Last week, our news team broke the story that the James River auction process had moved on from the potential buyers discussed at that time to an interest from Global Indemnity Insurance.

According to the report, Global Indemnity has made an indicative offer for James River of $15/share through an all-stock exchange. This compares to the undisturbed stock price of $6.75/share for James River before the news story publication, a Q4 reported book value of $14.20/share and tangible common equity of $9.05/share.

The deal comes at an interesting time for both franchises. Both James River and Global Indemnity are in the middle of multi-year turnaround efforts, and both have flirted with selling parts (or all) of the book.

Global Indemnity has not been fully able to capitalize on the merger of its precursor companies, Penn-America and United America Indemnity, in 2004. Recent efforts have even seen it attempting to sell Penn-America, banking on a specialty hard market, but the carrier ultimately claimed not to have found an appropriate deal value.

After its disastrous foray into the ride-share market, James River has seen several rounds of reserve adjustments. The company has made several attempts as of late to fix its book, including an anticipated sale of its casualty reinsurance business to Fleming Re. This transaction itself recently got bogged down in a dispute, and it remains to be seen if we will reach an orderly resolution.

Against this backdrop comes the courting of James River by Global Indemnity’s chairman, Saul Fox. The $15/share is the opening salvo price, and any deal will likely factor in additional adjustments.

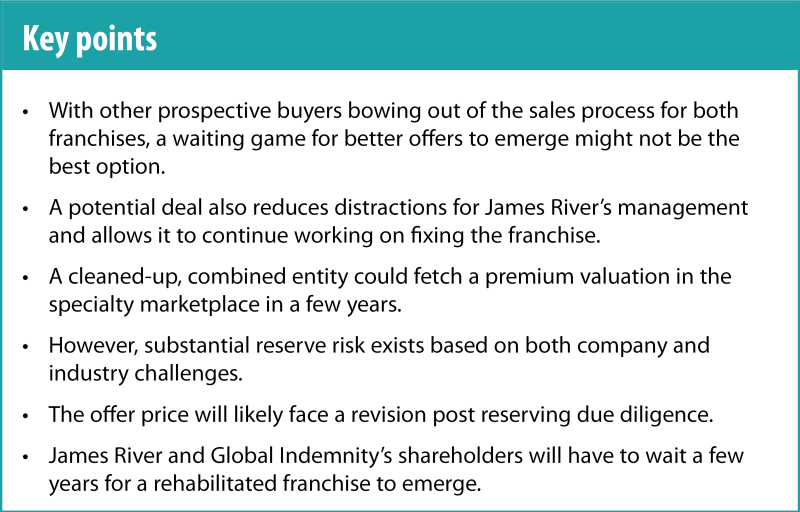

Below are a few factors to consider that might just make this deal work:

First, management and scale considerations could work in favor of the merger, making this deal likely.

Second, reserving is still a significant risk in this story.

Third, current shareholders will need to wait for the valuation to recover, but they could eventually benefit from a more attractive takeout value a few years later.

We discuss these points in detail below:

Management and scale considerations will play a significant role in getting this deal done

With waning interest in James River from other parties, and Global Indemnity not finding an appropriate valuation for its Penn-America business, the options are relatively limited for both these franchises.

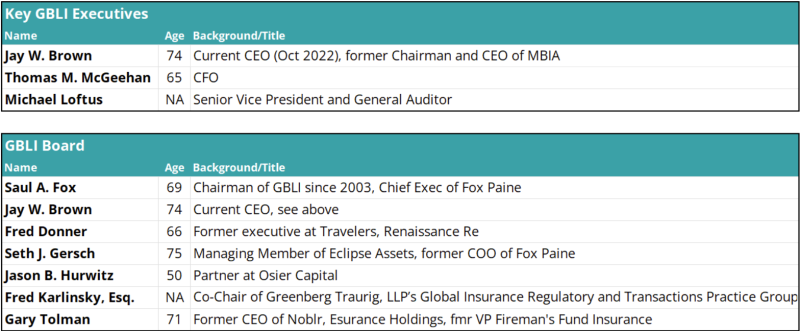

Global Indemnity recently hired a new CEO, Jay Brown, who has been on the board of directors since 2015 but retired from MBIA in 2017. Our news team's story suggests that Global Indemnity would like to retain James River’s management after any potential merger and let it operate as an independent franchise.

