One of the themes this earnings season has been the preponderance of reserve charges from prior accident years. This development was flagged in our 2024 outlook and fourth-quarter earnings preview.

As the earnings season winds down, the two biggest talking points on reserves are what years are deficient and if companies are taking down reserves from recent accident years to fill the prior years’ buckets.

Against that backdrop, the carrier reported a positive quarter generally bereft of large adverse movements in the reserves. Even then, the stock came under pressure as the market digested the trends discussed on the conference call and the press release.

We’ve written about AIG’s last major strategy initiative, AIG 200, and CEO Peter Zaffino’s focus in turning around this once floundering franchise. As the company transitions from ‘AIG 200’ to ‘AIG Next’ post-deconsolidation of Corebridge over 2024, the question now becomes whether Zaffino can take this success and keep up the momentum, especially in light of the overall worsening trend of reserves for the industry.

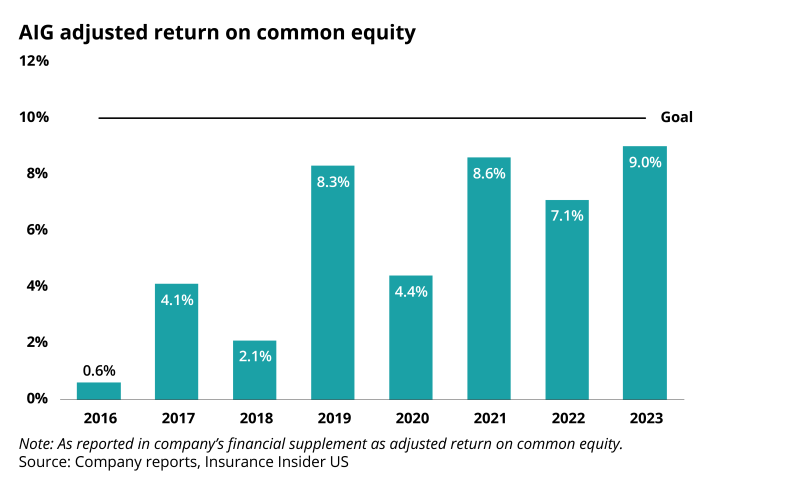

On the conference call, the discussion on reserves focused on attempting to distinguish AIG from the industry, and our note below looks at this by line. Beyond the reserve distinction, the other ever-present goal is a double-digit RoE. Admittedly, the definition of this goal has evolved over the years, and our note looks at this metric over time.

