Tradesman Program Managers’ Racketeer Influenced and Corrupt Organizations (Rico) Act lawsuits targeting allegedly fraudulent New York construction claims are creating ripple effects as defense lawyers and carriers are waking up to the magnitude of what could be the largest insurance fraud scheme in the US, sources told this publication.

The MGA and its parent company Roosevelt Road Re have filed two lawsuits against 20 defendants so far, citing violation of the Racketeer Influenced and Corrupt Organizations Act, a federal law that targets organized crime.

The list includes doctors, medical centers, and personal injury attorneys who allegedly participated in a “fraudulent scheme” involving immigrant workers trained to stage or exaggerate accidents on NY construction sites.

As the first Rico complaint was filed in March, it won’t be until at least next year that a decision is reached on these allegations. However, the case has already started to have an impact in and outside the courtroom, sources told this publication.

“The Rico cases may be even more important as just a wake-up call,” one NY-based defense attorney said. “Somebody finally spelled it out.”

Sources say the first Rico lawsuit in March sparked investigations at other defense law firms, which are “uncovering an eye-opening number of similar, large scale fraud rings” affecting other casualty lines, including premises liability.

Some carriers have started their own investigating process, with the possibility of pursuing their own Rico actions or claw-backs to recover payments on past fraudulent claims.

As for Tradesman, the MGA has more Rico complaints in the works based on findings from an investigation that went on for more than three years.

“This is not a one-off Rico case that you file and move on,” said Tradesman’s lawyer Kirk Willis. “This is, in our opinion, the biggest insurance fraud ring in America.”

All parties named in this story were contacted for comment. Most did not respond or did not comment.

Chilling effect

Sources indicate that a number of NY plaintiffs’ firms have been filing motions en masse, requesting withdrawal from hundreds of injury cases which could potentially add up to $1bn or more worth of risk departing the New York marketplace.

It is not new practice for attorneys to drop an ongoing case, but multiple sources say it has never happened at such large scale, across so many firms at once.

Under normal circumstances, “five or 10 in one year, would be a lot” per firm, according to John McDonough, London Fischer LLP partner and vice chairman of strategic risk and complex litigation.

“The plaintiff bar hasn’t sweated this much since tort reform efforts failed in the 1980s,” another defence attorney said.

In May 2024, an attorney from NY-based plaintiff firm Subin Associates told a NY Supreme Court judge that his company was seeking to be relieved from 200 to 300 cases, citing “concern with the referral source that got us the case”, according to court documents reviewed by this publication.

Two months later, the firm’s attorneys Eric and Herbert Subin were sued in Tradesman’s second Rico complaint and accused of collaborating with a “runner”, who was also named as a defendant in the suit for recruiting immigrant construction workers to stage accidents.

The official tally of dropped cases is unknown. But given that Subin alone has dumped more than 200, defense bar sources estimate that the year-to-date total could range from 500 to over 1,000.

For insurers with NY construction risk, or broadly casualty injury claims, that could translate to a significant amount of reserve releases down the road.

Tradesman says it has already seen “positive returns”.

According to the firm, the number of newly reported claims has been at a “near standstill” since its first Rico complaint in March. Year to date, it closed over 120 NY labor law cases with zero indemnity payments and has another 20-30 pending closures from open cases being dropped.

In addition, the MGA says its underwriting revenues on construction have doubled, partly thanks to the advertising effect of the lawsuit.

Tradesman suspects it has 600 more “fraudulent claims” in its catalogue, which the firm believes could lead to “unprecedented savings” if the current trajectory continues.

More deep dives

Insurers and defense councils have started to bake in Tradesman’s investigation and findings into their own defense strategies.

“We are pushing discovery in those cases and trying to get what we can in terms of helping the overall Rico picture to help establish things, rather than just closing them as quickly as we can,” said one attorney.

In addition, they are urging carriers to go through currently ongoing and past cases to find names, institutions, or patterns in the Rico complaint.

This includes taking a closer look at unwitnessed slip and falls where the ultimate payout vastly exceeded initial trauma records from the emergency care center.

Sources noted that most of the medical defendants in Tradesman’s complaint are well-known plaintiff testifiers in NY personal injury litigation.

One of them is Dr. Andrew Merola, a spine surgeon based in NYC, whom one defence attorney source said is involved in almost 70% of his personal injury cases. The defendant is accused of performing surgeries that were unnecessary and lacked medical basis.

Anecdotally, one lawyer suggested that out of thousands of doctors who do spine surgeries in NY, there seem to be 10-12 that repeatedly appeared on hundreds of personal injury cases.

“That’s not a coincidence - why would all the same doctors be doing surgeries and representing patients that happen to have multi-million-dollar lawsuits?”

Willis Law Firm, which represents Tradesman and Roosevelt Road Re in the Rico actions, has already been contacted by other insurers to be represented for a similar cause, according to managing partner Kirk Willis.

"Particularly when they feel like over 10%, if not 20% of their cases indeed have some hint of fraud in their claims unit or litigated claims, they feel like they want, at least, to have someone investigate,” he told Insurance Insider US.

For now, most of the carriers who reached out to them are involved in New York construction, according to Willis, but inquiries have come in from Georgia, Texas, and Florida as well.

