Last July, this publication said that the shadows were starting to lengthen on the Golden Age for US specialty insurers, but that it wasn’t over yet.

Just over a year later, E&S and specialty insurers continue to bask in the early evening sunlight of a remarkably favorable operating environment.

But the Golden Age is showing signs of evolution, with the property market increasingly doing the heavy lifting around growth and rate rises, whilst promising the highest prospective returns.

The E&S market delivered 16% growth in H1, and at time of writing it seemed highly likely when AM Best unveils its gold-standard report on the market that it will have breached the $100bn threshold. If it falls an inch short, the trailing twelve-month book will definitely be above the line after its first-half growth.

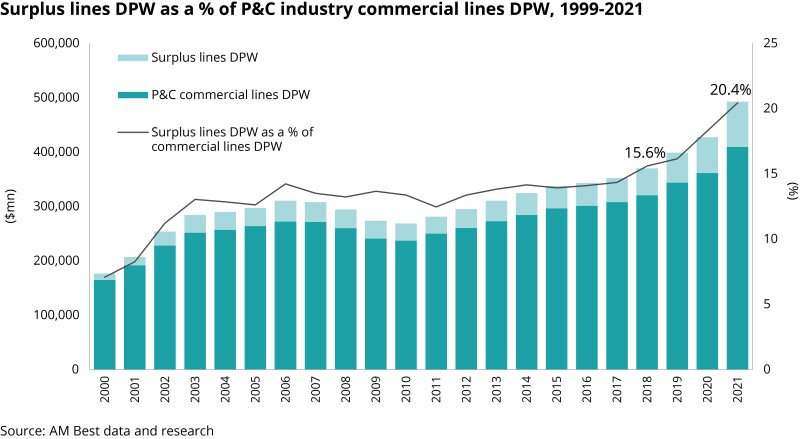

For a market that was only $45bn of premiums in 2017, this will represent a landmark achievement. A once unfavored corner of the US commercial lines market, which has a single-digit percentage market share in 2001 and was long range-bound at 13-14% could be ~22%-23% in 2022.

The Golden Age label remains justified because the E&S market is still growing at a rapid pace. It is doing so while property rates hit all-time highs, with insurers dominant and brokers scrambling for capacity.

In addition, overall portfolio quality is high due to strong rate adequacy, shorter limits, and tighter T&Cs. Good E&S insurers are budgeting combined ratios comfortably in the 80s on an ultimate basis.

But the picture is complex, and the outlook uncertain.

Cat-exposed property is something of a devil’s bargain, with increased rates and higher projected profitability coming alongside the requirement to accept a material increase in volatility. The reinsurance landscape had already showed signs of deteriorating last July, but it became much harder at 1 January, with cover below a 1-in-10-year return period disappearing, along with much quota share capacity and aggregate cover.

This is, however, a bargain that many E&S insurers are willing to take – they are risk takers at heart.

The growth in submission flows has slowed, and in H1 WSIA figures show transaction numbers rose only 3% - suggesting that growth was sustained overwhelmingly by rate and exposure growth.

It will become clearer over the next year or two just how much of the submission increase of recent years was driven by tidal flows, and how much was structural currents.

Over the last year, the pricing cycle has showed further fragmentation into micro-cycles, with professional lines like D&O and cyber increasingly challenged. Excess casualty in the mid- and high-excess layers has also likely fallen behind loss-cost inflation even if rates remain modestly positive in nominal terms.

There is an increasing need for insurers to underwrite their way through the market, rather than merely to put buckets out to catch the rain.

Prior-year reserve adequacy around casualty back books is also in question, with fears that elevated loss cost inflation is structural.

With scope for more reserve charges, it might be that the later stages of the Golden Age show an even more pronounced bias towards the stronger names.

Insurers also received an effective claims dividend from Covid across a two-year plus period, although this break on loss costs looks to have fully passed.

The uncertain outlook reflects a swathe of known unknowns.

The macro-economic landscape remains difficult to read. Growth has remained more resilient than most expected, with inflation also at last falling. But it remains to be seen if the Fed can fully tame inflation without triggering a recession.

Property market conditions will reflect the magnitude and distribution of cat losses in 2023, with Hurricanes Idalia and Hilary, as well as the Hawaiian wildfires, adding a further $10bn-$15bn to an active H1 that cost $43bn.

Otherwise, as a surplus lines market, the E&S insurers are highly dependent on the behavior of other parts of the insurance ecosystem.

Its growth is highly reliant on restricted appetite from the admitted insurers that write more than 3x as much commercial lines premium. If Travelers, Hartford, CNA and co decide that they want to go for growth, conditions will reverse rapidly.

This would likely move in tandem with a drive from large retail brokers to “bring the business home”, repatriating it from the wholesale channel. Little has been achieved on this front to date, but senior retail brokers are talking about it in private.

Client rate fatigue is already making itself felt through the increased use of captives, and various forms of under-insurance or restricted coverage. A revolt from clients could pressure the continuation of the Long Firming that extends back to 2018/19.

These known unknowns have the scope either to prolong the Golden Age, or to bring the curtain down on it.

