We telegraphed the US mid-market niche in which NFP is located as one segment that would be attractive to the firm.

Major strategic M&A is difficult to forecast.

Companies don’t typically telegraph intent because such deals are best worked on in the shadows.

And even if is a firm is open to a big acquisition and makes some outbound calls, most of what is explored never comes to fruition. The CEO of the target firm won’t retire, or he thinks his firm’s name should be added to the overall group. Or the stock market crashes. Or debt markets seize up. Or they just want 5% more.

There is an alchemy to a deal getting done that requires lots of elements to come together in the right proportions at the right moment.

That alchemy is rarely achieved.

So I am going to try not to overreach by making a firm prediction.

All those caveats now in place, my source intelligence says that Aon has become more active in weighing opportunities for acquisitions of scaled targets since Q4.

Based on that intel from banking and industry sources, I want to step back and think about the strategic case for an acquisition, and what kind of target may make sense for the firm.

I will argue that the timing makes sense for something bigger. The most compelling targets for the firm are private equity-owned broking businesses in the mid-market and small commercial space.

The time is right

There are multiple reasons why it would make sense for Aon to make such a move now.

First, organic growth is going to become harder to come by as the hugely extended P&C pricing cycle comes to an end, and inflation and growth fall. With the global brokers growing 8%-10% per quarter organically, one of the imperatives to find deals has been absent – but market growth will normalize.

Second, valuations are coming back down to earth. Private platform valuations are down a turn or two from their 18x peak, but this probably understates the amount valuations have fallen given that pro forma adjustments are being more conservatively calculated. (A deal at 18x pro forma Ebitda of $100mn values the firm at $1.8bn. A deal at 16x $90mn values the firm at $1.44bn – 20% less.)

The increased cost of debt capital is also a more meaningful drag on private equity bids, making Aon relatively more competitive for deals than it has been for years.

Third, enough time has probably passed. The Willis acquisition was inked just over three years ago, and broke up 20 months ago. Inevitably there was going to be a period of consolidation afterwards, with nothing of scale attempted in order to settle the horses – but it seems unlikely the Aon board/management team are operating under that constraint anymore.

Capital deployment framework

Aon operates with a different return on capital deployment framework from rival Marsh McLennan. The latter says explicitly that it “favors attractive acquisitions over share repurchases and believe[s] they are the better value creator over the longer term”. (CFO Mark McGivney on Marsh McLennan’s Q4 call.)

At Aon, the firm is looking for the highest “cash-on-cash” return, with CFO Christa Davies highlighting on its Q4 call that “buyback is top of the list, even at today’s prices”.

Given that the return on buybacks is in the eye of the beholder depending on where the company chooses to value its own shares, a confident management team will find it difficult to come up with M&A opportunities that screen as a higher return than share repurchases.

All of which is to say that the case for a cash-funded deal needs to be that much more compelling at Aon than at Marsh McLennan, not that I suspect they are undiscerning at Marsh McLennan.

Of course, Aon has inked (smaller) cash deals in recent years. Typically, it has spent cash to acquire what it sometimes refers to as “content and capabilities” – effectively businesses with talent or IP quite different than it has in its core businesses. (Think, Stroz Frieberg in cyber, or 601West to support intellectual property – much of this in the service of building “net new markets”.)

But it has largely steered clear of deploying its cash on consolidation, and focused more on returning cash to shareholders. Even the WTW deal was all-stock.

Regardless, it still seems plausible that it will look for a cash deal now.

As much as big players tend to skirt around the words, size matters in broking.

And Aon has allowed itself to be outgrown significantly by Marsh McLennan. In 2012 Aon’s revenue base was 96% the size of Marsh McLennan, and in 2022 it was 60% its size.

In the short term, this may not matter in terms of serving clients or driving shareholder returns. But in an industry where consolidation has been a huge driver of value and the consolidation game is far from played out, Aon will suffer in the longer term from sitting on the sidelines and buying back stock.

Short-term rational can be long-term irrational.

A deal in wholesale

My intelligence suggests that Aon favors acquisitions in risk, with health, human capital and wealth less likely to be major plays.

If this proves correct, there are two major parts of the market where it is absent or heavily underweight where it could go on the offensive.

1. Wholesale (including MGAs/binding)

2. Retail mid-market/small commercial/personal lines

Let’s take each of those areas in turn.

Wholesale is a narrow range of possible targets. Given the arcana of the London market and the relatively small size of third-party wholesale, a US wholesale platform would make more sense.