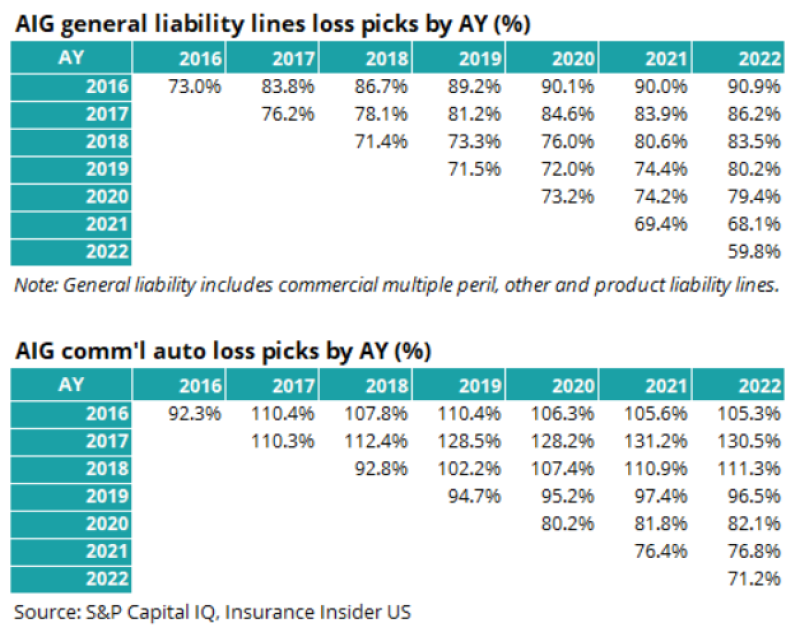

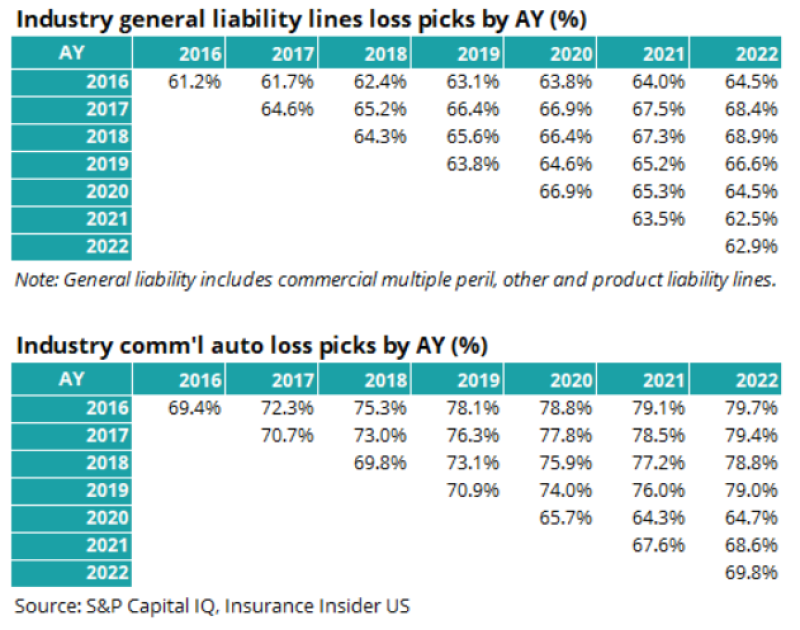

A look at AIG’s general liability loss development and loss picks vs the industry

One of the main themes this earnings season – as we predicted in our Q4 preview – is adverse development for 2015-2019. There has been no discernible pattern as to which carriers have been hit by this, with both small and large names announcing reserve strengthening, while other carriers have dodged this issue successfully. It does feel like we are in the early innings of these charges, and we would be shocked if this was a “one and done” earnings season.

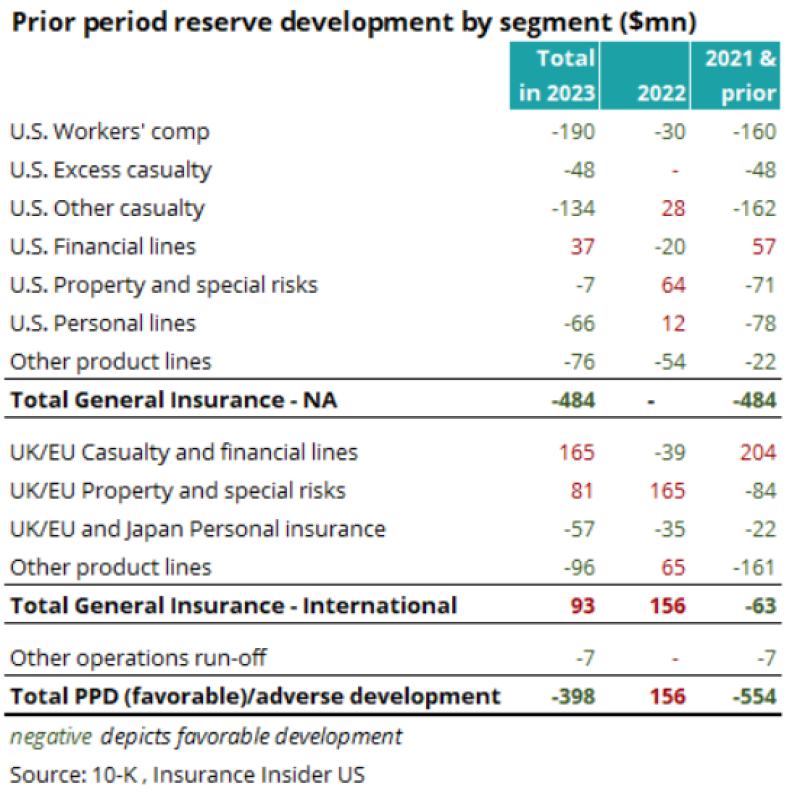

At the same time, AIG itself has undergone a lot of change in a short time frame. The recent earnings announcement and the subsequent 10-K filing gave insight into the moving parts of the reserves for 2023. The table below shows various pluses and minuses in different sub-segments to arrive at the annual development number of $398mn.

