Reinsurance relationships are essential in the insurance industry, offering vital support by providing capital relief and effective risk management. They address both frequent minor losses and major catastrophic events, as well as complex, longer-tail casualty losses.

The reinsurance industry began in 1846 with the establishment of Cologne Re, nearly two centuries after the beginnings of professional insurance as we know it in 1666. Since then, primary insurance’s younger cousin has taken on an integral role in the functioning of any efficient insurance marketplace.

In this note, we examine Schedule F data from the US statutory financials to see historical trends for the industry and dive a bit deeper to look at the California marketplace.

Note: this analysis is based on unaffiliated relationships only. The underlying data excludes intra-company relationships.

First, the assumed premium growth of US-exposed reinsurers has slowed significantly over the past year

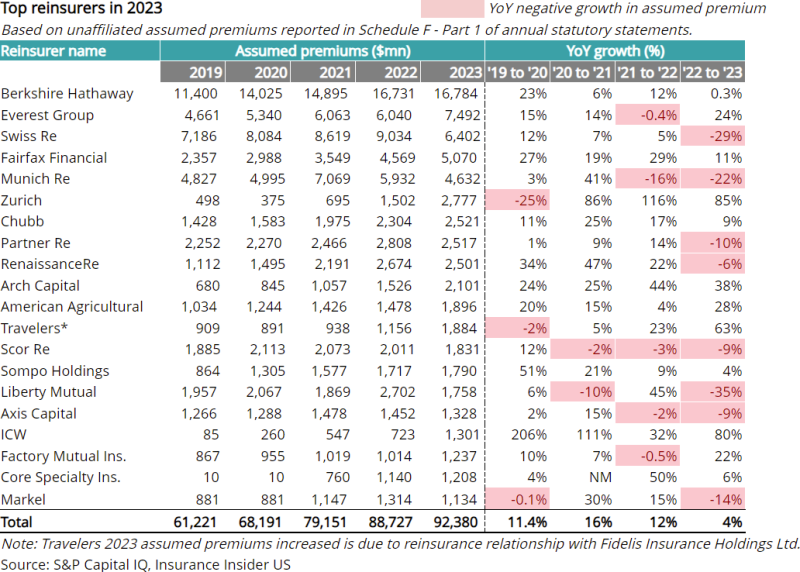

While previous years have largely seen reinsurers assume more and more US P&C risk, growth between 2022 and 2023 has ground nearly to a halt. Overall average assumed premium growth of top 20 reinsurers was just 0.5% in 2023, while in 2022 the growth for same cohort stood at 10.4%. At industry level, total assumed premiums growth was modest at 4% in 2023, compared to 12% growth in 2022 on a year-over-year basis.

This runs somewhat counter to the expected narrative, given the hard reinsurance market in 2023.

But the average masks significant growth from some of the reinsurers that were clearly in growth mode in 2023, as their growth was offset by a few carriers with double-digit decline in growth. Moreover, it is likely that some reinsurers captured growth outside their NAIC-filing entities.

Changing reinsurance structures and cedant decisions also no doubt influenced the outcomes: with reinsurers walking away from higher-paying, low-attaching reinsurance levels, and cedants managing spend to secure the tail cover they required.

The following chart shows the top US P&C reinsurers and their assumed premiums from 2019 to 2023.

We see that of the top 10 reinsurers, only one (Everest) has had a higher rate of YoY growth in 2023 when compared to 2022. It’s interesting to note that many in this cohort are even shrinking in terms of their number of assumed premiums, even among some companies that had significant growth in this space over the last few years.

But showing assumed premiums on their own only gives us part of the story. We also took a look at ceded premiums as a percentage of total premiums written to see if the drop in assumed premiums reflects a decrease in reinsurance utilization overall. This might not be unexpected as insurers sought to manage costs at a time of rising reinsurance rates. As this publication has covered, many large US carriers that were seeking to increase reinsurance coverage to extend protection further into their tail delayed timing of new purchasing into 2024.

