With every hard market comes a string of company formations. Since insurance companies need meaningful capital, most have private equity sponsors. We have seen this iteration at play following Hurricane Andrew in 1992, the WTC tragedy in 2001, the KRW hurricanes in 2005 and so forth.

Historically, many but not all of these companies were focused on capturing the pricing momentum following an event. However, as is often the case, this pricing momentum lasted a short time and this cohort had to ponder whether to diversify or stick with their knitting.

This resulted in many companies struggling to generate long-term book value growth (also known as value creation) while initially posting strong results. As fundamental shifts took place in the property-catastrophe space over time with the advent of third-party and other outside investors, pressures worsened as carriers struggled to growth their books’ profitability.

A pivot to other classes often resulted in trading short-term volatility for medium-term reserving challenges. With growing investor skepticism, many of these companies – whether due to capital pressures or seeing the writing on the wall from changing market conditions – were forced to the deal table.

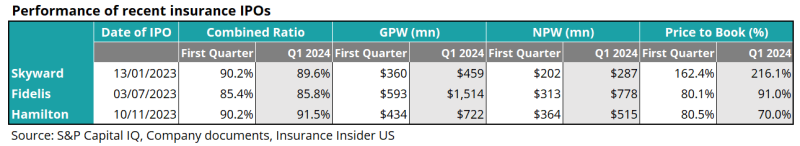

The past few years have seen a broader decline in public market activity. Despite these conditions, a handful of specialty insurance franchises have come into the market since the start of 2023, namely Skyward Specialty, Hamilton Group, and Fidelis Insurance Holdings. While Skyward has had significant success since its debut, the other two are still trying to find their sea-legs.

Bowhead Specialty also went public on May 23, with shares closing up 40% on its first day of trading.

With the new IPOs on the horizon, and the mixed results from the recent batch, we thought it would be an interesting exercise to take a historical look at insurance IPOs, focusing on the companies that have been acquired (whether by choice or need) to see what lessons there might be for the most recent and upcoming IPOs. This also has implications for the broader insurance industry.

Our results show an interesting trend. Almost all the IPOs had superior results in the first year of their operation. However, over time, many of these companies' results worsened due to either poor underwriting or market shifts, and they were effectively forced to look for a partner.

Additionally, a few of achieved double-digit value creation during their publicly traded years. However, not all of them were rewarded with a superior price-to-book multiple, which we discuss further in the note.

As to what this means for the recent group of IPOs and those to come, the takeaway is that the early years don’t necessarily determine the long-term trajectory of the company.

While Skyward has benefited from a clearer specialty franchise story and Fidelis as well as Hamilton have lagged, all is not lost if Hamilton and Fidelis can also show value creation over time.

We discuss these points in greater detail below:

First, initial results and ending results differ greatly for the majority of companies post-IPO

Over the past 20 to 30 years, there have been several waves of company formations, mostly leaning towards the reinsurance and property catastrophe space. This includes the class of 1993, the class of 2001, and the class of 2005.

Every successive class has struggled to differentiate itself and walk the tightrope of balancing top-line and bottom-line results.

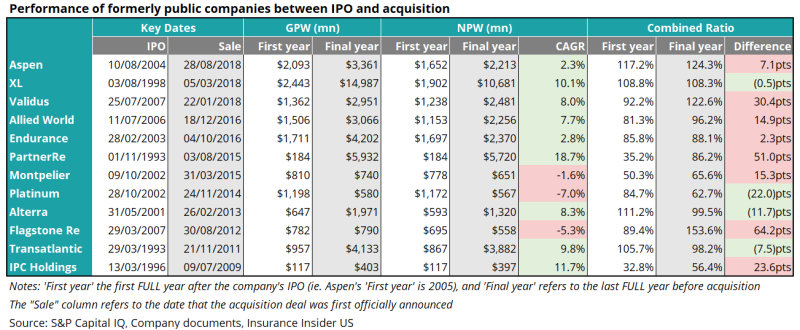

The table below shows some of the companies ordered by their sale date, along with columns showing how their premium and combined ratios evolved over time. The columns to the left show the growth in premium, and the right-most column shows the shift in the underwriting results. We would caution on the CAGR results that many of these companies may have had acquisitions or dispositions during this time.