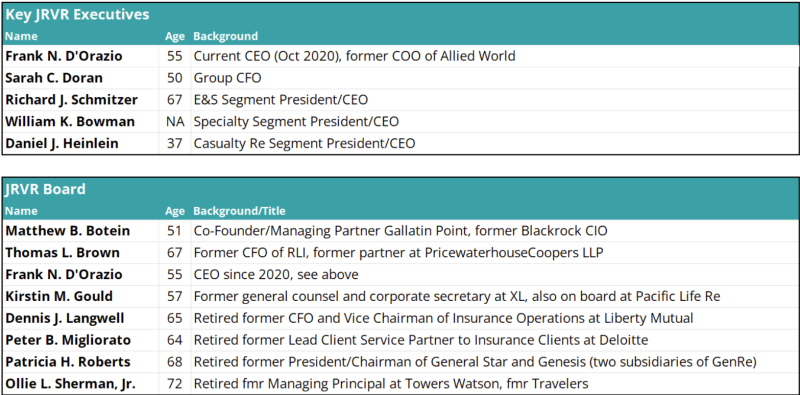

James River CEO Frank D’Orazio is also a relatively recent appointee, as shown in the table below, and a friendly merger would allow it to continue addressing its own challenges as well. Specialty carrier Skyward’s recent IPO valuation indicates a market for cleaner franchises. So, it could be posited that a cleaned-up Global Indemnity/James River could find a premium multiple rather than its current discounted multiple and low investor interest.

Source: Company documents, Insurance Insider US

The other challenge in the marketplace is company size and relevancy. Yes, we are in a favorable specialty market, but a smaller, troubled franchise acquisition would be of low interest to potential acquirers.

On the other hand, a cleaner, larger franchise in a few years could become attractive. Note that most carriers are busy building their organic books, but as pricing decelerates and companies are flush with excess capital, a potential acquisition would be of greater interest.

On a proforma basis, the combined E&S operations of James River and Global Indemnity create a $1.4bn-premium book, as per full-year 2023 data. This would rank the proforma entity as the 20th largest in the market by 2023 E&S premium (compared to James River and Global Indemnity’s individual 2023 rankings of 25th and 58th in the market, respectively).

Cash is always king and provides a certain exit value to owners of James River’s stock. But trading that stock for Global Indemnity’s stock leaves them open to potential insurance cycle and franchise vagaries, as discussed in the next point.

Reserving is a significant risk for this carrier combination

Both Global Indemnity and James River have faced different reserve challenges over the years. Among the other cleanup actions that James River has undertaken, it announced a sale of JRG Reinsurance Co (JRG Re) to legacy firm Fleming Intermediate Holdings late last year.

JRG Re had housed its casualty reinsurance book in this entity. However, this deal has recently gotten caught up in a dispute, and it is unclear what the next steps might be. This has likely led to other potential buyers pausing and wondering what the reserve scenario is at James River.

We view the $15/share as more of a starting point, which will likely be revised depending on due diligence. Based on 2023 Schedule P data, James River’s US business reserves are distributed as follows: 61% Other liability (occurrence), 14% Product Liability (occurrence), 7.4% workers' compensation, and 9.6% Commercial Auto in run-off.