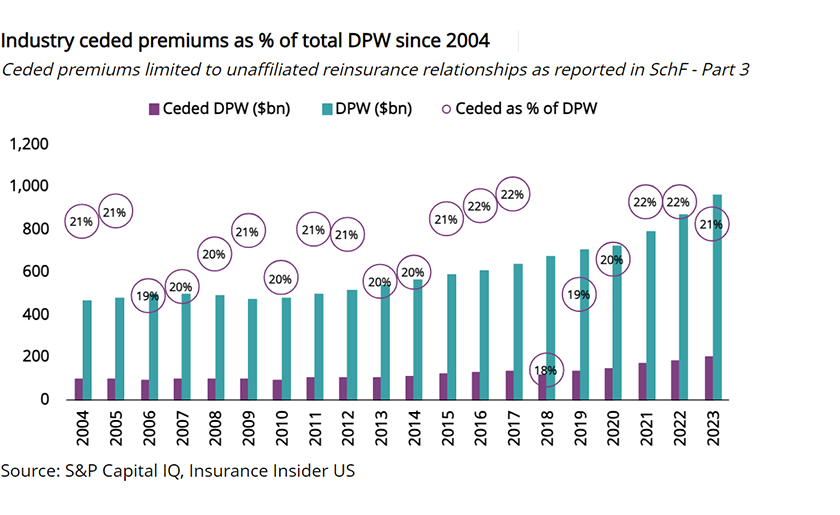

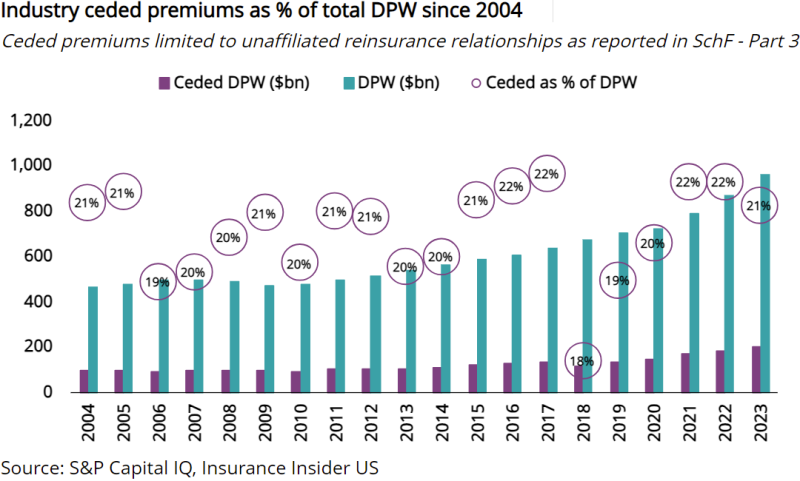

The chart below shows the relationship between overall direct premiums written and ceded premiums for the US P&C industry as a whole.

From this chart, we can see that the reinsurance segment’s position within the industry has remained relatively stable over the past year. Over 2023, 21% of premiums were ceded as a percent of industry DWP. This is a relatively minor decline when compared to previous years, with 2018 remaining the low point for the industry over the past two decades.