The key point to note here is how many companies significantly worsened during their public lifetimes. Most had strong combined ratios initially, with significant worsening by the final year. This is in part due to companies choosing to IPO based on favorable market conditions.

However, this supports our main argument that just because the times are favorable, it does not mean success is sustainable. The clear takeaway is that it's tough to generate consistent results in insurance and a multi-cycle plan is needed, rather than simply trying to capitalize on a short-term rate hardening bump.

Second, higher value creators sold when financial multiples were out of sync

We have often shown that, longer-term, there is a correlation between value creation and stock multiples. You can see that dynamic when you think of names such as Arch Capital, Progressive, RLI, or Kinsale, which trade at a higher multiple due to consistent growth in book value.

You can also see the inverse dynamic in play. When we are talking about acquisitions, this translates into low value creators getting a lower exit multiple, as they should.

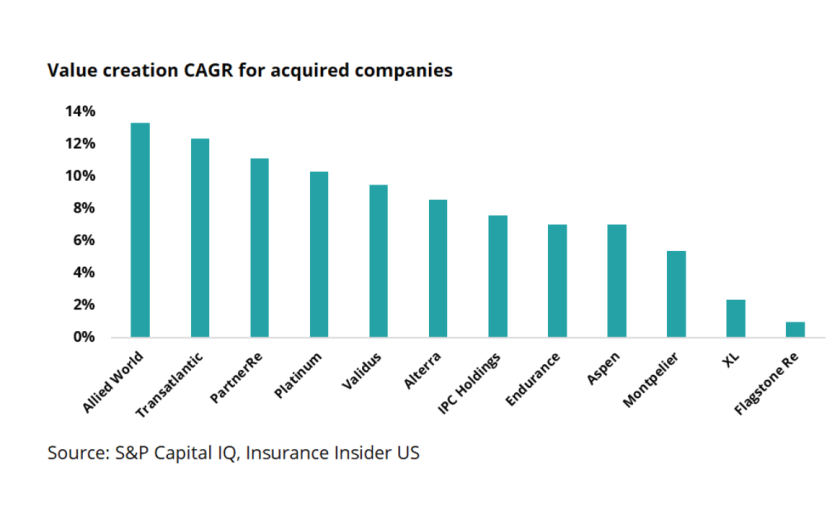

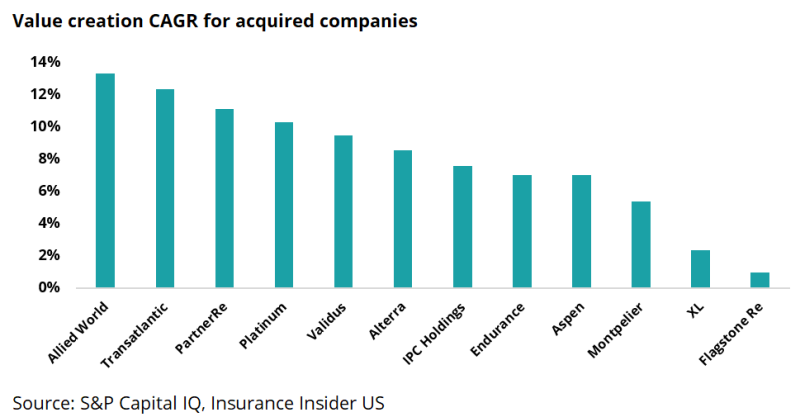

With this in mind, we decided to look at the historical value creation for the acquired companies above, to see how they fared, and then compare that to their eventual multiples. The value creation results, shown first below, show a wide range.

