We often talk about the "cost of goods sold" problem in insurance. We have seen many acquisitions go sideways due to adverse reserve development in the acquired entity after the deal has closed. Consequently, we often take a pessimistic view on balance sheet acquisitions, especially those with predominantly long-tail lines.

But what about acquisitions that carry little or no balance sheet risk? Specifically, what about consolidation related to MGAs?

Some of us joined the industry when the market was initially recovering from the crisis resulting from MGAs "giving away the pen” 20+ years ago. So, we still have trouble wholeheartedly embracing every MGA’s premise that they are providing a much-needed solution to a capacity, distribution, or specialty product problem. But that is a topic for another day.

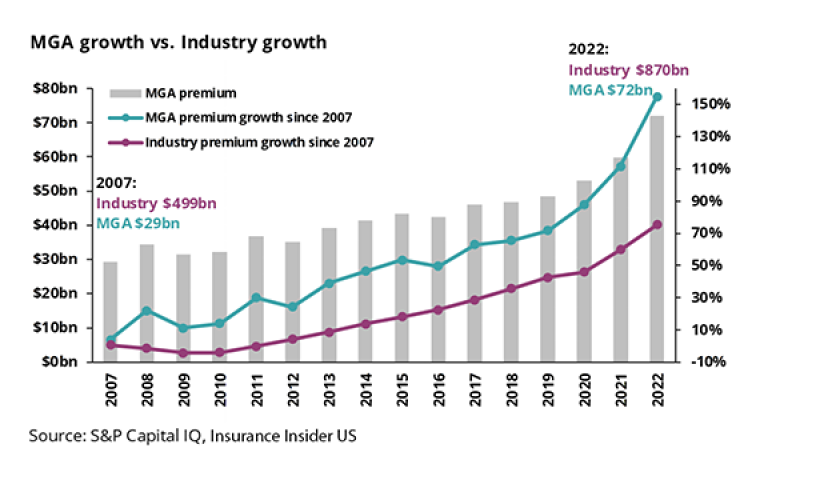

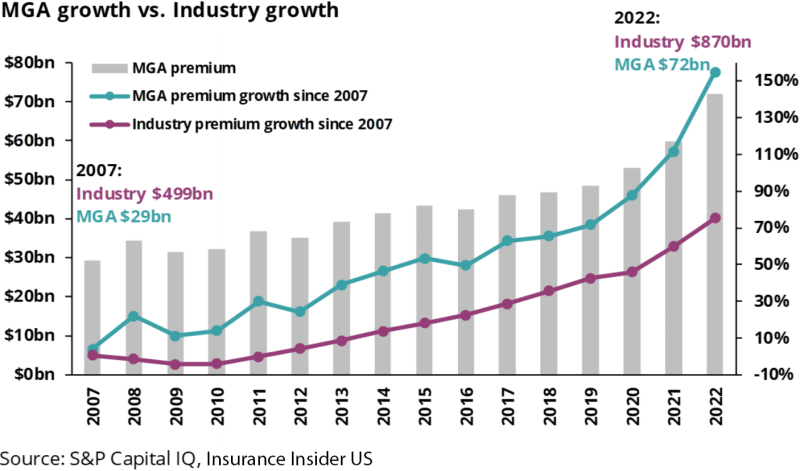

What is certain is that MGA premiums have continued to grow from strength to strength, nearly doubling over time, while the industry premium shows a slightly lower growth rate over a similar time frame.

If constructed correctly, MGAs (including InsurTechs) can provide primary insurers and reinsurers with well-priced business, giving their partners the option to dial back on growth when market conditions turn.

InsurTech MGAs, in theory, go even further in solving this problem, scaling up much faster. But with great growth comes great capital requirements. InsurTech MGAs can only scale up so much based on their PE capital and have now reached a fork in the road.

The current funding environment and higher cost of capital have slowed the flow of cheap money. Consequently, InsurTechs are being forced to either slow their growth and miss out on the hard market business, or look for exits like we saw this month with Corvus.

The Insurance Insider US Research team assessed the market landscape and the needed considerations for InsurTech MGA valuation.

Firstly, MGAs have witnessed rapid growth and now are potentially close to 10% of the marketplace for year-end 2023. This is no longer a fringe space, and insurers who partner with MGAs with unique books of business can accelerate their market penetration.

Secondly, valuing an MGA is as much an art as a science, and we would caution against using simplistic measures. Additionally, factors such as management and founder background, underwriting track record, tech platform, as well as size, complexity and diversity of the book will play an important role in which MGAs get acquired and which get left behind.

Thirdly, not every MGA will survive, and incumbents with excess capital will increasingly look at this space as an attractive place to deploy it. We also developed a partial list of interesting companies to watch.