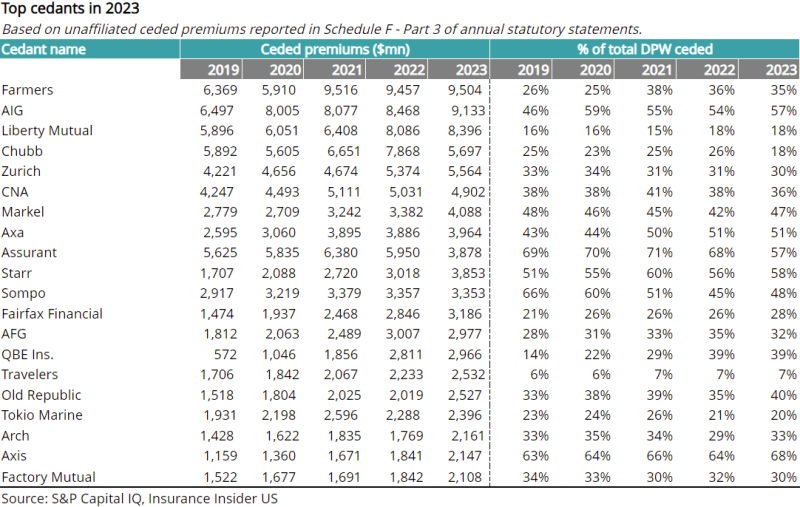

The following table shows the top cedants in 2023, by the amount of ceded premiums. The table also shows the percentage of their total DWP that they ceded to reinsurance for a given year.

The average growth of ceded premiums at top cedants has slowed, with 0.9% ceded premium growth on average in 2023, compared to 7.3% in 2022.

Second, reinsurer support is increasing for the particularly challenging California market

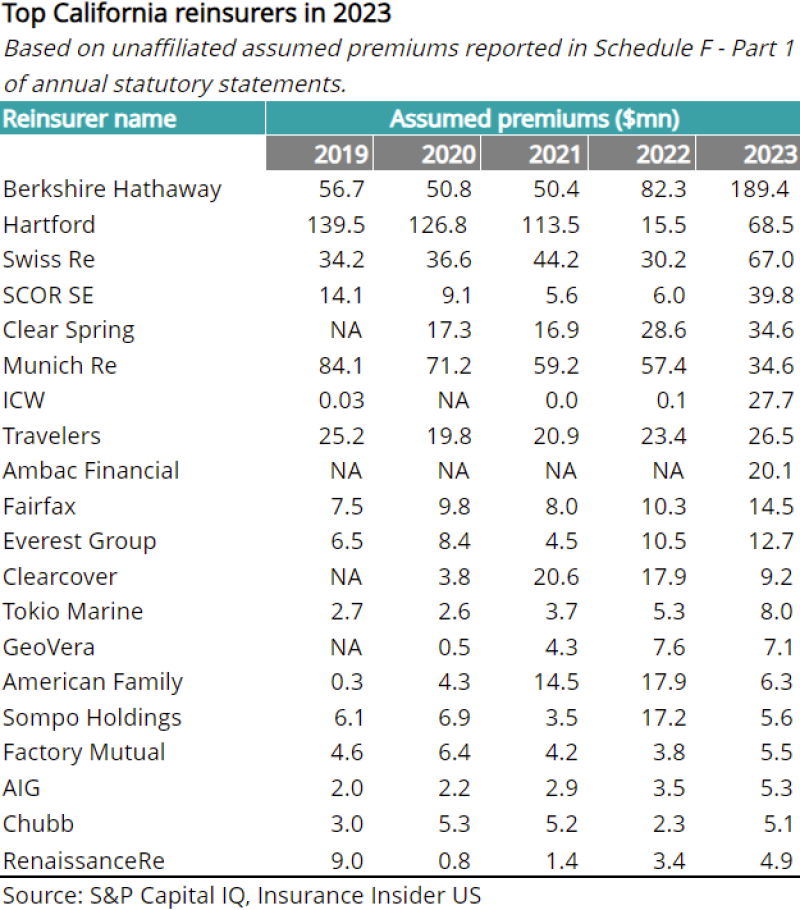

The chart below specifically zooms into the top reinsurers in California, which has been a particularly difficult place for P&C insurers in recent years.

Between 2022 and 2023, the total number of premiums assumed by the above cohort of top California reinsurers has increased by more than 73%.

On average, California P&C reinsurers have assumed 64% more premiums in 2023 when compared to 2022. This reflects the high loss ratios and legal restrictions on rate increases, which has led many primary insurers to share their risks.

