Soon-to-be RT Specialty co-president Brenda Austenfeld said she is yet to see large outflows from E&S to the admitted markets in property, despite rate slowdown in the class.

In an interview with this publication, she added that, considering the surge of less-modeled perils and the threat of a major windstorm in the peak of hurricane season, there will always be a portion of property business that needs to be in E&S.

“As far as admitted markets, I don't see them coming in as strong as what they've done in the past. They may come into very specific areas, yet not as a broad-brush approach as in previous years,” she said.

“Back in the day, rates for property did not vary as widely. Now, it's very segmented both throughout geography and by industry class.”

In July, Austenfeld was promoted to co-president of RT Specialty, along with Michael VanAcker, effective October 1. In tandem, Ed McCormack will take on the position of CEO of the wholesale brokerage division.

Austenfeld continued to say that all eyes are on the 2024 hurricane season as a key indicator of whether property rates will moderate further. At the time of the interview, Tropical Storm Helene – now projected to make landfall as a major hurricane on the northeast coast of the Gulf of Mexico – was yet to fully form.

“It’s [as if] the clock’s ticking. We’re in peak season right now, and everybody’s waiting to see how destructive any storm or hurricane could be,” she said.

“I think if we have zero impact of any severe storm, we might see a different shift. Yet then again, if we have a significant occurrence, we could also see things shift yet to more challenging markets.”

Austenfeld added that the definition of catastrophe has expanded to include severe convective storms (SCS), wildfires, hail and other perils that were once known as “secondary perils”. The increased frequency and severity of these perils is fueling business into the E&S property space, she said.

“Years ago, the definition of cat property was always hurricanes and earthquakes, and that was it,” she said.

“People talk about secondary perils today, yet they really have become the topic in the forefront. It's something that's being talked about on a regular basis.

“The first half of the year was one of the costliest on record for severe convective storms in the US. In addition, there are more acres burned in nine states throughout wildfire areas, which continues to be an important area that underwriters are watching.”

Austenfeld also highlighted the personal lines arena, pointing out that admitted carriers withdrawing from states like California and Florida has fed into the growth of the E&S market, especially in property.

Casualty opportunities

On casualty, the executive noted that she doesn’t see retailers or wholesalers coming into the space with significant capacity in the near term. That being said, she added that there’s always opportunity – “many times capacity is coming in with very short limits”.

“We do think there is opportunity throughout specific areas.”

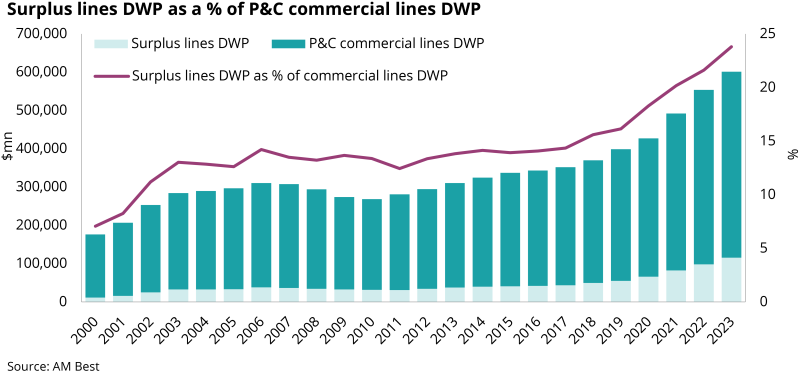

The US surplus lines market surpassed the $100bn premium threshold for the first time in 2023, producing $115.6bn in direct written premium, according to AM Best’s annual surplus lines report.

According to the ratings agency, this marks 17.4% growth from 2022 and is the sixth consecutive year of double-digit direct premium growth for the surplus market.

The increase can also be evidenced by the growth of the WSIA Annual Marketplace – which has hit a record of more than 8,000 registered attendees, compared to around 5,000 in 2019.

When asked about E&S regulation, Austenfeld said: “I think that everyone is cautious. Having said that, I think the hope is that we're able to continue forward with the freedom of rate and form that exists and why the E&S world exists today.”

Any kind of overarching regulation could severely impact the inflows into E&S, she said. She detailed that if the space were to be regulated too tightly, it would be challenging “to offer alternatives and solutions to opportunities”.

Wholesale broking

When asked about how wholesale brokers could approach M&A going forward, Austenfeld said that M&A is still an important avenue for growth.

She continued by saying that there has been more focus on delegated authority to expand wholesalers.

In September, Ryan Specialty completed its purchase of the P&C MGUs owned by Ethos Specialty Insurance from Ethos parent Ascot Group. Terms of the transaction were not disclosed.

Insurance Insider US earlier revealed that the two companies had agreed during talks to exclude Ethos’ M&A insurance practice, which accounted for around $140mn of the MGU segment’s roughly $220m premium volume.