Past performance is often not an indicator of future results. One might have said the same thing when watching the AFC Championship game this weekend: The Kansas City Chiefs prevailed vs crowd favorite Lamar Jackson and the Ravens. Things were even more unexpected in the NFC Championship game, where the favored 49ers had to come from behind, closing a stunning 17-point halftime deficit to end the Detroit Lions’ Cinderella story.

A similar upending of trends played out during the brokers earnings season. Truist kicked off earnings season a little over a week ago, releasing strong organic growth of 7.3%, up from 6.3% in the prior quarter and 5.6% Q4 2022. This caused the industry to ask the question, do Truist results indicate the direction for the rest of the group?

We think the real question is more nuanced than this, just like the Super Bowl match-up in two weeks focusing on the Chiefs’ offense vs the 49ers’ defense. In the past, we have written about the fact that Truist has a much larger wholesale portion than other brokers, meaning that the drivers of its numbers will differ.

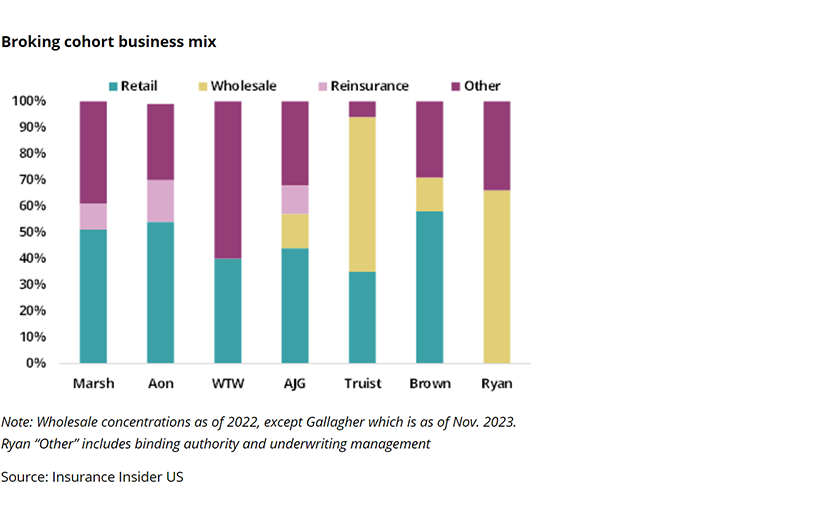

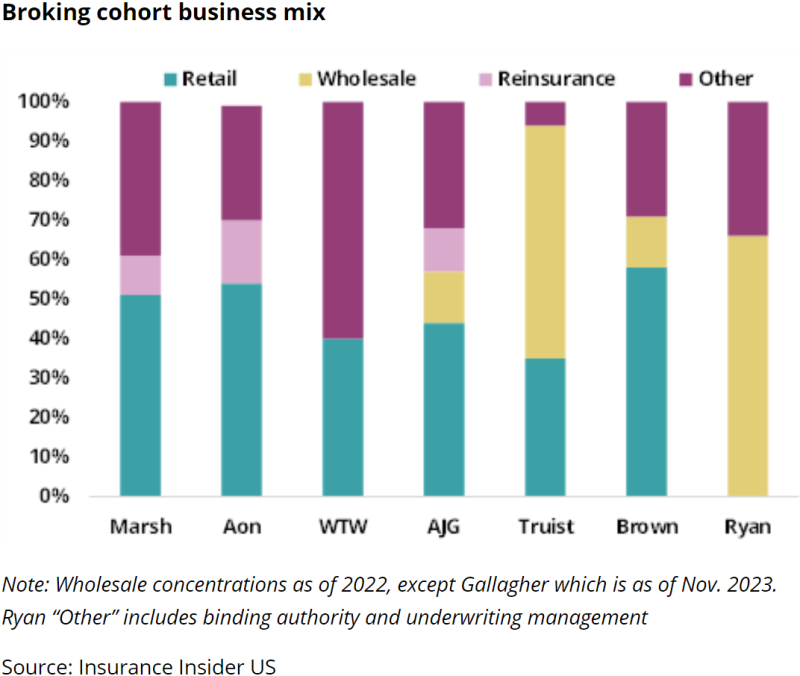

However, this is not the only differentiator in the sector. As the chart below shows, despite the broking cohort being made up of franchises with similar pieces, the concentrations of their business mix vary significantly.

This note will examine how some of these differences play out, and what we can expect from here.

