California has had similar issues, with carriers caught between wildfires, increasing auto loss costs, and a difficult regulatory environment.

Earlier this week, our news team reported on the situation in Texas, another cat-prone state which faces similar challenges on loss development and rising reinsurance costs. Sources on the ground suggested while the personal lines market is under pressure, it is unlikely to be the next California.

Following up on our news team’s reporting, this note explores the available data points for the Texas market and examines whether or not we are building to a situation similar to what we’ve seen in those other troubled states.

As with Citizens in Florida, Texas has seen a move towards state-sponsored insurer Twia

In our hurricane-related pieces, we’ve extensively covered the multi-decade migration of national insurance companies away from Florida, leaving local carriers, which have struggled in the difficult environment.

As those carriers moved away, Citizens, Florida’s state-backed insurer of last resort, has been picking up a lot of the slack.

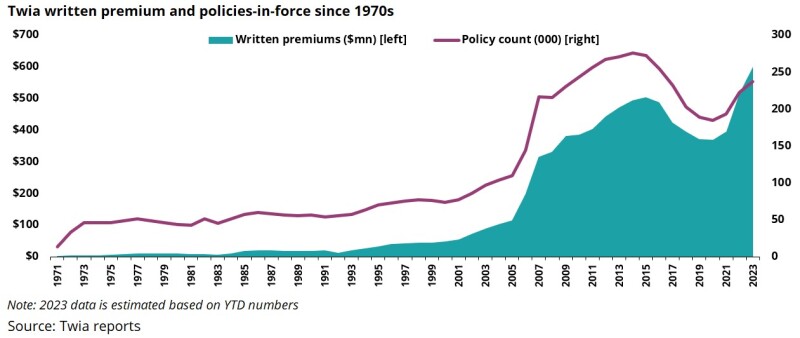

Texas has a similar quasi-state body called Twia (the Texas Windstorm Insurance Association), which has been around for decades. The chart below shows its policy count and premium since 1971.

There is a distinct, recent period during which the number of policies with Twia was declining, and we can see this has suddenly turned around over the past two or three years. We have not yet reached 2013 levels, which is somewhat promising as Texas has clearly survived a period like this before. The future will depend on whether this trend slows or continues its upward momentum.

So, while this trend does parallel what we have seen in Florida, it is not clear if this is a significant cause for concern yet.

California’s troubles were driven in part by regulation, which is not as difficult in Texas

Insurers in California have recently begun to pull out or stop new business, due to difficult results over the past few years. These results have been driven by a combination of forces beyond their control, primarily catastrophic wildfires, as well as the inflationary effects on loss costs, combined with a moratorium on rate filing approvals that would have let them combat the effects.

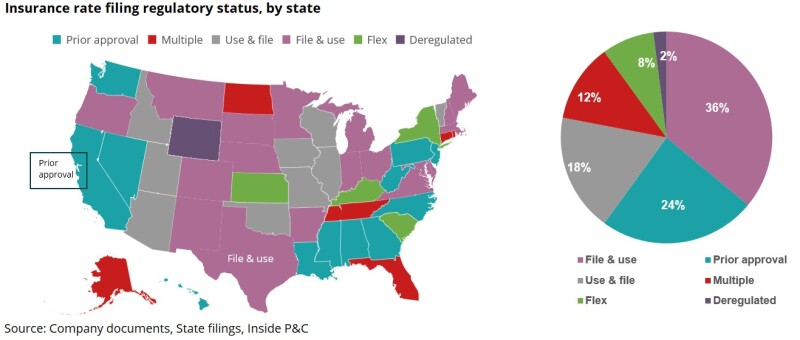

The map below shows the rate filing approval method for each state, and we can immediately see that Texas and California are in different situations. While California has the more difficult “prior approval” method, Texas is “File & use”. A rate filing moratorium on top of this exacerbated the situation in California.