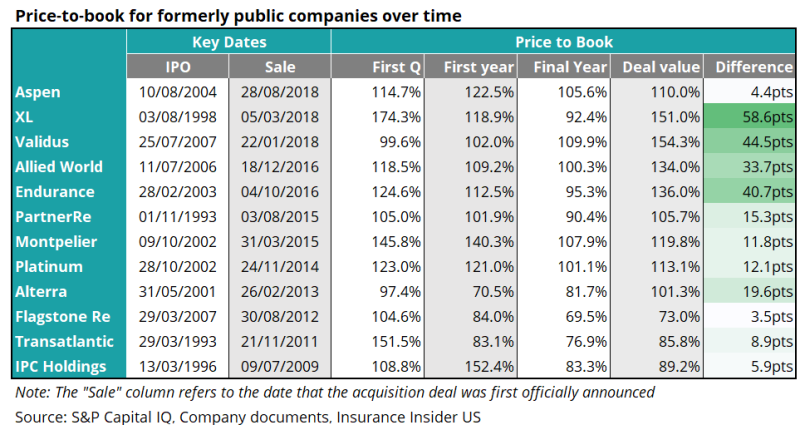

For the second part, we have the same cohort, with the evolution of the price-to-book along with the actual deal value. The difference between the final year’s price-to-book and the sale value is shown at the far right to highlight the premium paid (or not paid).

Comparing these two charts shows that there was a group of companies whose value creation was higher than the rest, but investors' perceptions were not in sync based on the valuation. This list includes Allied World, Validus, Endurance and Platinum Underwriters – all higher-quality underwriters.

The discrepancy was due to a combination of either noise in the numbers from catastrophe losses, reserve adjustments or a shift in broader market cycles.

The reasons for the shifting perception varied. For Allied World, it was rising adverse development in its North American healthcare and casualty classes. For Validus, it was short-tail reinsurers being seen as less favorable by investors due to the volatility. Platinum faced the inverse problem where it was a higher-quality writer, but its desire to stick to its knitting and shrink its book led to lower investor interest.

Taking a step back, a company’s longer-term valuation should sync with its value creation, but this relationship can break down short-to-mid-term, creating pressures on the management team to exit.

Nonetheless, a stark reality is that a handful of these companies have managed to create long-term value. This also partially explains the waves of consolidation we have seen in this industry over the past 10-15 years.

Third, the recent group of IPOs shows divergent performance, but the trajectories could change

One of the most significant changes we have seen in the present hard market is the relatively restrained level of public market activity in the insurance space. Prospective investors are less willing to back carriers if they have an option to buy into well-established franchises that might be trading at a relative discount.

The three companies that have recently gone public, Skyward, Fidelis, and Hamilton, have had mixed results. With its specialty book, Skyward has benefited from the “Golden Age of E&S”, and the stock has outperformed peers and the broader P&C group.

On the other hand, Fidelis Insurance Holdings, which went public in a unique manner, as part of a wider company split into a publicly traded balance sheet and an MGU (now The Fidelis Partnership), has taken longer for the investor community to get behind. Similarly, Hamilton, with its Two Sigma relationship and a repivoted specialty book, will need to establish a longer record to justify a premium valuation.

Taking into account Bowhead’s recent listing success (although it is early days) this could show that a market exists for clear, small specialty insurance stories in the US.

However, not all is lost. Our analysis above shows that results, combined ratios, and stock multiples can change materially over the company’s lifecycle. Both Fidelis and Hamilton could make a turnaround, and Skyward, currently leading the pack, will need to continue to balance competing forces to maintain its success.

In conclusion, our analysis of acquired companies shows that it’s easier to generate superior short-term results than it is to build a long-term record of value creation.

This led to an uptick in the consolidation activity for the prior classes of new insurance companies. This less-than-stellar opening act has led to a smaller group of companies choosing to IPO in the recent hard market, and serves as a warning to the next round of incumbents looking to go public.