The E&S market faces one further challenge. Overperform for a prolonged period of time, and observers will rebase their expectations.

E&S has been a winning bet for so long that the degree to which it is dependent on the cycle may have been lost sight of by investors – particularly when there is a temptation to label the growth as structural.

When expectations become sky high, nothing short of great results is good enough.

The Golden Age extends

The Golden Age was predicated on a rapid growth environment, and that continued through the second half of 2022 and on into 2023.

WSIA figures show that E&S premiums rose 16% in H1. E&S posterchild Kinsale provided an even more dramatic illustration of the market’s growth potential by posting 58% growth in gross premiums.

This leaves the market heading for its sixth consecutive year of double-digit growth, including at least one and potentially two years in excess of 20%.

These are incredibly striking numbers in a sector that broadly tracks the overall size of the economy.

Progressively the E&S market over the last 20-30 years has established itself as a core part of the US commercial lines ecosystem, and it has decisively underlined this status through the hardening phase of the cycle by seizing so much market share.

Despite a longstanding expectation that the firming of rates would peter out through 2022 and on in 2023, aggregate rate measures show a re-acceleration of E&S rates.

Using James River as a market proxy, rates can be seen to bottom out at +7% in Q4 before advancing to +9% in Q1 and 11% in Q2.

The rise in rates is likely largely driven by a rapid re-acceleration of property rates. Wholesale broker CRC’s REDY index shows rate increases surging from 11.3% in October to 28.2% in June.

Property underwriting sources have repeatedly described the market as the hardest they have ever seen, with rates at record levels.

Sources were also confident about the overall quality of underwriting portfolios in 2023. Books have benefited from years of compound rate rises, significant limit compression, increased retentions and tightened T&Cs.

The last three of these changes are not apparent in the headline financials, but are crucial in determining the quality of a portfolio.

The E&S market as a whole posted a 91% combined ratio in 2021, and saw this move out to 87% in 2022, as Hurricane Ian imposed a heavy cat load.

Good E&S insurers are budgeting combined ratios comfortably in the 80s on an ultimate basis, according to sources, and the best of the best may be in the 70s.

Complexities and warning signs

But while the landscape remains highly favorable, there are a number of complexities and warning signs.

1. Specialty insurers that want to grow property exposures into the hard market – or even retain their existing book – have to accept the trade-off between increased profitability, and higher volatility.

With insurers able to command rate increases of 40% or 50% on cat-exposed E&S property books, they have had the opportunity to write books with much improved projected profitability.

However, they are doing this into an environment where reinsurers are trying to “upstream” cat risk to the primary market.

This has included a push for substantially higher retentions on cat XoLs that have curbed the availability of cover below a 1-in-10-year return period. The ability to hand off cat risk ground-up through quota shares at attractive cedes, with sideways risk bought out through aggregate covers has also been severely constrained.

This has left insurers facing a trade-off between significantly increased profitability, and higher volatility. True E&S writers might like this kind of devil’s bargain – but in a world where investors dislike volatility and cat has underperformed year-in-year-out it remains a difficult strategic decision.

Sources have said that expectations of further premium uplift next year relied on an active wind season. However, some are now wondering whether the significantly increased average expected loss numbers in RMS’ new wind model could drive an additional bout of hardening.

The E&S market is divided on whether the admitted homeowners’ market in California and Florida represents an opportunity, or a banana skin. Some argue that the homeowners risk is akin to direct and facultative property, and could be written in the E&S market if it was priced properly and written on an appropriate policy form.

Others believe that personal lines is a “totally different ballgame” to commercial lines, or believe that it requires an infrastructure that they lack.

2. The overall pricing cycle has fragmented further, with areas like D&O and cyber causes for concern, and some layers of excess casualty falling behind loss-cost inflation.

D&O moved early and dramatically, and has since gone spectacularly into reverse with sources recently suggesting rate reductions of 25-30% on public D&O business.

This business surged into the E&S market in 2019 and 2020 as retailers struggling for capacity felt the need to maximize placement options. Most of the non-traditional public D&O has now moved back entirely to admitted paper, according to sources.

Cyber was another area that saw a wholesale boom during the 2021/22 capacity crunch, and which has gone into reverse as rates took a negative turn from Q4 last year.

The general liability market is more complex and multi-speed, but in a recent deep dive sources said that rate rises on mid- and high excess layers are low-to-mid single digits, with reductions of low single-digits achievable in some cases. (For background see: “General liability: Looking for harbingers of the turn”)

There has been some re-acceleration of rates in the lead umbrella and excess layers through the first half of the year, reflecting fears around rapidly rising severity.

In this kind of dynamic and fragmented environment, sources stressed that it was increasingly important for insurers to carefully underwrite their way through the market.

3. Submission flows are at record levels, but the rate of increase has slowed and premium growth is overwhelmingly being driven by higher premiums and valuations.

WSIA figures show that the number of E&S transactions – which rose ~7% in 2021 and 2022 – were up only 3% in the first half.

Year-to-date data in July from California, Florida, New York and Texas showed a 0.2% fall in the number of transactions, alongside a double-digit growth in premiums.

