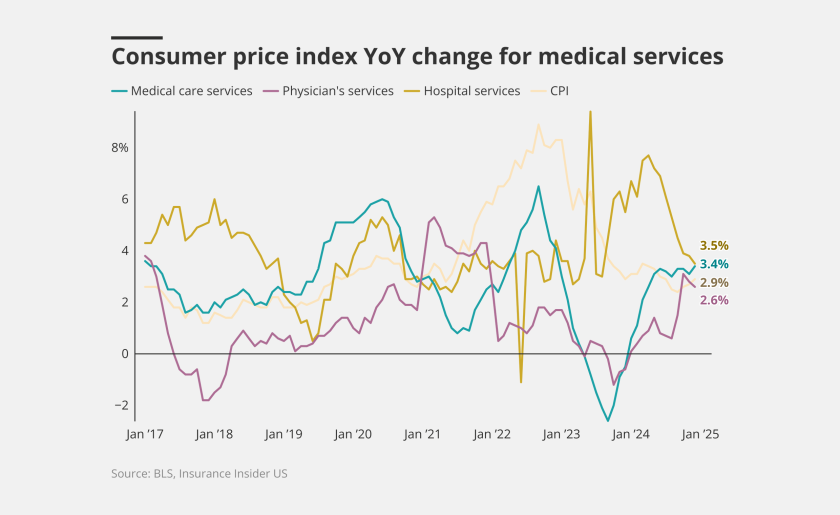

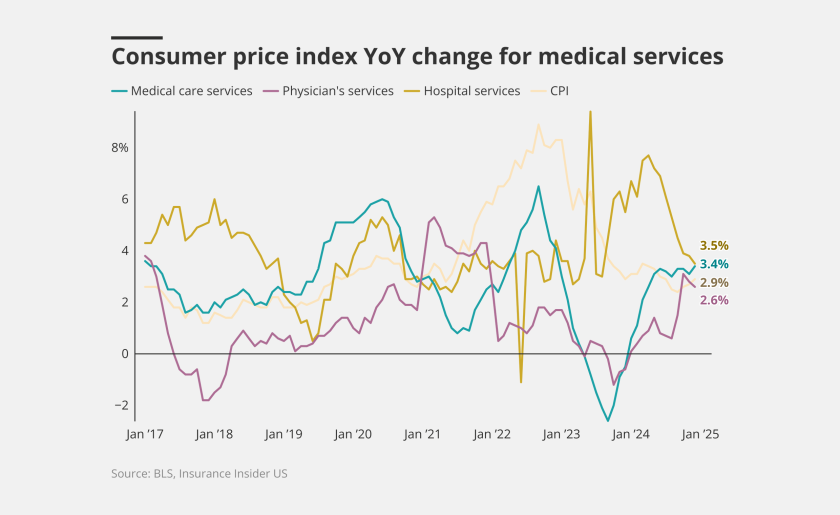

As we head into earnings next week, the direction of loss-cost inflation and pricing remains front and center. The most recent CIAB data, covering Q3, noted that pricing in commercial property has slowed, but that improvements for long tail...

As we head into earnings next week, the direction of loss-cost inflation and pricing remains front and center. The most recent CIAB data, covering Q3, noted that pricing in commercial property has slowed, but that improvements for long tail...