Earlier this week, WTW held its investor day. The event's purpose was to measure the company against its targets set in 2021, outline the targets for the future, and clarify the rumors surrounding a reinsurance broking JV with Bain.

We think the company did a decent job of explaining the various parts, although margin expansion remains a show-me story from here on out.

To say that WTW has had a tumultuous few years would be an understatement. In recent years, these could be traced to the Willis and Towers Watson merger, which created cultural issues and sustained underperformance. The failed merger with Aon and material distraction from antitrust and regulatory scrutiny followed these. This also coincided with the on/off/on-again divestiture of Willis Re.

These issues created pressure on employees, talent, and client retention while also giving an opening to its competition to capitalize. A course correction ensued, which was spelled out at its investor day in 2021. It focused on a strategy of growing, simplifying, and transforming its business with the eventual goal of improving margins - which trailed peers - by 500 basis points.

One of the franchise's struggles since the divestment of the treaty reinsurance business (more on this later) is how to portray the company in the market and to the investors.

As it stands, WTW has a larger health, wealth and career business with a stronger reputation, higher margin levels than in broking, but this is structurally a lower growth business than insurance broking.

How does WTW present this business mix as an advantage versus its competitors that have the reverse mix? Or is it a weakness to be addressed by growing broking much more quickly, including through acquisitions?

And ultimately, can these two halves of the business work together synergistically, or do they create dis-synergies?

The upside of having non-correlated businesses is that they buttress a franchise during a soft market. This can be seen at the largest brokers. In addition, the largest clients have bigger and more interconnected problems, and they could end up having multiple ports of call, across broking, modeling, human resources consulting, or benefits. This creates the opportunity for stickier client relationships, and the unlocking of cross-sell chances.

Unlike other brokers, WTW has had challenges making this piece work and has acknowledged it.

The downside of the conglomerate structure is that when faced with a hard market, pure-play smaller brokers can typically react and benefit from opportunities faster.

The larger brokers, which are on a multi-year strategic path, can't respond as quickly. And rightly so, since you can’t turn a tanker around with a speed boat change, or else the franchise will list.

So, to date WTW hasn't truly realized the benefits of being a larger entity, but it has faced some of the challenges that size brings.

It has been something of a case of the worst of both worlds.

To make matters worse, reinsurance markets also hardened following the past few years' active catastrophes and SCS activity, and the years of underpricing that preceded them. With Willis Re’s divestiture, the ability to exploit that dislocation was lost.

All these varied factors have added to the struggles the company has faced in closing the margin gap compared to its peers, which has continued to translate into the discounted valuation shown below.

On the positive side, WTW’s organic growth has rebounded strongly over the last year even as others have started to slow. It has also made respectable progress on margins, and by adding Marsh McLennan’s Lucy Clarke as its new broking chief now has respected broking leadership in place.

If the purpose of the Investor Day was to invigorate prospective investors to become interested in the WTW story here, we are not sure if that purpose was achieved since a lot of the pieces laid out were built on prior discussions.

However, if the aim was to show current investors that the company was going to continue chipping away the margin gap in the broking space with an increasing focus on the specialty space, maintain its consistent growth in the health, wealth, and career space, and dip its toes in the waters on the treaty reinsurance side, that threshold was met.

We discuss these points in detail below.

Treaty reinsurance is back on the plate, though details were light at this stage

Around 18 months after the Willis Re disposal, our editorial team alluded to WTW testing the water on re-entering the treaty reinsurance space.

This got louder after the expiration of the non-compete with AJ Gallagher, with CEO Carl Hess suggesting WTW’s desire to evaluate that side of the market. Our editorial team has covered this in detail in the past. We also provided further information about a potential partnership with Bain.

This was eventually confirmed today with the announcement of its pending JV with Bain. WTW will take a significant minority stake, although it punted providing additional details to the coming weeks. It expects to scale up as it sees demand and then take a controlling interest over time.

The reality is that the hard market on the reinsurance side has mostly played out. On the other hand, reinsurance broking is a higher-margin business that runs in the high 30s to low 40s and even 50s, depending on geography, class of business, and maturity. WTW’s Willis Re, for example, had a mid-30s margin before its disposition to AJ Gallagher.

Primarily, the structure of the start-up seems designed to allow WTW to participate in an off-balance sheet vehicle.

At this stage, we view this development as something to watch but more of a capital allocation strategy versus re-adding the third leg of the stool to the WTW portfolio.