The insurance/reinsurance mix drove result differences over the past year, but this trend is normalizing

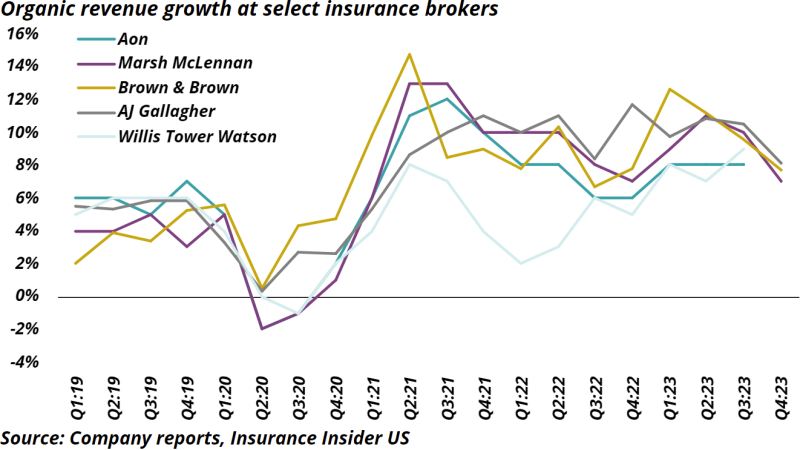

After rates began to moderate somewhat over the past two years (prop-cat excluded), we saw a bit of a wobble on the organic revenue trends, with many brokers heading down, then bumping back up as inflation increased. However, we noticed at this point that the movements for some brokers stood out in different quarters.

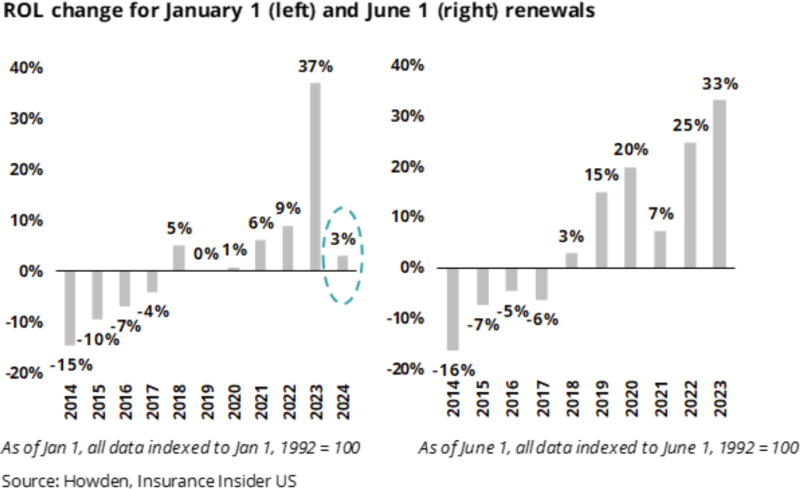

One of the key drivers here is how the business mix skews to reinsurance for some names. Looking at the rate-on-line chart from Howden below, we can see there was a spike in January 2023 to a 37% increase in global rate-on-line, followed by 33% in June for Florida renewals.

While these jumps don’t translate completely directly into broker numbers, they still have to have a significant impact on the top line (with minimal impact on the bottom line compared to the carriers).

Last year, we saw the clear winner from this phenomenon to be AJ Gallagher, whose timely acquisition of Willis Re a year prior led to having a major reinsurance operation exactly when these numbers started to come through. Gallagher Re’s organic growth was 20% in Q3 2023, and 12% in Q4 2023, both incredibly strong numbers.

However, with the major renewals being in January, April, and June, Q4 lacked momentum to keep this trend going. Looking back at the ROL chart, the January 2023 growth has dropped down to pre-2020 levels, so we expect this will not continue to be a driving force for organic growth.

Florida remains a wildcard. In the absence of an active hurricane season this past year, it may be hard to continue to get major increases at the June renewals, which would further flatten broker growth in this segment.

The takeaway here is that while reinsurance has been a tailwind for a subset of brokers, the tides have already begun to turn and we should not expect this to continue to drive outperformance.

