In 2018, after losses developed adversely for Everest, many began to expect that a leadership change was on the horizon. In August 2019, the company confirmed this with the announcement that Chubb executive Juan Andrade was joining the company. Initially appointed COO effective September 1, he was made CEO on January 1, 2020.

What followed was a revamp of the Everest model with a renewed focus on expanding the insurance business, reserve cleanups, new goals on growth and underwriting performance, catastrophe load, and total shareholder return.

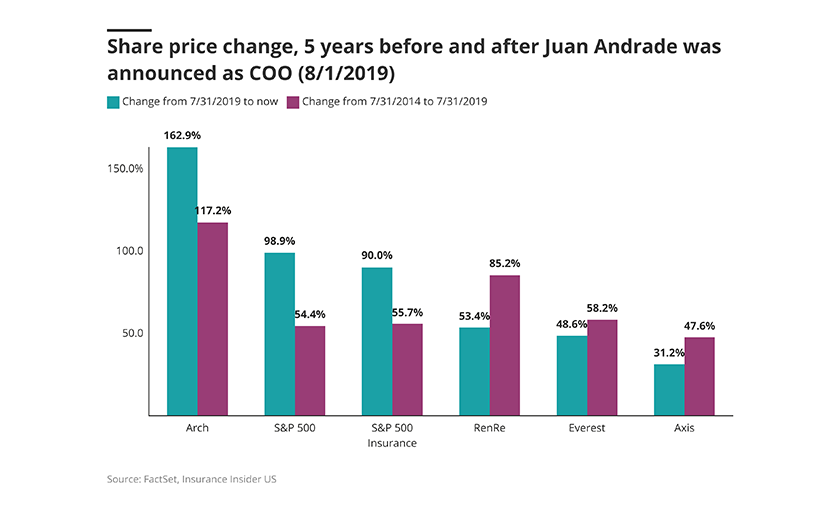

If the stock price is used as a barometer, progress has been mixed since Andrade’s arrival when compared to other reinsurance hybrids. Everest stock has outperformed Axis’ by 15 points since Andrade entered, though it has underperformed RenRe by 4.8 points and top-performer Arch by a massive 113.4 points.

In previous pieces, we have discussed the P&C industry’s reserving challenges and the continued adjustment of many companies in recent years.

One of the biggest shifts at Everest following Andrade’s arrival was refocusing the reinsurance book, while simultaneously setting out to build a leading insurance franchise with a truly global footprint. Building an insurance franchise through Covid and the years that followed has presented unique challenges in ascertaining the reality of loss cost trends.

The hardening of reinsurance markets in 2023 further complicated Everest’s trajectory. The company raised substantial capital to deploy much of it in cat reinsurance, as the opportunity was (presumably) too good to pass up.

This has complicated Everest’s story, leaving investors asking if it is fundamentally a reinsurance franchise with a secondary insurance business, or a business on its way to an insurance-majority mix that will tactically write more reinsurance in stressed periods?

Importantly, the history of insurance buildouts is characterized by growth bringing reserving challenges in its train.

In its third-quarter earnings conference call earlier this month, Everest used language that alluded to some likelihood of a reserve charge coming with its year-end reserve review.

CEO Juan Andrade noted that it was taking “ongoing and aggressive actions” in segments of its US insurance casualty book that are exposed to legal system abuse, noting that in addition to its standard quarterly reserve review process, the firm will conclude its annual long-tail deep dive reserve studies in Q4, “and we will continue to take a conservative approach to the findings”.

The stock fell as much as 10% on the day of earnings, but it recovered to end the day 6.4% down and has since advanced to be just 3% down on pre-earnings.

The impact of questions around its mix and reserving can be seen in the price-to-tangible book value graph shown below.

On a price-to-tangible book basis, Everest has struggled to break out long-term above a roughly 1x multiple, or just above, with it currently trading at ~1.2x.

Even Axis, which replaced Albert Benchimol with Vince Tizzio in 2022 after a long period of struggles, has begun to outpace Everest’s multiple. Everest’s stock trades at a higher multiple than other smaller Bermuda/hybrid peers such as SiriusPoint, Hamilton, and Fidelis, which trade in the 0.8-1.05x range.

As we look ahead to Q4, one of two things will happen. The first option is a reserve adjustment large enough to ‘kitchen sink’ the bad news, which - if communicated effectively - will end reserving adequacy questions, and put the company in a better position to look forward.

The alternative is a charge that investors view as insufficient, which starts another round of second-guessing on the quality of Everest’s book and whether the company has overextended itself by trying to build out insurance too quickly as it resumed growth in reinsurance.

Everest’s own 17% value creation target complicates its position. Within limits, it’s good to set challenging targets for your team, and Everest has hit the mark on a trailing three-year basis, with blow-out 2023 results and numbers again above this level for the year-to-date.

But only an exclusive club of companies consistently deliver even mid-teens returns. Setting the bar this high for investors risks missing shareholder expectations.