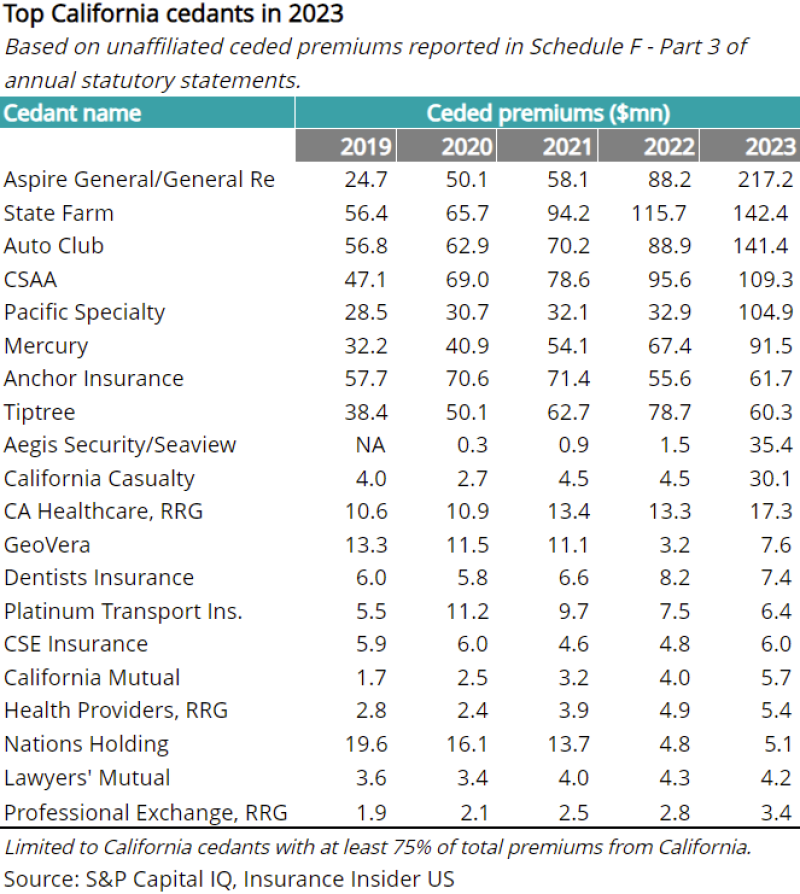

The other side of the market is shown below, with the top cedants in California listed by premiums ceded.

Third, global reinsurers remain the backbone providing support to US primary carriers

One particular observation that can be made about the US P&C (re)insurance market is that many of the largest reinsurance providers are non-Bermuda domiciled. Zurich, Swiss, and Munich – as the names suggest – are among the top 10 reinsurers in the United States, among other Europeans such as Hannover Re and certain Lloyd’s Syndicates.

These relationships are shown below, with each of the top 10 US cedants shown alongside their five largest reinsurance partners.

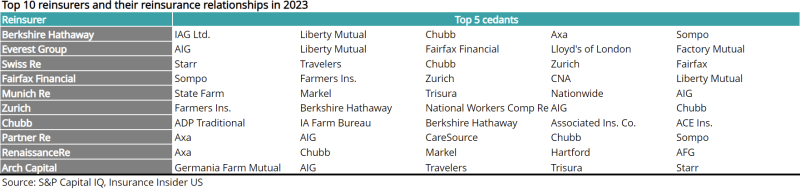

The chart below shows similar data portrayed in the opposite direction, with the top 10 reinsurers listed alongside their five largest cedants.

A mix of reinsurers – global and domestic – remain important to the US market, as they have over time.

However, many large reinsurers have made noteworthy strategic shifts towards entering specialty and E&S spaces due to the profitability of those markets, while the aforementioned international companies have remained concentrated in reinsurance.

In summary, reinsurance utilization in 2023 plateaued as cedants balance risk vs exposure and pricing expectations.

Two new trends could impact how these numbers look for 2024 and beyond. On the property-catastrophe side, La Niña is expected to result in an active hurricane season while the industry grapples with a continued uptick in SCS impacting property exposures. On the casualty side, continued nervousness surrounding soft market accident years and the consequent risk of reserve development could lead to changing retention patterns as well.