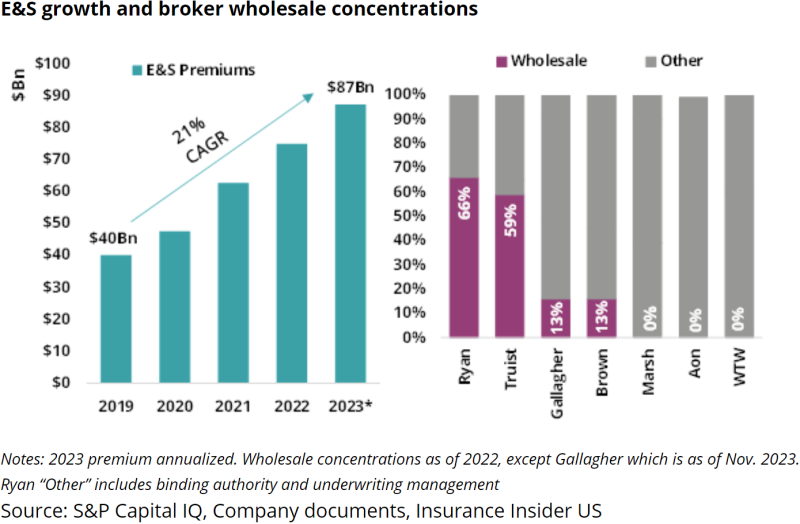

Wholesale vs retail is an ongoing differentiator, with E&S growth driving outperformance

In the noise of the reinsurance boom this past year, it was easy to lose sight of a larger, more overarching trend, which is coming to be a more clear-cut determining factor in this quarter’s success stories. That is the wholesale factor.

Though reinsurance may be normalizing, the E&S golden age has shown no signs of slowing. Looking at annual growth to reduce noise of cyclicality, we can see it has been very smooth growth for the space over the past five years.

This has caused those brokers with a concentration in wholesale (shown to the right) to outperform.

While not all brokers give a specific wholesale organic growth number, Gallagher has indicated that its wholesale arm, RPS, had 12% organic growth in Q4. Brown & Brown indicated wholesale growth of 14.5%. Ryan is also a good indication of this trend, as the wholesale brokers organic growth in Q3 was 14.7%

Based on this data, we would expect another double-digit quarter for this company when they report on February 27.

Looking to the near future, while the normalizing of rate and potential decrease in inflation should lower organic growth for brokers, we do expect a continued divergence in performance based on concentration in wholesale.

A subtler driver of success is the client base

The first two points give us a fair indication of why some brokers are outperforming the trend line. However, this does not yet explain what we have seen with Brown & Brown. This brings us to the underlying nature of the business brokered, specifically with respect to account focus and geography.

While Aon, Marsh, WTW and Gallagher exist in mostly the same very large global commercial space with variations as to the business mix, Brown has significant personal lines and small commercial business. It also has much more of a US focus.

As indicated in its 2022 10-K, Brown & Brown has 19% of its business in Florida (its home state), meaning that it benefits from the pricing shift there, and without having to pay losses like the carriers. In addition, another 37% of its business is concentrated in just five additional states. This means that any effects in those states are amplified.

Looking at the larger brokers, it is interesting to note that while we usually look only at the global numbers, if we drill down to the brokerage numbers for the US, we see smaller growth. In fact, booming growth in APAC and Latin America are significantly shifting the needle for these larger franchises despite their smaller size. For example, the Q4 organic growth for Marsh US/Canada was only 5% for Q4 2023, compared to its overall number of 7%.

This is additional proof that the geography and account mix are driving some of Brown & Brown’s success, as Marsh and Aon have a more uniform distribution in their US geographic concentration.

While growth is important, the real measure of success is margin expansion

So far, broker growth this quarter continues to be in the high single digits (with Ryan still potentially coming in even higher) - a positive trend for the group, even if it is part of a larger slowdown. However, the more important metric to look at is margins.

Unfortunately, not all brokers report the same data on margins, and with the 10-Ks not yet released, we can’t calculate the standardized operating margins for a few weeks. As a proxy, we have collected commentary from the calls.

Based on the information available, Brown & Brown and Truist had their margins shrink year-over-year, while Gallagher and Marsh saw some degree of expansion.

So while Brown & Brown and Truist have had some fairly strong organic growth, we can infer that the expenses have been growing in step with the organic growth, while the growth for Gallagher and Marsh may have been slightly more profitable.

In summary, while the broker super-cycle lifted all the companies’ results, as it winds down, we are seeing some of the individual franchises’ business mixes yield better results, depending on the cycles they are most attached to. Though reinsurance may be slowing down, wholesale should continue to be a primary driver of success for some companies, meaning we will continue to see differing results.