There are only three targets – namely the Big Three: Amwins, Ryan Specialty and Truist Insurance/CRC.

It isn’t clear that any of these businesses are for sale.

Amwins seems completely committed to its balanced staff/institutional shareholder structure, which is arguably the best ownership structure in the industry. Truist Insurance is in the middle of a reorganization that will see Stone Point become a minority owner, with an IPO likely to follow. And Ryan Specialty – which obviously has strong ties to Aon – is a public company, but with a voting rights structure that gives founding CEO Pat Ryan full control.

The second challenge is that the more of the distribution value chain you try to own, the more likely it is you will start to compete with your existing customers, or pick up important customers who have been your long-term competitors.

Either route is challenging. If Aon does buy one of the wholesalers, it will have at the minimum to factor in significant revenue breakage from Marsh revenues that would be pulled Day 1. In all likelihood, there would be other damage even if – and it’s a big if – it could hold the talent given the culture mismatch between big retailer and wholesaler.

Lastly, even if the road seems clear at this point, owning retail and wholesale in the same business at scale has brought regulatory attention before. This could certainly happen again, and Aon would be a much more attractive target for an ambitious Attorney General than groups that have both retail and wholesale like Brown & Brown or Hub.

Much of this is probably just about surmountable – if one of the platforms could be persuaded to sell. And the prize is meaningful. In a harder growth environment, the seemingly structural growth of E&S and MGAs would buoy future organic growth. Margins in wholesale are also strong, and Aon would likely bet on itself to raise the ceiling there.

So there is a case to be made, but it is just the much weaker case.

Retail broking acquisition

The more compelling move is for Aon – which is already a dominant player in large commercial broking and reinsurance broking – to set its sights on building this kind of position in the mid-market and below, starting with the acquisition of one of the more integrated PE-backed retail platforms.

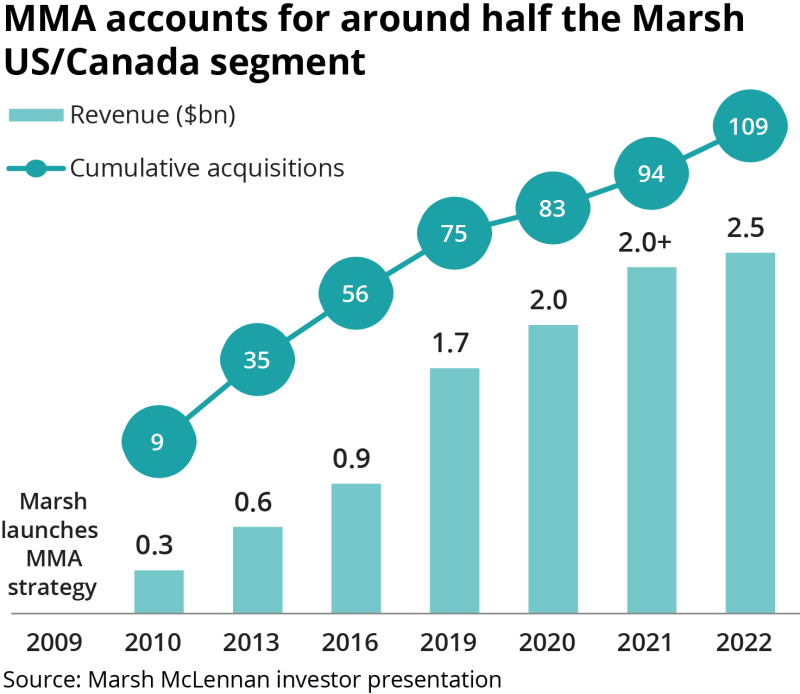

Marsh has proven through Marsh McLennan Agencies that global insurers can play successfully in the mid-market and below, empowering CEO Dave Eslick to build a business with ~$2.5bn of revenues that is probably worth upwards of $10bn on its own.

Much of MMA’s success has come from being able to persuade agencies it is seeking to buy that it can help them turbocharge growth post-deal – and sources suggest the numbers from acquired businesses bear this out.

The playbook isn’t exactly on display but it seems to reflect a combination of better data/analytics, improved placement strategy, access to new product, and market power.

As much as you would expect some similarities in execution, Aon would likely see an opportunity to extend its efforts to seed new markets for the products it is trying to get off the ground. And, one suspects, it would believe that plugging a mid-market platform into Aon Business Services – its back-office platform – would unlock cost savings over and above what Marsh has achieved.

