Last week, third-quarter statutory data came out, and as expected, the P&C industry had one of the best third quarters on record.

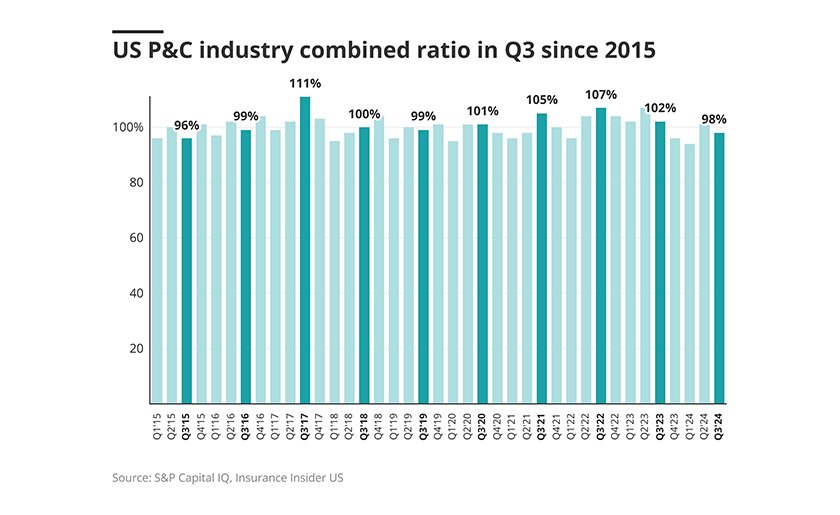

As the chart below shows, the industry's Q3 2024 combined ratio was 98%. This quarter continues to follow a trend that has emerged in 2024, with quarterly results continuing to improve significantly year-over-year. This is due to a decline in personal lines combined ratios, offset by an uptick in commercial lines combined ratios.

In Q4 2024 and beyond, we are anticipating a rise in quarterly loss ratios on the commercial lines side, which would be partially offset by sustained improvements in the personal lines segment. The fourth quarter, in particular, will also see the impact of year-end reserve adjustments on commercial lines loss ratios.

Our piece next week will delve deeper into the reserving movements by segment.

The chart below shows a quick snapshot of quarterly incurred loss ratio trends by quarter, and we discuss the outliers in detail below.

Commercial lines

Starting with commercial lines, results were mixed, reflecting the impact of catastrophe losses and reserve adjustments. The overall loss ratio worsened to 62.2% versus 59.4% in Q3 2023.

General liability

The table below shows loss ratios for general liability, which has continued to be the focus and topic of conversation over the past few years. Overall, loss ratios worsened to 65.7% this quarter, from 62.6% for Q3 2023.

We anticipate additional worsening in this line from year-end reserving adjustments. On a company basis, AIG, Travelers and Liberty Mutual showed improvement, while the rest of the group deteriorated.

Workers’ compensation

On the other hand, workers' compensation loss ratios continued to tick up quarterly, reflecting reserve releases partially offset by higher loss picks as pricing continues to reflect improved loss trends. Aside from Chubb and Old Republic, almost every other carrier's loss ratio was higher when compared to Q3 2023.

Note that some figures, such as Zurich, have been marked ‘NM’ in this note due to outsized quarterly adjustments.

Commercial auto

Commercial auto loss ratios improved overall to 72.0%, a surprise when compared to 74.7% in Q3 2023. While the line also improved sequentially from 77.6% last quarter, we would not put too much faith in one quarter’s numbers as the start of a new trend. Like general liability, we expect year-end reserve adjustments to increase the overall loss ratio for the year.

Fire and allied lines

The table below shows fire and allied lines, which are the most impacted by hurricanes and other major loss events. This ticked up by 10 points year-over-year to 74.9% and showed wide variance by carriers, reflective of individual exposures.

Medical malpractice

Although much of the discussion on social inflation is centered on workers’ comp, commercial auto and general liability, medical malpractice is also impacted by rising litigation costs.

Unlike general liability, which is still trying to keep up with loss cost trends, medical malpractice has seen successful attempts at course correction over the past few years. This can be seen in the 2.8-point loss ratio improvement this quarter, with an average of 50.2% versus 52.9% in Q3 2023.

Personal lines

Personal lines results reflect the corrective actions taken by carriers over the past few years after a meaningful spike in loss cost trends post-Covid.

These efforts seem to have been rewarded this quarter, as overall loss ratios fell by 11.8 points to 65.1% for Q3 2024.

Personal auto

Personal auto loss ratios continued to show an improving trend, with Q3 2024 at 64.5%, a 9.8-point improvement over Q3 2023.

Homeowners

The homeowners’ loss ratio was the real personal lines "winner" this quarter, with the overall loss ratio for the line falling by 14.5 points to 66.5%. We anticipate the Q4 2024 loss ratio to tick up, factoring in the impact of Hurricane Milton.