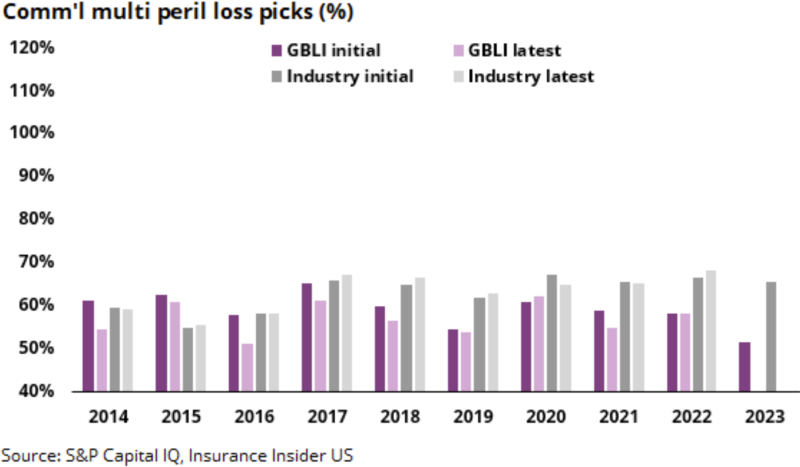

In comparison, Global Indemnity’s 2023 reserve buckets include Other Liability (occurrence) and Commercial multi-peril as the largest pieces at 33% and 29%, respectively.

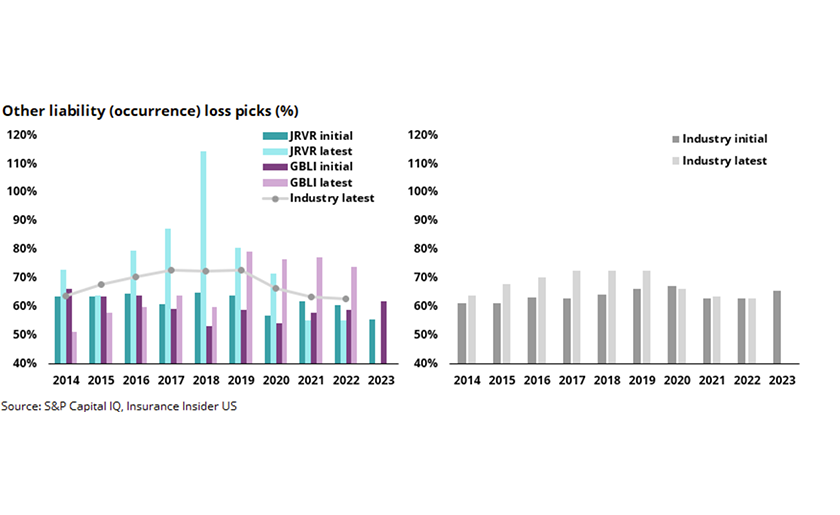

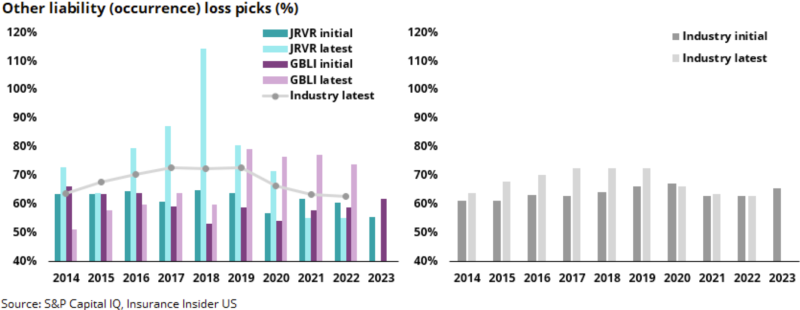

Starting with the Other Liability (occurrence) bucket, which is the largest for both James River and Global Indemnity, we can see the variations in loss picks vs. the industry in the chart below.

The left chart shows this segment's initial and developed pick as of 2023. The chart on the right side shows the industry loss picks for the same lines and how they developed. We have also plotted the developed loss picks for the industry, as shown in the dots below.

One can see a more significant variation in loss picks for James River’s prior year's buckets, while Global Indemnity shows a greater variation in recent years.