NY construction struggles

For years, New York construction has been a notoriously tough line of business for insurers, specifically for its unique labor laws.

New York Labor Law sections 240 and 241 impose “absolute liability on the construction companies, property owners and/or contractors" on workers’ falls or injuries from falling objects, Swiss Re wrote in a 2016 report.

“Generally, it does not matter whether or not the injured worker acted negligently, unless their negligent conduct was the sole cause of injury,” the report read, further estimating that injured workers win almost 90% of Labor Law 240 cases.

New York is the only state that has a strict liability statute applicable to construction work. Illinois, for example, was the last to have a scaffold law but repealed it in 1995.

In a legal environment where carriers have long accepted the disadvantage, sources have credited Tradesman for compiling what could be a “script” for injury fraud, which was suspected by the defense bar for years but never substantiated to such degree.

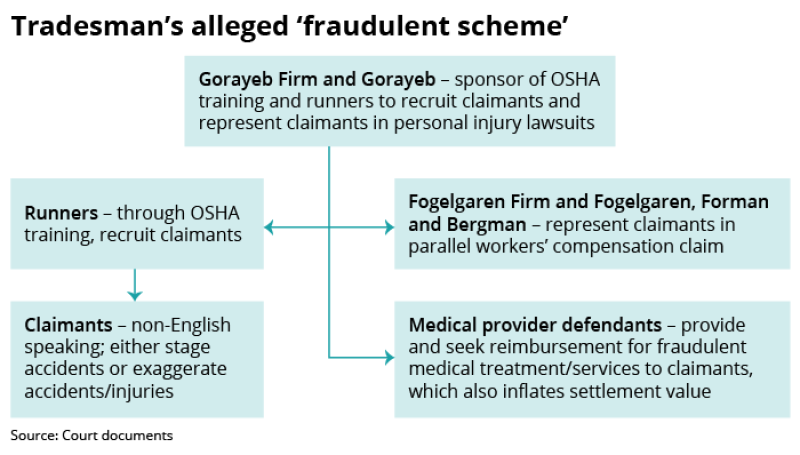

The first Rico suit laid out an “enterprise” of OSHA training centers (which offer safety certifications mandatory for construction workers), medical professionals, and two NY law firms: Gorayeb & Associates and Fogelgaren Forman & Bergman.

In summary, immigrant workers were allegedly groomed on how to stage construction accidents, underwent unnecessary medical procedures, and were referred amongst the defendants to inflate workers’ comp and personal injury claims.

Gorayeb represented claimants in personal injury lawsuits; the Fogelgaren firm represented them for claims made to the New York State Workers’ Compensation Board, according to the amended draft filed August 7.

For over three years, Tradesman collected evidence including surveillance videos of claimants’ falls and physical therapy notes with re-occurring misspellings such as “sofi-tissue”.

It invested an estimated $5mn in the investigation, which involved undercover covert cameras on Tradesman’s job sites and undercover investigators posing as workers.

The MGA first grew suspicious of a potential pattern in late 2020, when construction activity in New York City contracted due to the Covid-19 pandemic.

Despite the slowdown, Roosevelt Road Re's general liability claim adjustment expenses only grew, from $14mn in 2018 to $36mn in 2019, $59mn in 2020, $91mn in 2021 and $142mn in 2022.

The discrepancy is addressed in the latest NYC construction safety report published by the city’s Department of Buildings.

While the number of construction-site incidents and fatalities has fallen after 2019, the number of injuries remained steadily high, or even higher in some years, with “worker fall” leading the way by injury type.

“Notably, the data shows a large increase in ladder falls, stair falls and tripping incidents,” in settings where inspectors found that required safeguards had been in place, according to the 2023 report.

What happens next?

The extent of fraudulent activity is unknown. Tradesman alleged the practice in its Rico complaint started prior to 2018, and sources agree that the timeline could be much longer.

If the lawsuit is successful, the findings could be used to help identify patterns that were and are used for cases that are not 100% fraudulent but worked up to result in overpaid claims.

This would again provide additional hints for insurers to push against in court or re-open closed cases.

One upcoming process in the federal lawsuit is the discovery.

A specific aspect that defense attorneys are anticipating is the discovery process to shed light on third-party litigation funding (TPLF): whether they directly fund law firms, as well as the breakdown of how the ultimate compensation was split among the claimants versus other stakeholders.

Defense bar sources say that there has been strong pushback from plaintiffs’ attorneys to share any kind of information regarding litigation funding in court. The practice is largely unregulated in New York, as in the majority of US states.

Opponents of TPLF claim any direct liaison between law firms and TPLF is likely a breach of ethical conduct for law professionals whose only fiduciary duty should be to the clients they represent.

Willis Law Firm attorneys told this publication that there are more Rico complaints on the way from Tradesman, each one concentrating on different aspects of a larger picture.

The first and second Tradesman-Rico complaints focused on laying out an alleged framework of medical and legal professionals working together to stage accidents and inflate claims. Third-party litigation funders are next in line, along with other law firms to come.

“What we hope that these lawsuits do is recast and reframe the way that these cases are set up, settled, or litigated,” said Willis.

“You pay as an insurance company, but you don't pay for outright fraudulent behaviour.”