A number of senior executives told Inside P&C that they are still seeing double-digit growth in submission growth, so there is a partial mismatch between anecdotal evidence and data.

4. One of the biggest threats to the favorable operating environment is loss cost inflation in casualty lines, and the potential for reserve charges to emerge from the soft market years.

Increasing severity is a cause for concern in casualty lines, with one source suggesting that they had seen data that showed the average wrongful death claim rising from ~$10mn in 2019 to $18mn-$20mn in 2023 – equivalent to mid-to-high teens inflation.

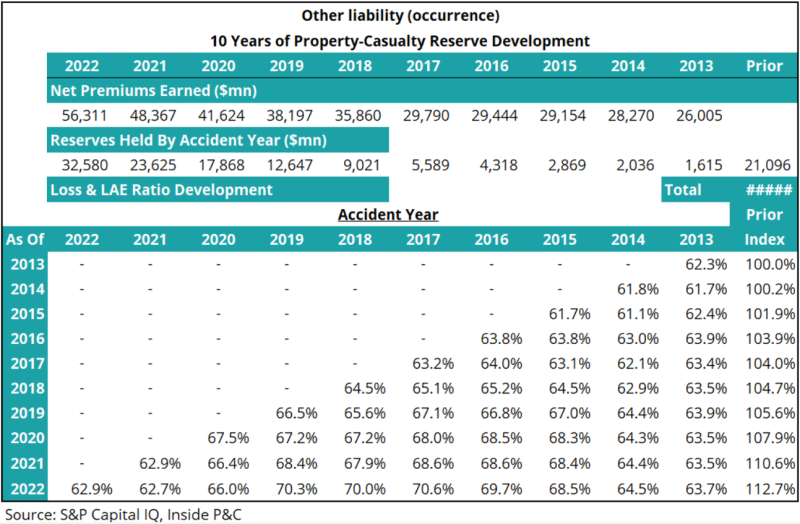

Alongside this, there are fears that further negative surprises will emerge from the underpriced 2014 to 2019 underwriting years.

The insurance industry did not hold its loss pick in other liability occurrence between 2013 and 2019, and multiple years have deteriorated by more than five percentage points.

Legacy market sources believe that there is a possibility that other specialty insurers will follow the likes of Argo and James River in taking a charge on their back books.

The factors driving uncertainty

The longevity of the specialty Golden Age will turn on a combination of macroeconomic factors, cat loss experience, and major strategic decisions by other parts of the insurance ecosystem.

CPI inflation has fallen from a peak of 9.1% to just 3.2% in July, with core inflation at 4.7%.

There is not a perfect read-across between CPI and insurance loss-cost inflation, but they are tied. Inflation has been a key extender of the commercial lines pricing cycle.

If inflation has indeed been tamed by the Fed and comes back down to its 2% target in the coming months, it is likely to start to pare back loss-cost inflation and this along with slower exposure increases could cool premium growth.

It may also set the scene for a reduction in interest rates next year – something which would hurt the attractive new-money yields currently available to insurers.

The resilience of the US economy has supported insurance growth over the last year. If interest rates did push the economy into recession, falling exposures could cause a ramp up in competition, ending the cycle of rate hardening.

Cat losses always remain a wildcard, and sea surface temperatures look favorable for hurricane activity. The year has already been an active period for cat losses with a high level of severe convective storm activity, a shock ~$5bn wildfire loss in Hawaii, and what looks to be a single-digit-billion wind loss from Idalia.

The sustainability of favorable conditions in the E&S market largely turns on restricted appetite in the admitted market.

The Golden Age was kicked off by the realization of insurers that they had overshot on rate reductions, triggering a massive shedding of business that cycled through to the E&S market.

Admitted insurers have been cautious on growth and highly focused on profitability, but history suggests that they will become comfortable enough at some point that they will seek growth.

At that point, they will offer bigger lines and lower prices, prompting a repatriation of business from E&S to the standard lines market.

The retail brokers will play an important role in ushering in this change. As their impatience grows with sharing brokerage with wholesalers, and they increase their focus on market-derived income as a hedge against a cycle turn, retail brokers are likely to increase pressure on standard lines carriers to increase their risk appetite.

After paying rate rises that started in 2017 in some lines, there is a high level of fatigue from end clients, according to sources. This pressure – which the retail brokers transmit to the market – could ultimately be decisive in bringing to a close the firming cycle that has been driving E&S growth.

It is possible to piece together these different dynamics in ways that could extend out the Golden Age well into 2024, or to construct scenarios where it would meet its demise.

Great Expectations

One of the problems with an extended Golden Age is that it drives expectations to unheard-of levels.

With every double-digit growth year backed by strong profitability that is posted, the expectation strengthens that this is par for the course.

This misses the reality that E&S insurers are not in control of their own fate. As a wholesale market, it relies on the retail market, and effectively profits from its weakness and the resultant caution.

Any time its major participants want, the admitted market can overpower its smaller, better performing mirror image to reclaim market share.

E&S insurers benefit disproportionately in the hardening phase of the cycle, but they have an additional top-line challenge in the softening phase.

They can’t have one without the other.

Golden Ages ultimately give way to Dark Ages.