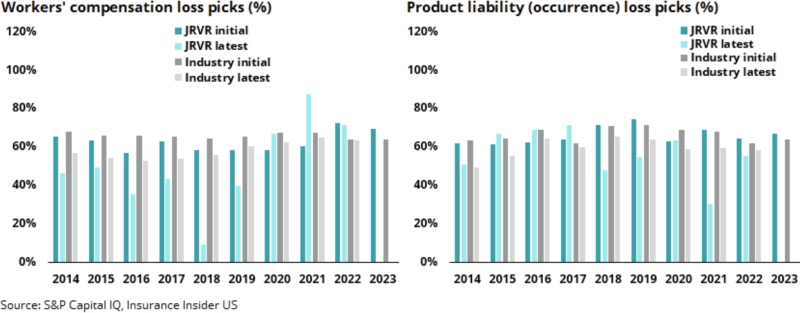

In the recently concluded earnings season, we witnessed many carriers adding to prior years' buckets (2015-2019) but also squeezing the workers’ compensation bucket to offset this development.

In our recent reserve analysis published last week, we noted this trend and expressed worry about the immature years and lines contributing to releases.

The chart below shows the workers’ compensation and product liability segments for James River, which are also showing greater volatility compared to the industry.

Taking a step back, if the industry continues to grapple with reserving and loss cost inflation challenges, this will also impact both James River and Global Indemnity. This could translate into additional reserve adjustments at the companies, further delaying a successful turnaround for the combined entity.

Current shareholders will have to wait

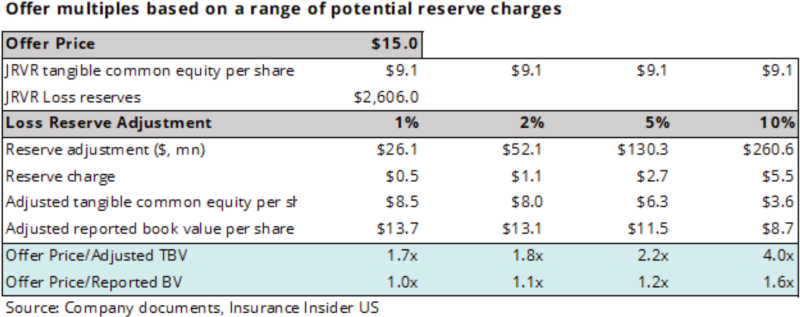

As of year-end 2023, James River’s tangible common equity was $9.05/share, and shareholders’ equity was $14.2/share. The $15 indicative offer price equates to 1.65x tangible book and 1.06x the reported book.

As noted earlier, a reserve adjustment remains a distinct possibility, and the table below shows various outcomes for hypothetical scenarios. Note that we are not suggesting that James River’s reserves are deficient by 1% to 10%. Rather, we are calculating the results for a range of possible values.

James River stock is trading at $8.68/share vs. the indicative offer price of $15/share, which likely reflects that the investment community is expecting a degree of reserve adjustment once Global Indemnity performs additional due diligence.

Of course, cash is king, as discussed above, and James River could play the waiting game. However, a drawn-out process without any buyers that meet its threshold signals a dwindling pool of suitors.

It’s worth noting that Cove Street Capital, the 14th largest investor in Global Indemnity, has warned that the company does not have the capabilities to make a success of its bid for James River. (See Jeffrey Bronchick’s interview with our news team here.)

On the other hand, Saul Fox being Global Indemnity's biggest shareholder makes it easier to get the deal done.