New margin targets reloaded, continuing the prior trajectory

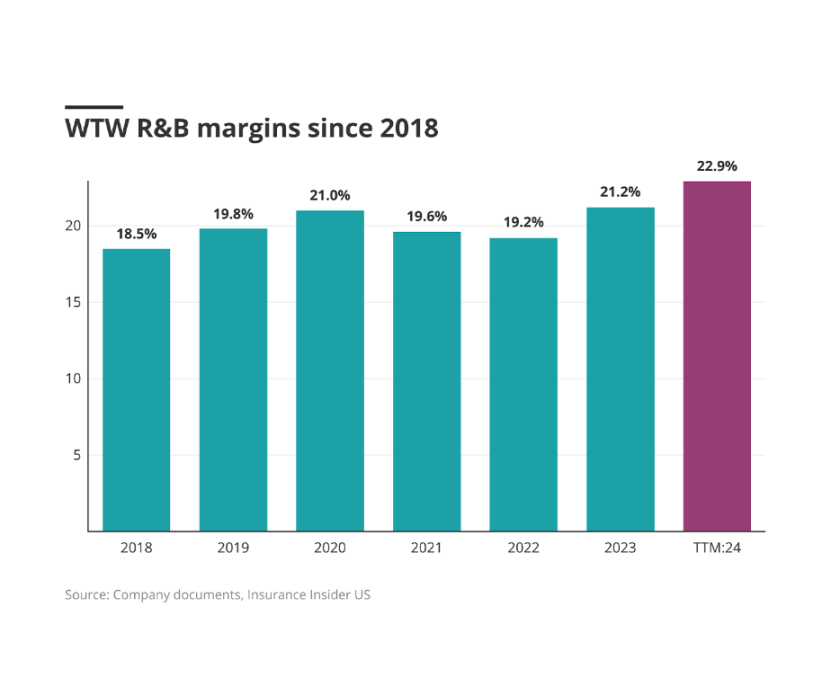

One of the biggest challenges faced by WTW has been the margin gap versus its peers, more so on the risk and broking side. WTW’s margins fall on the low 20s. This compares to Aon and Marsh’s margins in the mid-20s to low 30s, while AJ Gallagher and Brown’s margins are in the mid-30s.

Of course, business mix and types of accounts influence the underlying margin. Additionally, margins are not always comparable due to adjustments companies might make. Nonetheless, WTW’s margins have consistently been on the lower side, with North America being the lagging piece.

In 2021, the company set an ambitious target of a 500-basis point improvement by the end of 2024. Adjusting for Russia operations divestment and gain on sale, it has achieved a 330-basis point improvement since then and expects 2024 to end with a 23%-23.5% range - a respectable outcome.

For the next three years, the company expects to continue achieving a 100-basis point annual average margin and mid- to high-single-digit organic growth.

WTW recently hired Lucy Clarke as president of risk and broking from Marsh to focus on the turnaround effort. On December 4, the Insurance Insider US news team revealed that Michael Chang, head of risk and broking for North America, had left with immediate effect.

Since 2021, WTW Risk & Broking's organic growth has nearly doubled from +5% to +10% for TTM 2024. At the investor day, in addition to improving margins, the company outlined its expectations for mid-to-high single-digit organic growth over the next three years.

However, recent improvements in organic growth and margins have also benefited from industry tailwinds, which seem to be slowing down and will make it harder for WTW to meet its guidance.

Deals are back on the table

Another incremental change apart from the treaty reinsurance relationship was WTW’s desire to evaluate inorganic growth opportunities following a focus on using capital management via share buybacks as the preferred method of capital deployment.

On the Risk & Broking side, WTW went on record in stating that it will look at targeted acquisitions in middle-market brokerage and growth markets such as NA, Europe, and Asia.

The list below shows WTW’s deals over the past few years, which, admittedly, look light.

However, we note that it was one of the bidders for McGriff, which Marsh McLennan ultimately acquired in September of this year for $7.75bn. Based on its ambition in targeting a deal this size and Aon’s move for NFP, we would not be surprised to see a big-ticket deal in the mid-market.

Overall, WTW has definitely learned a lot of lessons from its missteps, and with the right approach, this can definitely serve as a playbook for what to avoid repeating as it attempts to bridge the organic growth and margin gap with its peers.

A sooner-than-expected soft insurance market might influence the trajectory of these expectations.