The note below covers these points in greater detail:

Firstly, MGAs are close to a $80bn-$90bn business, which is 10% of the industry

The chart below shows direct written premiums, written via US-based MGAs. Using Note 19 from NAIC statutory statements, we get to a market size of $72bn as of year-end 2022.

[Note that a major caveat exists when using Note 19 data. Under the MGA act of 2002, insurers report MGA relationships which are equal to, or greater than 5% of the prior period policyholders’ surplus. Consequently, industry participants may gross up the Note 19 numbers by 10% to 15% to get to a closer approximation of the marketplace.]

The chart below also shows that premiums have remained relatively stable over a long period, followed by an up-tick in recent years.

Historically, provision of paper to MGAs in a hard market falls away, as carriers take advantage of the returns available in the open market without additional fees. However, in this most recent cycle, the paper withdrawal from MGAs has not occurred to the extent that many expected, and in many cases the interests of fronting partners and reinsurers continue to be aligned.

This may also be partially due to MGAs’ focus on niche risks over a plain vanilla book of business favored in prior time periods.

Taking a step back, MGAs, including InsurTech MGAs, are here to stay for the near future, and it makes sense for primary insurers, brokers, and reinsurers to pay attention to this segment. That said, consolidation is an easy way for incumbents to capture some of the growth.

Secondly, valuing an MGA is as much an art as a science, and several factors are used to evaluate this group

Earlier this month, Travelers acquired Corvus for $435mn. In the absence of public financial data, we only have a few data points related to Corvus. These include a $240mn book of business for 2022, a prior funding round valuing the company at $750mn, and some recent deals for comparison.

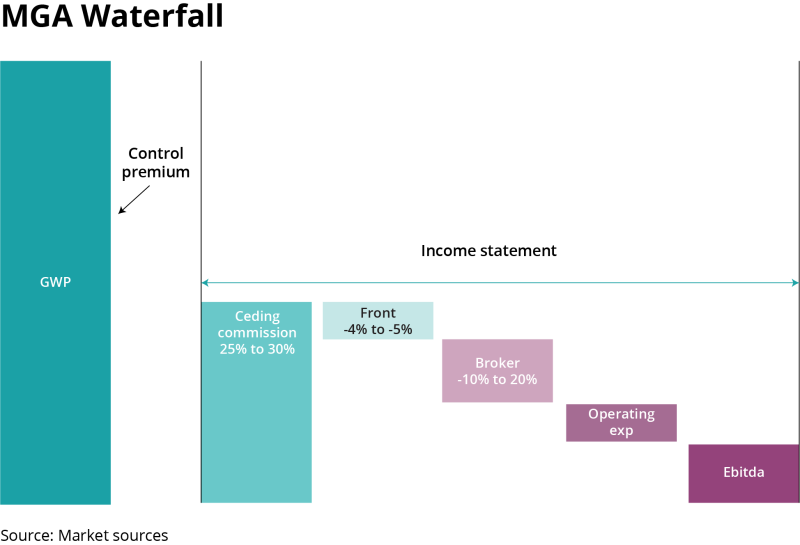

However, our discussions with several venture capital and private equity providers, InsurTechs, and investment bankers have revealed that valuing MGAs is as much an art as a science. Since outsiders don't have the detailed financials, a premium multiple is a starting point, but often only a very rough rule of thumb.

In the Corvus case, this multiple equated to 1.8x ($435mn/$240mn) its premium base. It is too simplistic to say that a 1.8x multiple seems richer or poorer than some other deals. Often, potential acquirers would do a much deeper analysis, including the impact of scaling up, restructuring the fronting and reinsurance commitments, and normalizing the expense base.

Some of these adjustments can add up substantially, as shown in the chart below, and a ground-up discounted cash flow analysis would be what a buyer would look to do.

Taking a step back, ranges of multiples such as 1x-1.5x GWP or 15x-20x Ebitda are starting points to compare deals for MGAs, but any actual buyer would do a much deeper analysis.

The chart below shows an MGA’s income statement. From a buyer’s perspective the amount of inflow/outflow from ceding commission, fronting and broker fees and operating expenses would be an important avenue to restructure.

Additionally, there are six key considerations when evaluating MGAs.

Our discussions with several market participants at VCs, PE and investment banks revealed the following items as core items to evaluate:

Team and employee background: Buyers and partners are willing to look beyond a mercurial founder and focus on the employee base's underwriting and reserving pedigree. This has become more relevant as the initial crop of InsurTechs have often stumbled in attempts to deliver.

Underwriting track record: At the ITC conference, this was one of the biggest changes we noticed in our meetings. Most, if not all, InsurTechs' management could answer questions surrounding the trajectory of underwriting profitability. With discussions surrounding potential loss cost inflation still unclear, this could become a bigger problem if the current accident years start developing adversely over a longer term. Recently, there has been a trend where partners would like the MGAs to have skin in the game (via rated balance sheet entities) and also maintain underwriting standards.