We discuss these points in detail below.

1. Was the premium growth too soon and too fast?

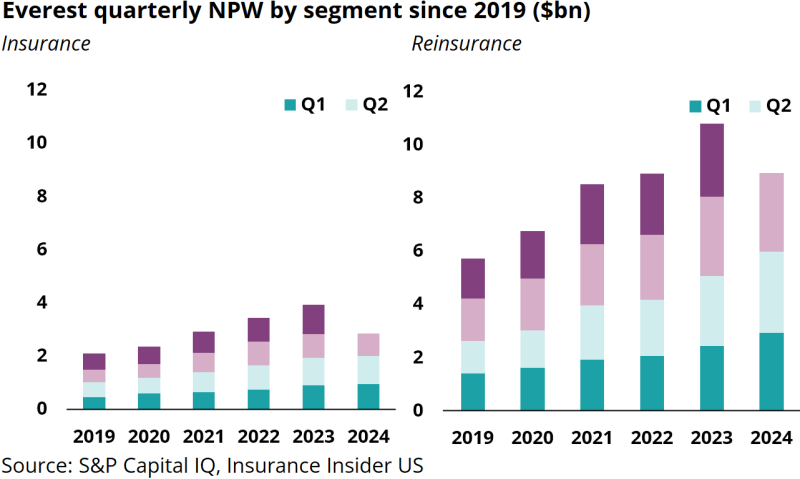

The chart below shows that Everest’s top line has nearly doubled in size when compared to 2019, with its reinsurance GWP growing from $6.4bn in 2019 to $11.5bn last year, and its insurance business up from $2.8bn to $5.2bn.

On the reinsurance side, the growth has come from recent hard market opportunities and from leaning into the property catastrophe space. On the insurance side, the growth has come from both North America and International, with International making up 15% of the top line, as discussed at Everest’s last investor day.

The chart below shows the quarterly breakdown with signs that the insurance piece, on an overall basis, slowed down in Q3 2024.

Zooming in on insurance, Everest’s business mix has mostly remained similar, aside from a significantly increased weighting to property/short tail lines and a relative tilting away from workers' compensation.

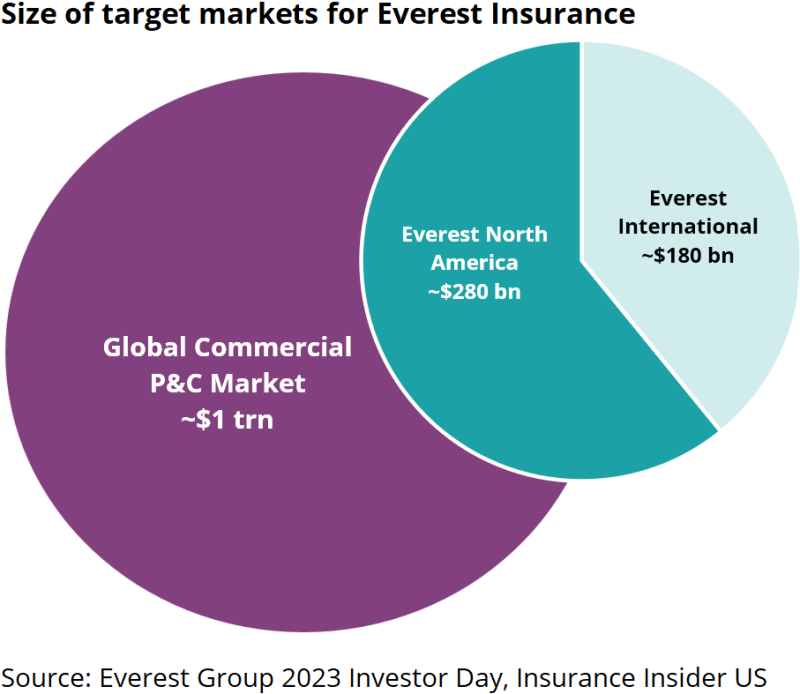

Drawing on Andrade’s background at Chubb, the company has also talked about building the insurance business with a global footprint. It believes that out of a global commercial P&C market of $1trn, Everest’s insurance business has a target market of $460bn. This splits $280bn for North America, and $180bn for international.

Everest has also disclosed that its international subsegment makes up 15% of the insurance business, which has likely grown since then. To hit the same split as the market sizes above, with ~40% coming from the international business, points to significant headroom within newly established portfolios.

When looking at total addressable market, one thing to consider is the profitable piece of that pie since there can be a big difference between the two. So, while the overall market might look huge, the best pieces can often be considerably smaller.

This expansion in the North American and build-out into the international insurance markets also comes as the company is trying to maximize its reinsurance opportunities.

In recent earnings calls, the company has alluded to pulling back somewhat on the North American insurance side due to social inflation and margin pressures, while international continues to pick up. This does lead to the question of whether the company has too many irons in the fire as it pursues its global strategy.