Like other players in the industry, workers compensation did the heavy lifting in the US apart from the other casualty bucket for the company, which includes construction defect, wraps and other guaranteed cost products. But beyond these movements, there aren’t any other material movements in non-workers' compensation buckets for general insurance in North America.

On the conference call, AIG suggested that it had been early in recognizing the trends in the North American - general liability and commercial auto lines, to name a few, and that’s why it had not experienced the level of reserve adjustment seen at some of the peer companies. Since the updated data will be reflected in the 2023 statutory filings, which will only start in March, we thought it would be interesting to revisit year-end 2022 filings and back-test those comments.

The triangle below shows AIG’s general liability loss picks, which are read from left to right, with the developed loss pick shown for every subsequent period.

The triangles below are the same lines for the overall P&C industry, and yes, there is truth to the assertion that AIG’s loss picks appear to be higher than the industry loss picks.

For example, for 2017, AIG’s initial pick was 76.2% for general liability lines, and it had developed to 86.2% by the end of 2022. The industry’s initial loss pick was 64.6% and had only developed to 68.4%.

That said, it would be fair to say that a definitive assertion on picking one over the other would be too simplistic a takeaway. Consequently, monitoring these trends for the next few years should address the challenge of comparing loss picks.

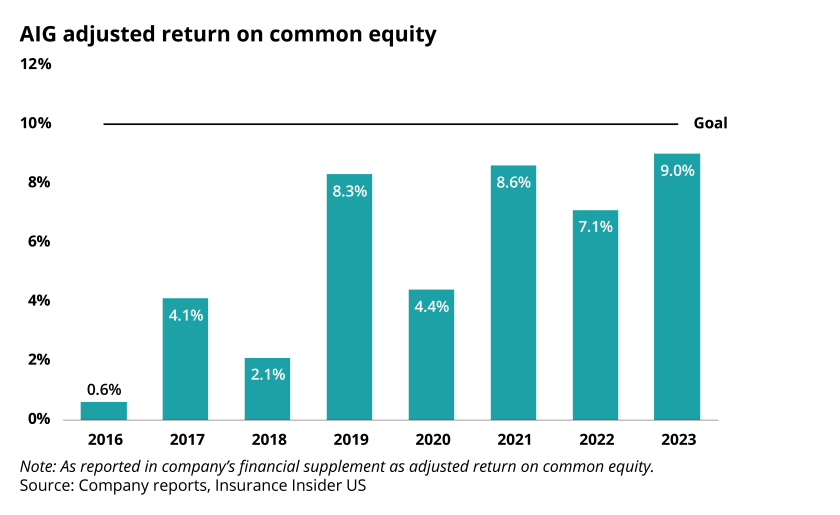

The ROCE goal remains front and center and appears closer

The leadership at AIG has been chasing a double-digit RoE through at least the last three regimes, and the definition has somewhat changed over the years.

With the industry’s substantial reserving noise, it was a possibility that a charge for AIG could derail this goal somewhat.

Our last notes on AIG 200 and Zaffino’s turnaround have shown annual and quarterly graphs of the progress on this front. And although it has been hit in individual quarters, as of 2023, it has not yet been achieved on an annual basis. However, the chart below shows that AIG is making substantial progress.

While there are still ups and downs, looking at the data, there is a very clear upward trend, leaving the low single digits behind. Additionally, the accounting and math with Corebridge still poses some challenges in performing an apples-to-apples comparison. We feel that post-deconsolidation would give a better line of sight into the future trajectory of the company’s RoE.

In summary, AIG’s results did not reflect adverse reserve movements like its peers, and the company appears closer to its ROCE goal. However, caution is warranted based on how loss costs and social inflation trends evolve over the next few years.