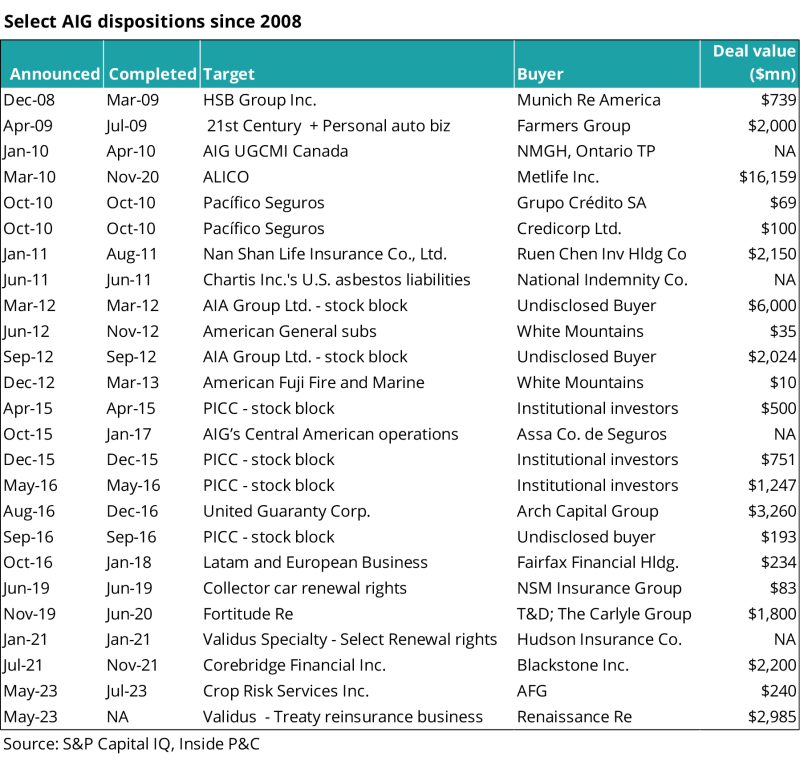

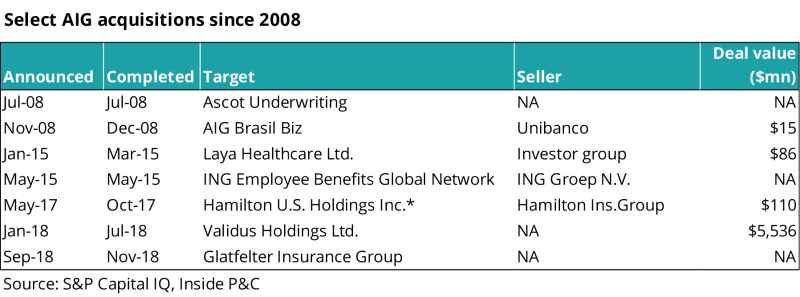

The chart below shows a selection of dispositions since 2008. We can see the differing strategies, with many earlier cuts being very small geographic-based dispositions, and a smaller selection of mid-size cuts later. Below that, we show acquisitions and would note how short the list is.

The disposition list highlights why something the CEOs agreed on seems to have had uneven execution; it’s hard to know what and how much to cut.

In 2008-2010, pressured by the financial crisis, the company made a few major sales, but after the initial flurry, things slowed somewhat and there seemed to be hesitation to take decisive action regarding entities that in many cases were not underperforming.

Although dispositions continued since then, there was still a desire to keep some pieces together in the pursuit of diversification, right up to Zaffino being named CEO.

This is where he came in with the sales of Validus and Corebridge. Neither company had a performance problem per se, which is likely why his predecessors held onto them. However, they differ materially from the core business, creating noise for an already troubled company.

Taking a step back, historically we have been down this road when many companies had P&C and life housed together, but eventually investors soured on the idea because of the interest rate risk and balance sheet risk under the same umbrella. The diversification strategy never worked out, and it eventually turned into investors fretting about what part of the company would underperform on a macro basis.

Regarding Validus, the original acquisition coincided with an unusual uptick in cat losses for the industry, and because of that, the losses started exhibiting volatility that was higher than what internal projections would have shown prior to the acquisition.

With the life business’s sensitivity to interest rates and reinsurance being on its own completely different cycle, CEOs trying to walk the line and keeping these businesses on meant a game of whack a mole for leadership, as they addressed crisis after crisis in unrelated sub-businesses. It’s simply too difficult to try to right the ship while also addressing all the moving parts of these entities.

Zaffino recognized this and made the difficult call of disposing of these two companies, which is one of the places we see a difference in follow-through. This eventually led to the right decision to sell the treaty reinsurance business to RenRe, while keeping the other pieces, including Lloyd’s and US specialty, under AIG.

While those were the two biggest shifts, Zaffino also sold the crop business and moved the high-net-worth business to an MGA with Stone Point in a bid to reduce volatility.

The benefit of this strategy is that when all the core pieces are working at their full potential and the business becomes a capital generation machine, it always has the option to acquire other missing pieces if needed down the road.

In summary, it's often difficult to walk and chew gum at the same time. For AIG, several prior CEOs got bogged down in excessive promised deliverables and continued missing the mark on these. Under Zaffino, we got closer to the stated goals and separation from businesses that no longer made logical sense to be under the AIG umbrella.