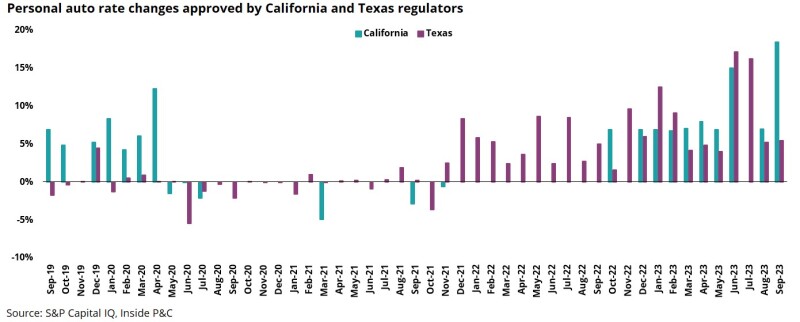

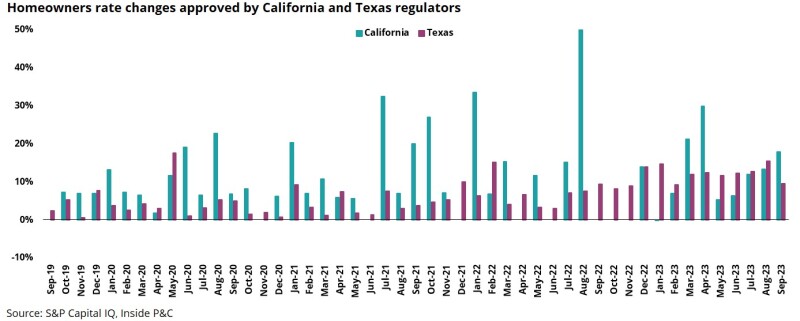

The charts below show the rate activity in California vs. Texas for auto and homeowners’. The two lines paint slightly different pictures. In personal auto, we can see the moratorium in California. Texas had minimal change during that time, as loss costs were lower due to Covid.

The important part to note is that when loss costs began to increase again, insurers in California were trapped while those in Texas could begin to push the pedal.

In homeowners’, we see a slightly different story, with consistent smaller increases in Texas, and more sporadic, giant rate increases in California.

These charts emphasize the challenges California faces as a state in terms of regulation and rate approvals. As Texas heads into a difficult period, it is doing so without having been held back for three years on rate, so the situation is not as challenging as it has been in California.

Texas has had more stable top lines and results than either Florida or California over the past 20 years

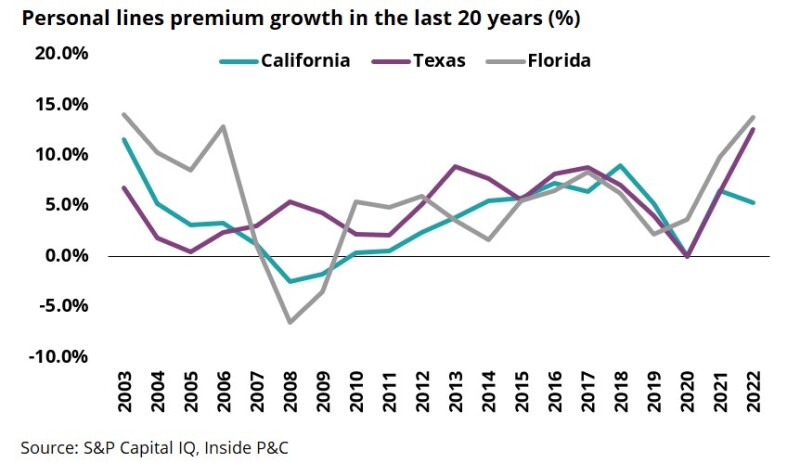

All three states have been facing difficulties from natural disasters, and all three are highly populated, so it is not that surprising to see the premium growth charts below mostly following the same direction.

Keeping in mind the chart below shows change in premium, it is significant that Texas’s trend line is consistently above the x axis, while the other two have sunk below below. In Florida and California, premiums have fluctuated, while premiums in Texas have consistently grown, bar a flat development period for Covid.

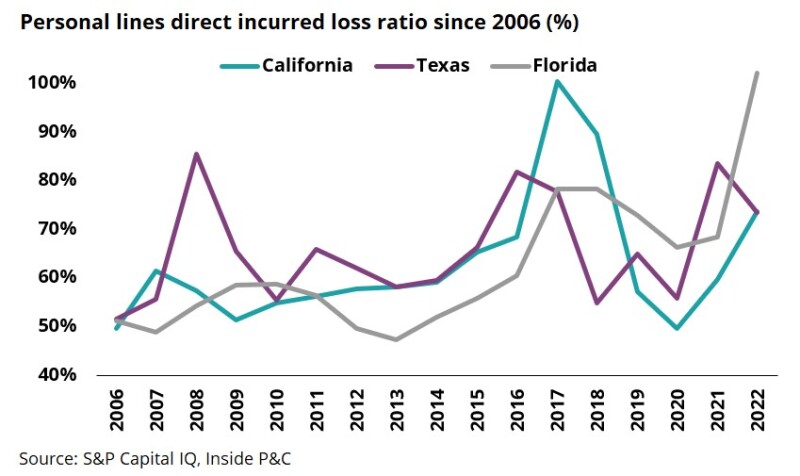

Moving to loss ratio data, the Texas personal lines market has had years when it has performed worse or better than the other two states, but we would highlight that the Texan results have a narrower range.

All states have ups or downs, but massive swings make things harder to navigate. So, while these loss ratios might look like they net out to about the same, the marginal stability of Texas would make the environment easier for insurers operating there.

In summary, there are a number of parallels between the situations in Florida and California and what is beginning to develop in Texas. However, those situations were exacerbated by outside factors which do not apply in Texas. So, while Texas may be heading into a similarly tough patch, there is a good chance it will not reach the levels we have seen in the other two states.