In our Q2 earnings preview, we anticipated more discussion on soft market and even recent years’ reserve levels, and their adequacy. However, as noted in our earnings recap, the actual level of adjustments was lower than we expected. In fact, results in most cases were better than expected, although the stock price moves after earnings continued to reflect future concerns.

With second-quarter (half-year) statutory data out, we took another look at reserve releases and loss ratio trends over time.

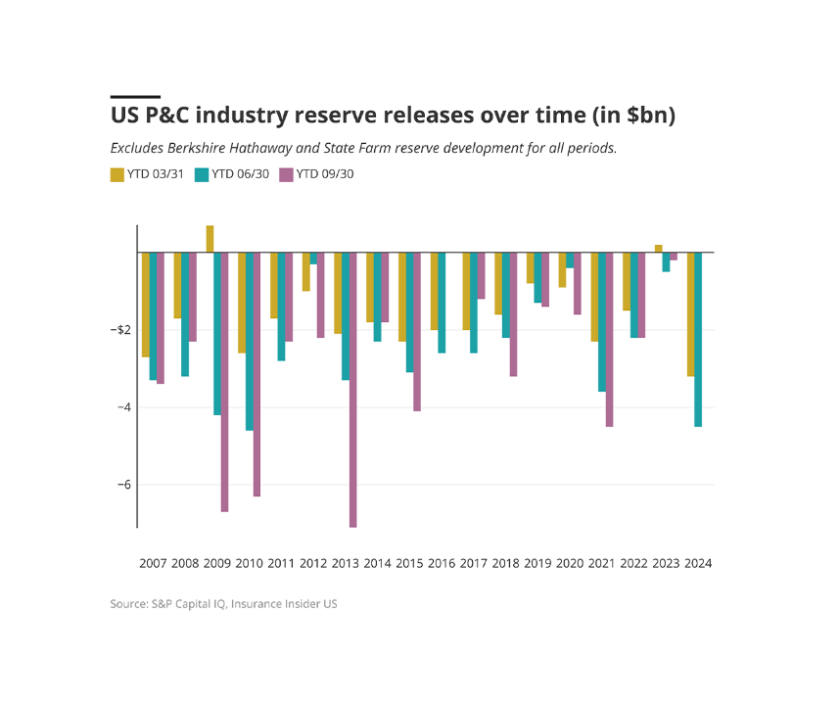

Industry reserve releases at the highest level since 2010: Cause for concern

In our piece on last quarter’s statutory reserving data, we highlighted the high level of reserve releases. These trends continued into Q2, resulting in the P&C industry having one of the highest levels of reserve releases since 2010, at $5bn for the first six months of 2024. We find this high level surprising since there continues to be a question mark over soft market reserves.

Prior industry commentary has stated that the Covid-19 years have significant reserve redundancies. This notion has been challenged, however, with carriers such as Travelers and Selective adjusting their recent accident years. These adjustments were attributed to changes in claims patterns.

We believe the high level of commercial lines releases is a combination of adverse development in general liability being offset by releases from workers’ compensation. Meanwhile, in personal lines, greater reserve releases have been driven by rates beginning to catch up with loss cost trends. As discussed in our next point, the high level of releases in commercial lines is likely illusory as we expect negative adjustments coinciding with year-end reserve reviews.

Although quarterly data does not give detailed by-line release numbers, we can also expect that shorter-tail lines releases played a role in the overall positive development. Our year-end analysis had shown that both special property and auto physical damage had nearly offset personal private passenger auto liability and homeowners’ adverse development.

Loss ratios tend to be worse on a full-year basis, compared to mid-year

We have added a new exhibit with this note. The tables below show loss ratio at the half-year mark and then at the year-end mark.

A few observations: 2017’s particularly high loss ratios jump out due to the impact of hurricanes Harvey, Irma and Maria in that year for all P&C lines and commercial lines; and after 2017, we see loss ratios on both an annual and a semi-annual basis deteriorate consistently year over year.

The tables below show this same metric, but for general liability and workers’ compensation lines in particular. Despite all the discussion surrounding year-end reserve reviews and the consequent reserve additions, for 2023 the loss ratio for general liability only worsened by 260 basis points between the half-year mark and the full year.

For the first six months of 2024, general liability has had a loss ratio of 59.7% – a number likely to get worse by the end of the year as year-end results factor in detailed reserve reviews.

On the other hand, workers’ compensation loss ratios have declined for several years, which could signal earnings management. We would also like to note that recent data suggests an uptick in unemployment claims and, historically, rising unemployment has correlated with a worsening workers’ compensation loss cost environment.

The next set of tables looks at loss ratios for medical malpractice and commercial auto liability lines. For the industry, note the higher loss picks for recent years resulting in a modest takedown by year-end.

On the other hand, commercial auto loss picks have worsened when comparing six-month and year-end numbers. Loss picks for the first six months of 2024 are at 75.8%, which is more in line with the year-end 2023 number. This could signal less movement through the rest of the year, and a smaller change by the end of the year.

Taking a step back, we would be surprised if loss ratios improve for many of the groups mentioned above since historically year-end numbers are higher than loss ratios at the mid-year mark. This year, we will be paying particular attention to the extent of the deterioration.

At company level, trends surprisingly improved

The chart below shows year-to-date reserve development for the P&C industry and breaks these developments down by the top 20 companies. Here we can see trends on a company level, to see which carriers have consistently favorable development and which have more mixed trends.

State Farm and Berkshire Hathaway are among the largest and most consistent companies in terms of releases, so a separate metric has been created to show industry performance excluding those companies.

Note that the analysis below looks at development as a percentage of prior reserves and should not be confused with points of reserve development as a percentage of earned premium. This is a limitation of quarterly statutory data, where earned premium is not available.

Excluding Berkshire Hathaway and State Farm, we see that the industry has released more reserves in the first half of 2024 than in any first-half since the pandemic. Many personal lines players, such as Progressive and Nationwide, have made small releases in contrast to the major reserve strengthening that characterized their results at this time last year.

Notably, all the companies that have had adverse development in the past six months also had adverse development at this point last year. Companies including Zurich, AIG, and CNA have again revised their loss picks this year. These developments are uniformly smaller than they were last year, which we view as troublesome – as companies balance good news of rate hardening with the bad news of reserve development. Another factor to complicate the picture is the relative underperformance of P&C stocks for 2024, as we explored in previous notes.

The chart below focuses on the commercial lines writers of the P&C industry.

Excluding Berkshire Hathaway and State Farm, we again see that the P&C industry has released more commercial lines reserves than in any year since before the pandemic. The names on the top 20 list remain largely the same, with the notable addition of smaller commercial-focused companies such as Great American, Axa, Markel, Allianz, Sompo and FM Global.

Among this cohort of commercial carriers, we find significant positive reserve development (Axa, Great American) and some of the largest adverse reserve development (Allianz). This indicates that, in contrast to the relatively strong year personal lines have enjoyed, commercial lines have been more of a mixed bag based on the lines written by a given company.

In summary, we remain cautious on the commercial lines cohort and find it concerning that 2024 had one of the largest releases since 2010. While this is good news on paper, questions about rate and the longevity of the hard market may mean these releases are premature.

Our prior reserving analysis shows that the industry has been quick in releasing reserves on the workers’ compensation side but slow in realizing adverse trends for the soft market years, as well as addressing recent years’ reserves.