As we expected, reserving discussions continued to be center stage this earnings season.

We specifically anticipated more discourse around prior period development, particularly focused on the recent accident years.

A number of carriers reported adverse development across problematic casualty lines. Commercial auto liability reserving and pricing was a notable topic on a number of earnings calls, which we discussed in a previous note.

For example, The Hartford and Selective reported reserve charges of $16mn and $10mn, respectively, both of which were partially offset by workers’ compensation releases among other lines.

Given these recent developments, we thought it would be an interesting exercise to compare the levels of reserve releases over time to discern trends.

Broadly, we found that the elevated releases across the commercial, specialty and regional lines of business set the stage for a trend reversal as we head into the deeper year-end reserve review, with charges on the horizon for Q4.

This again draws into question the role of workers’ compensation in offsetting adverse development, which we have discussed at length.

It also highlights a greater acceptance that despite rate rises the industry has struggled to keep up with loss cost trends, with many carriers now beginning the belated process of tweaking reserve picks.

Reserve releases remain elevated industry-wide despite increasing concerns surrounding reserving adequacy

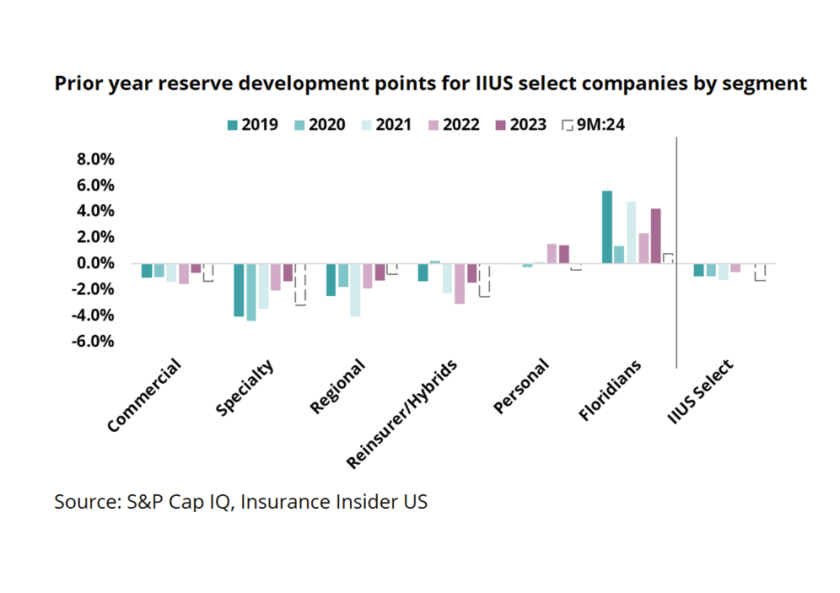

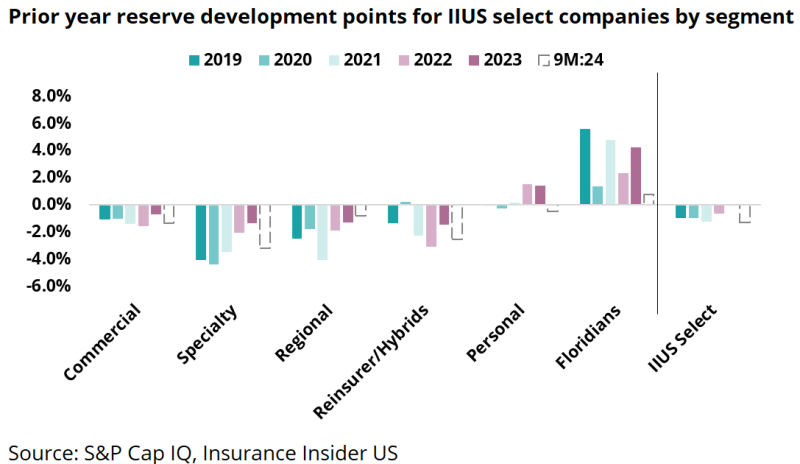

The chart below shows prior-year reserve development for select companies by segment on a GAAP basis. We have excluded companies which are undergoing material restructuring and had outsized one-time reserve adjustments. (For a full listing of all companies included in each cohort, please see the appendix.)

