Historically, when pure-play reinsurers were more common, insurance stocks would react more to the news of impending hurricanes. With the evolution of hybrids and the lack of concentrated publicly traded catastrophe reinsurers, moves nowadays are less pronounced (outside of the Florida domestics).

However, more widely, the performance of (re)insurance stocks does not reflect recent company results and current market conditions.

If one looks at the pricing commentary from the recent earnings calls, commercial and specialty continue to get rate on rate, and reinsurance has had several renewals now in the high double-digits. In addition, though results during earnings were something of a mixed bag on an individual name basis, overall results were strong for the sector.

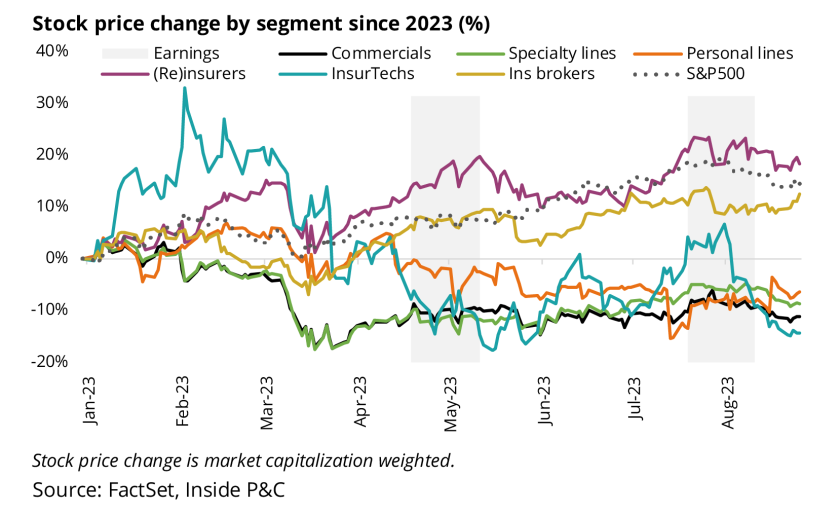

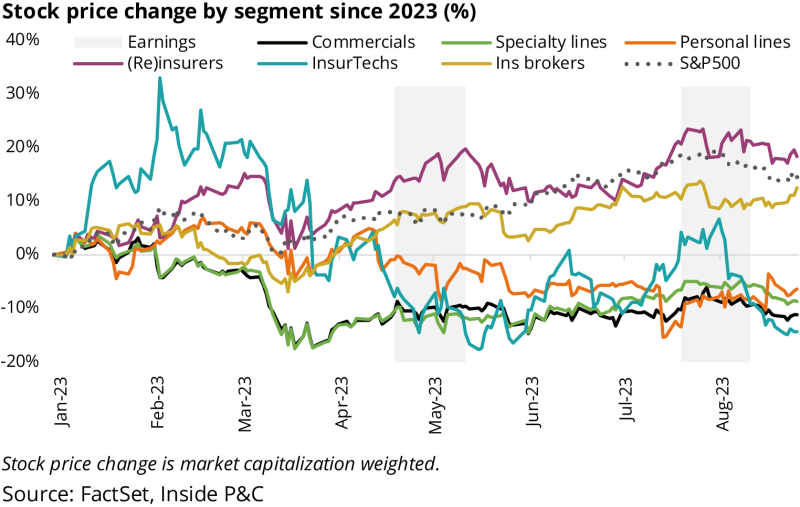

With this in mind, the price change chart below is a bit surprising, with only the (re)insurer cohort beating the S&P year to date (in this analysis RenRe, Everest Group, Axis Capital, Arch Capital, SiriusPoint, Greenlight Re). Their stocks got a boost earlier in the year on post-double-digit renewals but have settled back in the mid-single-digit range, despite the hard market.

Commercial and specialty insurers started to go down early in the year and have not recovered despite the rate discussion and good results. Brokers (not including Truist) are nearly tied with the S&P, despite continued double-digit organic growth against all predictions.