Size of book (current and potential): From large lines of businesses to a monoline focus, InsurTech MGAs come in all sizes and shapes. At the same time, valuation will also depend on the total addressable market vs current penetration.

Tech platform and its uniqueness: A unique technology platform that allows the InsurTech MGA to capture an emerging risk, for example, cyber, will have real revenue stickiness in the long term.

Complexity of product: Is the MGA offering a plain vanilla coverage trying to replace an incumbent product, or is it offering a new set of products to cover an emerging risk?

Diversity of business: Potential InsurTech MGA buyers would also evaluate if several streams of businesses are available to an MGA and the degree to which these could interact in different economic and pricing scenarios.

Consequently, in a flood of MGAs, the ones which have a check mark for the above six factors will rise to the top as attractive consolidation candidates, while the others will be left behind.

Thirdly, who will be the buyers and sellers in the next round of consolidation?

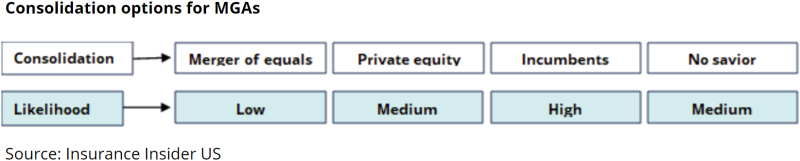

The graphic below shows the likelihood of different consolidation outcomes in the InsurTech MGA space. Amid a difficult funding environment for InsurTech MGAs, the only survivors will be those who have a unique story, and incumbents like Travelers will get to pick and choose the better performers.

The other aspect to note is the incumbent industry's capital level, especially on the commercial insurance side.

In our research piece last week we had highlighted the difference between commercial insurance rate/pricing discussion vs their top line. Insurers continue to pick and choose the best places to position capital, and owning a niche InsurTech MGA is another avenue.

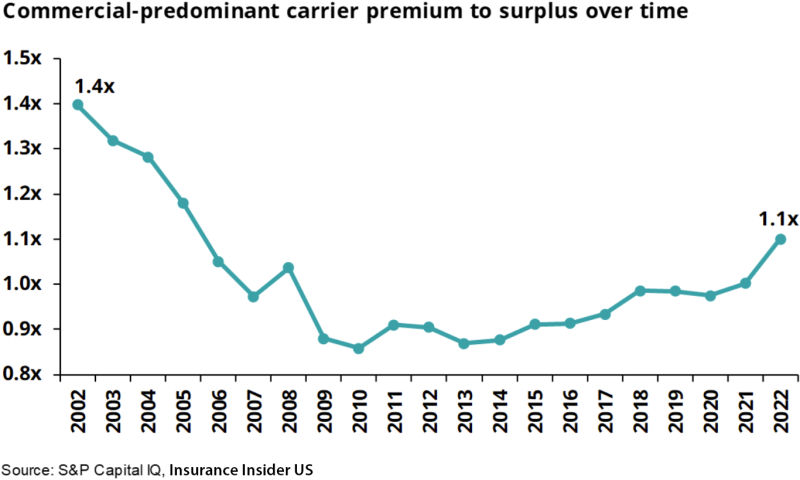

The chart below shows the premium to surplus for these carriers, which still appears to be lower than historical norms.

Currently the industry is writing at a 1.1x premium to surplus, this compares to a much higher level seen post 9/11, which was a true hard market. If we were to optimize the capital being used and assume a higher premium to surplus, in theory, the rest should be excess capital.

The exercise below shows a theoretical $40bn cushion which can be utilized for other purposes.

Yes, some of this capital would be reduced by the additional premiums written in 2023, but the above exercise shows that the industry has the flexibility to deploy some of this excess via acquisitions of InsurTech MGAs as well.

Will the industry deploy this in entirety? Unlikely. But it still leaves billions of dollars which could be put to use.

In terms of which Insurtech MGAs could feature in the next round of consolidation, the list below is a starting point but not exhaustive.

Recently, there has been a pivot where MGAs are beginning to have skin in the game, with a balance sheet entity along with their MGA operations. Our list has attempted to collate these public disclosures on a best-effort basis.

In summary, we believe that no matter what multiples are discussed in the press, the buyers will likely take a long-term ground-up view of this space.

The uniqueness, background, and the potential to scale up would be essential differentiators in attractiveness. Not every InsurTech MGA is going to survive.

Incumbents will continue to pick and choose and look at entities that can help them leapfrog entry into new lines and segments or use the technical platform to speed up the process. In that case, two plus two would end up looking like a five with the right partner.