Beginning with personal lines, it has been well known that personal lines carriers have struggled with reserve adequacy. The years 2022 and 2023 saw significant adjustments for the cohort.

During the same time period, commercial releases trended down, which is representative of adverse development in casualty lines being offset by significant releases in other lines, namely workers’ compensation.

Specialty reserve releases trended down from 2019 to 2023 but have picked up at 9M 24 and surpassed both 2023 and 2022. Regionals are the most muted among the segments we observed, though their 9M 24 reserve releases also outpaced 2023.

Of our summation of the select companies, we find that the 9M 24 reserve releases are staggering in comparison to prior full-year periods.

The 9M 2024 reserves developed favorably by 1.3pts for the composite shown above, which is a larger positive contribution than the past two full-year periods combined (i.e., -0.7pts). More broadly, the releases at the nine-month mark are running well ahead of 2023 as well as the past five full-year periods.

This could also signal the possibility of a bigger reserve cleanup adjustment at year-end. We recently discussed this possibility in our Everest Group note, with the company changing its tonality on its earnings call.

Reserve growth is picking up, reflective of industry challenges or future problems

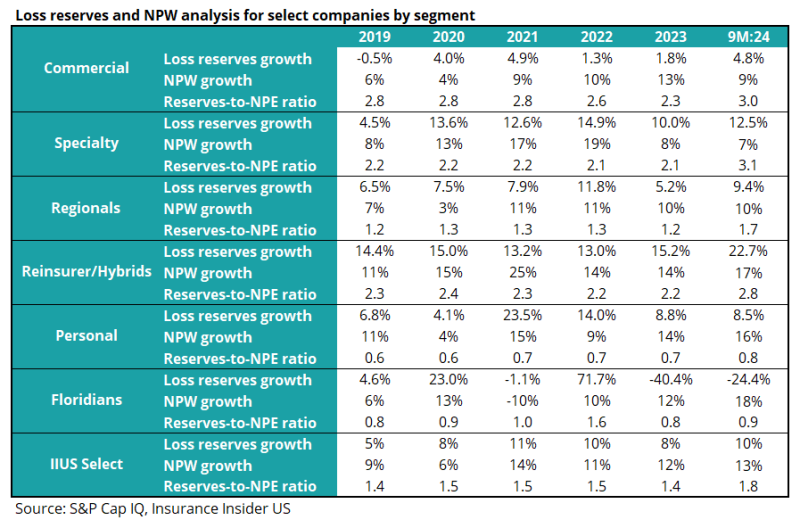

We also looked at a few other basic measures which indicate the strength of reserving. The table below looks at premium growth and compares it to reserving growth. We also looked at the loss reserves to net premiums earned ratio over time.

Premiums outpacing reserve growth can be a sign of the industry expecting rate to outpace loss costs. Premiums growth running behind loss reserve growth can be a sign of conservatism, or reflective of a worsening environment.

The reserve to earned premium ratio shows how much the companies are holding reserves vs. the premiums being earned and, similarly, a rising ratio is reflective of caution or deteriorating market conditions.

This analysis is fairly high level, and we would point to a detailed statutory analysis as the better barometer. Nonetheless, when reviewing these metrics, the numbers do show increasing industry concern on loss reserve adequacy due to a rising reserve-to-earned premium ratio, as well as loss reserves growth outpacing premium growth.

In summary, these counterintuitive trends, whereby the industry has stepped hard on the reserve release accelerator in some lines to offset the negative trends in general liability, will likely prove to be overly optimistic.

We continue to anticipate reserve cleanups to happen at the year-end and will last into 2025 as the market begrudgingly accepts worsening social inflation trends.

Appendix

Regarding the select cohorts, commercial includes Travelers, Chubb, The Hartford, and CNA. Personal includes Progressive, Allstate, Kemper, Mercury, Horace Mann, and Safety. Regional includes Selective, The Hanover Group, Cincinnati, and Donegal.

Specialty includes Fidelis Insurance, Global Indemnity, ProAssurance, Skyward, American Financial Group, WR Berkley, RLI, Hamilton, Kinsale, and Employers.

Reinsurer/hybrid includes Arch, Everest Group, RenRe, Axis, and Greenlight. Lastly, Floridians includes Universal, HCI, Heritage, and American Coastal.