Of course, such a move would not be without its issues. Aon’s strategy – Aon United – focuses on knitting the group together with one brand, one P&L, one relationship manager for each client, one executive team. The limits of this model would be tested if Aon were to buy one of the PE-backed platforms, and it would likely need to flex to fully capture the opportunity.

It seems an odd statement given the ferocious pace of consolidation over the past decade, but the US mid-market and small commercial space remains highly fragmented. And it is huge. Sources estimate $40bn-$60bn of revenues in this segment – four to five Marshes – and it is likely no player has more than about a 10% share.

After a frenetic period of platform creation and scaling over the past five years, more difficult conditions could augur the beginning of the consolidation of some of the consolidators.

If Aon chooses to stay away from the market, other brokers will capture the new clients and scale benefits of doing that consolidation work, and there is no shortage of dynamic firms both in the public space (Marsh McLennan, AJ Gallagher, Brown & Brown) and on the private side (Hub, Acrisure, USI, AssuredPartners, etc) who could look to fill the void.

And Aon is well placed to execute on the consolidation opportunity due to its balance sheet strength, efficiency, data/analytics, investor confidence and strong management team.

Consolidation of the US mid-market/small commercial space is no longer in an early inning, but it is not too late for Aon to play successfully – particularly if its starting point was an already established and successful platform.

The wild card

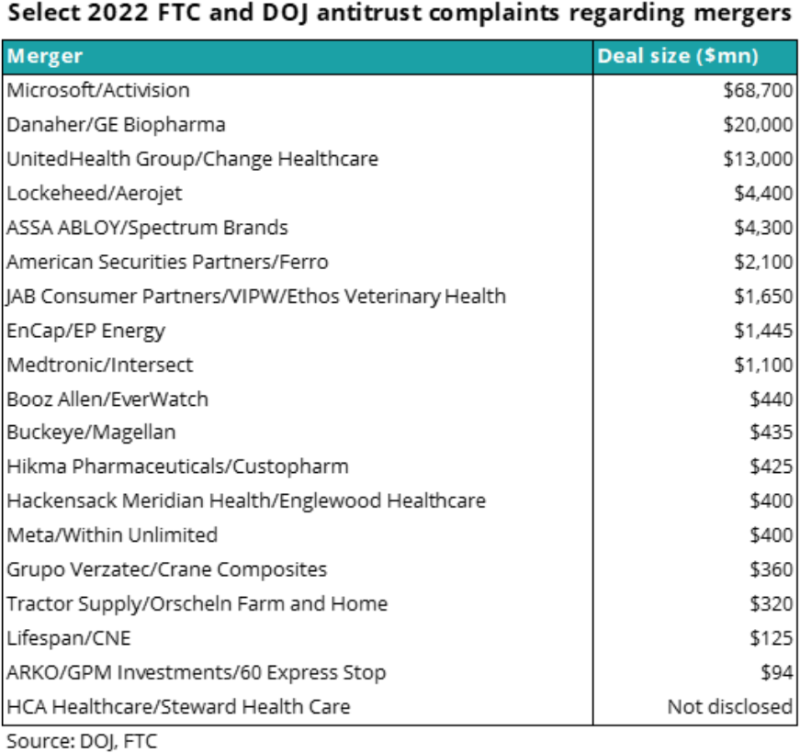

There is a wild card that complicates the picture. The antitrust landscape in the US has become highly stringent and politicized, with a string of even small deals coming under regulatory pressure.

A fair analysis of an Aon deal for a $5bn-$15bn mid-market retailer would show that the firm has small market share in that space, and even had it made a bolder play by seeking to buy Hub it would not have crossed a threshold that should give a judicious regulator pause for thought.

The market is and would remain fragmented, deconsolidated and with low barriers to entry.

But it is not clear that the US has judicious antitrust watchdogs right now, and Aon may still have a target on its back.

If the company were to fix on another deal at scale and were this to be torpedoed by antitrust, it is hard to see how all of the leadership team would survive.

This kind of wild card could mean that paranoia prevails. (Although is it truly paranoia if they really are out to get you?)

In such a case, a similar playbook could be rolled out internationally – targeting the UK, Continental Europe and Australia – although going international would also mean going smaller because the markets are smaller.

All deal-making is, of course, inherently risky. But there are risks attached to doing nothing too, and the odds are shortening that Aon will now make a move.