Even the InsurTechs are down after the initial exuberance trailed off as the “but for” narrative struggled to take hold. Beyond InsurTechs, only personal lines makes some amount of sense, slightly down year to date on continued noise and uncertainty.

With conflicting results and stock movement on our radar, we decided to revisit this topic and see if there are any sector-specific trends. Our note below analyzes these stock movements and the short interest to see what trends have emerged.

With the recession “cancelled”, broader investor focus has turned to growth sectors such as tech

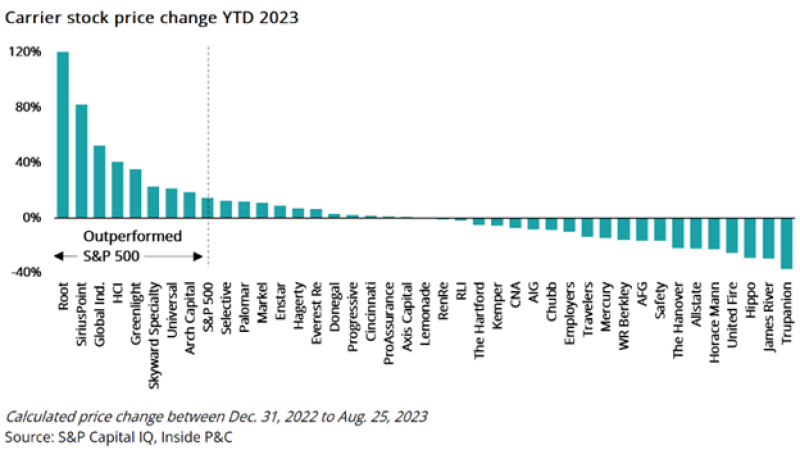

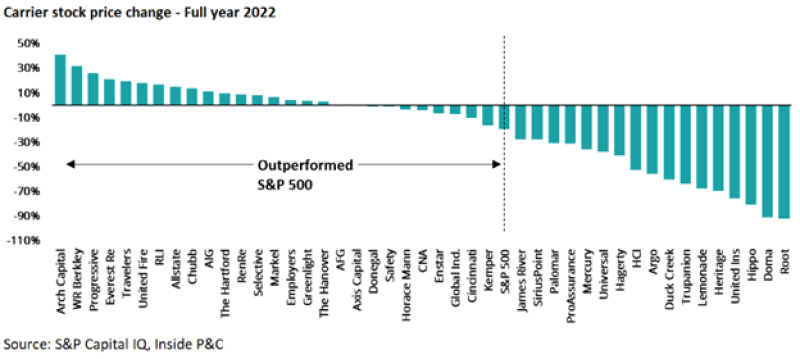

Our chart above showed year-to-date price change by cohort. However, if we drill down to performance by name, we see that very few carriers have outperformed, and the exceptions are not the usual list, with Root topping the chart thanks to the recent rumors of an all-cash acquisition at a premium. As shown in the second chart below, Root was the worst performer in 2022.

For reference, 2022 looked much better based on how many carriers outperformed the S&P 500!

So, what has driven this drop during a more stable time? We have covered before that insurance is a value sector and often considered a safe haven play, and we have shown that stock prices and volume were up as fear of an imminent recession increased.

Now, we are hearing more and more news that the recession is failing to appear, and has been “cancelled”, meaning the fears driving people toward safer plays may have abated somewhat. So, while insurance is not underperforming, the shifts in the economic outlook are likely making growth plays such as tech appear more appealing.

Throughout these shifts, we have noted our expectation of an eventual recession or a soft landing, but for now we have been proven wrong. We would still be cautious on this topic, as we don’t yet know what actions the Fed will take in the near future, and any news or even rumor could swing things back in the other direction.