Since international insurance is a somewhat recent expansion area, with primary builds notoriously difficult, it remains to be seen how that book will perform in the longer term.

2. Will Everest take the right size of charge and message it effectively to investors?

Everest is no stranger to reserve adjustments, as long-term followers of the company will recall.

Following Andrade’s arrival, the company took a $400mn charge (3% of Q3 2020 reserves), which was followed by $392mn last year (1.6% of Q3 2023 reserves), which was offset by $397mn in favorable development elsewhere.

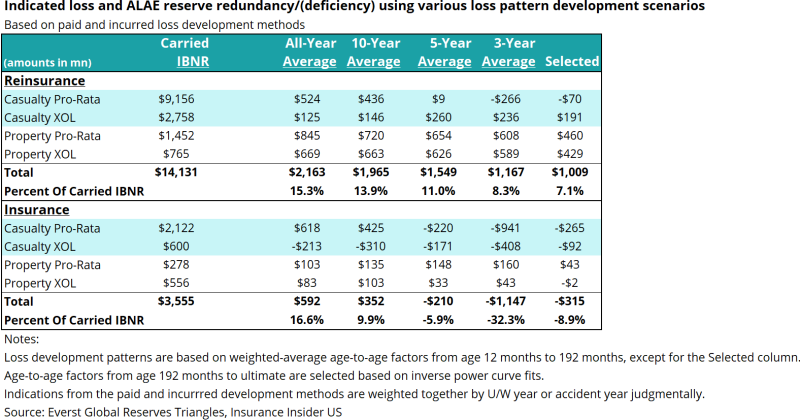

Our evaluation of Everest’s global triangles, as shown below, points to a reserve deficiency in casualty insurance of a few hundred million dollars. The company has redundant reserves on the non-casualty side and in reinsurance to offset part or all of this if it chooses to.

Moreover, the company has substantial earnings power in the book right now, with net operating profits of $2.1bn through nine months.

We would also note that the company repurchased $100mn worth of shares in the third quarter and also increased its buyback to 10 million shares, which we believe is a soft signal of things to come.

But would a charge like this be perceived as enough? Any reserve charge should be material enough to include an additional buffer beyond the stated analysis, which would increase the likelihood of the company kitchen-sinking or resetting the narrative by cleaning the house.

If Everest gets the Q4 move right, it could boost confidence. One recent example is Swiss Re, which strengthened its US liability reserves on November 7, sending the stock up by 6.6%. Of course, history is strewn with many examples of firms that did not handle charges well, and which were punished by investors.

3. High teens value creation is extremely tough to pull off long-term

Our prior research pieces have stressed the correlation between price to book and total value creation, which is defined as the change in book value, including dividends, over time.

Everest’s definition of value creation in its objectives uses changes in reported book value, excluding AOCI. It terms this TSR. Everest’s 2024-2026 financial targets include a 3-year TSR goal of greater than 17%.

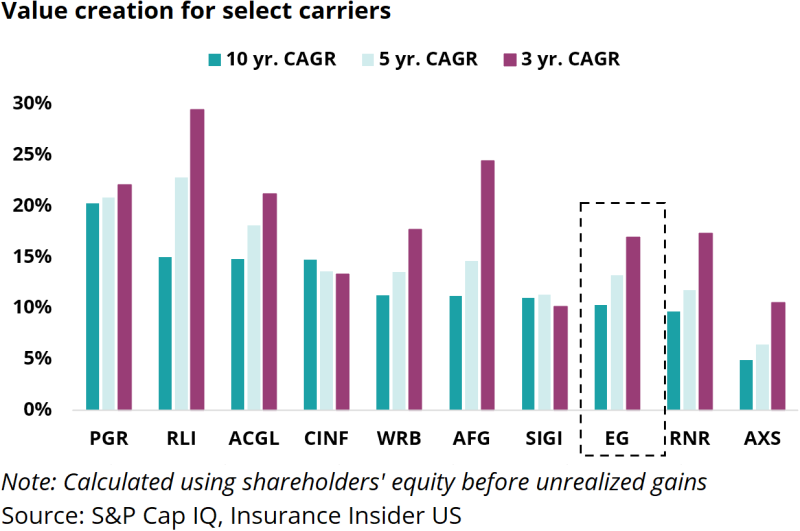

The chart below shows value creation for the trailing twelve months ending September 30, 2024. What jumps out is that long-term value creation in the mid-teens or higher is very hard to achieve, with even good companies falling short of this mark.

Everest’s current price to tangible book value ex. AOCI is at roughly 1.2x as of publication, while the hybrid cohort’s median sits at just under 1.5x. In our view, Everest will only be able to break the valuation limitations if it can maintain its recent impressive value creation trajectory in the long term.

Since the list of long-term value creators has remained mostly unchanged over the years, Everest has an uphill climb from here to join that club.

Double-digit top-line growth, double-digit value creation, limiting volatility, and international expansion are heavy lifts in our view, and we remain cautious about whether the company can pull all of them off at once.