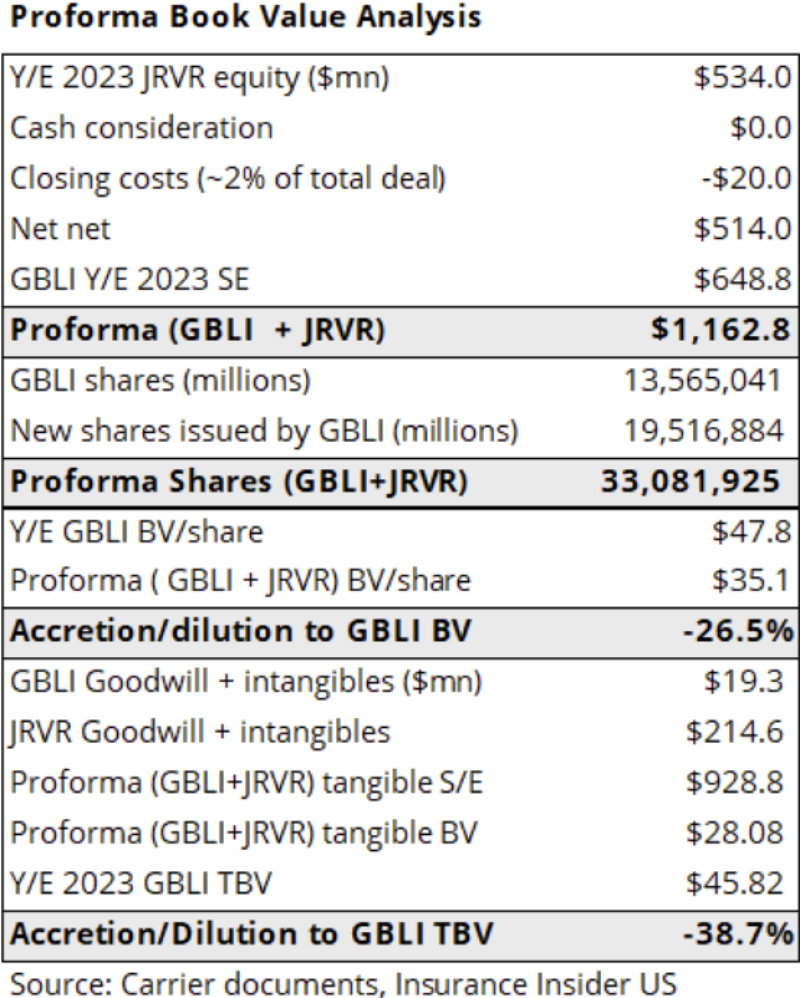

The table below shows a meaningful dilution to Global Indemnity’s book value if the deal is done at current multiples, which we view as an unlikely outcome.

In summary, the deal would likely be consummated with short to medium-term valuation pain.

However, there is also a possibility of the combined entities emerging as a cleaner and better franchise, where the sum of the parts make up a more attractive whole for a potential take-out in a few years.

APPENDIX:

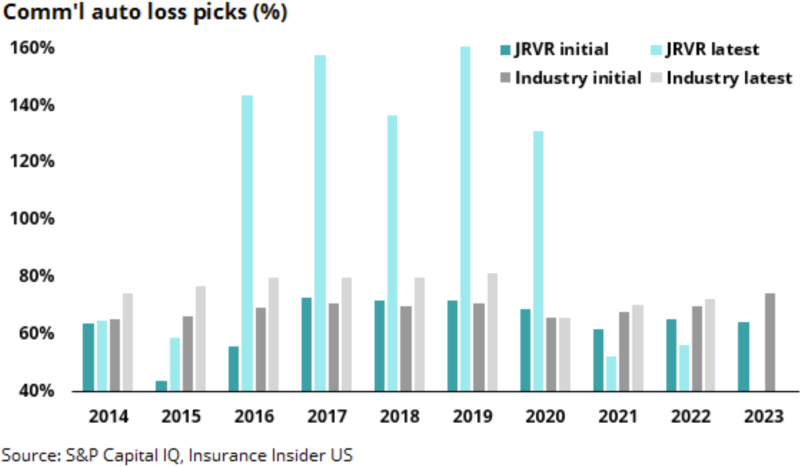

The chart below shows commercial auto development for James River, and these have already been well documented in the past with the business in run-off.

For Global Indemnity, the chart below shows its CMP book, which has witnessed releases over time. We would highlight that this is a shorter-tail line.