Short interest mostly unchanged for P&C, but InsurTech rises

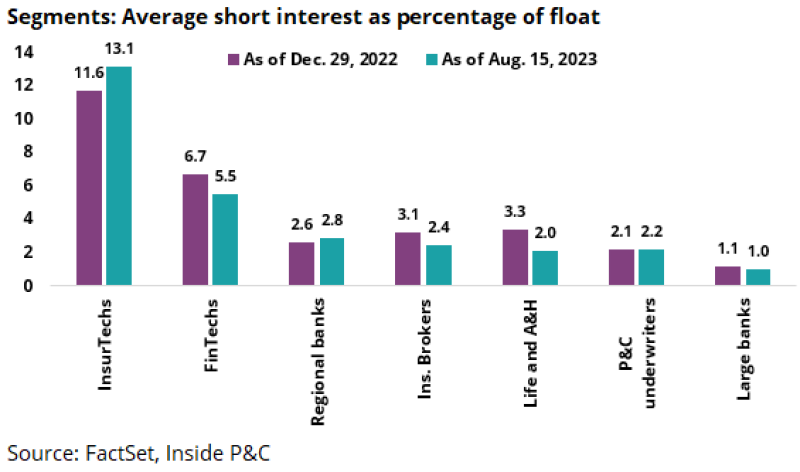

Based on the changes we see above, we thought it would make sense to review the recently released short interest data as well. The chart below shows major P&C sub-sectors, along with other related industries for comparison.

First, we would note that the short interest is essentially unchanged for P&C underwriters, indicating that although we are seeing some noise in the stock price, there is still an underlying view of forward-looking stability. Brokers’ short interest has gone down, which makes sense given the drop in stock price vs. positive earnings.

InsurTechs are an outlier, with a fairly large increase, which is driven by the very real prospect of funding issues down the road, as well as the fact that Root’s stock price did not drop after the acquisition rumors, even though the deal did not materialize.

Going back to our earlier point regarding the shift in investor sentiment towards growth plays, we can see that fintechs had a notable reduction in short interest, supporting our conclusion that this is in part driving the changes.

On an individual company basis, we see a few noteworthy short interest shifts

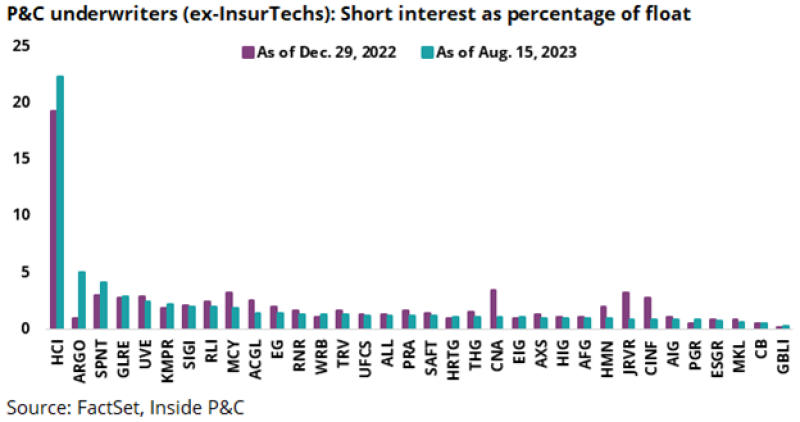

The table below shows the P&C underwriters’ individual short interest now vs. at the end of 2022.

While the majority of carriers have not seen a meaningful shift, we would highlight some names.

Noteworthy changes:

Argo has the largest increase in short interest by a wide margin, which we would ascribe to a merger-arb play, pending the close of its present deal with Brookfield.

HCI has consistently traded at a significant premium compared to peers. The increase below could be a reflection of it being an outlier combined with the hurricane season.

SiriusPoint stock has recovered materially over 2023 based on the steps taken to fix underperformance. The increase in short interest is likely a bet on execution risk from here.

James River has a decrease in short interest, but we should view this as the result of prior high short interest leveling out after the stock has sunk significantly.

In summary, despite meaningful positives for the industry, we are not seeing the good news priced in on P&C stocks, as shifts in the economy have led investors back to growth names.

Short interest shows a slightly different picture, with P&C mostly unchanged. We remain cautious on the outlook, as it is not certain a recession is out of the question.