The P&C industry had another strong quarter, with many carriers reporting year-over-year improvements in underwriting profitability and brokers posting mid-single digit to low-double digit organic growth. However, for all the positive elements of the season, adverse developments in casualty reserves continued to cast a shadow over sentiment.

As we discussed in our Q2 earnings takeaways piece, senior management at Travelers and Selective pointed early on in the reporting season to the challenging social inflationary environment – particularly litigation financing, nuclear verdicts, etc. – as a primary driver of the rising loss costs weighing on casualty lines.

Against this backdrop, we decided to dive deeper into the commentary surrounding social inflation and its impact on the industry at large. We found that many carriers of various sizes across all segments discussed the impact of social inflation on the casualty loss-cost environment.

We also examined civil case counts and data on nuclear verdicts from TransRe to better understand how social inflation has impacted the industry and will continue to do so over time.

Based on our analysis of call commentary and the aforesaid data, we found the following:

The Covid-19 case backlog has still not cleared years after the closures, though the impact may not be uniform across carriers.

Data from TransRe shows the increase in nuclear verdicts seen over the past decade shows no signs of slowing in 2024.

An industry-level claims data analysis paints a mixed picture, but worrisome upward trends arise in a number of lines.

We elaborate on these points below.

US court data shows the Covid-era backlog has not yet cleared

A particularly noteworthy quote from this past earnings season came from Daniel Frey, CFO of Travelers, regarding the Covid-19 backlog.

While discussing the company’s second-quarter results, he mentioned that the court backlog from the Covid-19 shutdown was “largely resolved” and that this “element of uncertainty is, to a large degree, behind us”.

Later in the call, an analyst asked for additional color on the claim and sought to clarify if it was based on Travelers’ own data or external industry information. Frey clarified that the assessment was an evaluation of Travelers’ data, saying: “We believe we have the market relevance to understand what’s going on more broadly.”

This comment led us to wonder if Travelers was an outlier in seeing the backlog cleared, or if the company was representative of a broader industry trend. A review of all the transcripts showed no similar comments from other carriers, but nothing contradictory either, so we turned to data from the US courts as the best indicator.

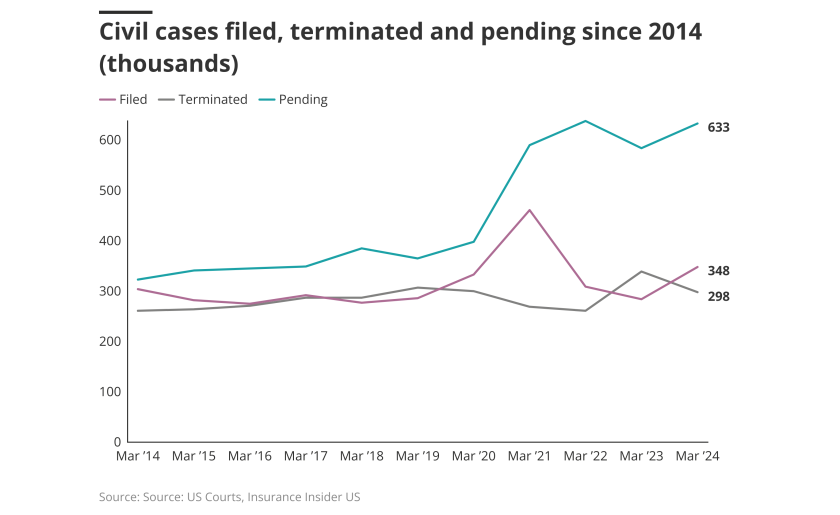

The chart below shows the number of civil cases filed, terminated and pending over the past 10 years.

The data shows the number of pending cases remains elevated, whereas the number of terminated cases has not yet seen a commensurate uptick that would suggest an easing of the backlog.

While there did seem to be a peak and downturn in the number of pending cases in early 2022, it’s clear the pending numbers have not yet returned to normal.

While we don’t know what portion of the number above would have a direct impact on insurance, it is highly unlikely that the industry has cleared this bottleneck, and much more likely that Travelers is an outlier.

So, what does this mean for the industry? This gap ultimately impacts claims and reserves, as carriers with outstanding cases will have to ensure they have adequate reserves to handle payouts when the cases do eventually resolve.

The backlog issue is compounded by the fact that nuclear verdict trends continue to worsen

While the Covid-19 backlog is primarily a logistical matter brought on by court closures, it is only one facet of the litigation landscape issues that have been brewing for years.

One of the main challenges we heard referenced repeatedly on calls was nuclear verdicts.

For example, Michael McKenna, head of North America insurance at Axis, said: “Things like escalating litigation funding, fueling social inflation, which in turn is pushing out more nuclear verdicts, is driving up the ultimate cost of goods sold for the market.”

Turning to the chart below, we can see that McKenna’s assessment is correct. According to the latest data from TransRe, the number of nuclear verdicts has been increasing over time. Note that the sharp decline in 2020 and 2021 was due to the Covid-19 shutdowns.

Once outliers, heightened nuclear verdict counts have become increasingly normalized over the past decade, and this shows no sign of abating in 2024. This is a dangerous trend for insurers.

As settlement costs skyrocket, it will become increasingly difficult for insurers to determine the best loss picks and set aside adequate reserves for their casualty lines of business. This will also put pressure on pricing, which is running below loss-cost trend, according to Liberty Mutual management.

Several companies have been responding by pulling back on their exposure altogether. Carl Linder, Co-CEO of AFG, said in his Q2 earnings call that the firm’s top-line growth was offset partially by an effort to manage exposures in social inflation-exposed businesses.

Juan Andrade, CEO of Everest Group, similarly noted that the company was reducing writings in certain lines, classes and jurisdictions in response to social inflation.

The combination of more frequent lawsuits, unpredictable awards and continuing delays from the Covid-era closures add up to a difficult combination of circumstances for carriers and actuaries to navigate. Specifically, these conditions lead to heightened claims frequency and severity that the industry might not be pricing for, or have reserved for.

Industry-level claims data paints a mixed picture, but several lines show worrying upward trends

One other way to examine the impact of litigation cost trends on the industry is to take a step back and look at the claims data. The table below shows the number of first-year claims reported by line of business for the industry.

Several lines of business, such as workers’ compensation and commercial multi-peril, have only shown year-over-year deviations relatively in line with normal expectations. Even the product liability lines have shown a marked year-over-year decrease in claims count.

These downward trends are somewhat surprising given the rise in social inflation, or even simply the normal growth in the lines, which would naturally produce a proportionately higher number of claims over time.

However, medical professional liability and other liability do show increases in first-year reported claims counts. It is possible the impact of social inflation has not yet manifested itself in the claims counts of other lines, and we will perhaps see more movement in the 2024 and 2025 data.

So, these trends are diverging on a line-by-line basis. We would also highlight that some of the stability we have seen in the total defense costs is the result of increasing severity (as represented by the nuclear verdicts discussed earlier) being offset by decreasing frequency shown in the claims count above.

Nonetheless, the trends we are already seeing in medical professional liability and other liability would align with those we have discussed in recent reserving notes, and it remains to be seen how these lines and others will develop as the social inflationary environment worsens over time.

In summary, external data shows that while Travelers may have cleared its own backlog, hold-ups seemingly remain for the industry at large. The latest nuclear verdict data from TransRe shows that the increase over the past 10 years is not slowing down. And lastly, industry-level claims data paints a mixed picture, but several lines show upward indicators that could correlate with the social inflationary trends carriers continue to observe.